What was true for the last 40 years that is not true anymore?

What current allocations cannot fulfill their expected returns?

Interest Rates and possible directions?

What Money Flows is this creating?

How did Money Flows impact the Financial Markets last year and this year?

Lessons from prior mistakes and victories?

Caution flags and green lights?

Why do great questions often lead to great answers?

Headline Round Up

*ADP Data Shows Best Month for New Jobs Since September 2020.

*U.S. Consumer Confidence Best Since Pandemic Start!

*International Monetary Fund Raises Prediction of Full Global Economic Recovery this Year.

*Texas Manufacturing Smashes Expectations with Record Breaking March Surge!

*Bullish Southwest Buying 100 New Boeing 737’s.

*Home Prices Rise at Fastest Pace in 15 Years.

*Pending Home Sales Drop Over 10% in February on Inventory Shortage.

*Impending Doom!? How afraid should we be and how afraid are the markets?

*CDC Extends National Eviction Ban through June 30th?

*One of the World’s Hidden Fortunes is Wiped Out in Days!

*Huge Global Money Flows on “Reflation” Trading.

*Good Inflation Numbers?

*Twenty Year U.S. Treasury Down 13% in Price for 2021?

*Junk Bonds in Sweet Spot of Credit Upgrades.

*New York Legalizes Pot and Schumer Pushes Senate to Fire it Up.

*Austin Proposes Natural Gas Bans?

*Bitcoin and Digital Asset Rollouts by Brokerage Firms? Could that mark a significant inflection peak?

*CryptoPal! PayPal Ready for Crypto Payments.

*Former BlackRock Executive Says Green Investing “Is Definitely Not Going to Work.”

Dow Jones Industrial Average (Year to Date)

– Courtesy of Bloomberg LP

Dow Jones Industrial Index & AllianceBernstein Global High Yield Income Fund, Inc. – Comparative Returns (Approx. 27 years)

– Courtesy of Bloomberg LP

iShares 20 Year Treasury Bond ETF & iBoxx High Yield Corporate Bond ETF (Year to Date)

– Courtesy of Bloomberg LP

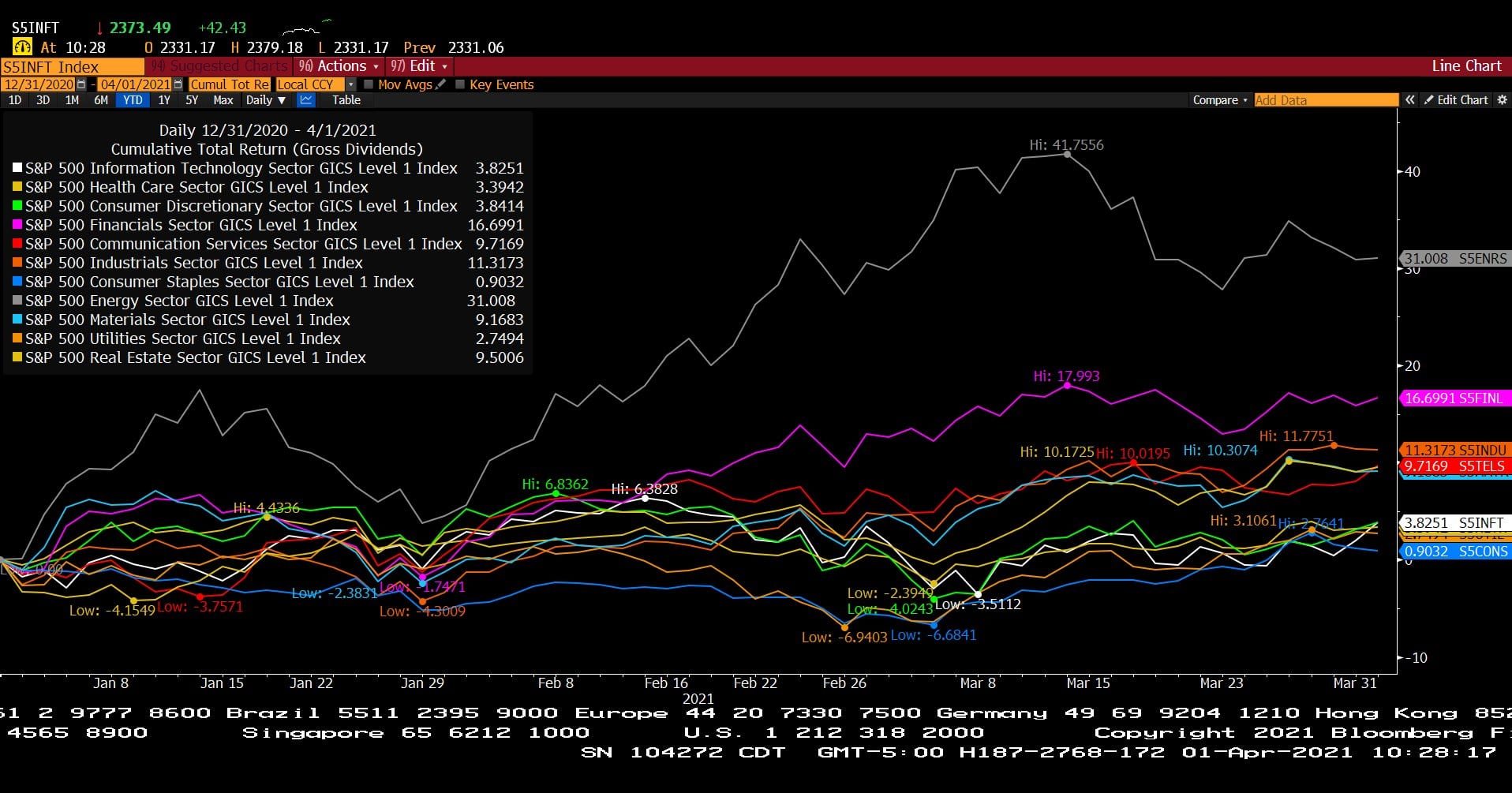

Standard & Poor’s 500 Index Sector Performance, Cumulative Total Return – Gross Dividends (Year to Date)

– Courtesy of Bloomberg LP

Generic Crude Oil Futures, Spot Price (1 Year)

– Courtesy of Bloomberg LP

Generic Corn Futures, Spot Price (1 Year)

– Courtesy of Bloomberg LP

Generic Wheat Futures, Spot Price (1 Year)

– Courtesy of Bloomberg LP

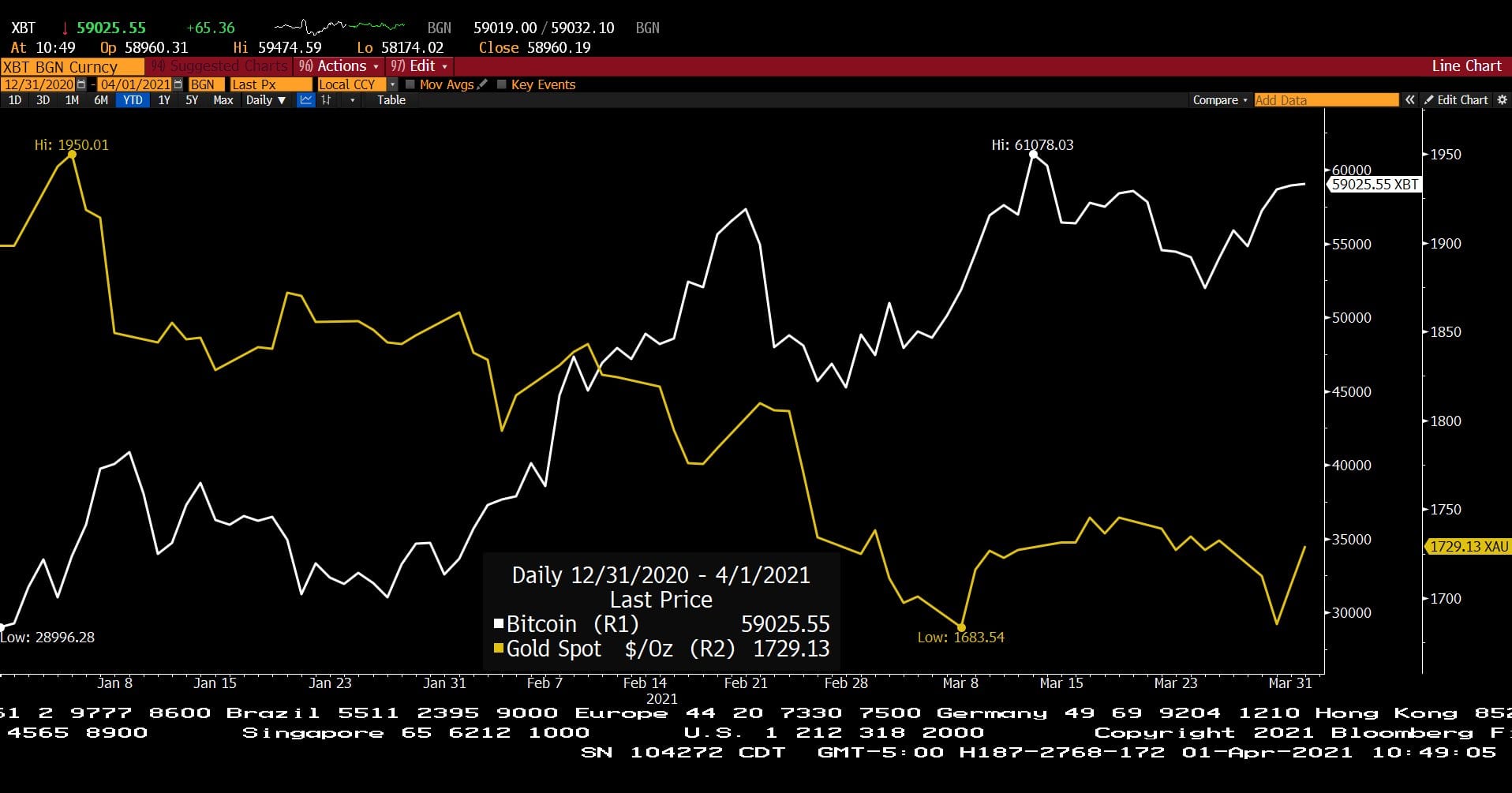

Bitcoin Currency, Spot Price & Generic Gold Futures, Spot Price (Year to Date)

– Courtesy of Bloomberg LP

Profit Report

• We love talking to clients! Here are this week’s best topics including the headline that spooked a client this week along with retirement plan contribution coordination.

• The 25 page FACT SHEET on Infrastructure. Important high points?