How did Europe wreck the U.S. stimulus party?

Was the Financial Market wilting a head fake?

What is coming in April that investors need to know?

Why is taking on debt more fun than paying it back?

What does that mean for the next decade?

What is an SPAC and what does it mean for the 2021 Capital Markets?

What are the key parts to the Infrastructure discussion?

What part does Texas play in renewable energy?

When will Interest Rates actually rise?

What should we be doing right now to evolve portfolio strategy?

Headline Round Up

*How the U.S. Crushed Europe on COVID-19 Vaccine Rollout!

*European Flights Facing Complex Red Tape Restrictions.

*U.S. Passenger Travel Over 50% Restored compared to 2019!

*Updated Earnings Forecast on the S&P 500 Send Important Message for April Announcements.

*Space SPACs?

*”Don’t Beam Me Up Yet Scotty, I Gotta Album Coming Out!” William Shatner at 90 And Still Going Strong!

*SPAC “Voodoo?”

*Trump Advisor Announces Launch of New Social Media Platform This Summer.

*Is the Oil Rally Over? Not so fast.

*Current Rig Count Under Half of Year Ago!

*Hydrogen Goes Into Pipelines Too? What for?

*Nuclear Trounces Coal!

*SEC Goes Green on Emission Goals.

*Dallas Federal Reserve President Robert Kaplan Predicts When the Fed will Change Posture!

*The Biden Infrastructure Plan?

Dow Jones Industrial Average (Year to Date)

– Courtesy of Bloomberg LP

Quarterly Standard & Poor’s 500 Index – Earnings Estimates (5 Years)

– Courtesy of Bloomberg LP

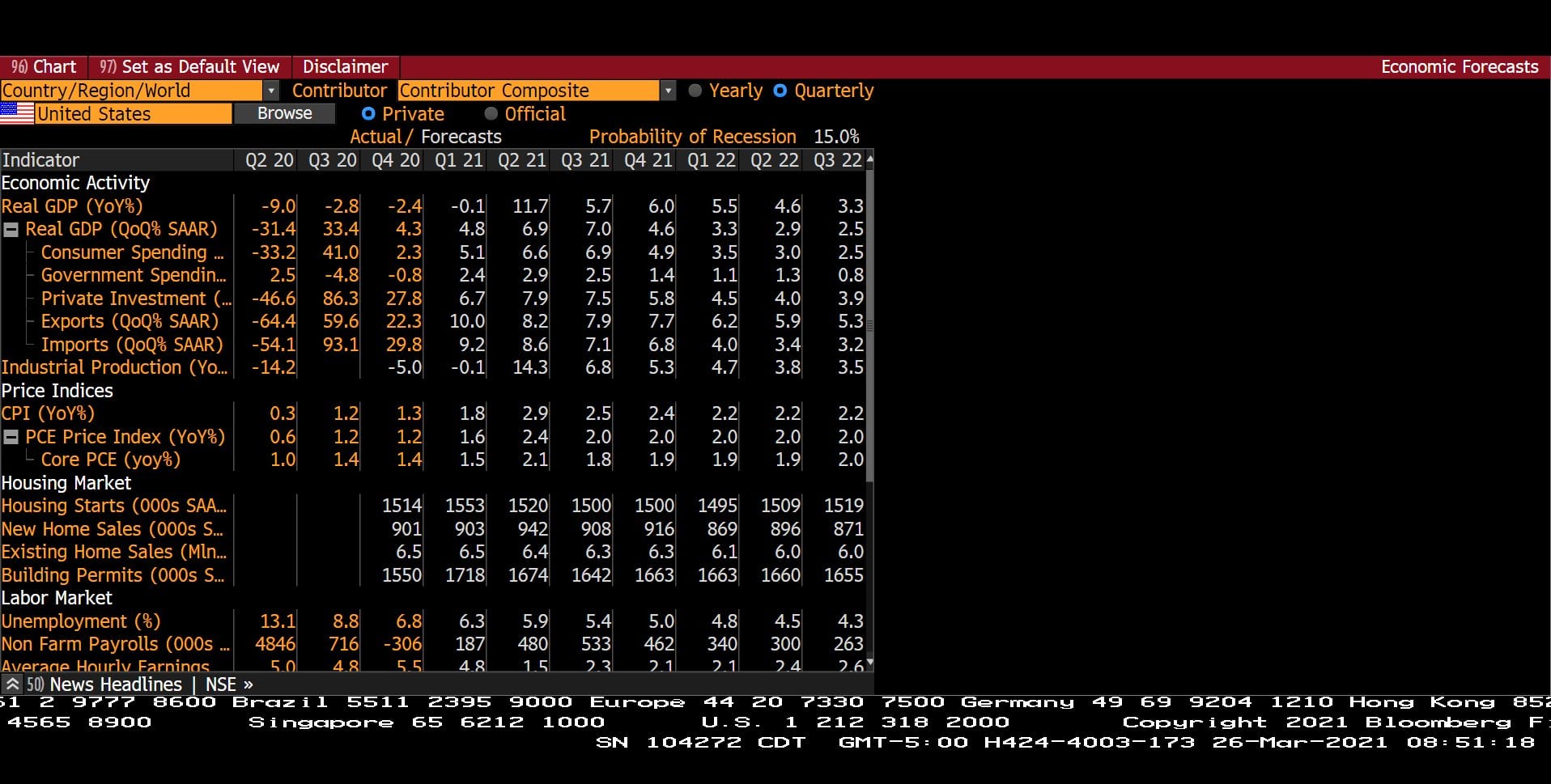

Quarterly U.S. Economic Forecast with Probability of Recession (Q2 2020 – Q3 2022)

– Courtesy of Bloomberg LP

World Bond Market Pricing ( 03/26/2021 – 10 Year Maturities)

– Courtesy of Bloomberg LP

iShares 20 Year Treasury Bond ETF, Cumulative Total Return – Gross Dividends (Year to Date)

– Courtesy of Bloomberg LP

DoubleLine Income Solutions Fund (Year to Date)

– Courtesy of Bloomberg LP

Generic Crude Oil Futures, Spot Price (Year to Date)

– Courtesy of Bloomberg LP

Profit Report

1. Why is taking on debt more fun than paying it back?

2. What does that mean for the next decade?

3. Important research on Inflation Strategies for 2022?

4. We Love Talking to Clients! Here were this week’s best topics including the Document Vault!