How long will the current boom last?

When do we reach record employment again?

What is likely to cause the next market correction?

Is the Infrastructure package going to drive any gains?

What Asset Classes are most attractive?

What should I harvest from my portfolio?

Will cannabis be legalized?

How many different tax increases proposals are being discussed?

Where does PappaDean see danger?

Headline Round Up

*Help Wanted! Job Openings Near All Time High Even After Almost a Million Hired Last Month!

*Global Growth Forecast Increased to 6%!

*Jamie Dimon Declares Boom Can Easily Run to 2023!

*Federal Reserve: Quantitative Easing (QE) Not Over Yet…Then When? What happened last time?

*Texas COVID-19 Cases Drop After Reopening?

*Vaccines Hit Record 4 Million in One Day.

*Google Says Get Back to the Office!

*Samsung Profits Up 44% on Chip Shortage.

*Energy Debt Reductions, Share Buybacks, Dividend Increases Coming? BP Says Yes.

*Could the Middle East Explode Again? How?

*Shell Returns to Profitability.

*Oil Rangebound?

*Carnival Cruise Bookings Surge Before Restart.

*World’s Top Liquefied Natural Gas (LNG) Buyers Preparing for Next Winter

*ESG Gold Rush! What Happens to Investment Returns When Money Pours in too Fast?

*BlackRock Ties Borrowing Costs to Diversity Goals?

*G-20 Global MINIMUM TAX RATE? Why? Corporate tax hike protection? Emerging Market benefits?

*Blockchain to Settle Stock Trades in Hours Not Days.

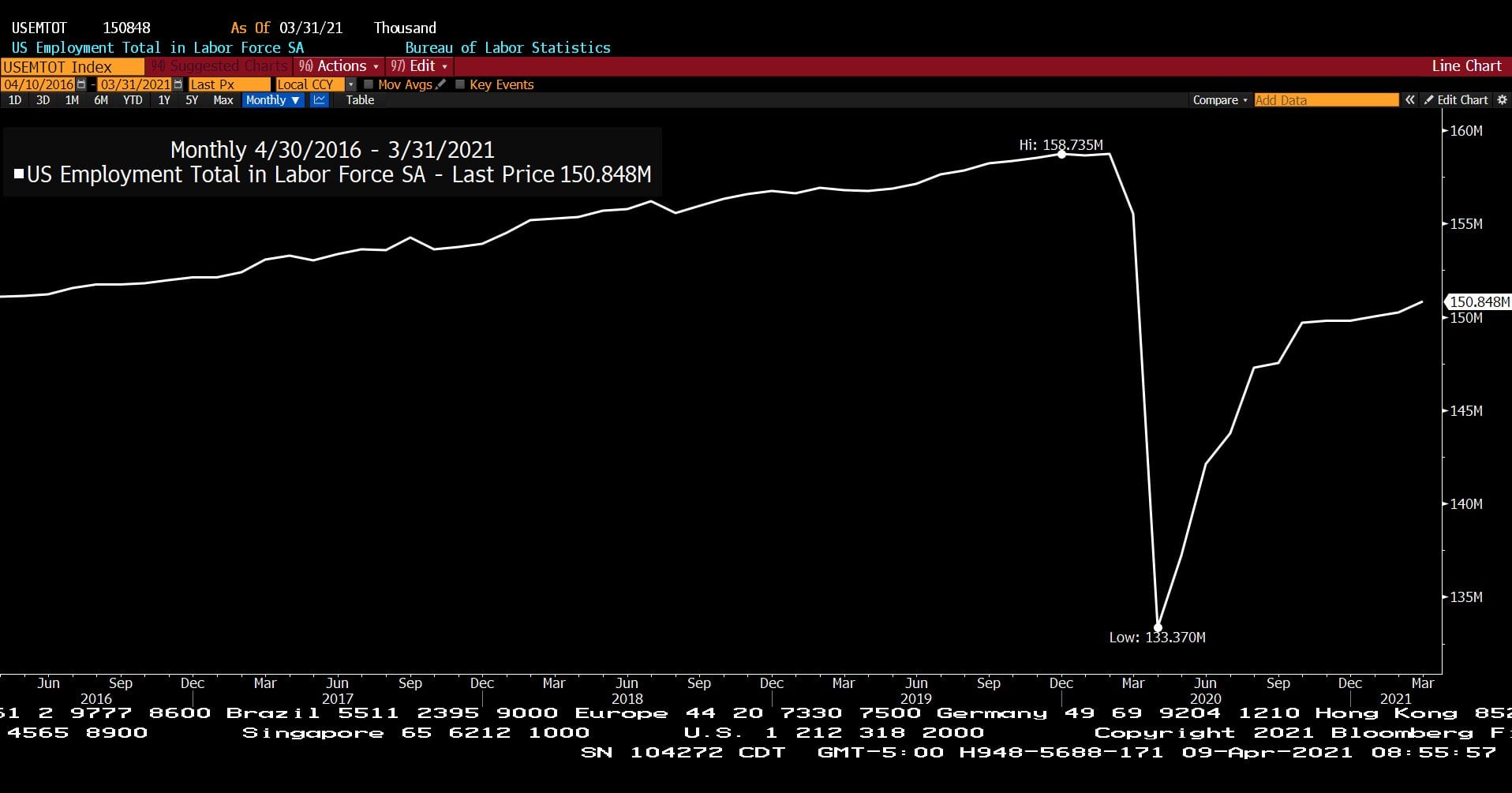

U.S. Employment Total in Labor Force, Seasonally Adjusted (Approx. 5 Years)

– Courtesy of Bloomberg LP

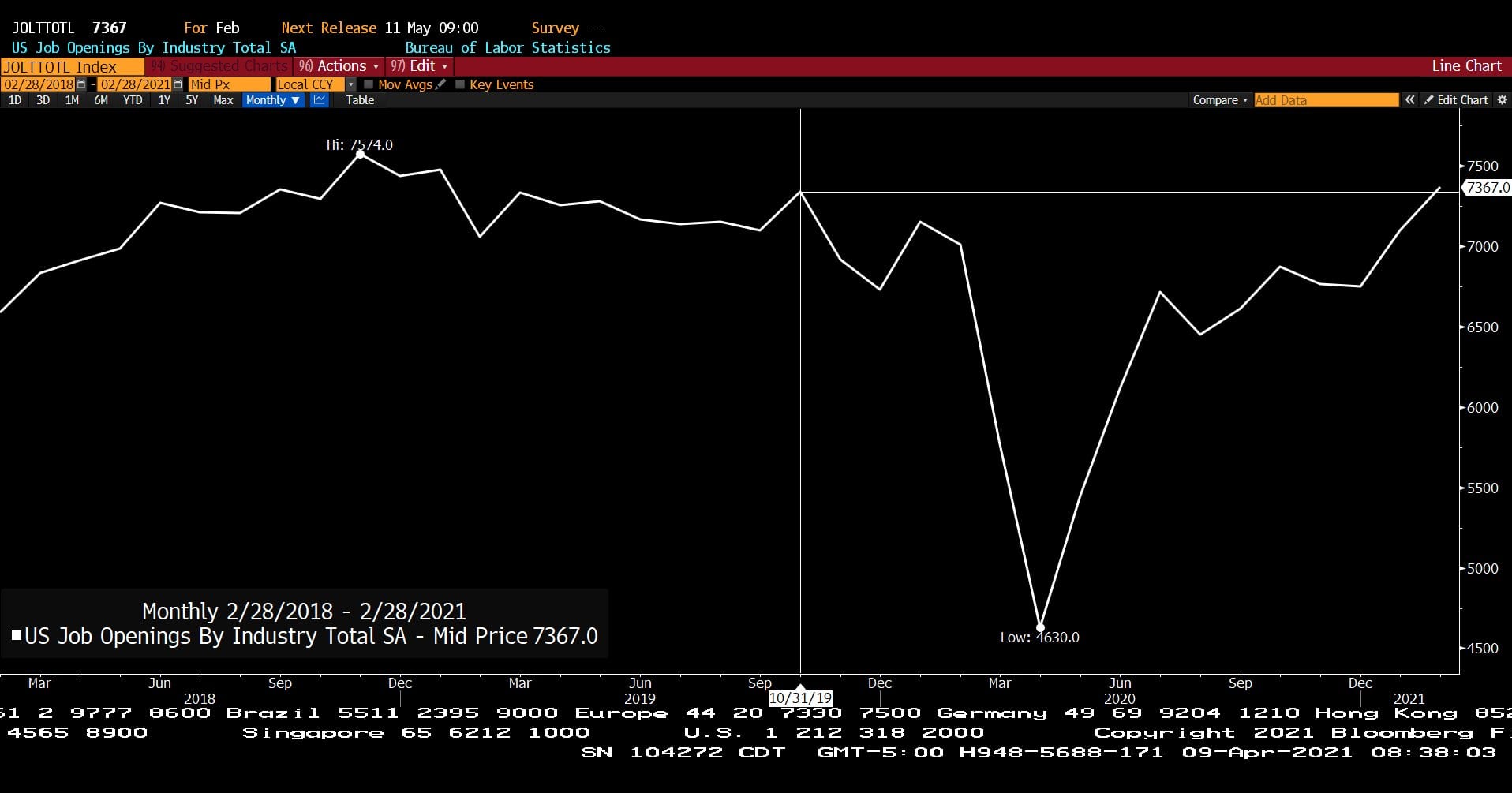

U.S. Job Openings by Industry Total, Seasonally Adjusted (3 Years in Feb 2021)

– Courtesy of Bloomberg LP

Dow Jones Industrial Average (Year to Date)

– Courtesy of Bloomberg LP

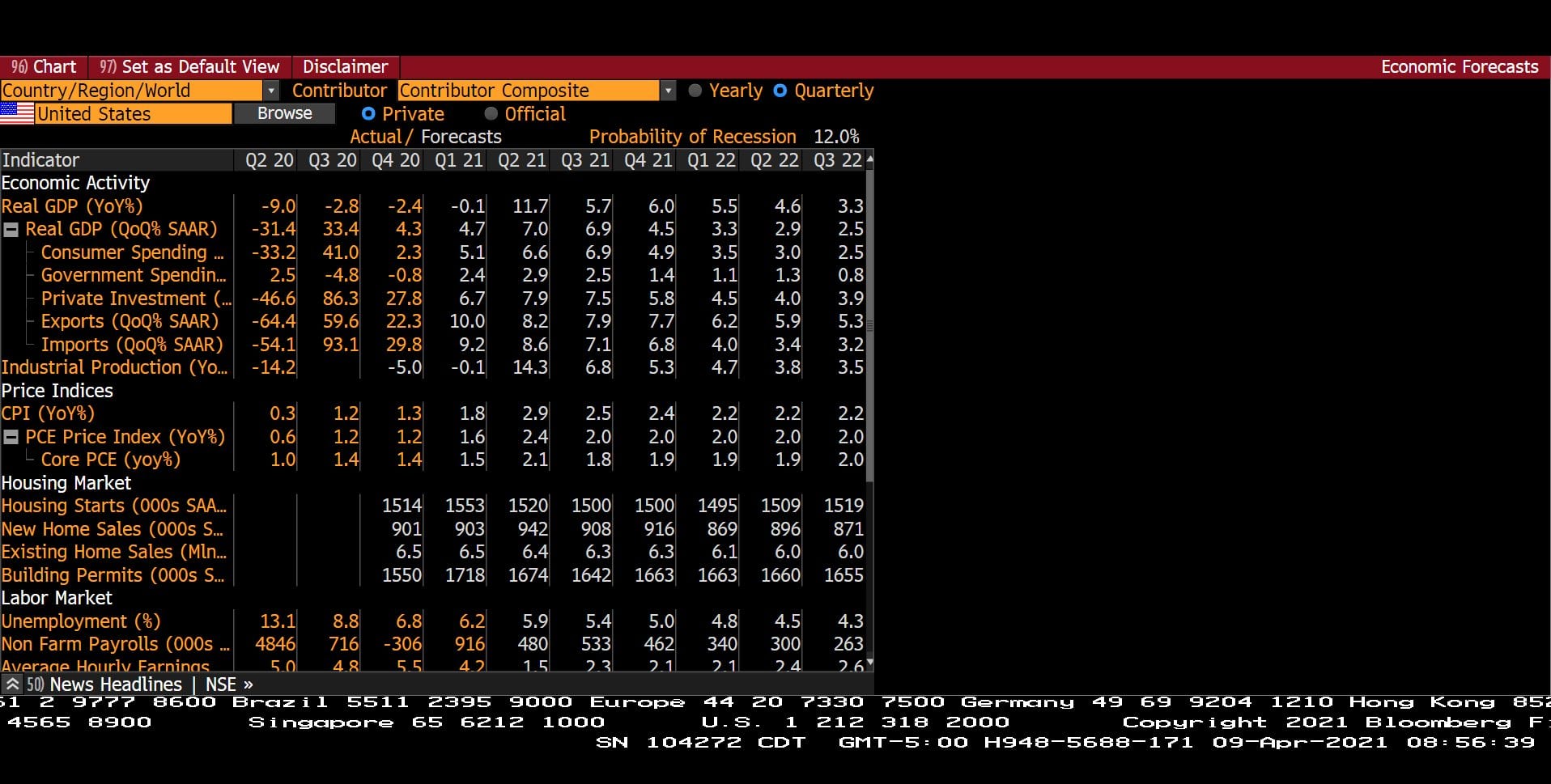

Quarterly U.S. Economic Forecast with Probability of Recession (Q2 2020 – Q3 2022)

– Courtesy of Bloomberg LP

Standard & Poor’s 500 Index Quarterly Earnings Estimates Graph (3 Years)

– Courtesy of Bloomberg LP

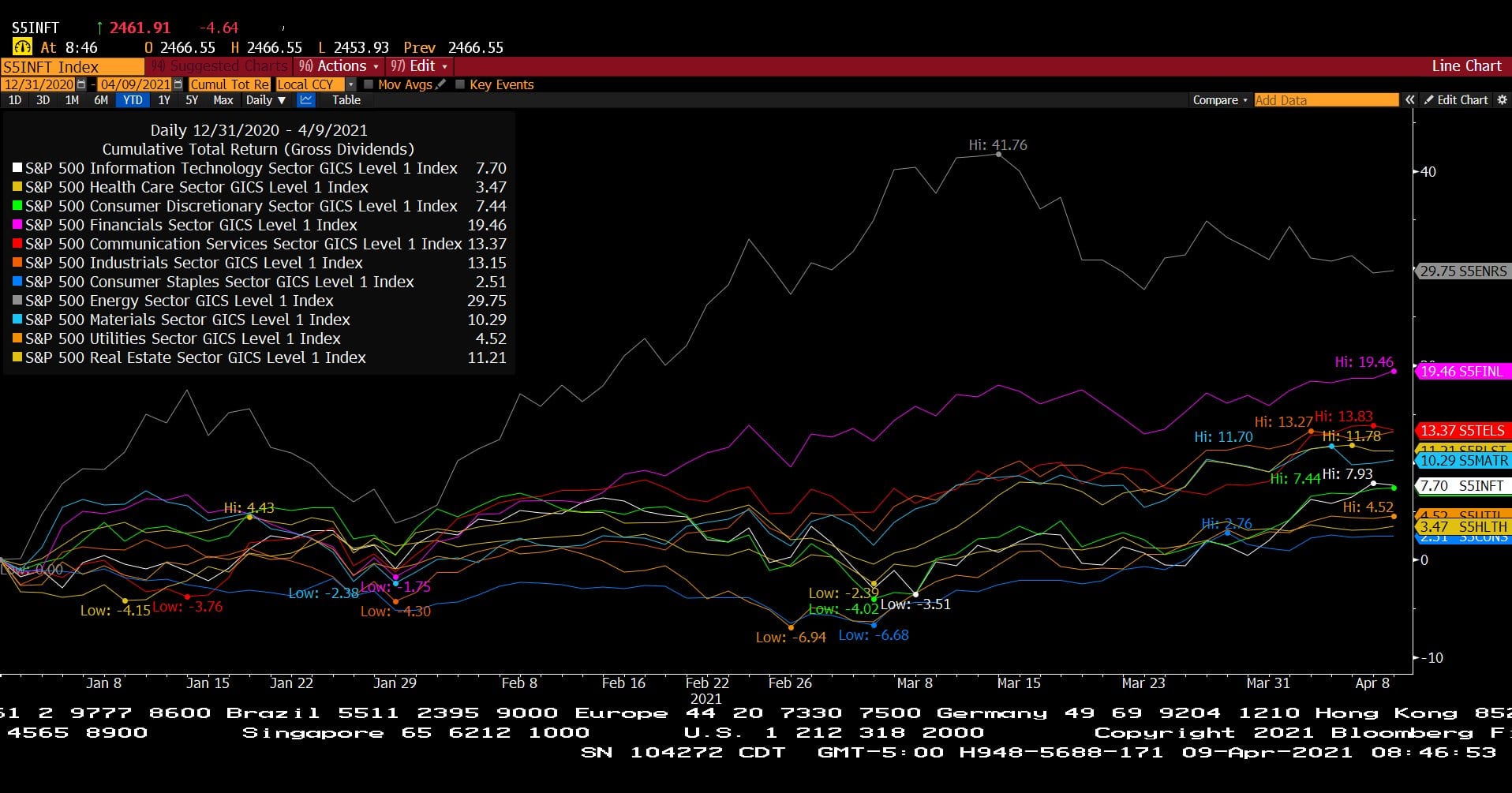

Standard & Poor’s 500 Index Sector Performance, Cumulative Total Return – Gross Dividends (Year to Date)

– Courtesy of Bloomberg LP

Generic Crude Oil Futures, Spot Price (1 Year)

– Courtesy of Bloomberg LP

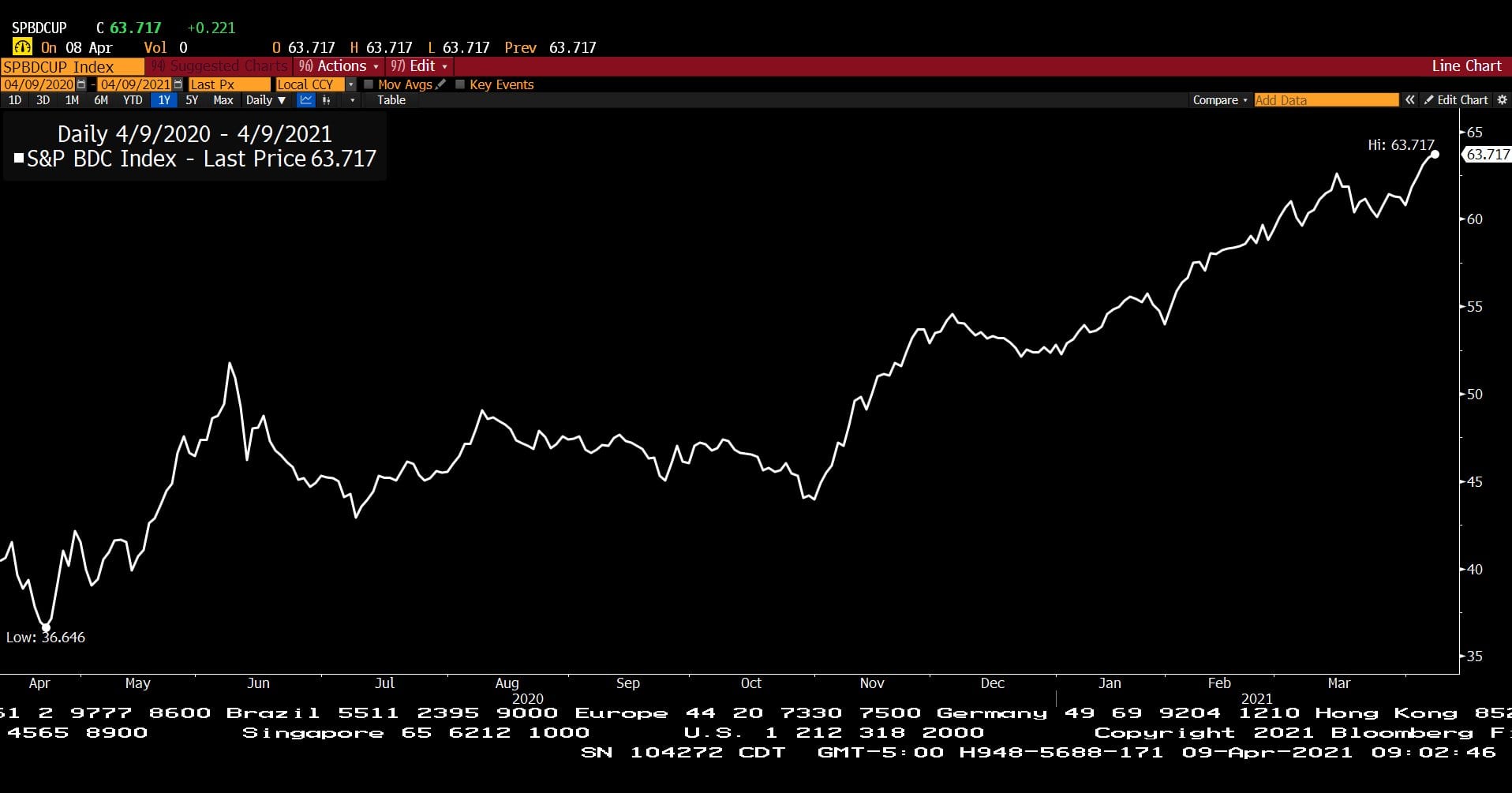

Standard & Poor’s Business Development Company Index, Spot Price (1 Year)

– Courtesy of Bloomberg LP

ETFMG Alternative Harvest ETF (1 Year)

– Courtesy of Bloomberg LP

Profit Report

What is a BDC and How Can I Benefit?

PappaDean’s Corner of Wisdom

In the past, what consequences results when Washington shifts to altruistic expansion of power at the expense of capital formation?