What could be the keys to reliable performance for the next decade?

Why is “tactical safety” a key component of portfolios for the next 10 years?

What does the 90-day outperformance of medical companies’ dividends indicate for the future?

Why is Natural Gas so curiously strong right now?

Does Energy Infrastructure play a part in the green revolution?

What is “ESG” and what does it mean for money flows?

What does it mean when a company “puts on the green jacket”?

Does nuclear power have a future?

How are Real Estate Investment Trusts (REITs) and Interest Rates related?

What are Growth and Innovation companies?

What is a Cash Flow panic?

Will there be an Interest Rate spike in 2023?

The 2021 Q4 MGAM Client Update

Wow! Vanessa Avila, our Director of Client Reporting has evolved the client portal app.modestpark.com to a new level of planning utility. As you scroll through the pie charts you will notice the addition of Investment category and sub sector allocations. This takes our review process to a new level of allocation reporting mastery providing the ability to easily see the key components of the portfolio discussed in this update.

It is our belief that McGowanGroup Asset Management is poised for a great decade ahead in both relative and absolute risk adjusted performance evidenced by the results since Q4 of 2020.

As both the team and Investment Committee have evolved with a base of highly intelligent clients, applied technology is providing greater research and trading capability as well as evolving excellent service platforms.

Compelling Opportunities

Tactical Safety

What about the next correction? Over the past 35 years since the practice was founded, a key to success has been deployment of safety reserves into great assets at bargain prices after market disruptions. Our research sources indicate the potential for a tightening rate spike in 2023.

Global High Yield Lending

With cash rates near zero, money flows appear to indicate a cash flow panic on the part of institutions and pensions. The current phase investors seeking yield provides appreciation opportunities with great bond managers that have higher yielding portfolios in place. This phase could last through 2022.

Growth with Income

Dividend companies with the ability to raise payouts have also provided a long-term inflation hedge based upon previous cycles. The strong level of recent inflation leads us to the conclusion that opportunities in Healthcare and Energy Infrastructure are reasonably able to benefit from systemic inflation. Current research for our target list includes Real Estate Investment Trusts and Utilities capable of providing cleaner power.

Growth and Innovation

Equity corrections have provided and, are likely to continue to provide the ability to add great innovation companies and funds at bargain prices. The evolution of Clean Technologies and Global Technology platforms provides a foundation for future appreciation.

Dow Jones Industrial Average (Year to Date)

– Courtesy of Bloomberg LP

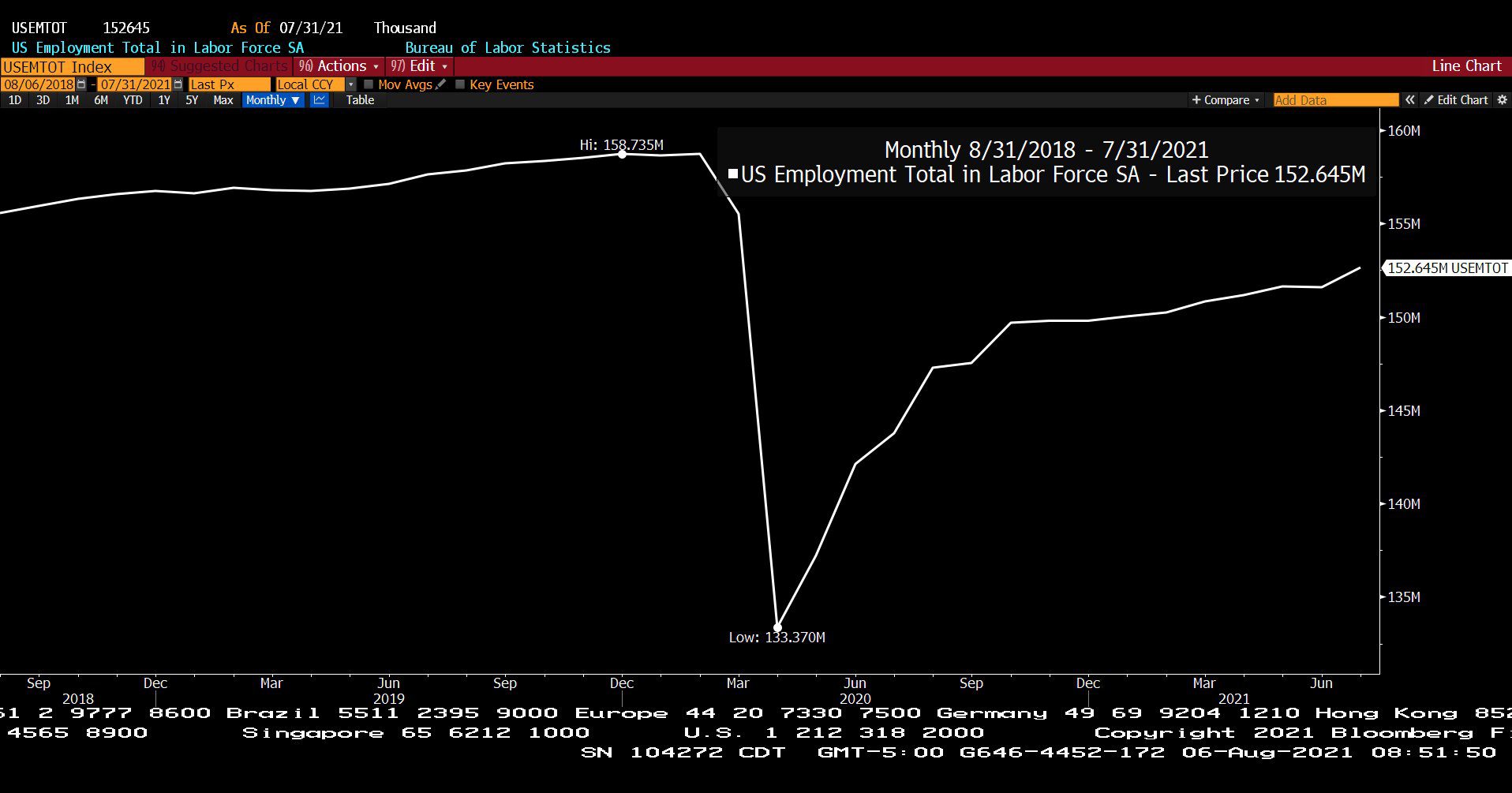

U.S. Employment Total in Labor Force, Seasonally Adjusted (08/31/2018 – 07/31/2021)

– Courtesy of Bloomberg LP

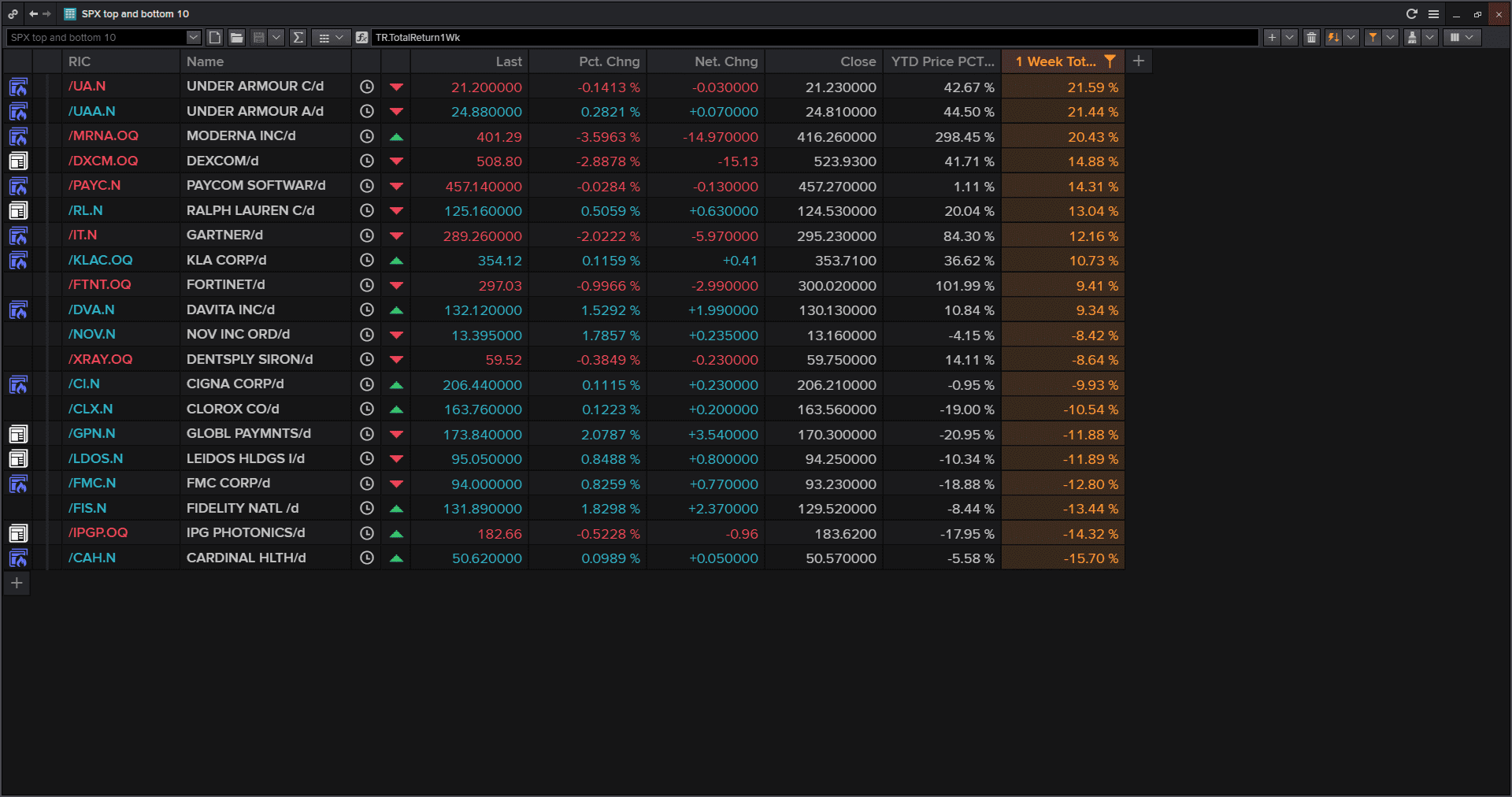

Standard & Poor’s 500 Index, Top 10 and Bottom 10 Companies (08/06/2021)

– Courtesy of Refinitiv

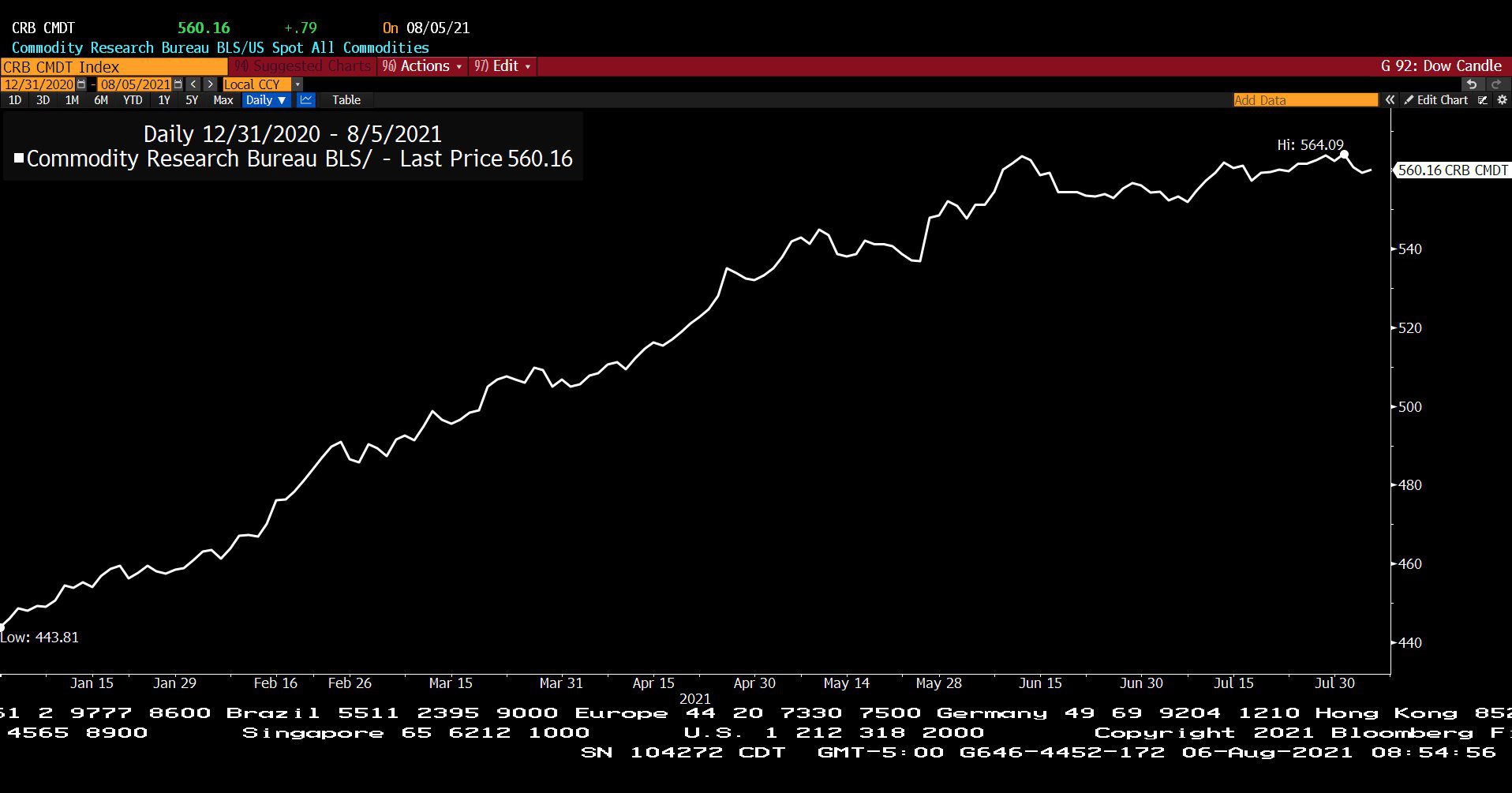

Commodity Research Bureau Index (12/31/2020 – 08/05/2021)

– Courtesy of Bloomberg LP

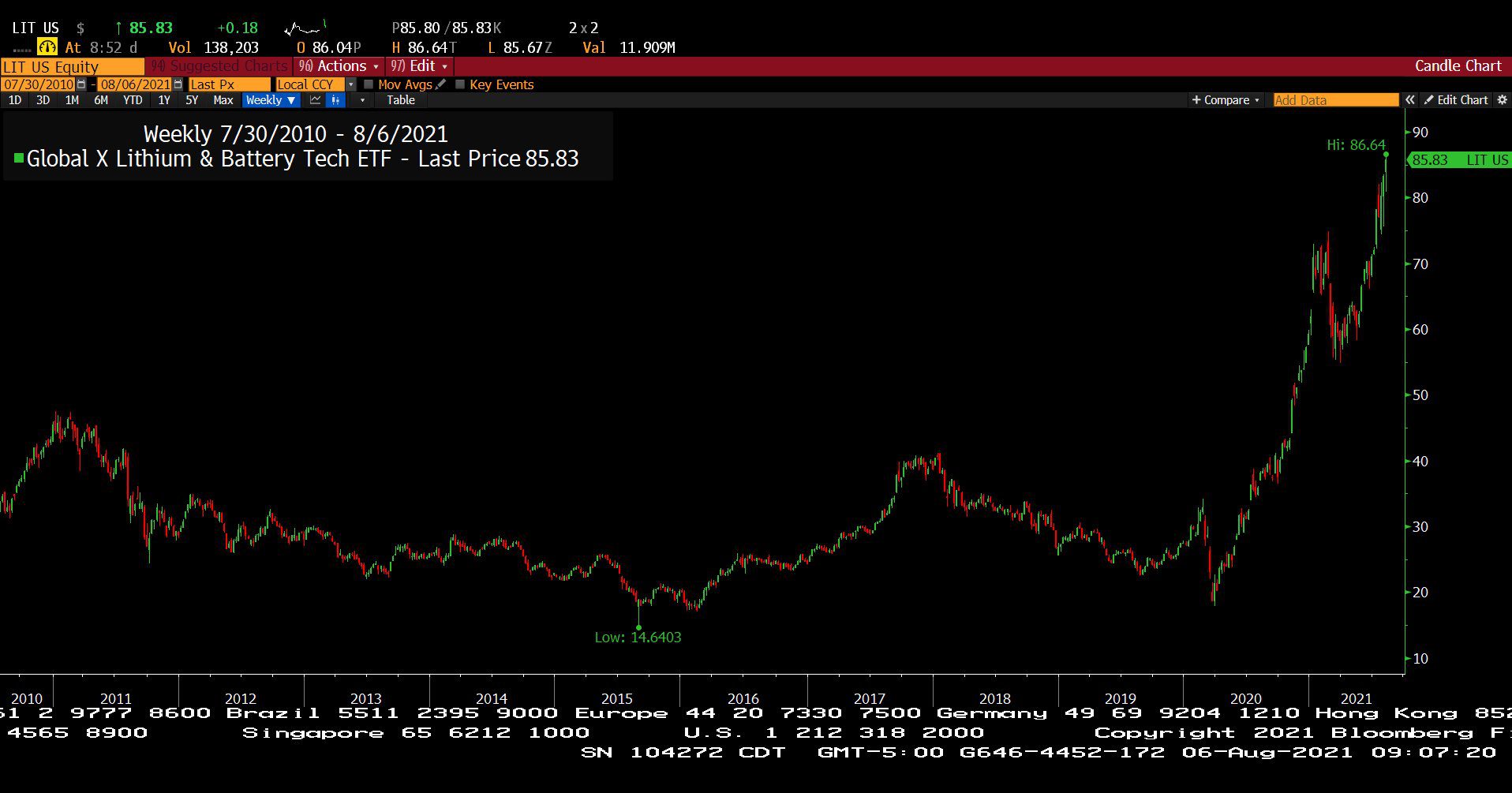

Global X Lithium & Battery Tech ETF (Year to Date)

– Courtesy of Bloomberg LP

Healthcare Select Sector SPDR Fund (Year to Date)

– Courtesy of Bloomberg LP

Headline Round Up

*35,000 on the Dow Again!

*Goldman Sachs Says 7% More to Go!

*Dallas County Risk Level RED!

* “Yellen” About the Debt Ceiling.

*KKR & Co., Inc. Raises Record $59 Billion Buyout Fund. Equity valuation peak?

*Jobs Report! How long until record employment? Then rate spike?

*Apartment Rents Post Record Gains!

*Jump in Mortgage Borrowing Fuels U.S. House Price Boom. Over-levered?

*EV Battery Materials Crunch Fuels Recycling?

*Infrastructure Boom! Current holdings?

*Natural Gas This Summer’s Hottest Commodity!

*Mini Nuclear Reactors?

*Earnings Updates! Big Oil and Banks Big!

*Reese Witherspoon Sells Hello Sunshine for $900 Billion.

*Old III Forks Now Champions Club Poker Club? What could go wrong?

Profit Report

Summer Planning Season!

Best Client Questions of the Week:

-

Long Term Care? Updates from clients!

-

Annuities? The conundrum of safety! Why does 2023 matter in the decision process?

-

Equity and Speculation vs. Panic and Despair? Solutions?

MGAM Disciplines and Evolution.