What Do the 2010-2013 Recovery Scenario Parallels, in the Financial Markets, Tell Us About Potential Strategy?

What Factors Are Emerging That Could Cause the Next Corrections?

What is True and What is Unknown in the Equity Markets?

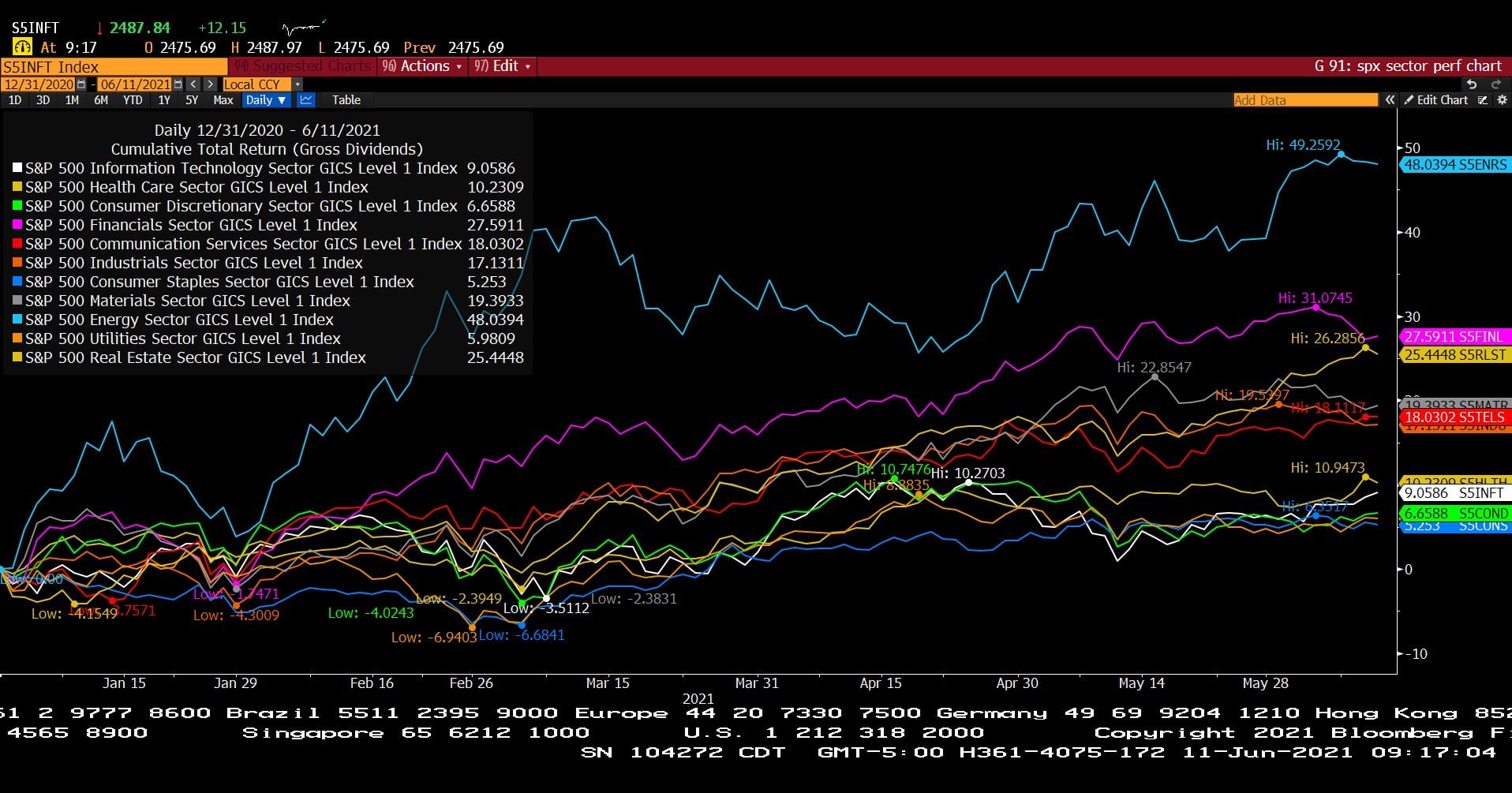

What Categories Could Continue to Outperform?

What Does the Current Trading Euphoria Tell Us About the Future?

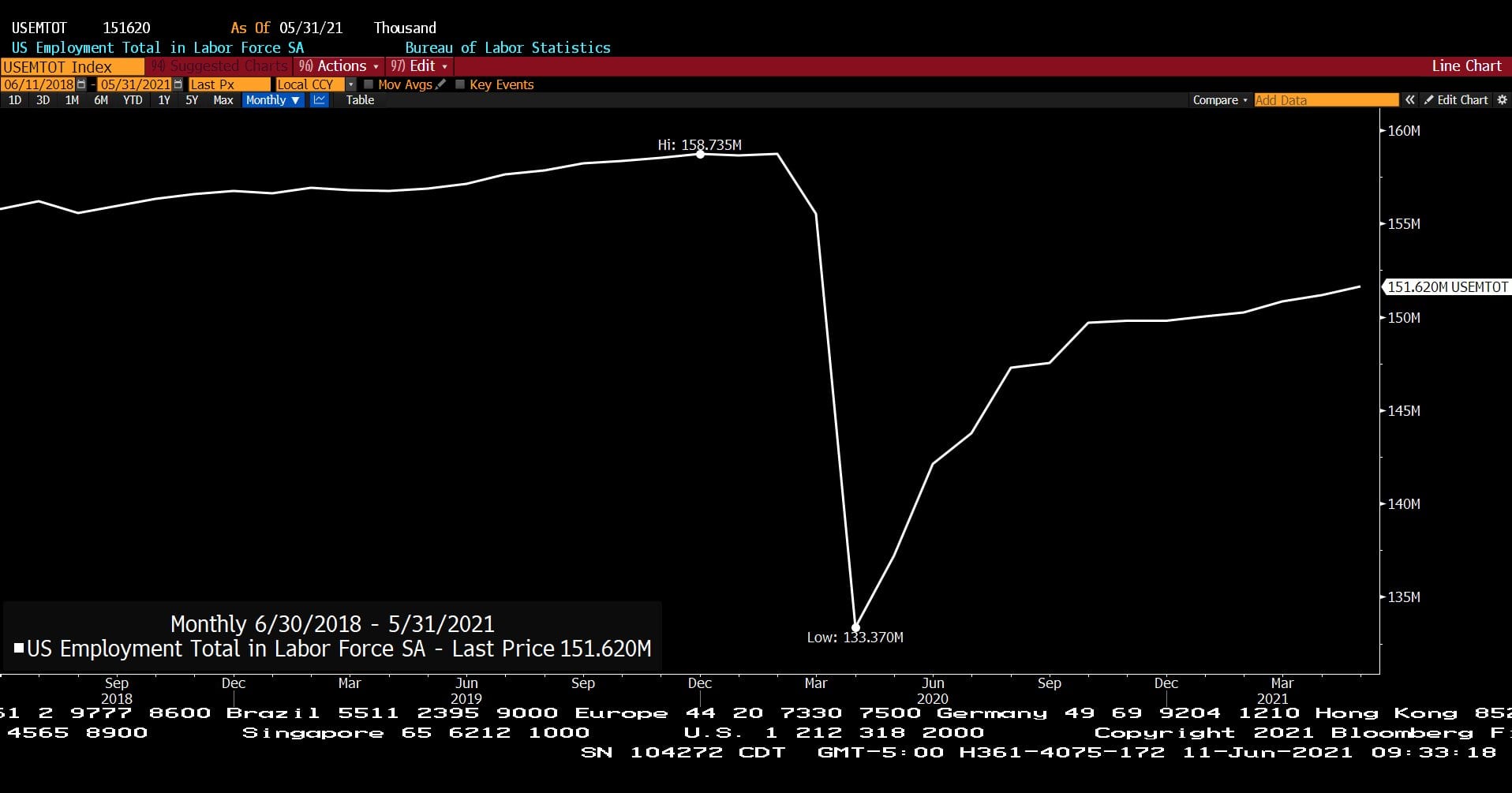

When Are We on Track to Reach Record Employment?

What is BTU, British Thermal Unit, agnostic?

I Want a Great Financial Advisory Team; Where do I find them?

Headline Round Up

*Cyber Counterattack! Yes, There IS an FBI and Bravo ANOM! Crypto Impact?

*A Record 9.3 Million Jobs Available!

*A Record Number Quit in April?

*10 Year Treasury Yield Back Below 1.5%!

*Inflation Spikes to Highest Level Since 2008?

*U.S. Taxpayers to Fund 500 Million Pfizer Shots for “Low Income Nations”.

*Biogen Alzheimer Breakthrough!

*Boeing Jet Sales Surge!

*Microchip RACE! Ferrari Hires Chip Guy as CEO.

*Seeking Alpha Features Medical REITS.

*Big Tech Flocking to Austin! Big Finance and Hedge Funds Love Dallas!

*Taxpayers Flee California Moving $8.8 Billion in Income to Texas, Arizona, and Nevada.

*Pension Funds Nearly Fully Funded! What does it mean for the Bond Market? Compression?

*Tax Foundation Says Biden’s Infrastructure Plan to Reduce Economic Growth?

*Global Tax Collusion?

*Oil Tops $70. $100 Option Bets.

*Pipelines Extend Gains for 2021.

Dow Jones Industrial Average (Year to Date)

– Courtesy of Bloomberg LP

U.S. Consumer Price Index, Urban Consumers Year Over Year – Non Seasonally Adjusted (Approx. 15 Years)

– Courtesy of Bloomberg LP

Global X MLP ETF (Year to Date)

– Courtesy of Bloomberg LP

U.S. Employment Total in Labor Force Index, Seasonally Adjusted (Approx. 3 Years)

– Courtesy of Bloomberg LP

Standard & Poor’s 500 Index Sectors – Cumulative Total Returns, Gross Dividends (Year to Date)

– Courtesy of Bloomberg LP

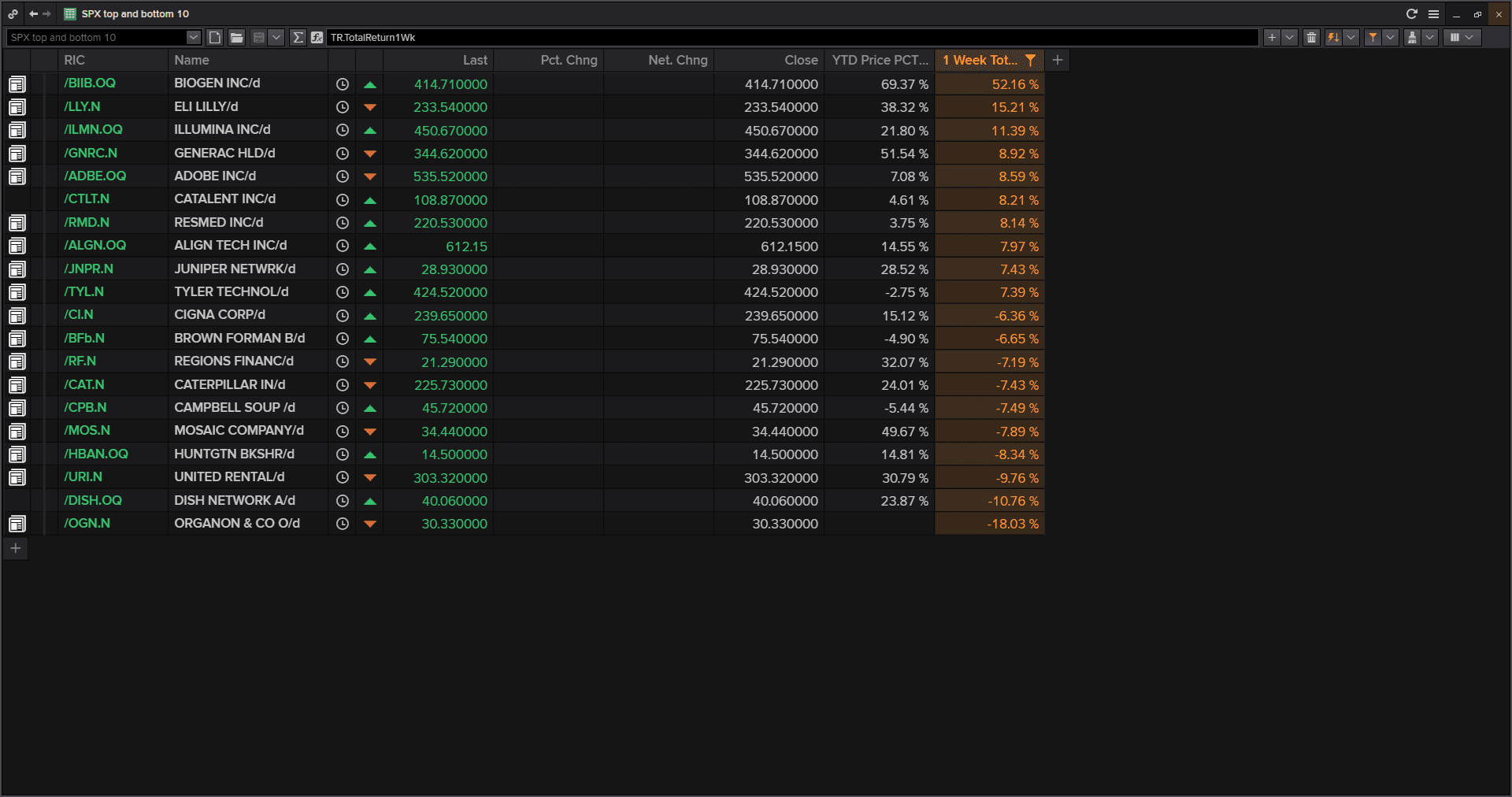

Standard & Poor’s 500 Top 10 and Bottom 10 Performers (06/11/2021)

– Courtesy of Refinitiv

U.S. West Texas Intermediate Crude Oil Future Spot Price (Approx. 20 Years)

– Courtesy of Bloomberg LP

Profit Report

What Does the Current Trading Euphoria Tell Us About the Future?

What Should We be Doing This Summer in Our Portfolios?

What is Summer Planning Season?

Alternative Investing Trends and Results?

Best Client Anecdotes and Questions This Week!