What were the financial market impacts of the Federal Reserve announcements this week?

What are the new economic forecasts for the U.S. economy?

Did the market rally on the news of Russia-Ukraine stalemate or strong news on the U.S. economy?

How does slowing growth impact investments?

What are the best potential bargains for forward returns right now?

Why did traditional low-cost investment portfolios lose money in the first 2 ½ months of 2022?

What happened to Chinese stocks and why?

If Interest Rates are increasing, how can I get a pay raise on my portfolio?

Headline Round Up

*Federal Reserve Raises Fed Funds Rate, 6 More Hikes Planned, Ends Bond Buying, Plus New Economic Projections.

*Dow Spikes Over 500 Points at Announcements to 34,000!

*PIMCO and Guggenheim Promptly Issue Research on Investing During Interest Rate Hike Cycle.

*Producer Prices Rise 10% in 12 Months.

*Housing Starts Strongest Since 2006.

*Mortgage Rates Top 4%, 2019.

*Walmart Hiring 50,000 Workers by 2022 End.

*Warren Buffett Scoops Up Another $1 Billion in OXY.

*Oil Spikes Back over $103 per Barrel.

*Nuveen Weighs In on Investing with Higher For Longer Oil Prices.

*U.S. Crude Oil Inventory Plummets 22% in 9 Months!

*The Biggest Commodity Supply Squeeze in Modern History?

*Be Afraid? Saudi Arabia and China Consider Oil Sales without Dollars?

*600 SPAC-weeds Looking for a Deal to Buy.

*Nickel Plummets to $42k per Ton After Hitting $100k?

*China’s Biggest Ever Equity Collapse!

*Florida Builds a Railroad for 1/20th the price than California? Punchline: Florida’s Railroad Already Working with Revenue!

*House Spending Bill Has 4,000 Earmarks Adding $10 Billion to Debt.

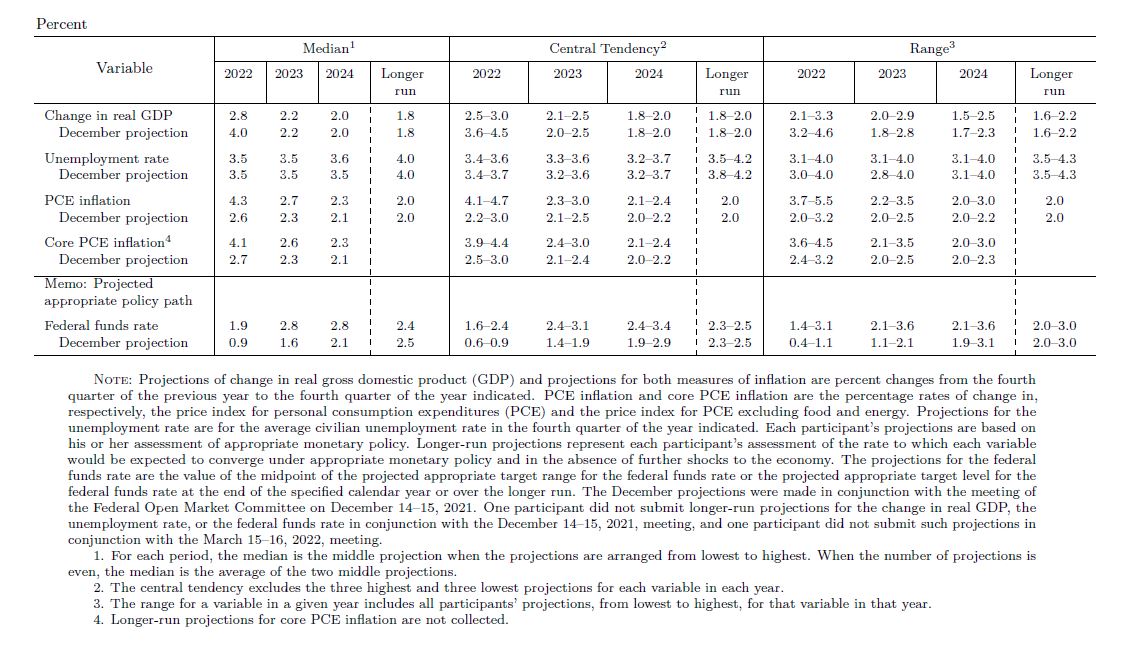

Summary of Economic Projections, Pg. 2 (03/16/2022)

– Courtesy of Federal Reserve Board and Federal Open Market Committee

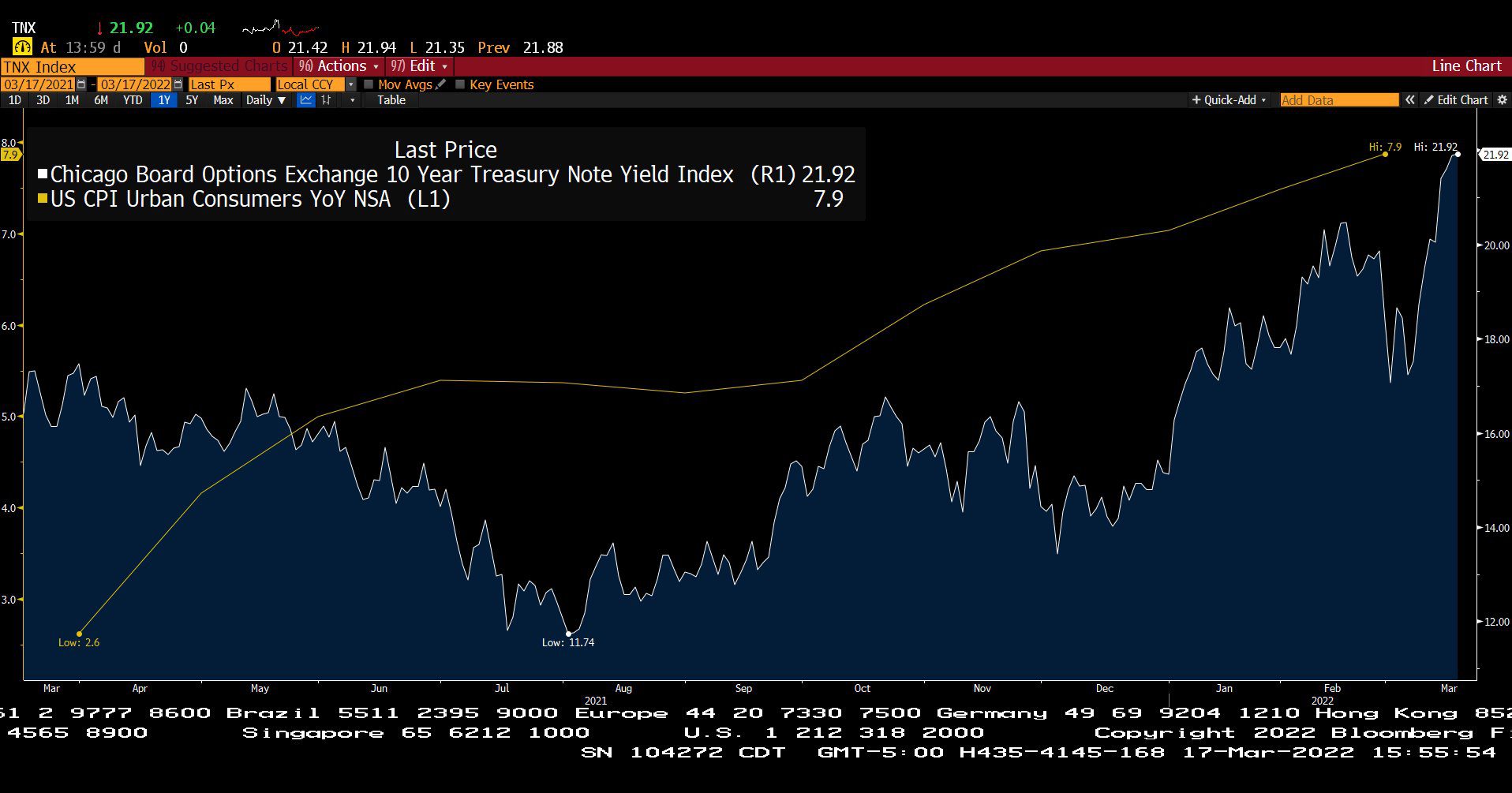

C.B.O.E. 10 Year Treasury Note Yield Index & U.S. Consumer Price Index – Urban Consumers, Year over Year, Non-Seasonally Adjusted (03/17/2021 – 03/17/2022)

– Courtesy of Bloomberg LP

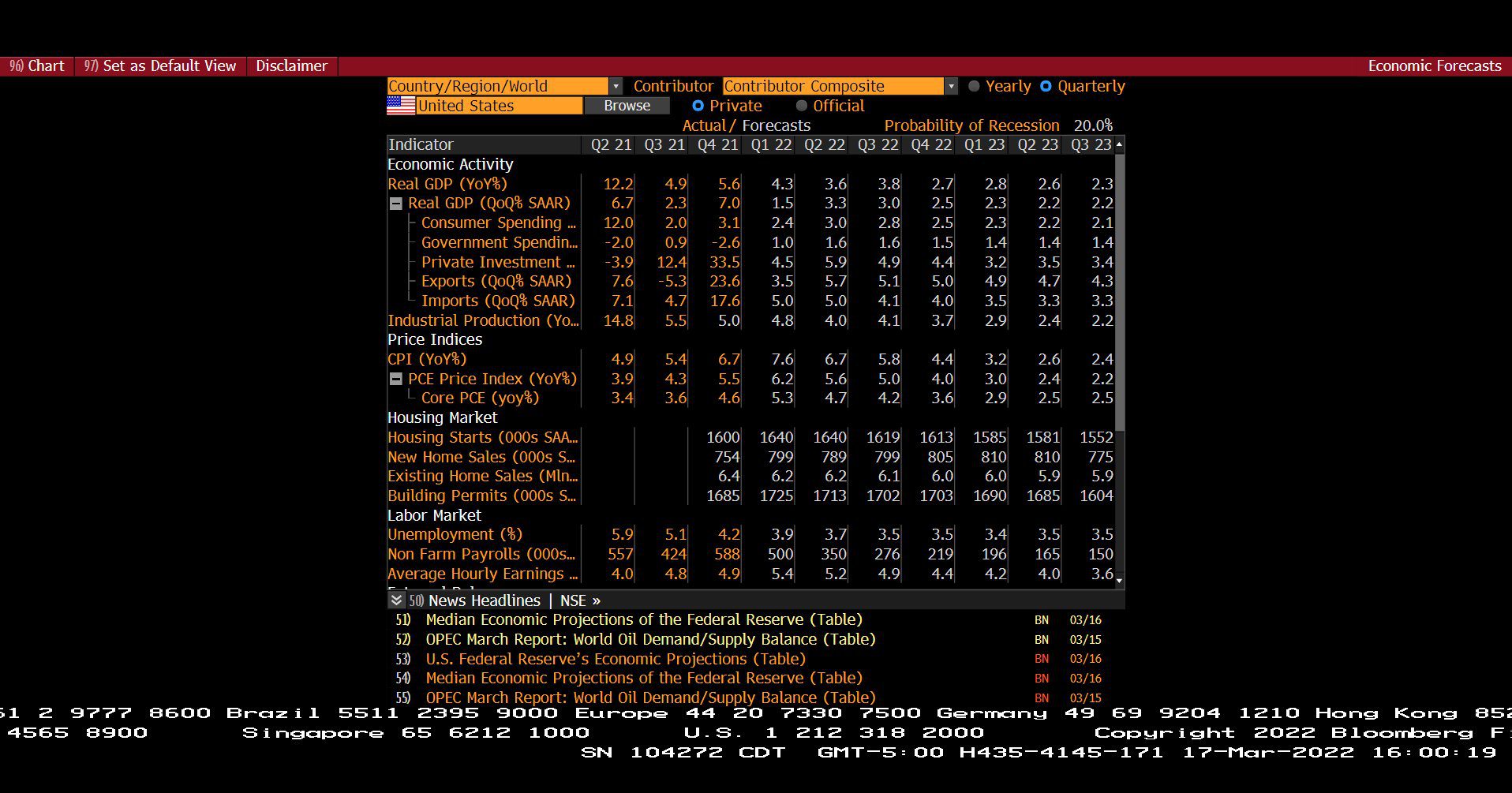

Quarterly U.S. Economic Forecasts with Probability of Recession (Q2 2021 – Q3 2023)

– Courtesy of Bloomberg LP

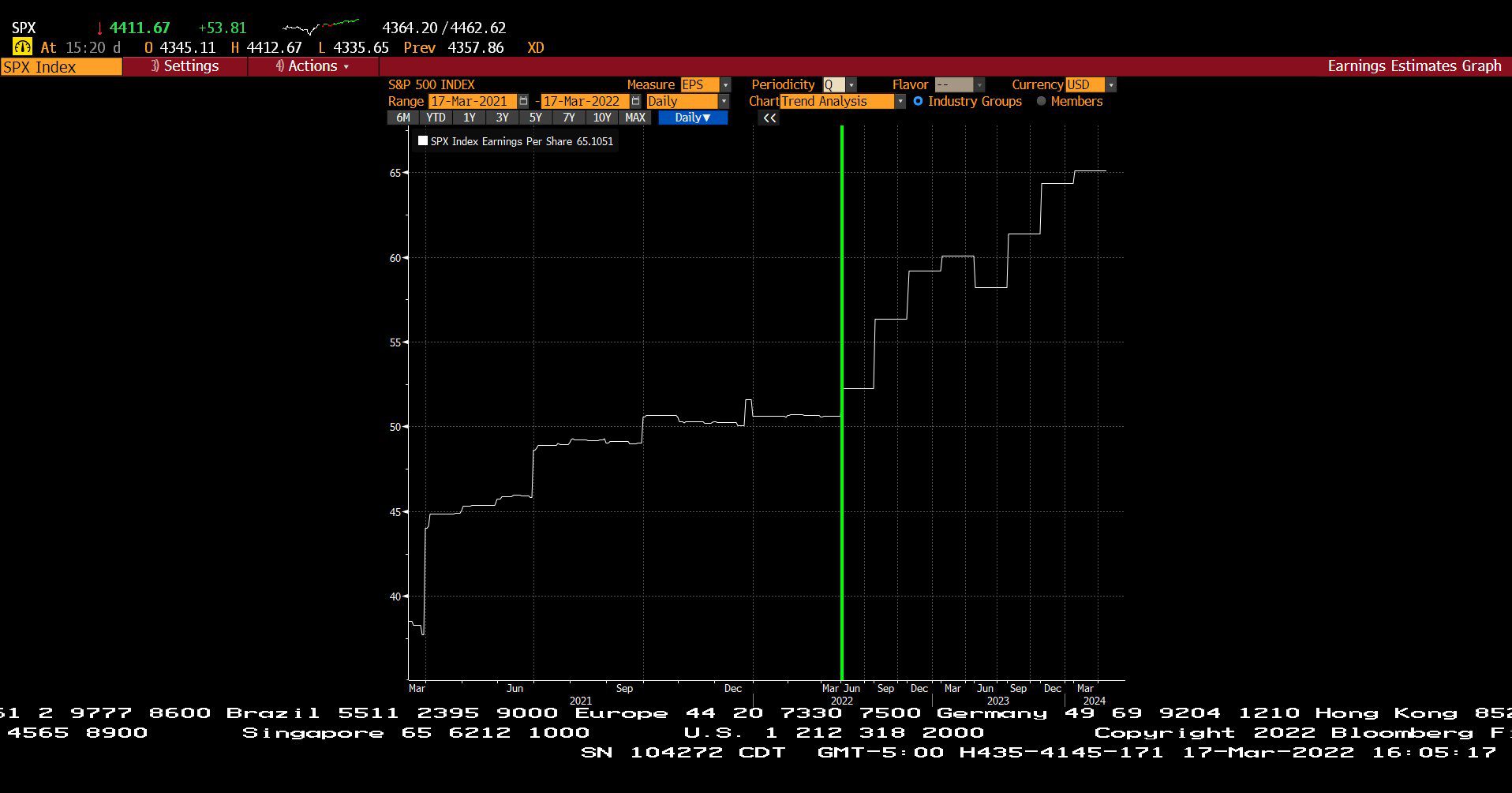

Standard & Poor’s 500 Index – Quarterly Earnings Estimates (03/17/2021 – 03/17/2022 )

– Courtesy of Bloomberg LP

Dow Jones Industrial Average (03/17/2021 – 03/17/2022)

– Courtesy of Bloomberg LP

Hang Seng Index (03/17/2021 – 03/17/2022)

– Courtesy of Bloomberg LP

Global X MLP ETF (03/17/2021 – 03/17/2022)

– Courtesy of Bloomberg LP

Generic Crude Oil Contract Spot Price (03/17/2021 – 03/17/2022)

– Courtesy of Bloomberg LP

U.S. Dollar Index Spot Price, Gold Spot Price per Oz., Generic Crude Oil Contract Spot Price (03/23/1997 – 03/17/2022)

– Courtesy of Bloomberg LP

Profit Report

Traditional 60/40 Low Cost Index Portfolios Down More than 10% in 2022?