How does The McGowanGroup define a Cash Flow panic?

When did we see the last Cash Flow panic?

What were the outcomes in the Equity markets from 2012?

“Run in Circles, Scream, and Shout!”, or just buy great Cash Flow ahead of time?

What do we know so far about the COVID-19 Omicron variant?

Why does The Team That Cares enjoy talking to clients?

What does the term “Group” mean in The McGowanGroup?

What should investors be doing to prepare for 2022?

Headline Round Up

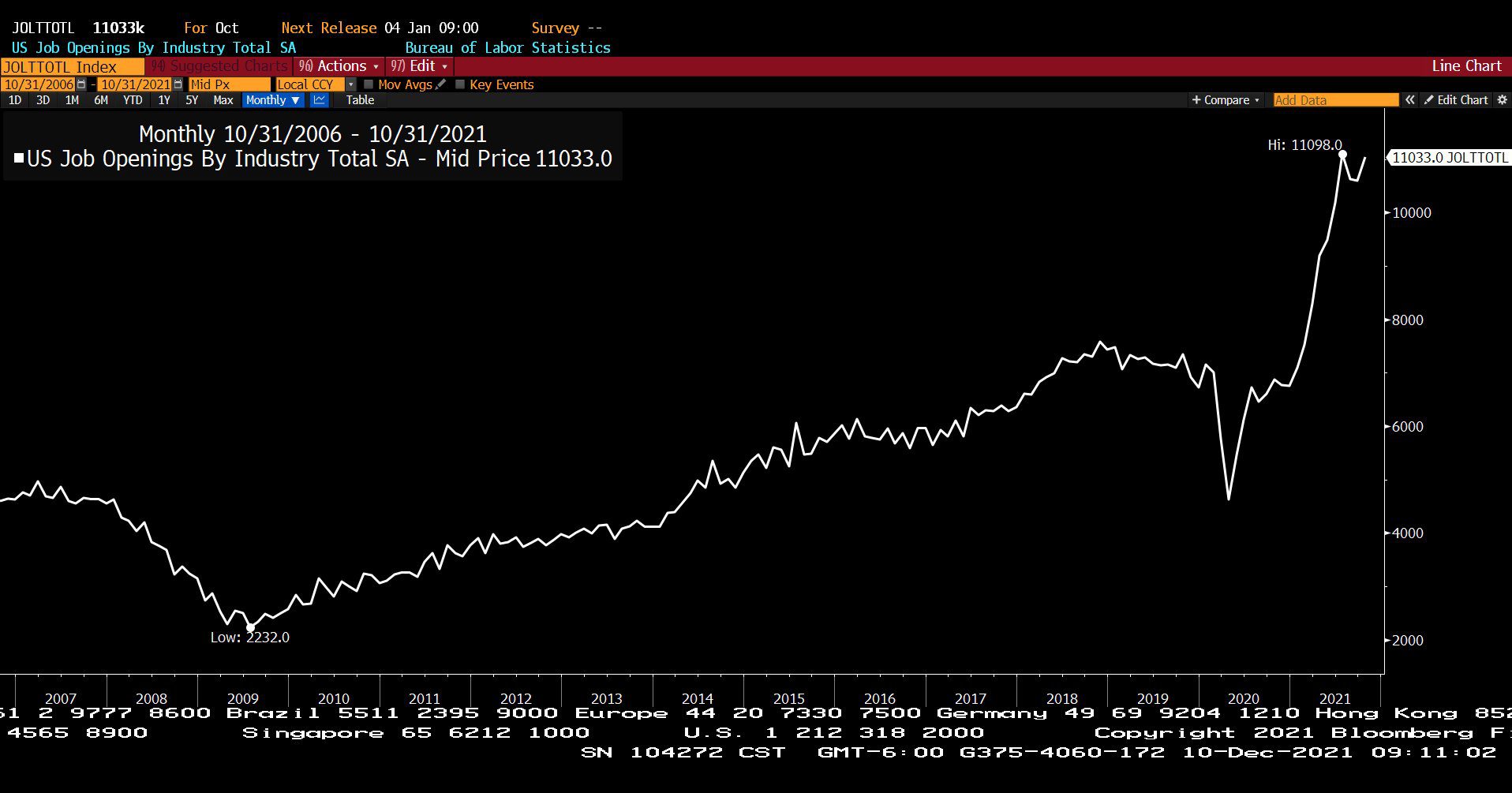

*11 Million Jobs Available! Pay raises in 2022 or else?

*Unemployment Claims at 52 Year Low Again!

*Omicron Fear Subsides “Far Milder.”

*Productivity Down Over 5%, Unit Labor Costs Up Nearly 10%. Profit squeeze?

*Ukraine Stand Off! Financial Market Impacts?

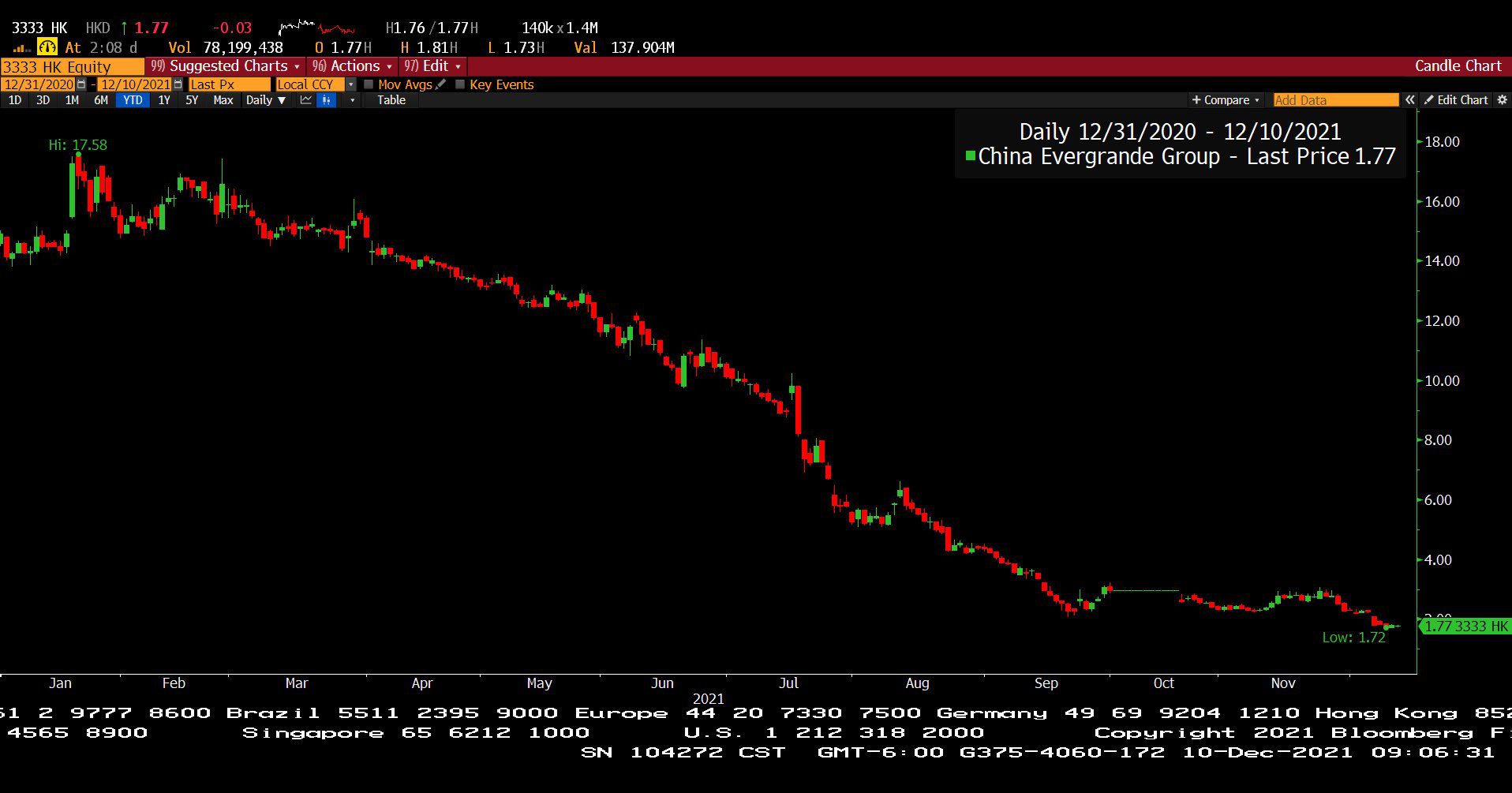

*Chinese Developer Evergrande Group Default Official Now! Global Debt market impacts?

*Copper Retreats as Chinese Construction Boom Smacked.

*Credit Suisse Boosts S&P 500 Target for 2022 to 5,200. Projected gain over 10%? Is Range Forecasting better than Time, Date, and Value Projection?

*Congress Will Vote on Debt Ceiling Increase Through Mid-Term Elections.

*Amazon’s AWS Wreaks Havoc! Is Bezos busy on other stuff?

*Southwest Airlines Makes a Profit. Dividend in 2023?

*Inflation Defies Old Models. Strong demand pushes restricted supply?

*Man Who Claims He Invented Bitcoin Wins Trial and Gets to Keep $50 Billion?

*Amex Reports Spending is 30% More than Pre Pandemic Levels?

*Tesla’s Lithium Extraction Technology! U.S. has world’s largest lithium reserves?

*Robinhood Option Frenzy!

*GameStop Losing Money Again?

*Austin Boom Creates Huge Housing Shortages.

*Texas Energy Gold Rush Headlines!

U.S. Job Openings by Industry Total, Seasonally Adjusted (10/31/2006 – 10/31/2021)

– Courtesy of Bloomberg LP

Yearly U.S. Economic Forecasts with Probability of Recession (2014 – 2023)

– Courtesy of Bloomberg LP

Dow Jones Industrial Average Index (Year to Date)

– Courtesy of Bloomberg LP

C.B.O.E. 10 Year Treasury Note Yield Index (Year to Date)

– Courtesy of Bloomberg LP

West Texas Intermediate Crude Futures Spot Price (Year to Date)

– Courtesy of Bloomberg LP

Quarterly Standard & Poor’s 500 Index Earnings Estimates (12/10/2018 – 12/10/2021)

– Courtesy of Bloomberg LP

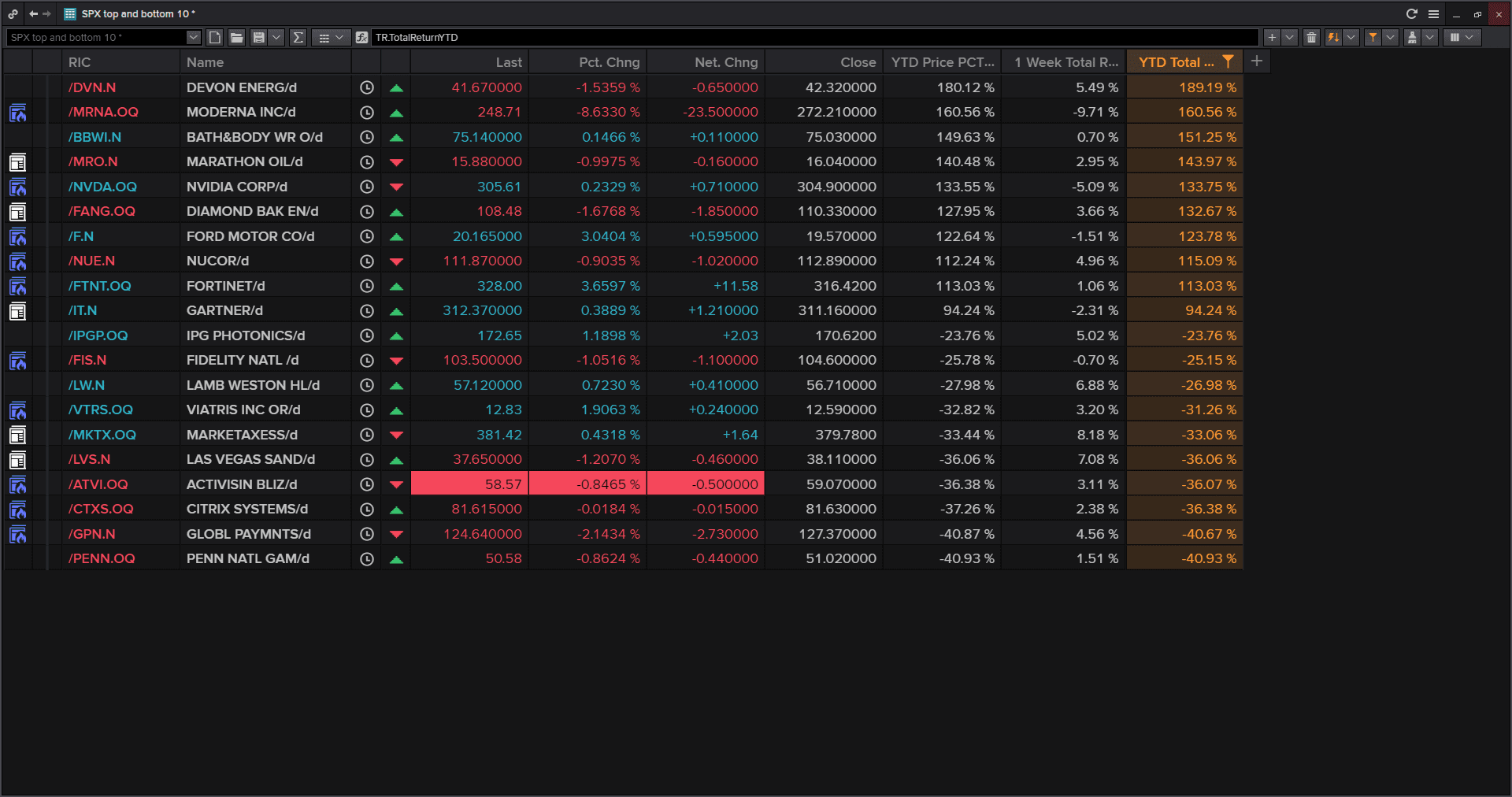

Standard & Poor’s 500 Index – Top 10 and Bottom 10 (12/10/2021)

– Courtesy of Refinitiv Datastream

GameStop, Corp. (Year to Date)

– Courtesy of Bloomberg LP

China Evergrande Group (Year to Date)

– Courtesy of Bloomberg LP

Profit Report

Great Questions Can Be The Basis for Great Answers!

7 Key Steps for 2022 Investment Plan Upgrades & How do I Adjust My Investment Plan for future Inflation?

1. Why is Investment Portfolio cash flow so important longer term? – For retirees, the ideal ratio is reinvestment of 20% of portfolio cash flow. This standard provides a framework for Allocation and Expense planning.

2. What is a “Tactical Safety” allocation and how can it be used effectively? – With slowing growth through 2022, tactical safety allows a plan to react to future corrections with a target list for great assets. Cash reserves help to avoid selling assets at unfortunate times.

3. Why should High Yield Global Lending be a permanent allocation for my Investment Portfolio? – Well managed portfolios of loans and bonds can provide opportunities for increased income and gain potential. In times of crisis, attractive discounts tend to emerge from fearful selling. Allocation planning can build in rebalancing additions. “Be the Bank!”

4. How do I prepare for future market corrections? – The study of prior market selloffs provides lessons for planning that can be likened to a fire drill where pre-planned actions increase the likelihood of success.

5. Why is excellent service so important for improving my Investment Performance? – A long-term plan executed by a well-managed and devoted team helps avoid service distractions. Excellent service is the basis for staying focused on opportunity because of the peace of mind created.

6. How can automated performance tracking improve my decision making? – The database record of actual overall performance provides guidance for future decisions in a more scientific process. Headlines and politics can often result in poor decisions driven by anxiety.

7. How can my goals and allocations be adjusted for current inflation forecasts including likely beneficiaries? – The world economies have moved from oversupply crisis to demand exceeding supply in many areas. Capital that provides solutions to these issues likely benefits with excess returns.