What is really happening to the Purchasing Power of the Dollar?

What Asset Classes have, in the past, kept pace with or exceeded Inflation?

Why are Growth Stock valuations impacted more by Inflation expectations?

What is Net Present Value of future earnings?

What is a Cap Rate?

What is a Discount Rate?

What is a Negative Real Rate?

What does all this mean for Investors?

What performed well in the Financial Markets this week?

Headline Round Up

*Pipelines Matter! Gasoline Spiked Briefly Over $3.

*Lumber Prices Up 5 Fold? Does your dollar buy 20% as much?

*Copper Prices Double? Dollar buys 50% as much?

*Corn Prices Double? Half as much popcorn?

*Wheat Prices Up 50%? $1 loaf of bread now $1.50?

*Iron Ore Hot!

*Home Prices Up Record 16%. One room less for same dollars?

*Consumer Inflation 4.2%.

*Producer Inflation 9.5%.

*Shortages!

*Worker Shortages Too!

*Used Cars Up 54%. One Toyota instead of two?

*McDonald’s Average Wage More Than $13.

*Job Openings Top 8 Million for First Time Ever!

*Smart Bond Traders 5 Year Inflation Expectations?

*The Fed Case for Inflation Spike Ending?

*What is ARKK? How Much Did ARKK Go Down in 90 days? What does it tell investors and who is Catherine D. Wood?

*Middle East Conflict Escalates!

*Energy Information Administration (EIA) Energy Projections Through 2050! What are the key surprises for investors?

Dow Jones Industrial Average (Year to Date)

– Courtesy of Bloomberg LP

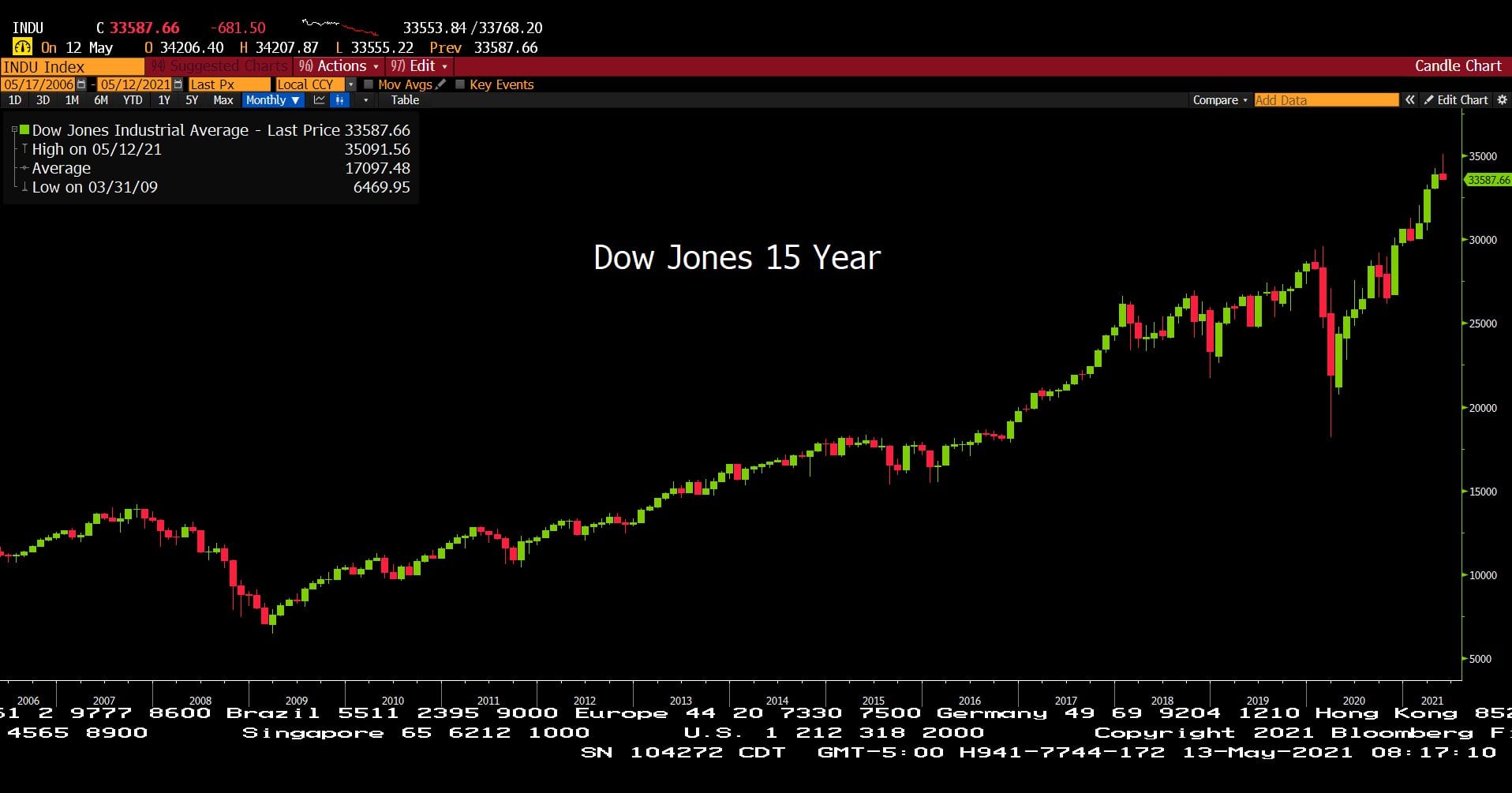

Dow Jones Industrial Average (Approx. 15 Years)

– Courtesy of Bloomberg LP

U.S. Consumer Price Index – Urban Consumers Year Over Year, Non Seasonally Adjusted (Approx. 5 Years)

– Courtesy of Bloomberg LP

U.S. Producers Price Index – Finished Goods, Non Seasonally Adjusted, Year Over Year (Approx. 5 Years)

– Courtesy of Bloomberg LP

London Metal Exchange 3 Month Copper Contract Spot Price (Approx. 5 Years)

– Courtesy of Bloomberg LP

Generic Corn Contract Spot Price (Approx. 5 Years)

– Courtesy of Bloomberg LP

Generic Lumber Contract Spot Price (Approx. 5 Years)

– Courtesy of Bloomberg LP

Generic Wheat Contract Spot Price (Approx. 5 Years)

– Courtesy of Bloomberg LP

Generic West Texas Intermediate Crude Contract Spot Price (Approx. 15 Years)

– Courtesy of Bloomberg LP

Profit Report

The Future of Interest Rates!

What Does Recurrent Investment Advisors Say About Inflation Preparation?

Best Client Anecdotes and Questions This Week!

Tactical Allocation?