What is the “Texas Energy Gold Rush?”

What are the potential outcomes for traditional Oil and Gas Infrastructure companies between now and 2025?

How long will it take before Renewables begin to reduce demand for Oil and Gas.

What does Europe teach us about the future of Green Energy versus Traditional Energy?

What kinds of shortages is the Electric Vehicle sector already creating?

How can we prepare for Inflation?

What is “The Tree and the Fruit” harvesting plan and how can I benefit?

Headline Round Up

*Energy Policy Facing Backlash from All Sides.

*President Biden Asks China President XI to Sell Oil from China’s Strategic Petroleum Reserve?

*Record Permian Basin Production!

*Crude Oil Inventories 7% Below 5 Year Average.

*Option Traders Betting on $300 Oil???

*PJSC Rosneft Oil Company CEO, Igor Sechin, Says Energy Market Super Cycle.

*Germany Suspends Nord Stream 2 Certification Before Winter Arrives.

*Europe’s Energy Policy Benefitting Russia and Iran?

*Bill Gates TerraPower Building First Advanced Nuclear Reactor in Wyoming Coal Town.

*Electric Vehicle Impact: Metals Bull Market!

*Solar Electricity Projected to Grow from 3% to 20% by 2050?

*U.S. Set to Become #1 Liquefied Natural Gas (LNG) Exporter in the World!

*Dallas Based CyrusOne Data Center Giant Bought By KKR for $15 Billion.

*Retailers In Rally Mode!

*Out of More than $1 Trillion, Texas Infrastructure to Receive $35 Billion? Under 4% vs. Texas Population 8%?

*Equity Buybacks Top $1 Trillion This Year Poised to Top 2018 Record.

*Buy of the Week: Get your Turkey Now! Prices Up between 20% and 30% & Harder to Find!

Dow Jones Industrial Average Index (Year to Date)

– Courtesy of Bloomberg LP

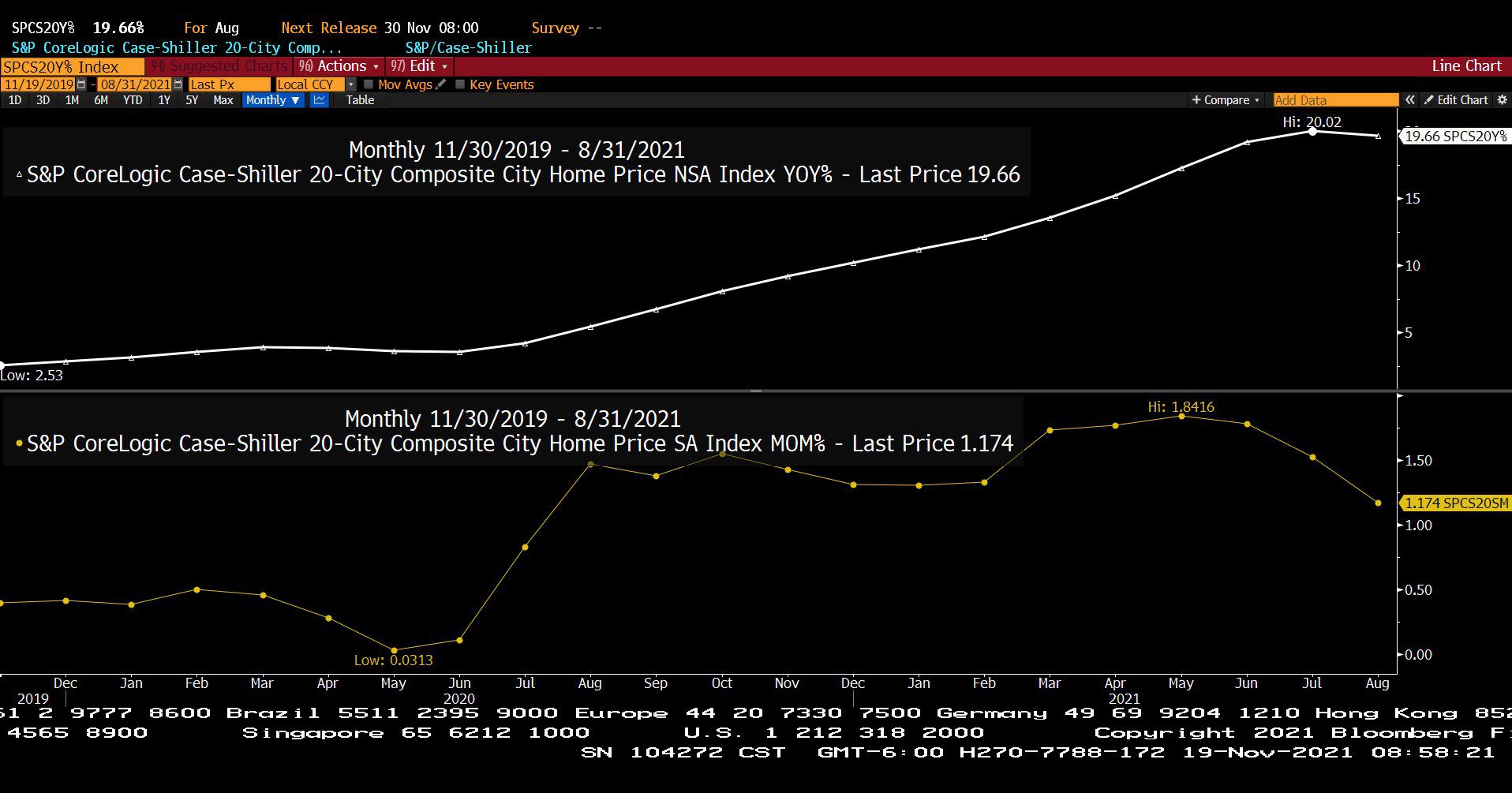

S&P CoreLogic Case-Shiller 20 City Composite City Home Price, Non Seasonally Adjusted & Year over Year & Seasonally Adjusted Month over Month (11/19/2019 – 08/31/2021)

– Courtesy of Bloomberg LP

Macy’s, Inc. (Year to Date)

– Courtesy of Bloomberg LP

Target Corp. (Year to Date)

– Courtesy of Bloomberg LP

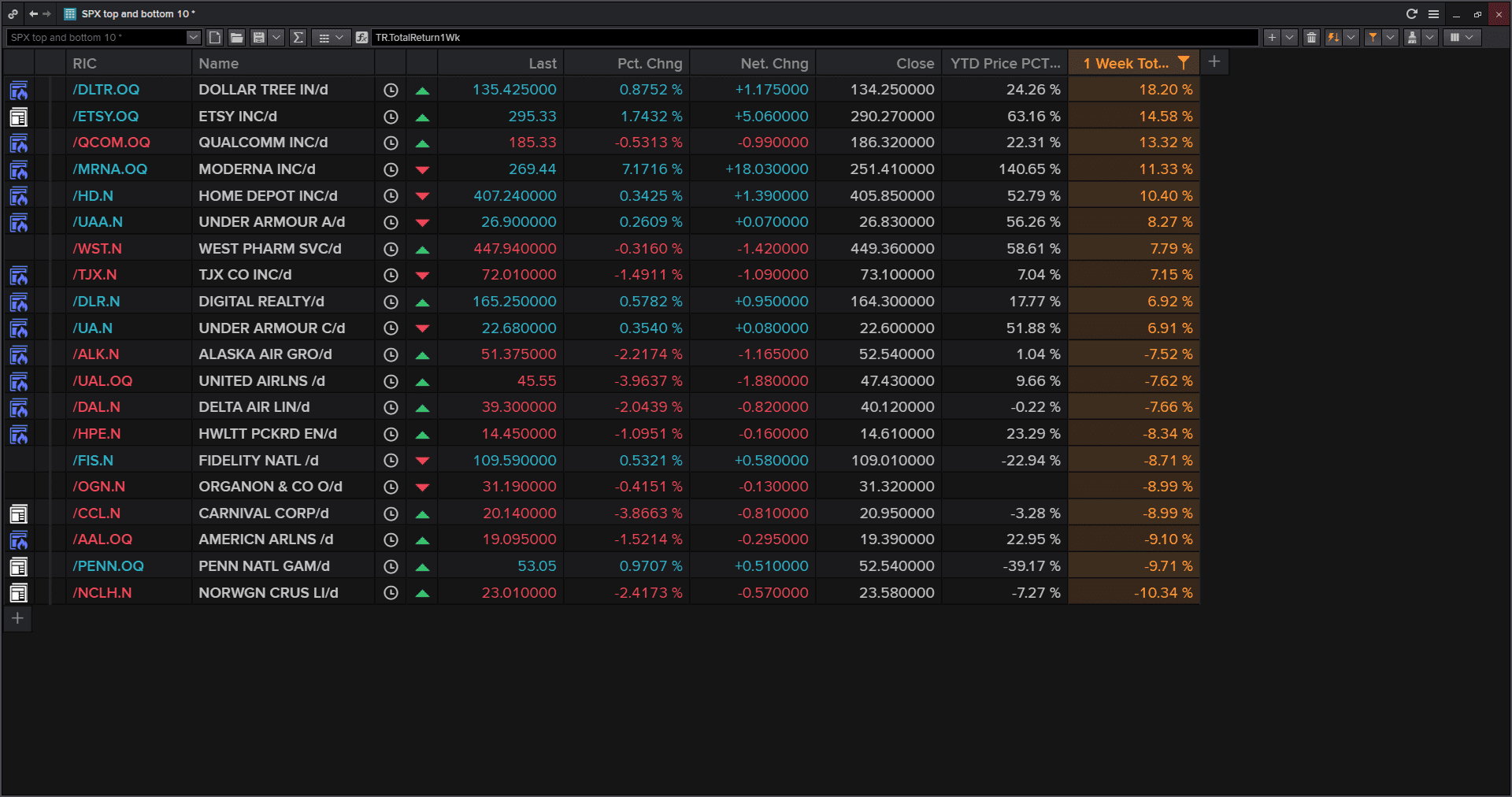

Standard & Poor’s 500 Index – Top 10 and Bottom 10 (11/19/2021)

– Courtesy of Refinitiv Datastream

Commodity Research Bureau BLS (11/18/2019 – 11/18/2021)

– Courtesy of Bloomberg LP

Natural Gas Futures Contract Spot Price (11/18/2019 – 11/18/2021)

– Courtesy of Bloomberg LP

Generic Crude Futures Spot Price (11/18/2019 – 11/18/2021)

– Courtesy of Bloomberg LP

Profit Report

*Key Strategies for Investment Plan Updates

-

Unprecedented Fiscal and Monetary Expansion

-

Demand Overwhelming Supply – Shortages and Commodity Spikes

-

Global Energy Crisis: The Texas Energy Gold Rush – The Clean Technology Revolution

-

Inflation

-

Accelerating Digital Technology Revolutions

-

Capital Markets Innovations

-

Crypto Mania

-

Raging Bull Market in Equities and Real Estate

-

Tax Planning Uncertainty

*5 Portfolio Constructions Themes for 2022!

*Great Questions Can Be The Basis for Great Answers!