Q: What is summer planning season?

A: McGowanGroup clients are encouraged to schedule a 2023 planning call to update financial plans, schedule a preliminary 2023 tax planning call with their CPA’s, and update estate planning logistics.

Q: What events happen in July that could set off a large equity rally?

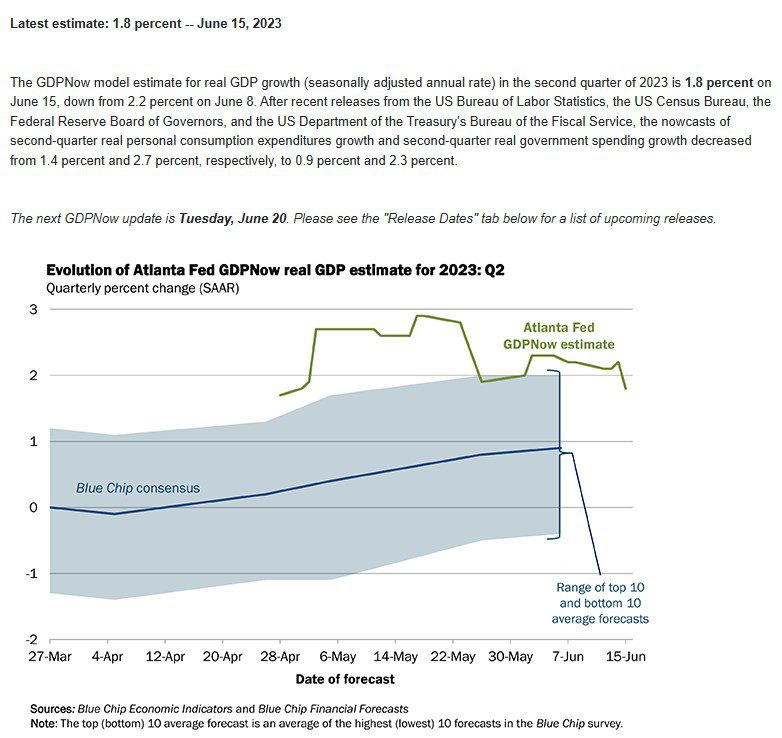

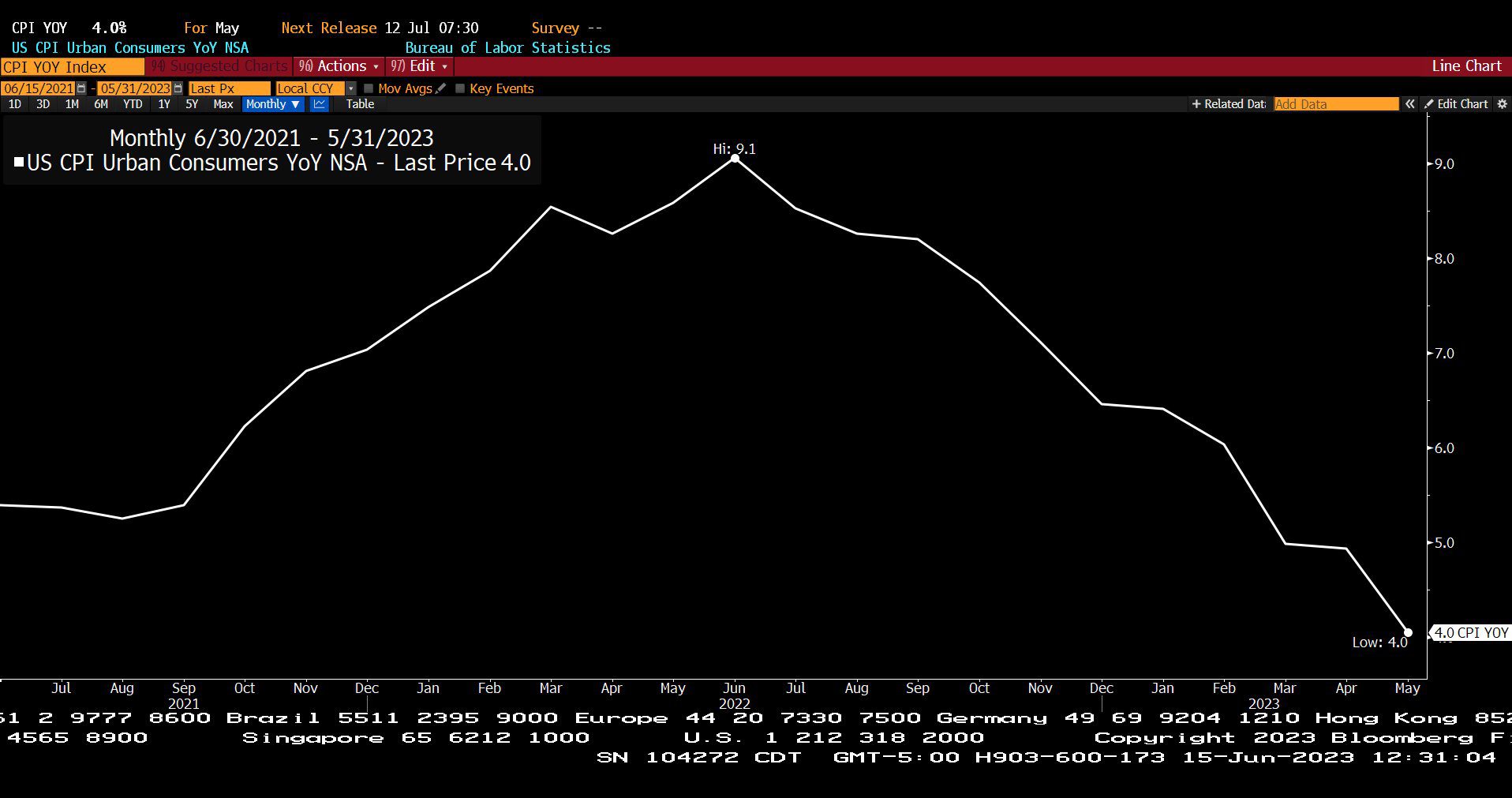

A: The trailing 12 month inflation rate, as of June 2023, drops by another 1% and company earnings announcements after the 4th of July Holiday can likely bring positive surprises especially related to economic growth.

Q: What are some of the impacts of the Securities & Exchange Commission’s (SEC) allegations against crypto exchanges so far?

A: The collective value of crypto currencies has fallen nearly $100 Billion since the SEC sued two of the largest crypto exchanges.

U.S. Consumer Price Index – Urban Consumers Year over Year, Non Seasonally Adjusted (06/15/2021 – 05/31/2023)

– Courtesy of Bloomberg LP

Dow Jones Industrial Average (12/30/2022 – 06/15/2023)

– Courtesy of Bloomberg LP

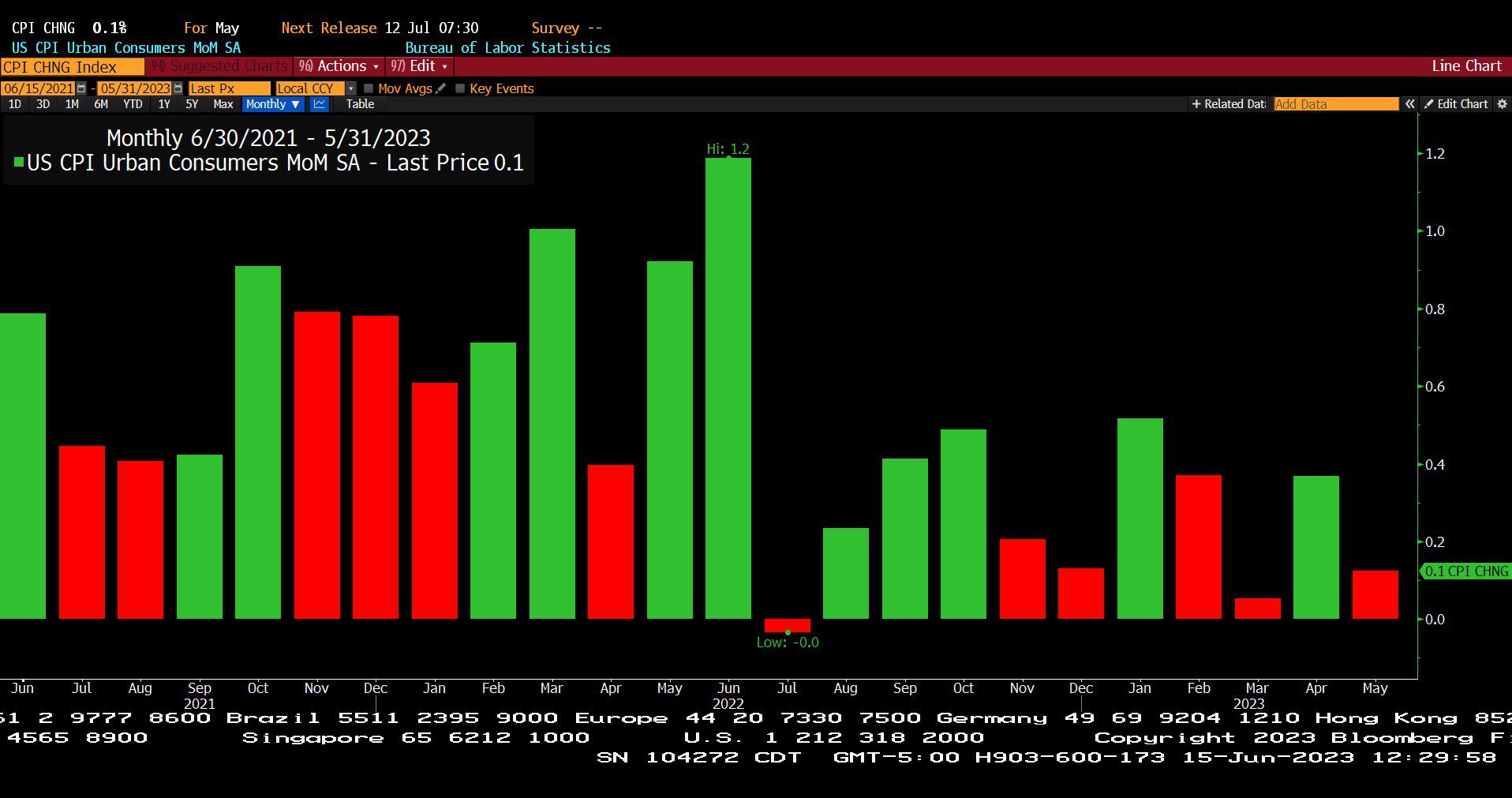

U.S. Consumer Price Index – Urban Consumers Month over Month, Seasonally Adjusted (06/15/2021 – 05/31/2023)

– Courtesy of Bloomberg LP

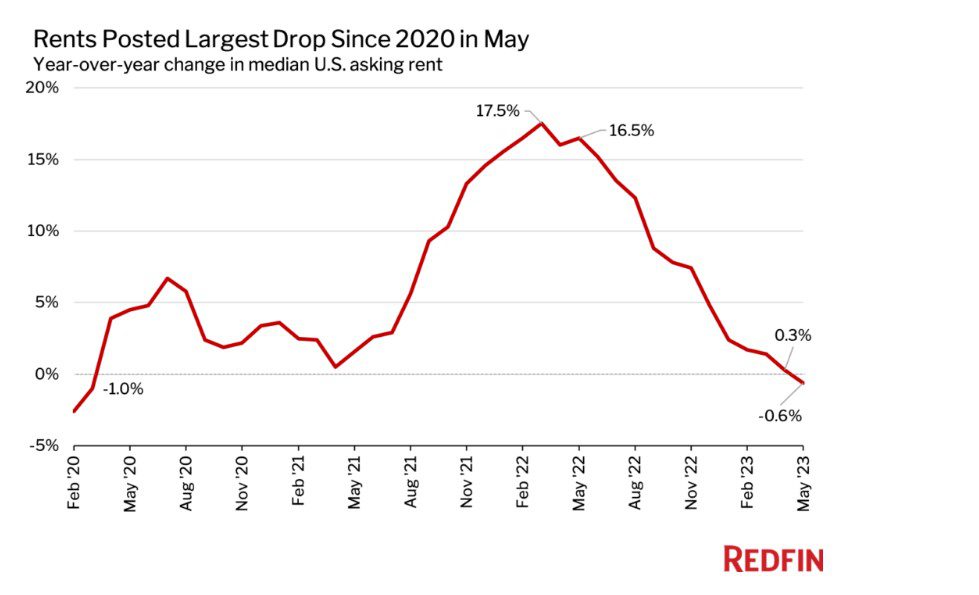

Rents Year over Year Change in Median U.S. Asking Rent (02/2020 – 05/2023)

– Courtesy of Redfin

Standard & Poor’s 500 Index and Federal Funds Target Rate Index (06/15/2003 – 06/15/2023)

– Courtesy of Bloomberg LP

Evolution of Atlanta Fed GDPNow Real GDP Estimate for 2023 – Q2 (06/15/2023)

– Courtesy of The Atlanta Federal Reserve

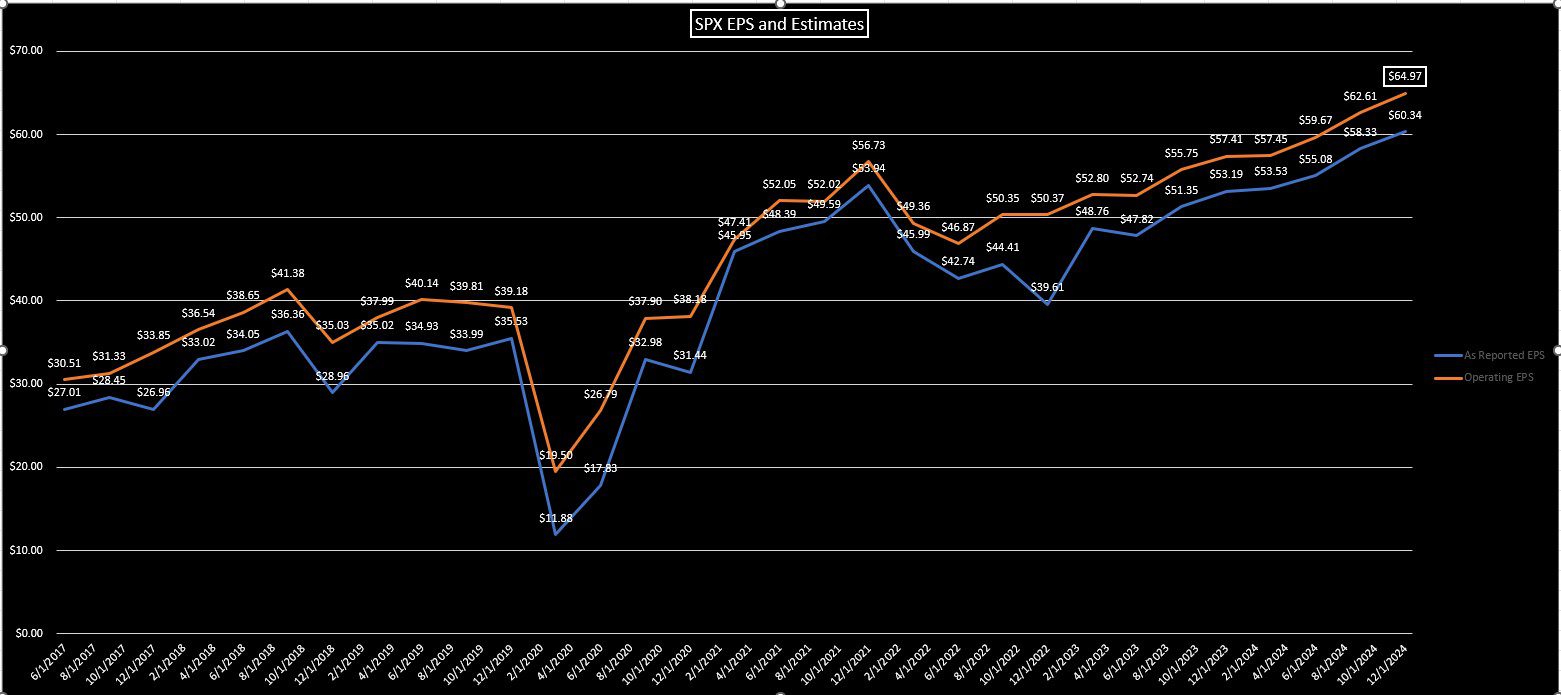

Standard & Poor’s 500 Index -Bi Monthly Earnings Per Share and Current Estimates (06/01/2017 – 12/01/2024)

– Courtesy of Bloomberg LP

Headline Round Up

*U.S. Federal Reserve Pauses Interest Rate Hikes for Now and Updates Forward Projections.

*Recent Egg Prices Drop Most in 72 Years in May!

*Inflation Down from 9% in June 2022 to 4%!

*New Lease Rents Poised for Drop, Only Second Time Since 2008.

*Goldman’s Chief Economist, Jan Hatzius, Says U.S. Economy on Course for a “Soft Landing.”

*Official End to Bear Market Last Week! Bulls See Room to Run with Bears Running in Fear of Being Wrong.

*Goldman Sachs CEO, David Solomon, Under Fire from Disgruntled Goldman Partners for DJ Side Hustle and More?

*Microsoft’s Suddenly Dominates Emerging Artificial Intelligence (AI) Software Market. *Nvidia’s AI Software Tricked into Data Breach!

*More Startups Throw in the Towel Due to Lack of Cash. Mass Extinction Event?

*Saudi Arabia Suckered Again by Russia! Saudis “Useful Idiots” for Russians?

*Drunk Russian Captain Crashes Oil Tanker in Irkutsk Region of Russia.

*Retail Sales Unexpectedly Rise in May, But What About the Recession?

*NextDecade Corp’s $11.5 Billion Rio Grande Liquified Natural Gas (LNG) Export Terminal Slated for 2027 Start!

*Texas’ Fragile Power Grid to Face Break Record Power Demand with Intense Heat This Early in the Summer?

*Permian New Record from Natural Gas Production in 2022.

*Solar Stocks Are Hot!

*Advanced Micro Device’s (AMD) New Chip to Rival Nvidia.

*Oracle Hits Record High on AI Frenzy as Cloud Demand Soars.

*BlackRock Japan ETF Pulls in $1B in June on Amazing Japanese Nikkei Rally.

*Impossible Foods Shares Getting Grilled.

Profit Report

1. Why does McGowanGroup Wealth Management (MGWM) post our favorite CPA’s and Estate Planning Attorneys on our website*?

* MGWM does not receive compensation for/pay for referrals.

2. Why is your wealth management team important for your financial legacy after you are gone?

3. What are 3 of the biggest mistakes clients can make in retirement planning and how do we avoid them?

-

Retiring too soon: Avocation Phase.

-

Overfunding kids and grandkids during retirement: Set clear, defined boundaries and stick to them.

-

Overspending: 80% of free cash flow leaves a 20% reinvestment rate.