What do we know so far about the COVID-19 Omicron variant?

What major moves occurred in the Financial markets this week?

What were the financial outcomes of the COVID-19 Delta variant surge over the summer?

When equity markets correct, what is the impact on cryptocurrency markets?

What Asset Categories increased in value this week?

Is this just a normal 10% correction after a major rally in the Equity markets?

Is there a Debt Ceiling impact?

Build Back Better when? New taxes?

What are the impacts from the 50 million barrel sale from the U.S. Strategic Petroleum Reserve?

What are important questions for 2022 & what should we be doing to prepare?

Headline Round Up

*Omicron and Travel Bans Announced on the Friday After Thanksgiving During Shortest Trading Day of the Year?

*Dow Jones drops below 34,000 at the lows of the week. What do the charts tell us?

*Oil Drops to Near $62 from Recent High of $85? Jefferies says $150 while Exxon curtails new supply.

*Biden Says Fed Chair Powell will Work to Combat Climate Change?

*Credit Card Applications Hit High Point!

*Metaverse Real Estate? Non-Fungible Tokens? Are these smart financial moves?

*Jobs Market Strong!

*Coal at a 10 Year High?

*Nissan Investing Over $17 Billion in Battery Powered Vehicles During Next 5 Years.

*Electric Vehicle (EV) Makers Desperate to Ditch Cobalt!

*Scramble for EV Battery Metals Just Beginning?

*SpaceX Risk of Bankruptcy?

*Fundstrat’s Tom Lee an Aggressive Buyer! Cramer’s List?

*Snowflake Inc.’s Revenue Doubles and Still Loses $155 Million?

Dow Jones Industrial Average Index (Year to Date)

– Courtesy of Bloomberg LP

C.B.O.E. 30 Year Treasury Bond Yield Index (Year to Date)

– Courtesy of Bloomberg LP

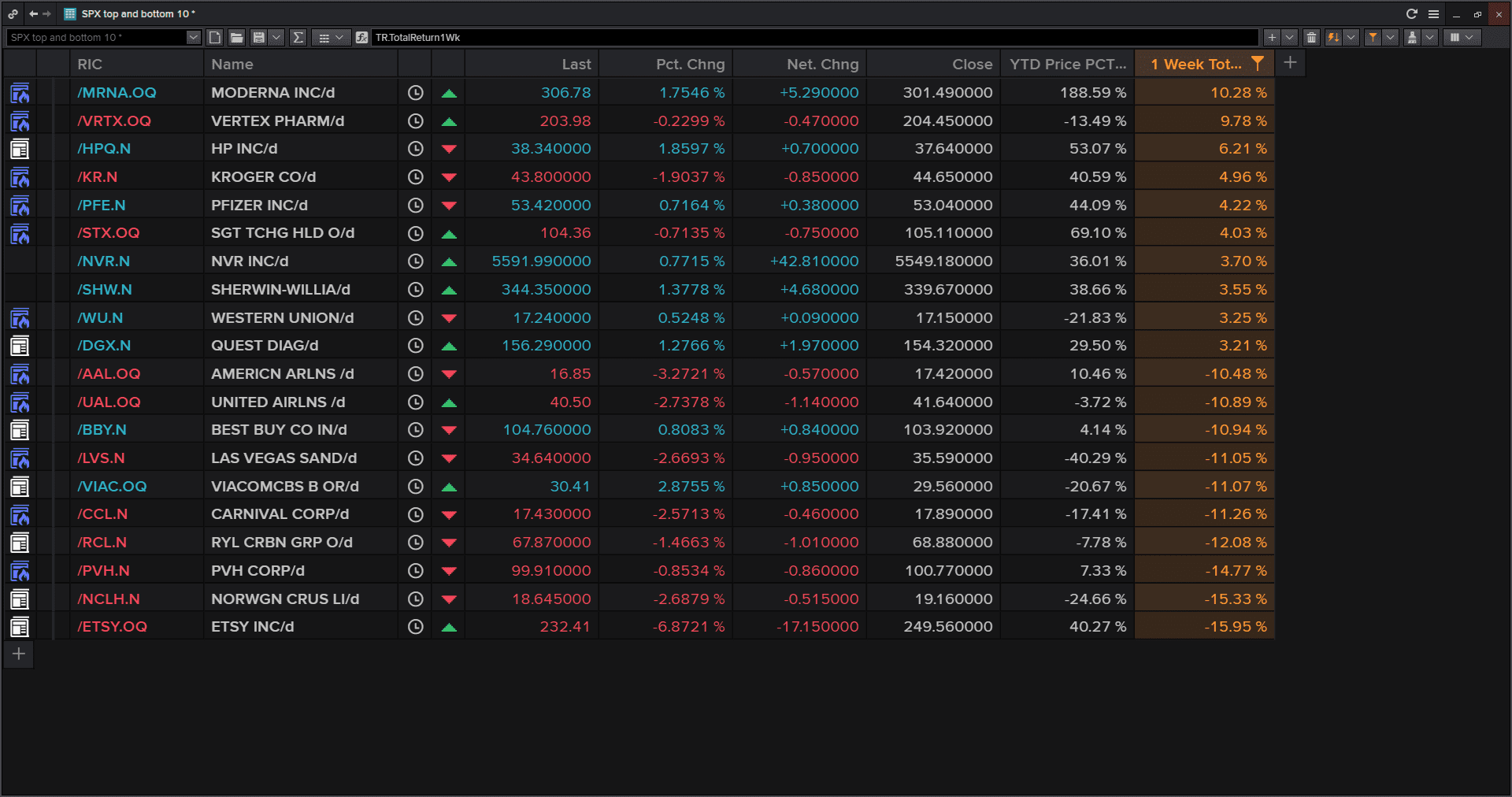

Standard & Poor’s 500 Index – Top 10 and Bottom 10 (12/03/2021)

– Courtesy of Refinitiv Datastream

Generic Crude Futures Spot Price (Year to Date)

– Courtesy of Bloomberg LP

Exxon Mobil Corp. & Chevron Corp. (Year to Date)

– Courtesy of Bloomberg LP

Global X MLP ETF (Year to Date)

– Courtesy of Bloomberg LP

Alibaba Group Holding Ltd. (Year to Date)

– Courtesy of Bloomberg LP

ProShares Bitcoin Strategy ETF (10/19/2021 – 12/03/2021)

– Courtesy of Bloomberg LP

iShares MSCI South Africa ETF (Year to Date)

– Courtesy of Bloomberg LP

Profit Report

*2022 Tax Brackets?

*2022 Preparation:

-

Unprecedented Fiscal and Monetary Expansion

-

Demand Overwhelming Supply – Shortages and Commodity Spikes

-

Global Energy Crisis: The Texas Energy Gold Rush – The Clean Technology Revolution

-

Inflation

-

Accelerating Digital Technology Revolutions

-

Capital Markets Innovations

-

Crypto Mania

-

Raging Bull Market in Equities and Real Estate

-

Tax Planning Uncertainty