This week’s tour through the global charts provides Intelligence for investors with a fast paced exploration of what companies actually cost versus forward returns. The strategy implications contain both bubble warnings and guidance for 2021 preparation.

Dow Jones Industrial Average (Year to Date)

– Courtesy of Bloomberg LP

Invesco QQQ Trust Series 1 (Year to Date)

– Courtesy of Bloomberg LP

Nasdaq Composite Index (Approx. 25 Years)

– Courtesy of Bloomberg LP

Top 10 Performers of the Nasdaq (07/24/2020)

– Courtesy of Bloomberg LP

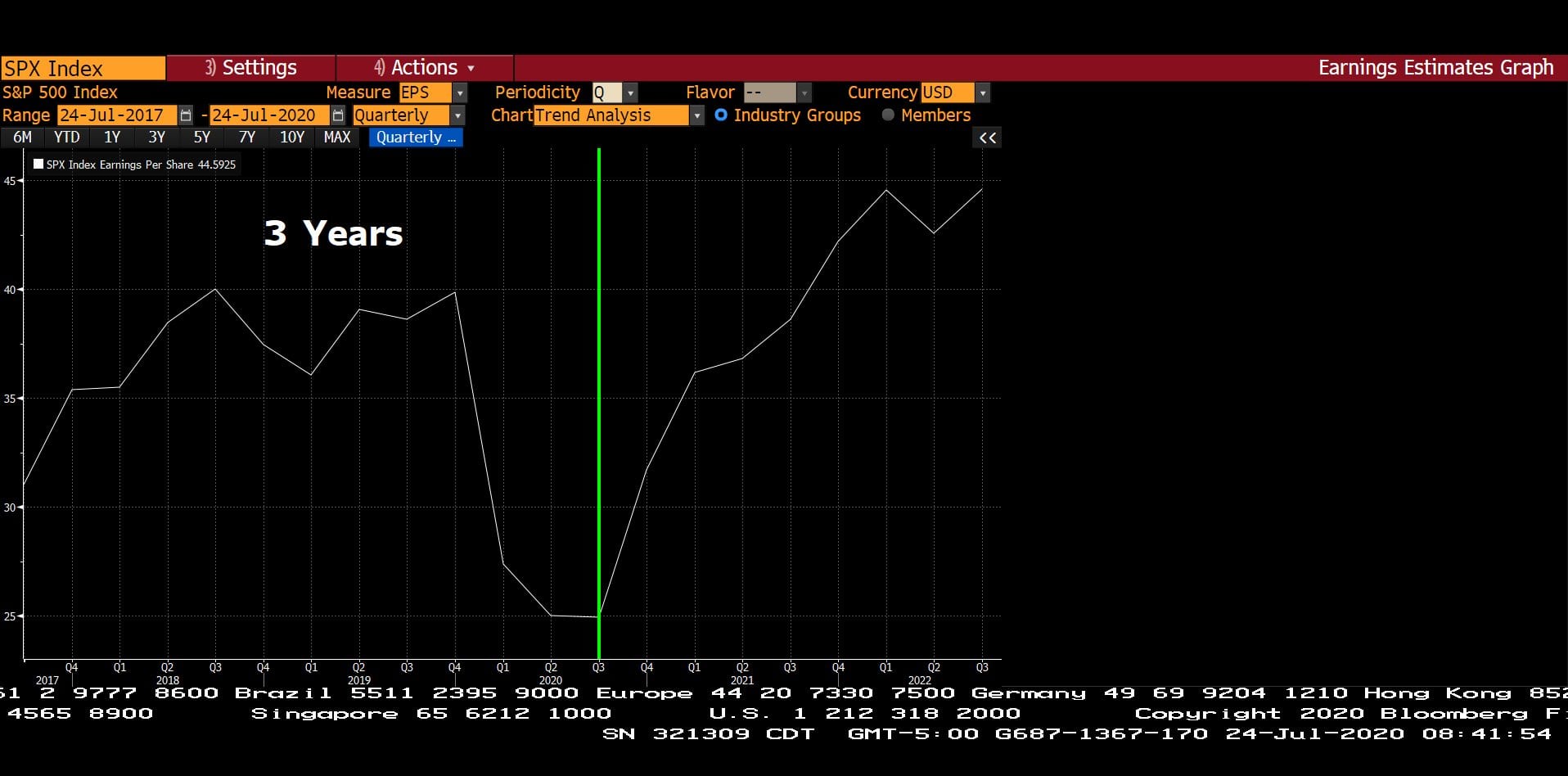

Standard & Poor’s 500 Index – Earnings Estimates (3 Years)

– Courtesy of Bloomberg LP

Top 10 Performers of the Standard & Poor’s 500 Index (07/24/2020)

– Courtesy of Bloomberg LP

Top 11 Sectors of the Standard & Poor’s 500 Index (07/24/2020)

– Courtesy of Bloomberg LP

Standard & Poor’s 500 Energy Sector GICS Level 1 Index (Approx. 25 Years)

– Courtesy of Bloomberg LP

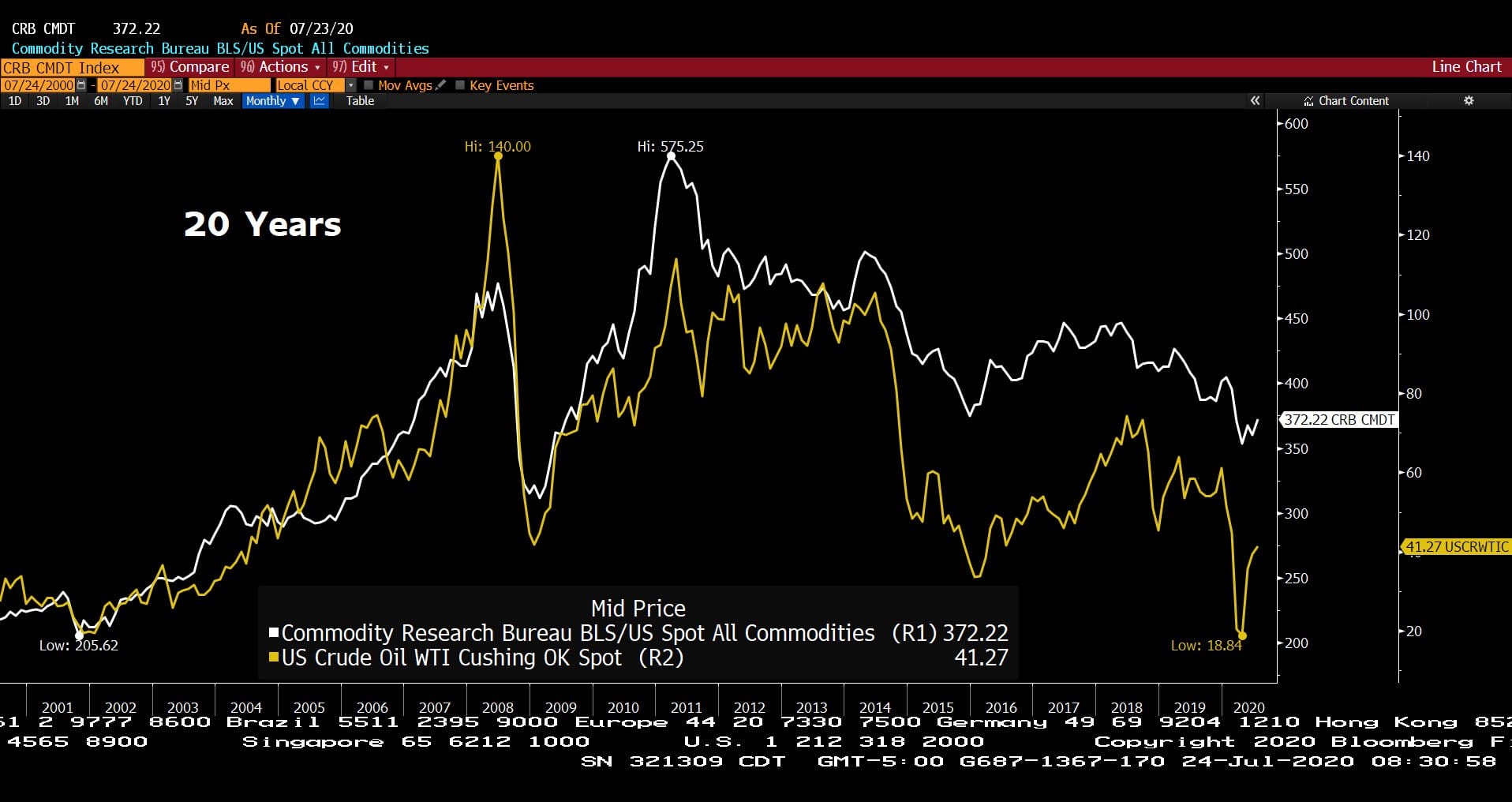

Commodity Research Bureau BLS/U.S. Spot & U.S. Crude Oil West Texas Intermediate – Cushing, OK Spot Price (20 Years)

– Courtesy of Bloomberg LP

U.S. Dollar Index Spot Price & U.S. Crude Oil West Texas Intermediate – Cushing, OK Spot Price (Approx. 20 Years)

– Courtesy of Bloomberg LP

U.S. Dollar Index Spot Price & U.S. Crude Oil West Texas Intermediate – Cushing, OK Spot Price (Approx. 37 Years)

– Courtesy of Bloomberg LP

Headline Round Up!

*Did the NASDAQ Crack?

*5 Companies Make Up 23% of the S&P Valuation?

*Corporate Bonds Undervalued?

*Existing Home Sales Spike Sets Record! 20.7%.

*Vaccine Progress? Who and When?

*Medical Research Theft? Crack Down on China! Houston Hackers Get the Boot.

*Dollar Tumbles, Metals and Commodities Rally?

*Texas Instruments Trades to $140 Overnight and Plummets Back to $130.

*Microsoft Reports Strong Growth!

*Apple Net Income Projections Plummet.

*AT&T Profits Decline, Again.

*Coca Cola Sales Drop 23%?

*Twitter Profits and Revenue Fall?

*Pimco Teams Up With Texas Entreprenuer for Distressed Debt Fund.

Texas Energy Gold Rush

*Chevron Buys Noble Energy for $5B

*U.S. Energy Information Administration (EIA): Oil Demand to Hit 2019 Levels By August 2021?

*Kinder Morgan Raises Dividend Again.