Q: What did Janet Yellen do during her visit to China?

A: At an arranged dinner she was unknowingly served a dish featuring mushrooms known for their psychedelic effects.

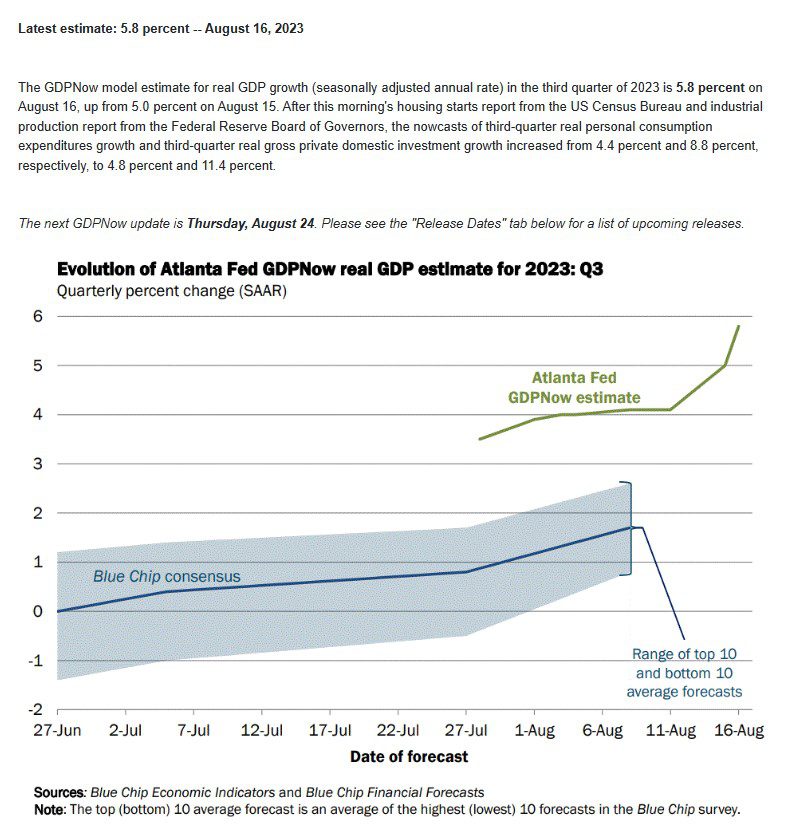

Q: What is a likely explanation for the 55 basis point spike in long US Treasury yields in less than a month?

A: Atlanta Fed estimated current economic growth this week at a whopping 5.8%.

Q: Is China destined to collapse?

A: Real estate collapse, demographic aging, exports plummet, and recent economic news paint a picture underscored by Alex in his Japan example of lost decades after the 1989 peak.

Headline Round Up

*Long US Treasury Bond Yield Hits Highest Since 2008!

*New Single Family Home Construction Rises 6.7%

*Warren Buffet’s Berkshire Hathaway Buys Over $700 Million in Arlington Based DR Horton Shares.

*Inflation Raises Average Household Costs By Over $700 Per Month.

*Wall Street Raising Billions to Scoop Up Commercial Real Estate.

*Goldman Sees Fed Cutting Rates in First Half of 2024.

*Japan’s Economic Growth 6% in the Second Quarter!

*Regulators Gone Wild? A Wall Street Journal Opinion piece.

*AI Salaries Rise to as Much as $900,000 Annual Pay.

*Tesla Cuts Model S and Model X Prices by $10,000 for new Standard Range models.

*Streaming Inflation: Prices up 25% in a Year for many online providers.

*European Natural Gas Spikes 40% as Strike Risk in Australia Could Shut Down 10% of Global Supply.

*Global Oil Demand Hits Record High of 103MM barrels in June!

Mergers and Acquisitions:

*Energy Transfer Buys Crestwood for $7.1 Billion in stock.

Skid Row:

*Proterra Leaves $1.6 Billion in Debt After $6.7 Billion in Market Capitalization Evaporated.

*Vinfast, a Vietnamese EV Startup Spikes to $86 Billion in Value vs GM and Ford Market Cap is Less than $50 Billion each.

*Hawaiian Electric Drops 63% Over Maui Fire.

iShares 20+ Year Treasury Bond ETF (12/30/2022 – 08/18/2023)

– Courtesy of Bloomberg LP

Evolution of Atlanta Fed GDPNow Real GDP Estimate for Q3 2023

– Courtesy of The Atlanta Federal Reserve

Dow Jones Industrial Average Index Year to Date (12/30/2022 – 08/18/2023)

– Courtesy of Bloomberg LP

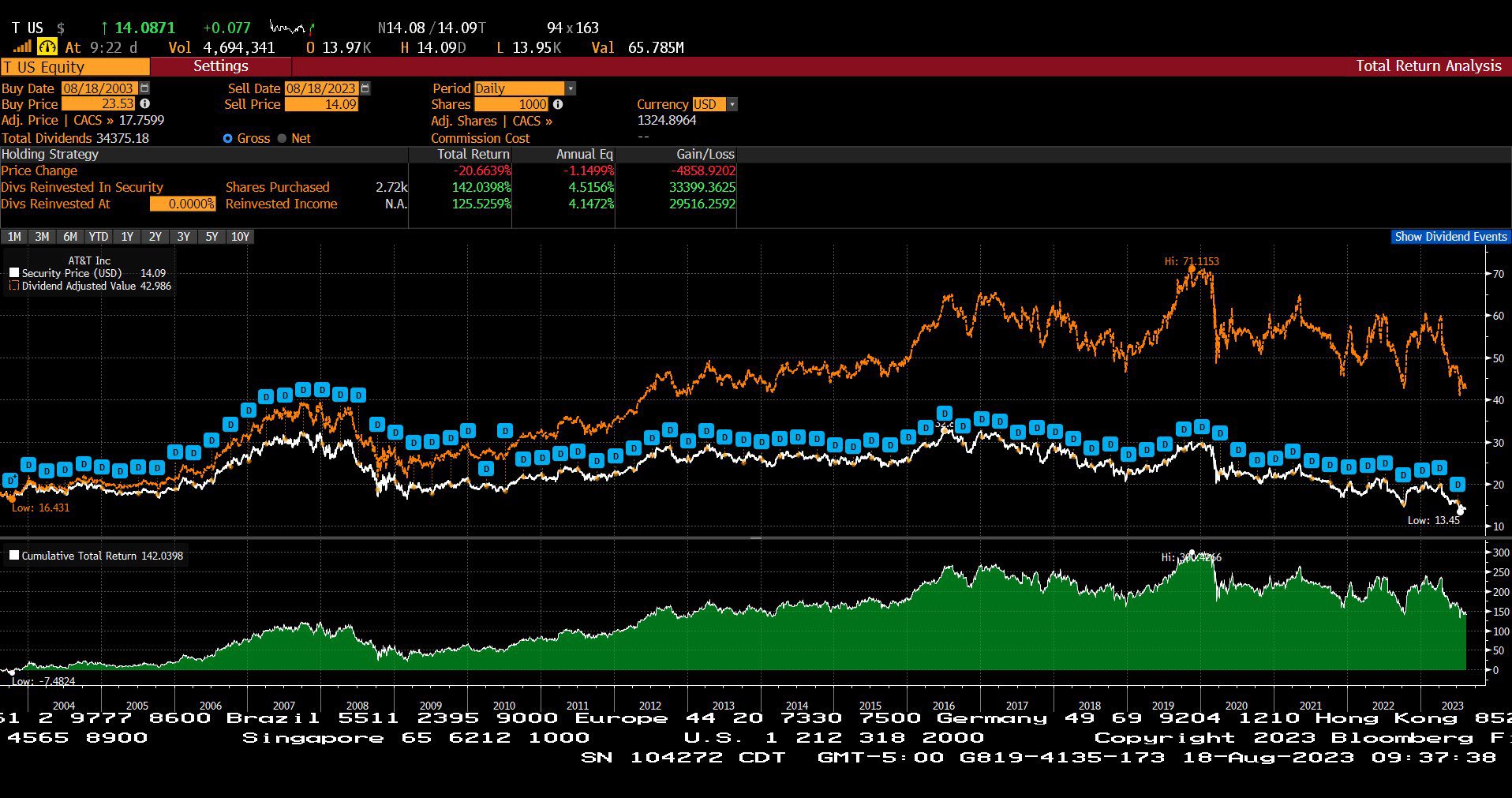

AT&T Total Return (08/18/2003 – 08/18/2023)

– Courtesy of Bloomberg LP

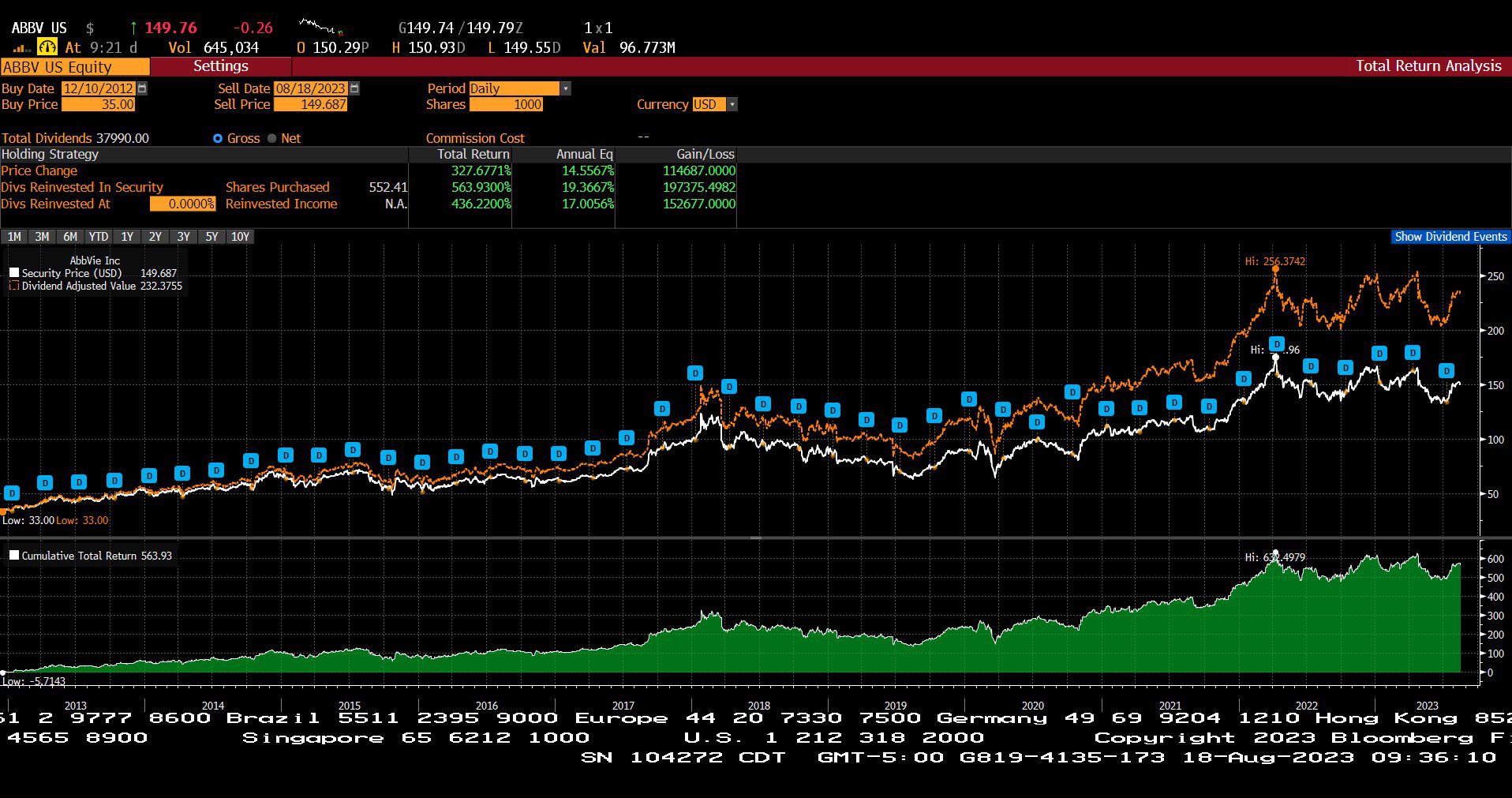

Abbvie Inc. Total Return (12/10/2012 – 08/18/2023)

– Courtesy of Bloomberg LP

AllianceBernstein Global High Income Total Return (07/28/1993 – 08/18/2023)

– Courtesy of Bloomberg LP

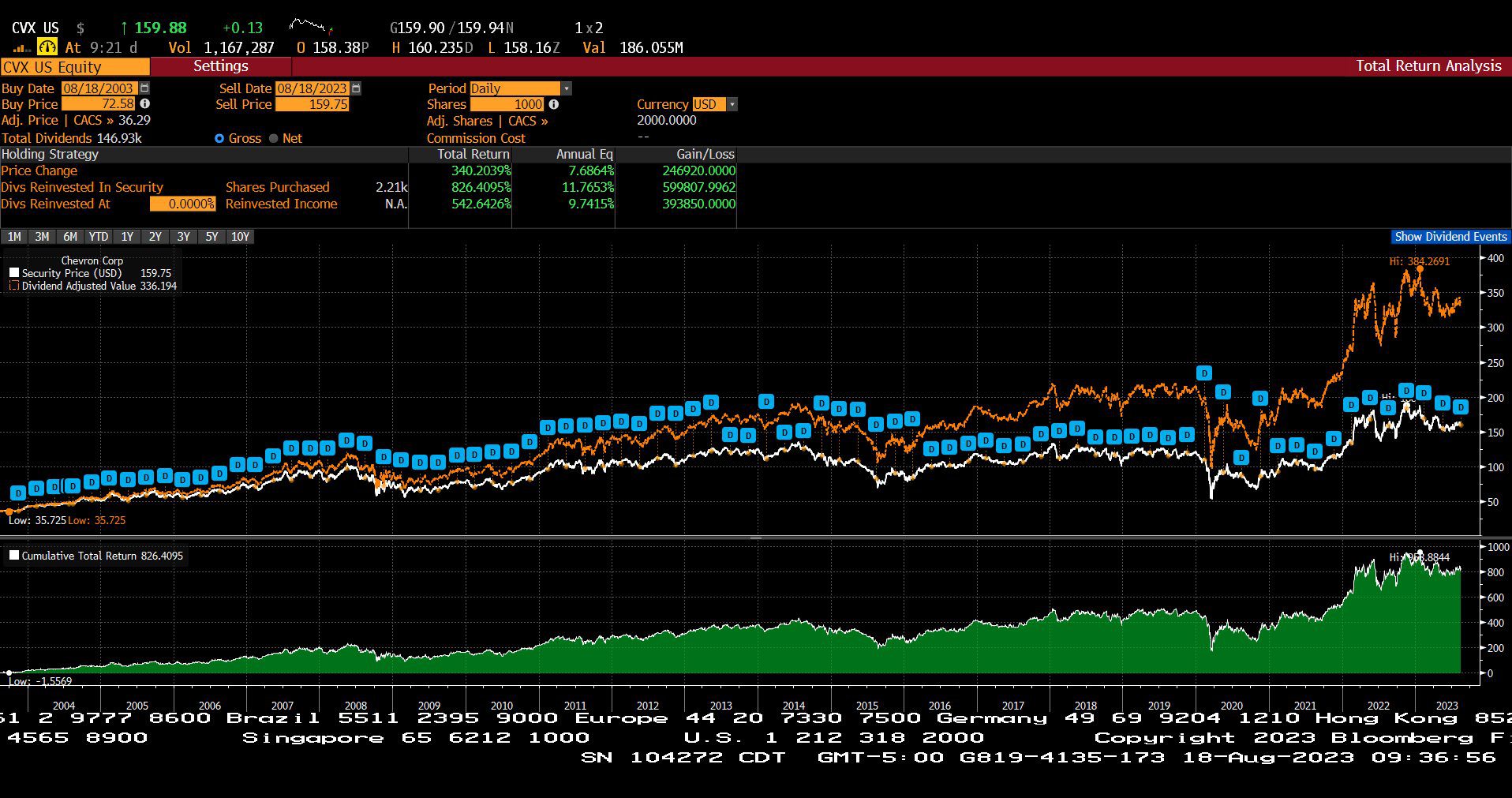

Chevron Total Return (08/18/2003 – 08/18/2023)

– Courtesy of Bloomberg LP

Proterra Inc. Since Inception (11/24/2020 – 08/18/2023)

– Courtesy of Bloomberg LP

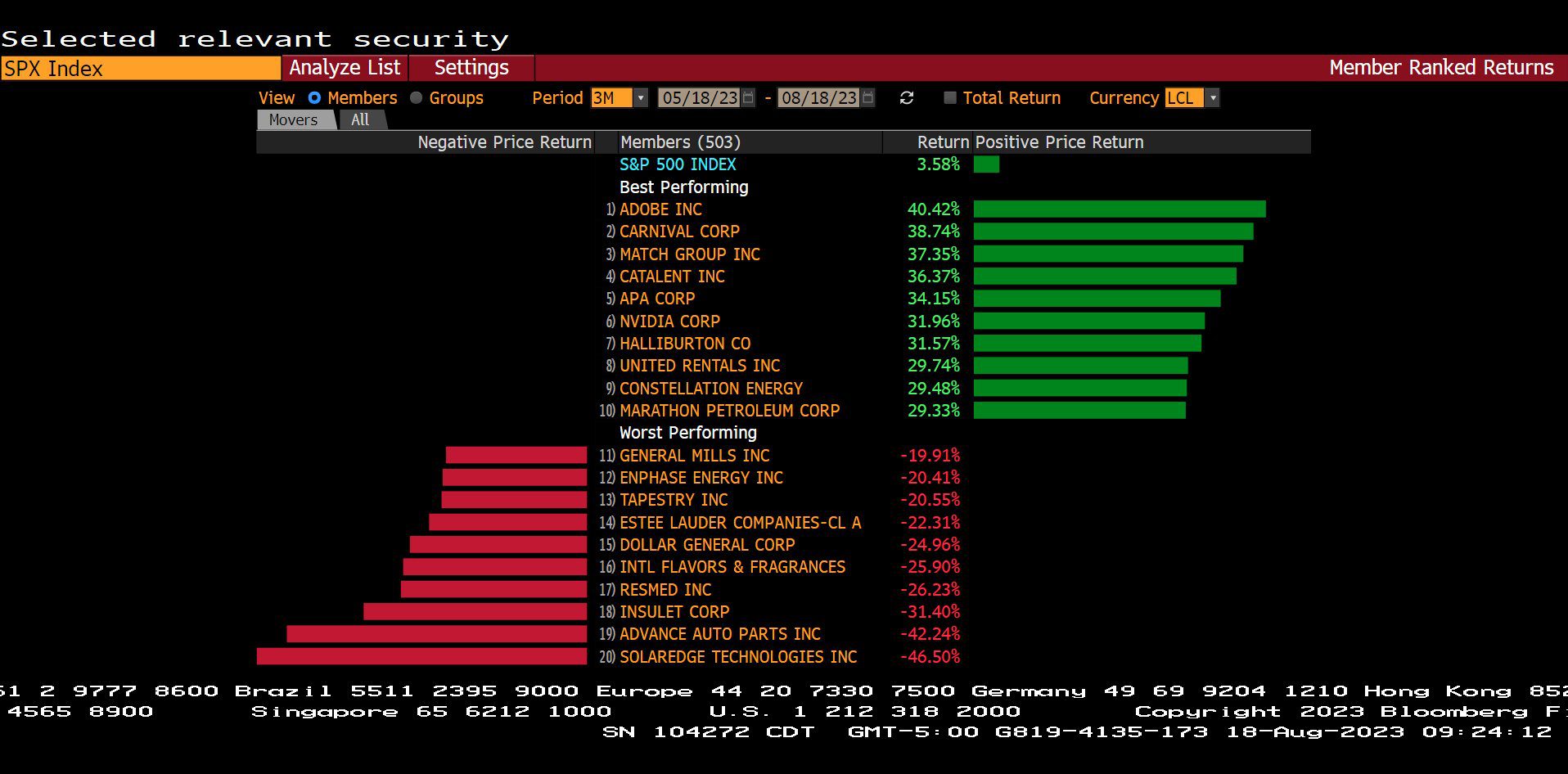

Standard & Poor’s 500 Index – Top 10 and Bottom 10 (05/18/2023 – 08/18/2023)

– Courtesy of Bloomberg LP

Profit Report

Why should investors hire McGowanGroup Wealth Management (MGWM) to build Energy and Global High Yield portfolios?