What are in the first 17 executive orders signed by President Biden?

Will the first “100 days” of the Biden Administration bring dramatic shifts?

Federal policy changes and impacts? Glacier or speed boat?

Counterintuitive: Washington vs. Financial Markets?

Headline Round Up!

*Barrage of Agenda Changes!

*Texas Leads Nation in Administered Vaccines So Far!

*Herd Immunity Projected During the Summer for the Nation! The “Summer of Love” ?

*Dallas Claims #1 Spot for Commercial Property Deals!

*North Texas Big Share Gains! What do the charts tell us about 2021?

*Earnings Season in Full Swing. What have we learned so far?

*Janet Yellen “Yelling” Loudly Again as Treasury Secretary.

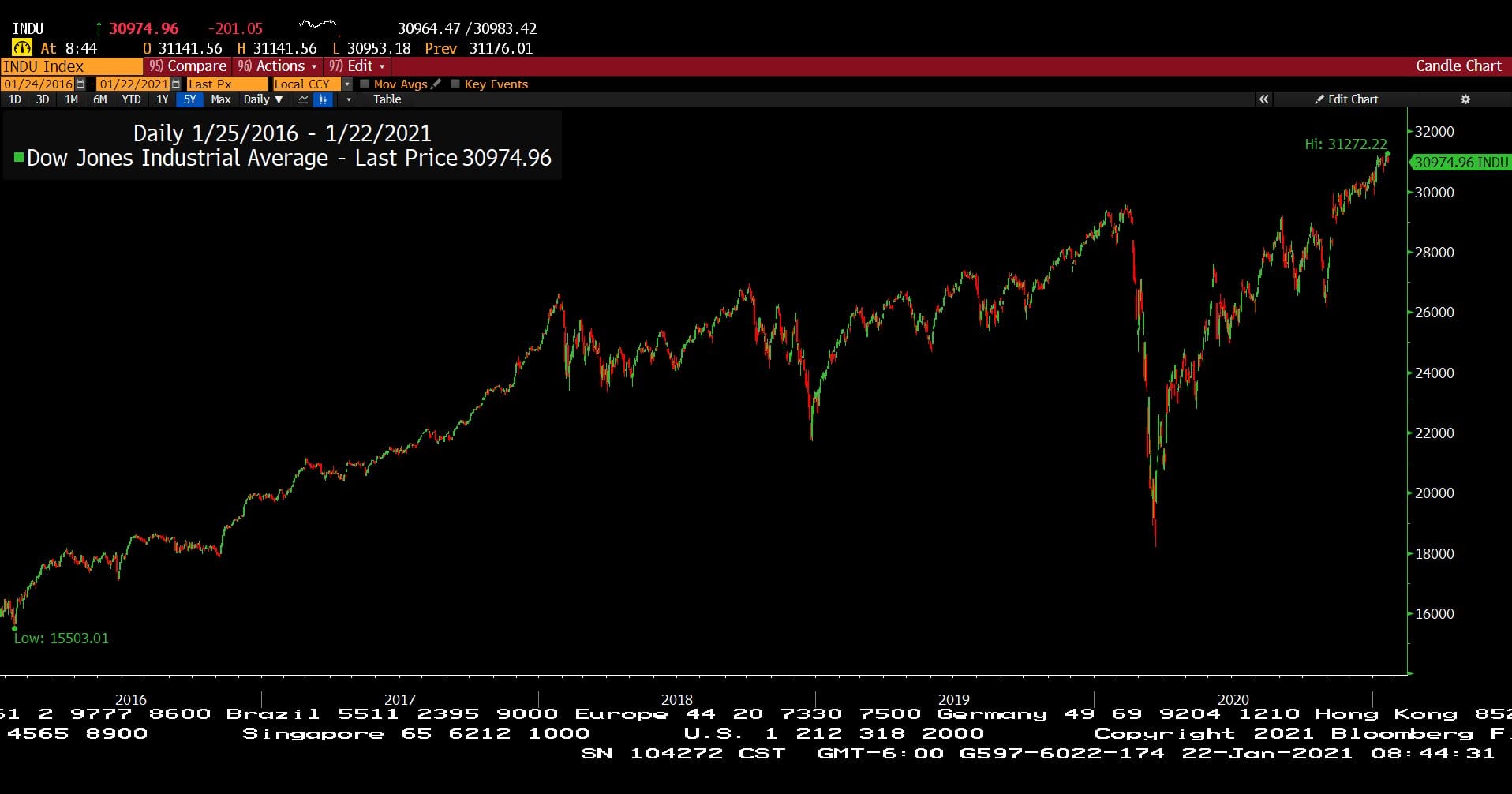

Dow Jones Industrial Average Index (Approx. 5 Years)

– Courtesy of Bloomberg LP

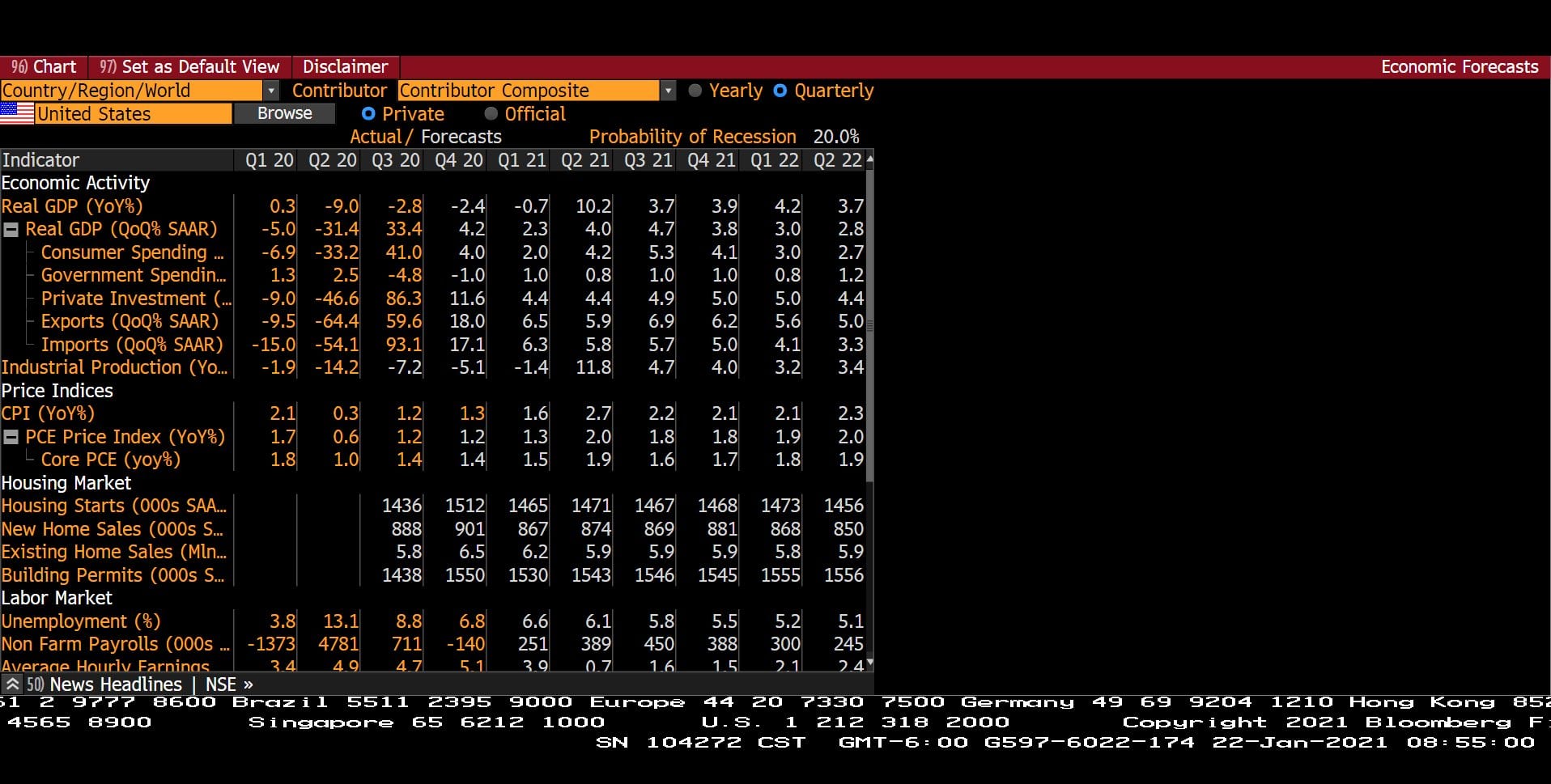

Quarterly U.S. Economic Forecasts with Probability of Recession (Q1 2020 – Q2 2022)

– Courtesy of Bloomberg LP

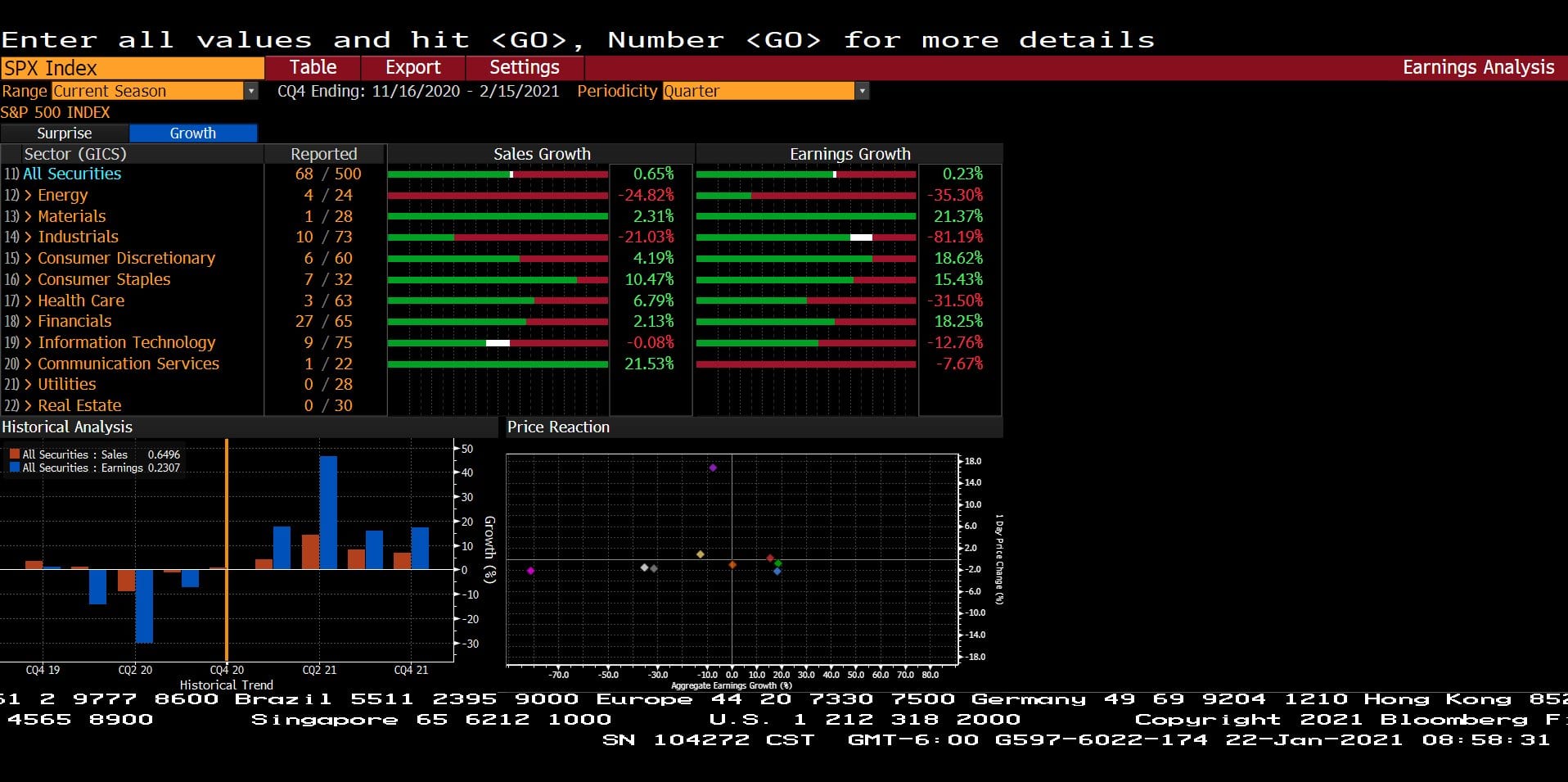

Quarterly Earnings Analysis for Standard & Poor’s 500 Index (11/16/2020 – 02/15/2021)

– Courtesy of Bloomberg LP

Health Care Select Sector SPDR Fund (Approx. 5 Years)

– Courtesy of Bloomberg LP

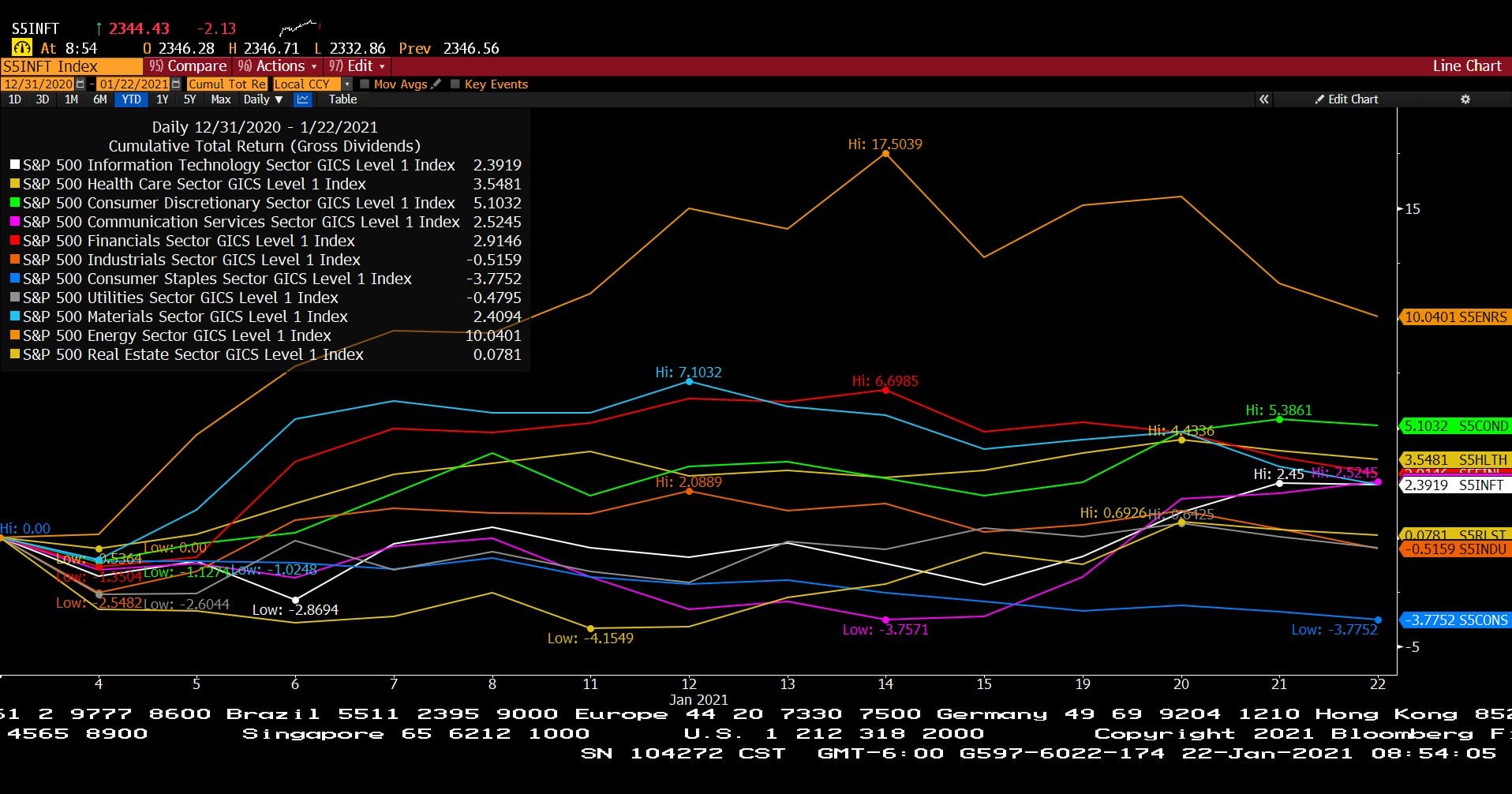

Standard & Poor’s 500 Index Cumulative Total Return – Gross Dividends (Year to Date)

– Courtesy of Bloomberg LP

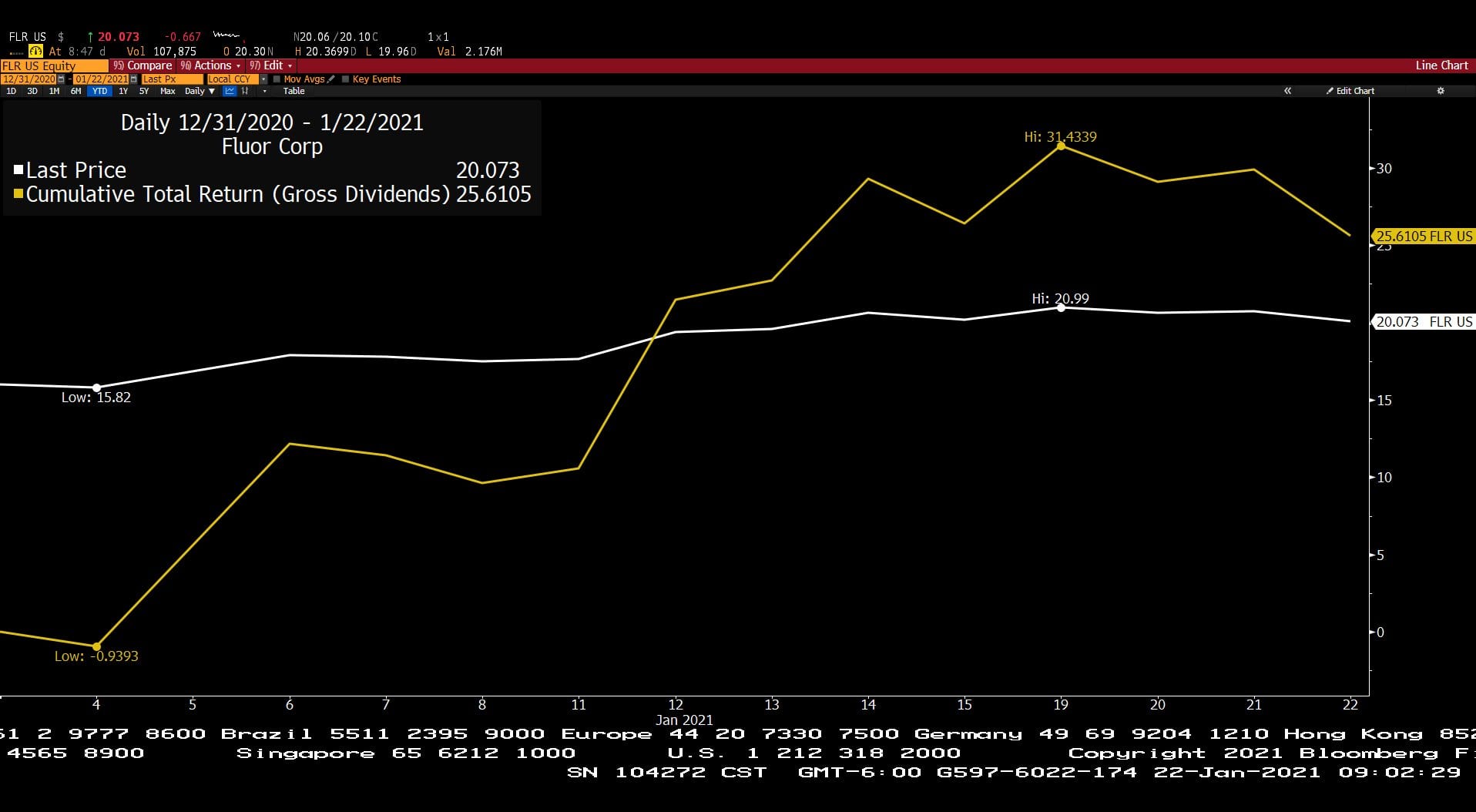

Fluor Corp. – Prices with Cumulative Total Return Gross Dividends (Year to Date)

– Courtesy of Bloomberg LP

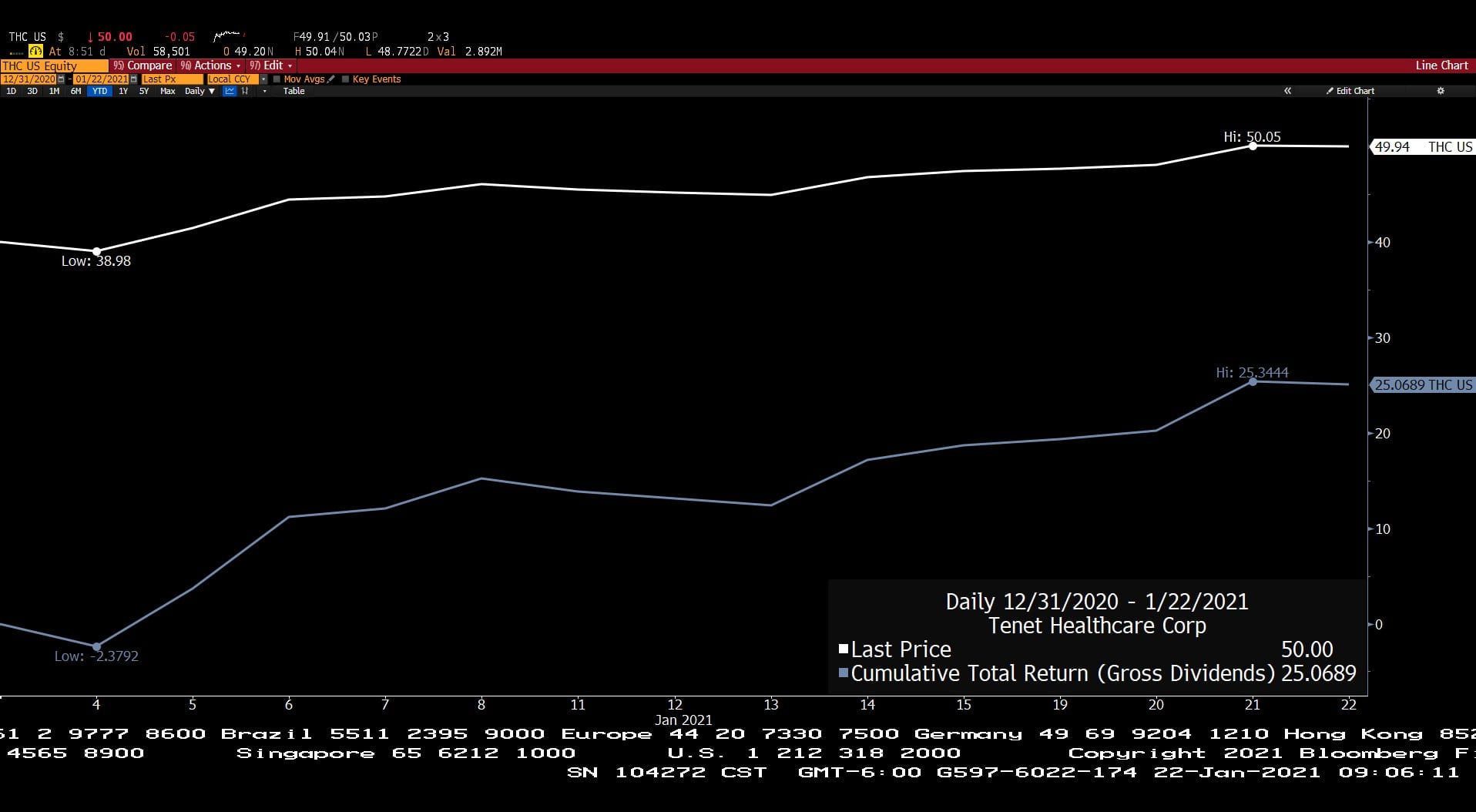

Tenet Healthcare Corp. – Prices with Cumulative Total Return Gross Dividends (Year to Date)

– Courtesy of Bloomberg LP

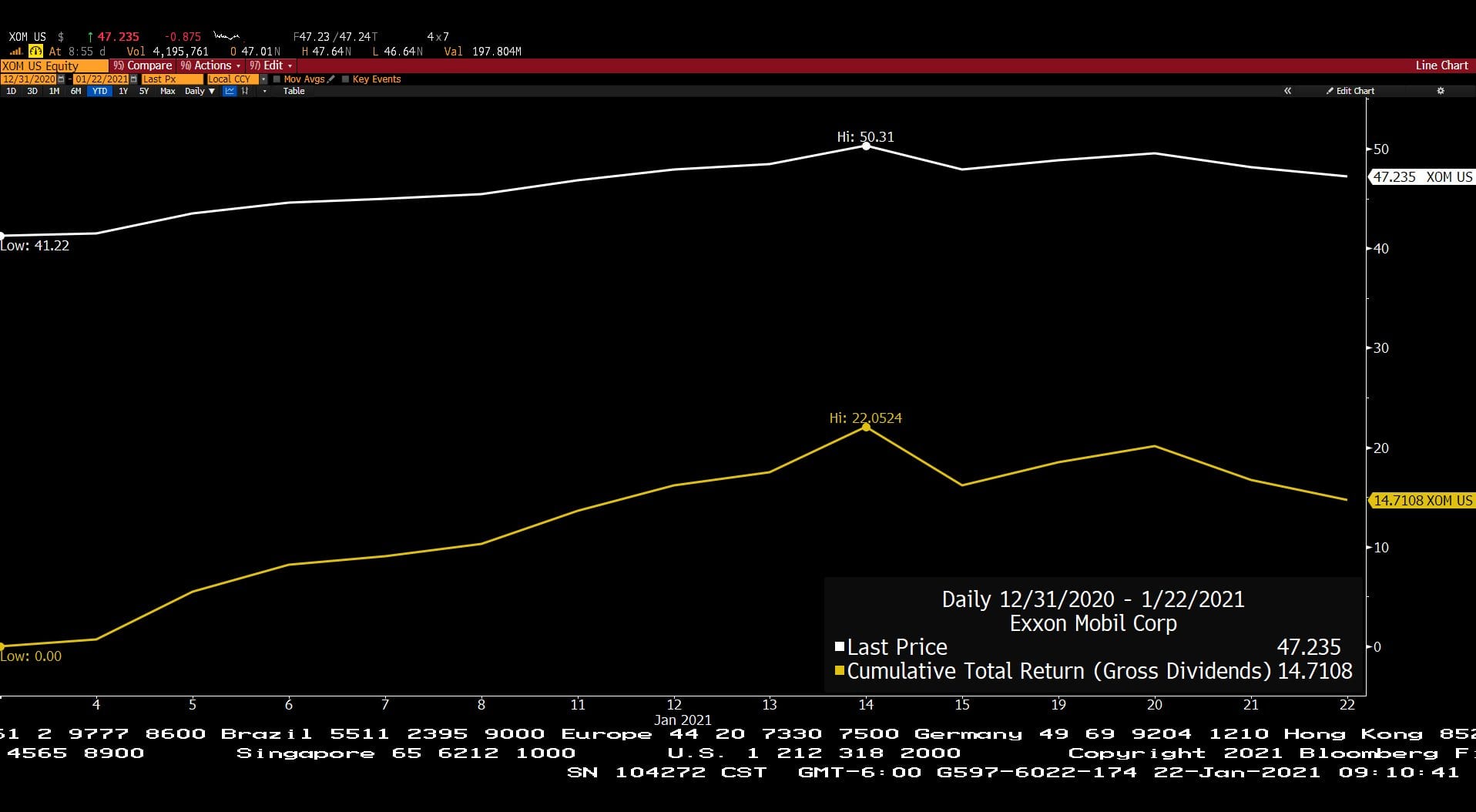

Exxon Mobil Corp. – Prices with Cumulative Total Return Gross Dividends (Year to Date)

– Courtesy of Bloomberg LP

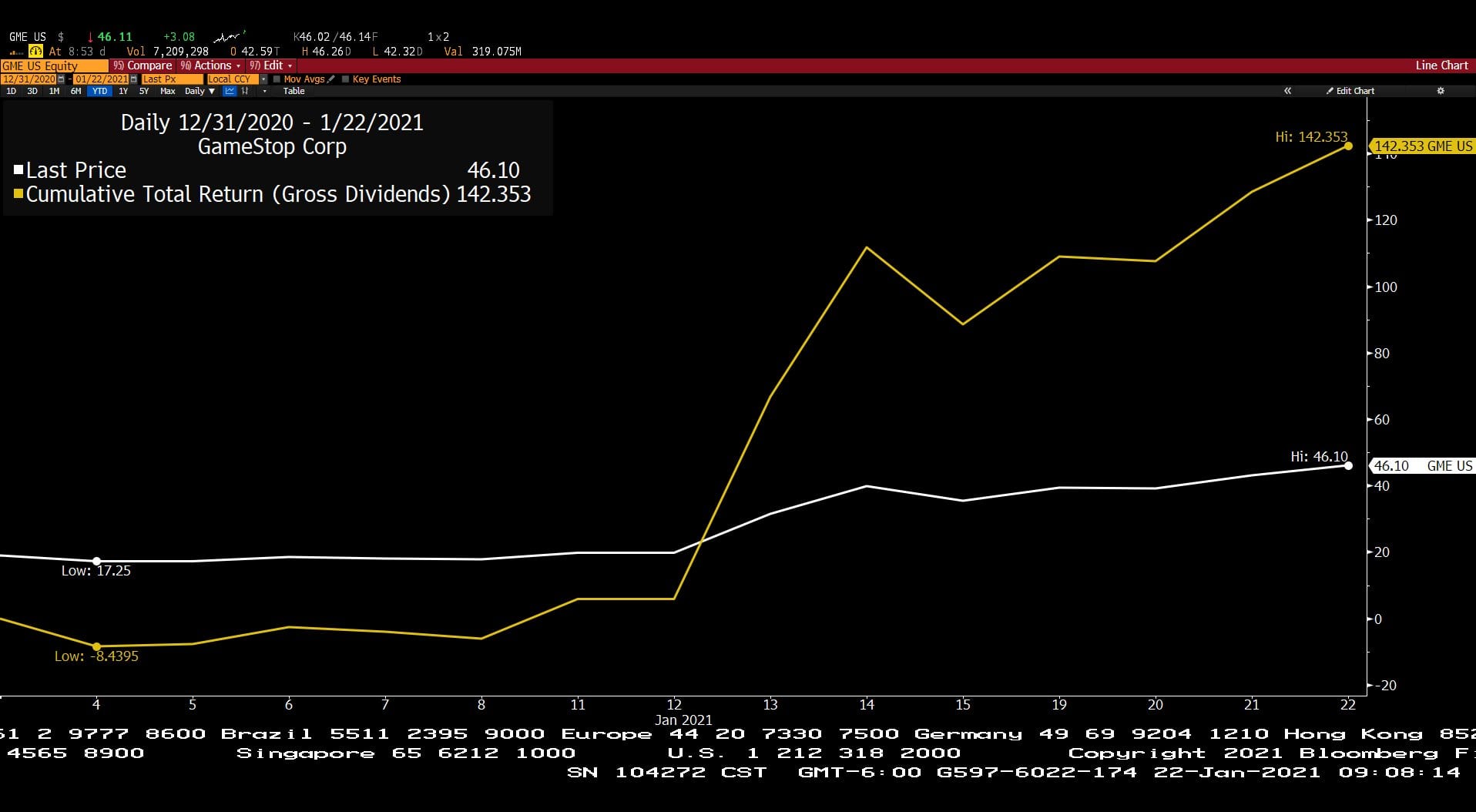

GameStop, Corp. – Prices with Cumulative Total Return Gross Dividends (Year to Date)

– Courtesy of Bloomberg LP

Profit Report!

Client questions from this week.

Over the next 5 years, what mistakes are built into traditional portfolios? (Hint: 1.1% at a premium with 6.7% duration risk downside.)

Real Estate 2021: when and how?

Cannabis REIT – what is that?

“Renewables” trading and pricing.