Where is the Stimulus Going?

How Much Will the Value of the U.S. Dollar shrink?

What Should I do About it?

What Should I Know About This Week’s Federal Reserve Announcements and the Economy?

“Who is John Galt?”

What are the Most “Extraordinary Popular Delusions?”

Where are the Bargains in the Financial Markets?

What are the Key Parts of a Great Investment Plan?

Headline Round Up

*The Federal Reserve Made Bold Proclamations! What does it mean for the Economy and the Financial Markets?

*Guggenheim Says It’s Time for Inflation Fear Reality Check!

*RiverFront Says Not Yet!

*Deutsche Bank Projects Dollar Down Trend.

*CryptoMania Tops $2 Trillion and 4000 Coins? Driven by fears of dollar degradation?

*Lessons from Hedge Fund Manager Chris Coleman.

*Housing Shortage Updates.

*Dalio Says “Buy Stuff, Any Stuff, That Will Equal Inflation or Better.”

*Oil Declines on Stockpiles; Back Up to December Levels.

*U.S. Oil Demand Roaring Back!

*Electric Vehicles (2% of new vehicles last year) Expansion Will Force Huge Mining Expansion.

*American Airlines and Southwest Shares Roar Back to Life. Delta Bookings Up 30% This Month.

*Unemployment Will Fall to Below 4% Says Goldman.

*China Deletes Alibaba Browser App Like Amazon and Apple Killed Parler.

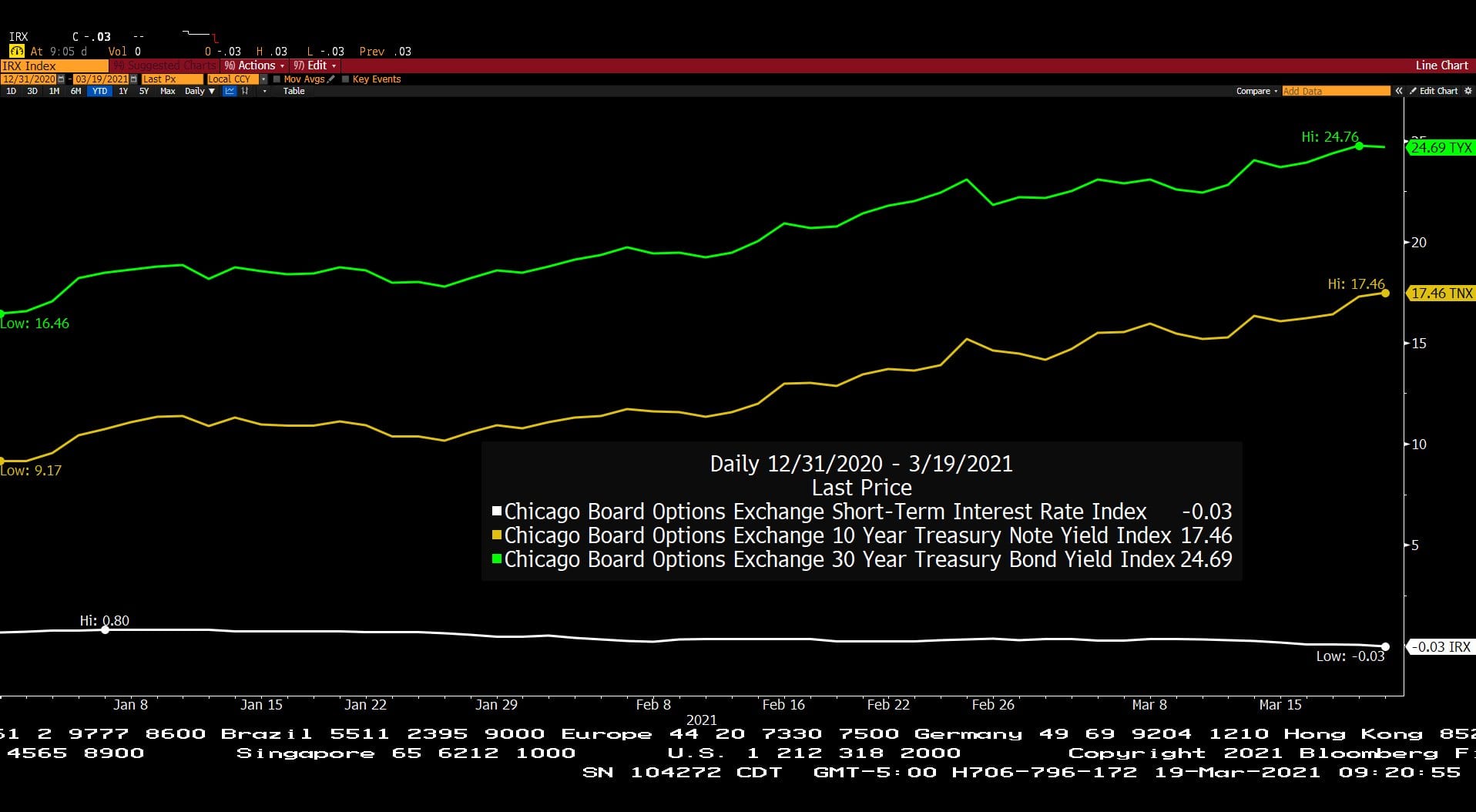

C.B.O.E. Short Term Interest Rate Index, 10 Year Treasury Note Yield Index & 30 Year Tresury Bond Yield Index (Year to Date)

– Courtesy of Bloomberg LP

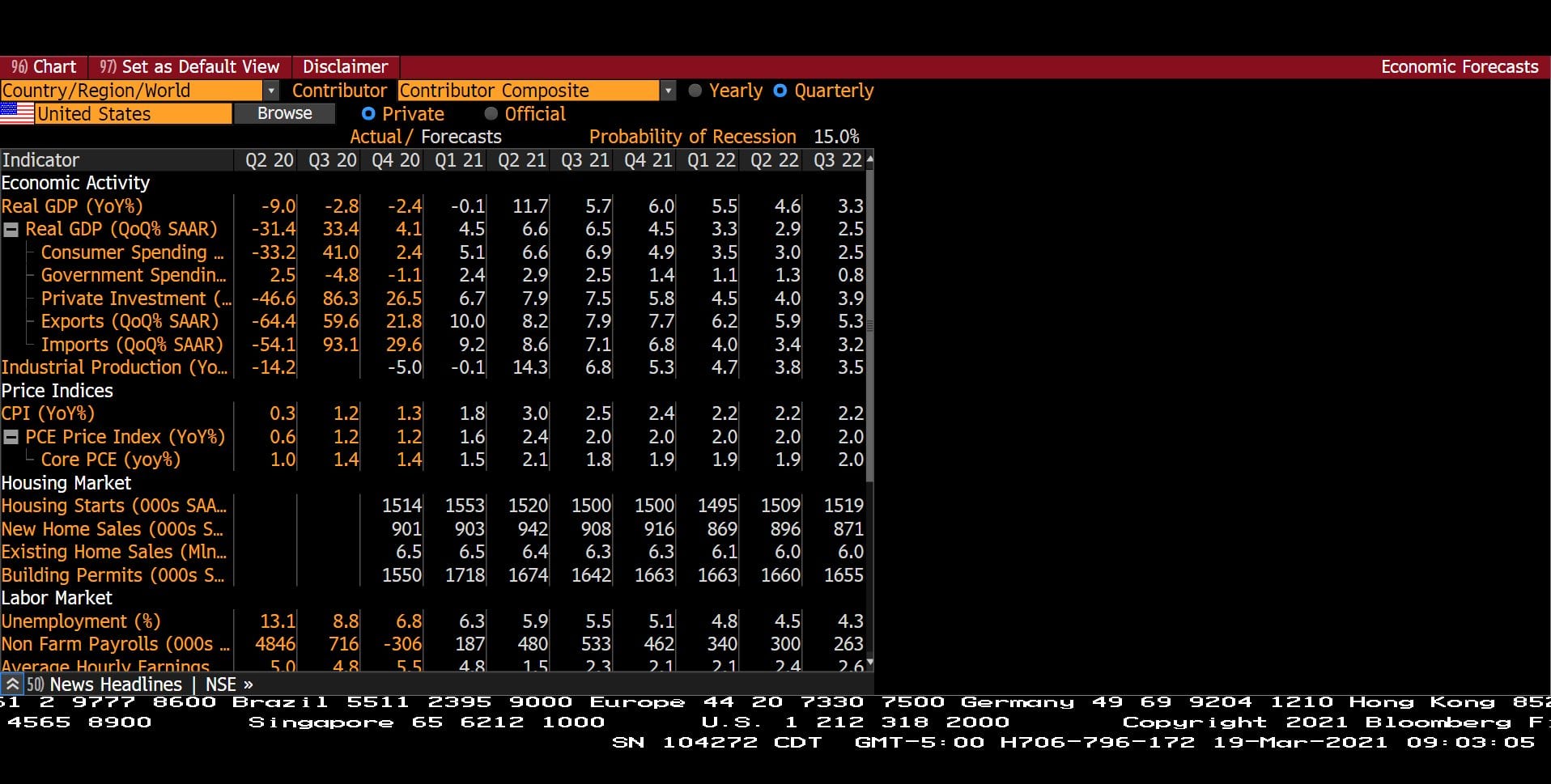

Quarterly U.S. Economic Forecasts with Probabilty of Recession (Q2 2020 – Q3 2022)

– Courtesy of Bloomberg LP

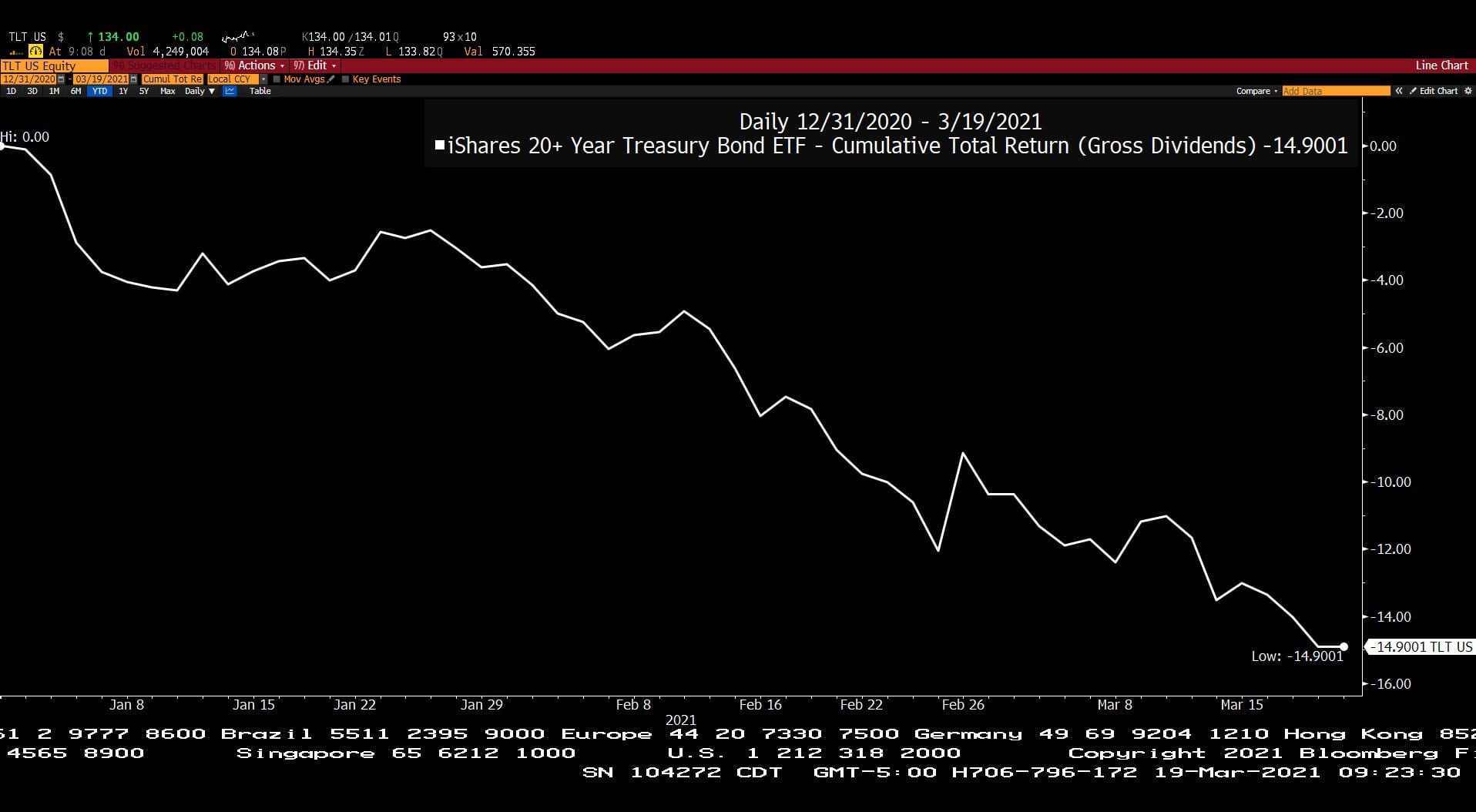

iShares 20 Year Treasury Bond ETF, Cumulative Total Return – Gross Dividends (Year to Date)

– Courtesy of Bloomberg LP

Generic Crude Oil Futures, Spot Price (Year to Date)

– Courtesy of Bloomberg LP

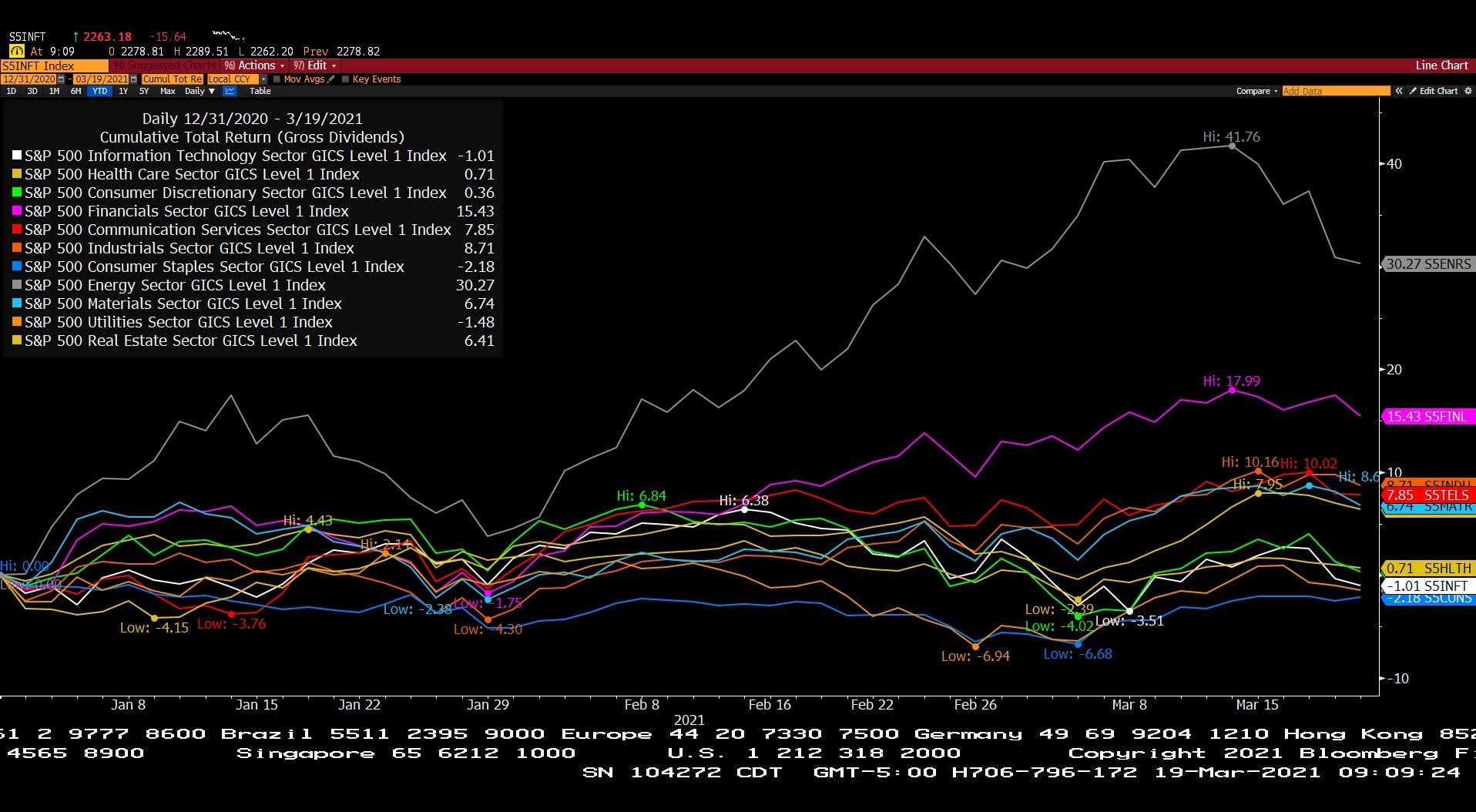

Standard & Poor’s 500 Cumulative Total Return by Sector – Gross Dividends (Year to Date)

– Courtesy of Bloomberg LP

N.Y.S.E. FANG Index, Cumulative Total Return – Gross Dividends (Year to Date)

– Courtesy of Bloomberg LP

Global X MLP ETF (Year to Date)

– Courtesy of Bloomberg LP

DoubleLine Income Solutions Fund (Year to Date)

– Courtesy of Bloomberg LP

Bitcoin Currency Spot Price (Year to Date)

– Courtesy of Bloomberg LP

Texas Capital Bancshares, Inc. (Year to Date)

– Courtesy of Bloomberg LP

Profit Report

1. Who is Hedgeye and How Can They Help?

2. We Love Talking to Clients! Here were this week’s best topics!

-

Fear of Missing Out (FOMO): Tech Stocks Wilt but Many Investors Remain Fixated on Finding the Next Big Trade.

-

Data Safety, Electromagnetic Pulse (EMP) Dangers, and Data Retention?

-

What Goes Into a Real Investment Plan and Why is This Vital?