What did the 3rd quarter performance of the Equity markets teach us about the economic cycle?

What is the “Bullwhip” phase of the Economy?

What are the major Supply Chain issues right now?

Why are the October and November corporate results important for Sector Rotation?

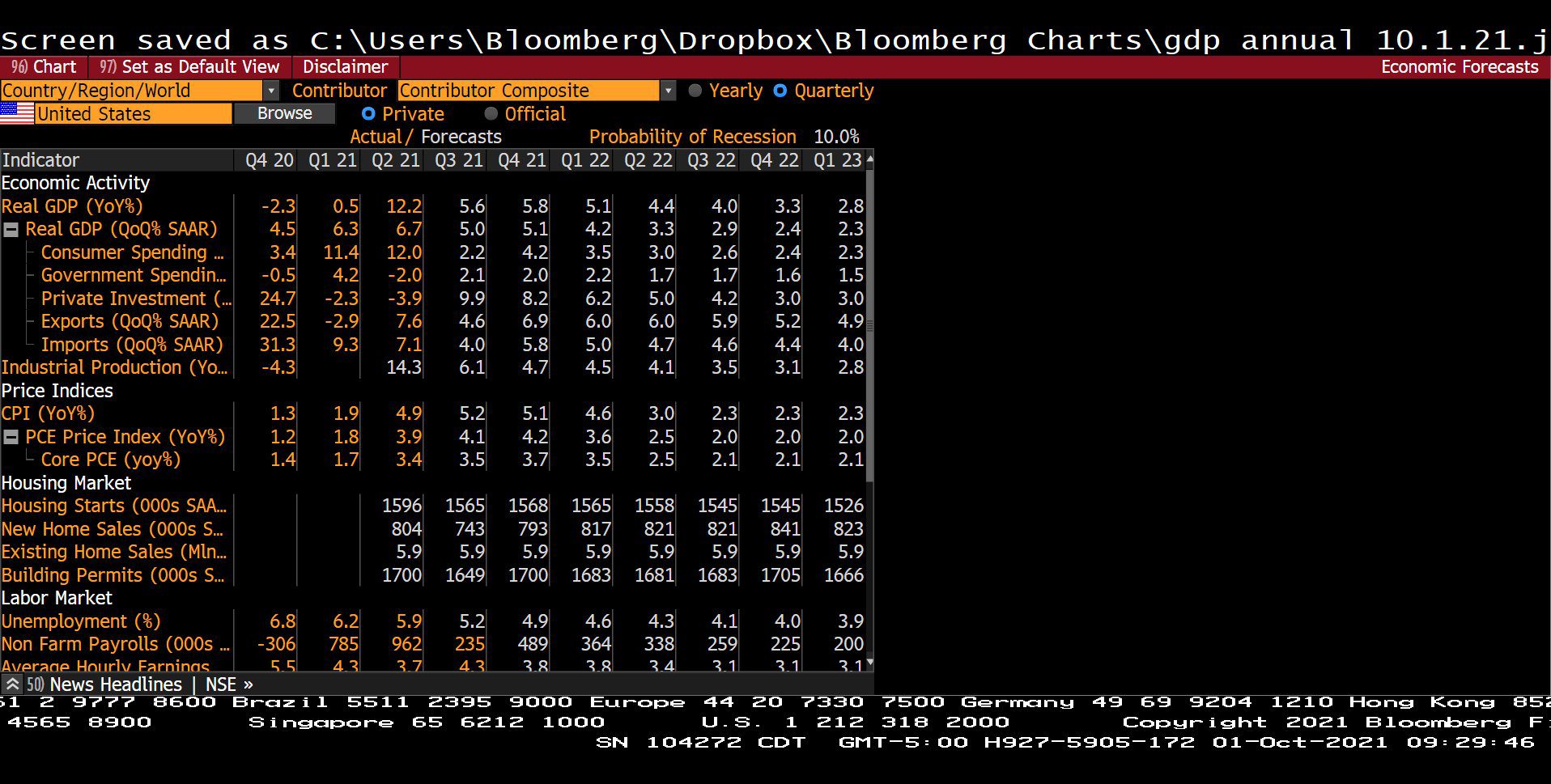

What are the updated projections for 2021 and 2022 economic growth?

What did the spike in Oil and Natural Gas this week telegraph for Q4 2021 and 2022?

What is the real story on Gold?

How do I get a highly motivated, intelligent team to help me make better decisions?

Headline Round Up

*Q3 Performance?

*Supply Chain Shortages Underscored by Change in Private Inventories!

*Real Estate Frenzy!

*Dallas Fed Said Texas Factory Outlook Surged Nearly 20% in September!

*Again Washington: Where is that Infrastructure? Is the Economy overheated already? What is that $3.5 trillion dollar thing?

*Cotton at Decade High!

*Dollar Tree Now 2 Dollar Tree!

*Bed Bath and OMG?

*Natural Gas Spikes to $6.26/MMBTU. Oil Topped $76.

*China Orders Energy Supplies to be Secured for Winter at All Costs!

*Goldman Now Says $90 Oil After Correctly Sticking to $80 Brent Target.

*The Great Battery Charge! Energy transition updates? “BTU agnostic?”

*Lucid Delivering $169,000 520 Mile Range EVs Next Month! Just for fun we check the chart.

*Brian McGaugh’s Restoration Hardware Ten Bagger!

*Delta Downturn = Economic Upturn?

*Evergrande Not Grand! What does it mean for China and Emerging Market Equity funds?

Dow Jones Industrial Average (Year to Date)

– Courtesy of Bloomberg LP

Quarterly U.S. Economic Actual/Forecasts with Probability of Recession (Q4 2020 – Q1 2023)

– Courtesy of Bloomberg LP

Gold Spot Price per Oz. (Approx. 10 Years)

– Courtesy of Bloomberg LP

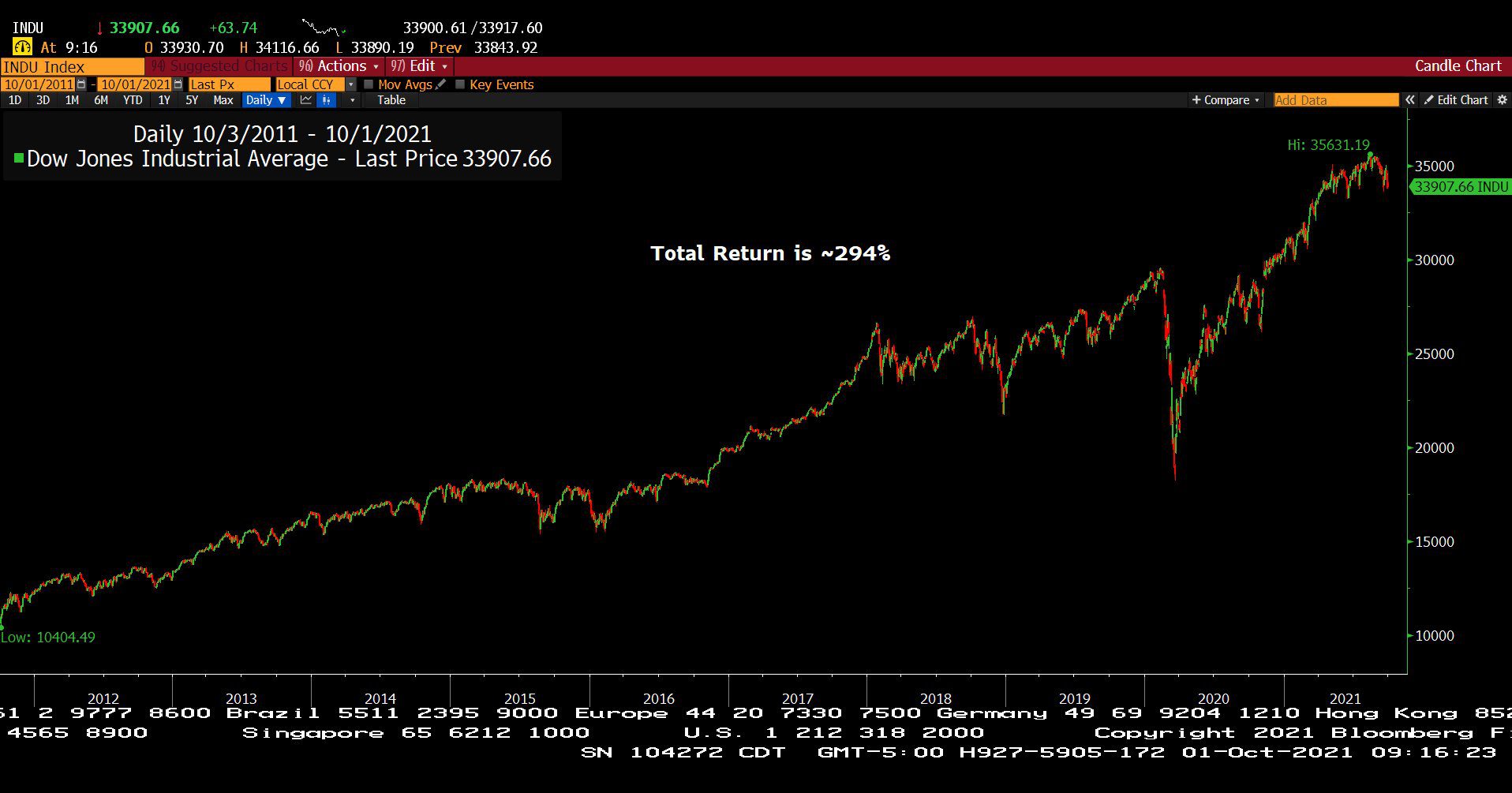

Dow Jones Industrial Average (Approx. 10 Years)

– Courtesy of Bloomberg LP

U.S. Consumer Price Index – Urban Consumers, Non-Seasonally Adjusted (Approx. 10 Years)

– Courtesy of Bloomberg LP

Invesco QQQ Trust Series 1 (Approx. 10 Years)

– Courtesy of Bloomberg LP

Natural Gas Futures Spot Price (Year to Date)

– Courtesy of Bloomberg LP

Bed Bath & Beyond, Inc. (Year to Date)

– Courtesy of Bloomberg LP

China Evergrande Group (Since Inception)

– Courtesy of Bloomberg LP

Profit Report

Success Stories: How Some University Endowments Nailed with Private Equity and Venture Capital. Downside?