• What is ahead for 2021 and 2022?

• Economic growth?

• Taxes?

• Impact of massive Fiscal Stimulus?

• Impact of Federal Reserve expansions?

• Government policy changes ahead?

• 2022: Does the Economy go through rehab after over stimulation?

• Investment strategy? What should we do now and next year?

• 2021 Asset Class targets and sell triggers?

• What happens after COVID-19?

Join us! NetWorth Radio brings an action-packed tour of the current Financial Markets and the big winners since the end of October along with what’s ahead.

PappaDean’s corner of financial wisdom will provide insights that you just can’t get anywhere else.

Dow Jones Industrial Average (Year to Date)

– Courtesy of Bloomberg LP

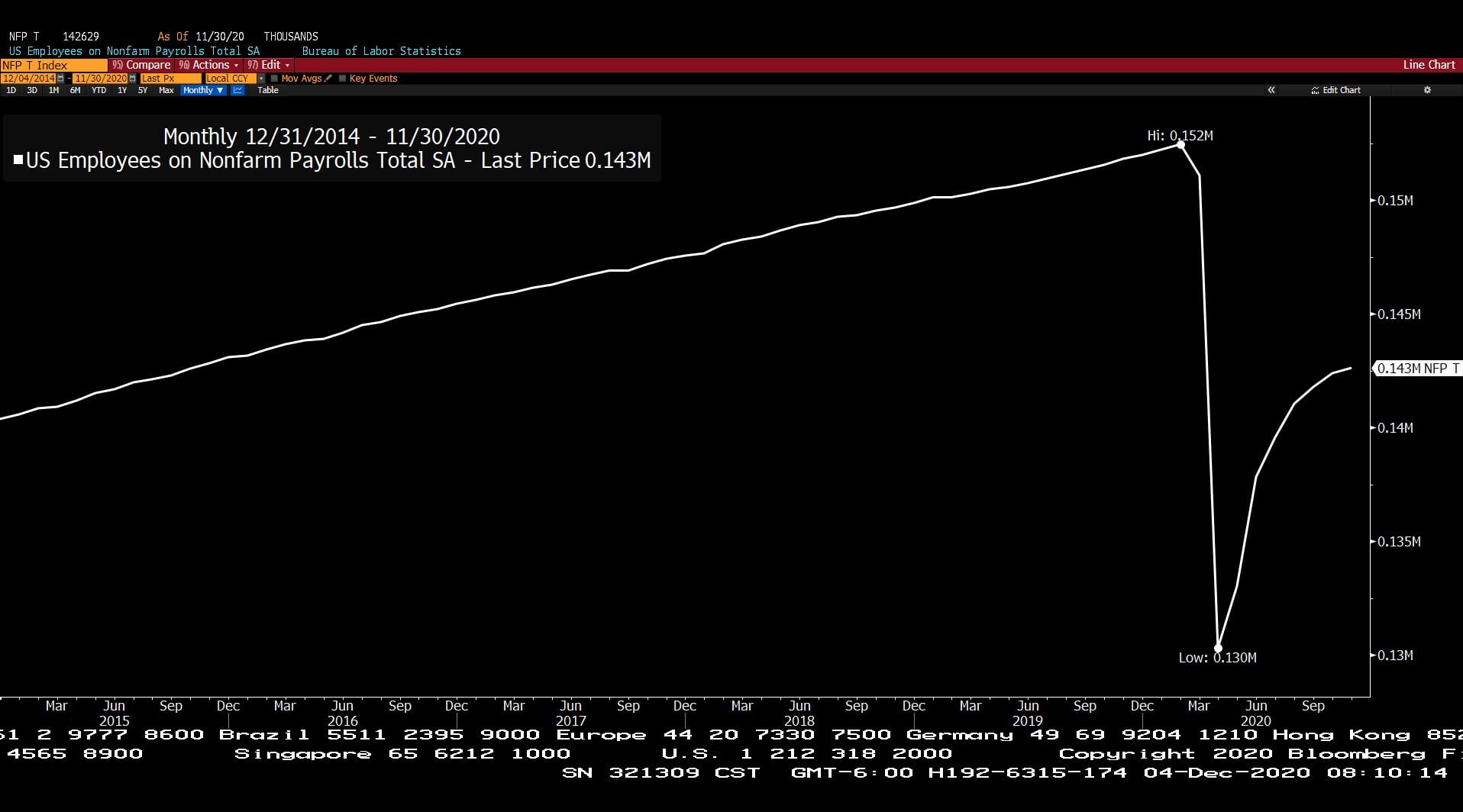

U.S. Employees on NonFarm Payrolls Totals – Seasonally Adjusted (Approx. 6 Years)

– Courtesy of Bloomberg LP

ETF Fund Flows (12/4/2020 )

– Courtesy of Bloomberg LP

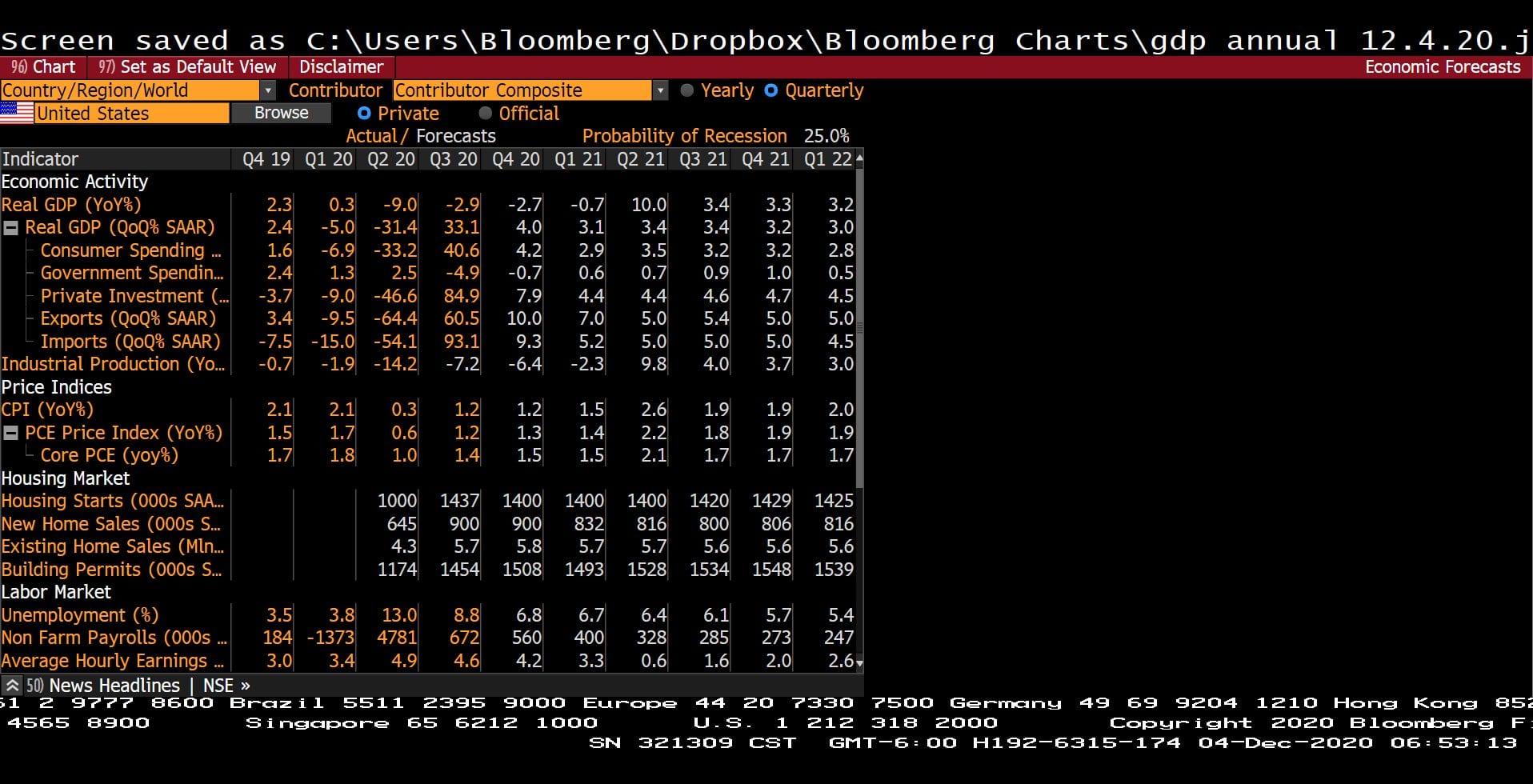

Quarterly U.S. Economic Forecasts with Probability of Recession (Q4 2019 – Q1 2022)

– Courtesy of Bloomberg LP

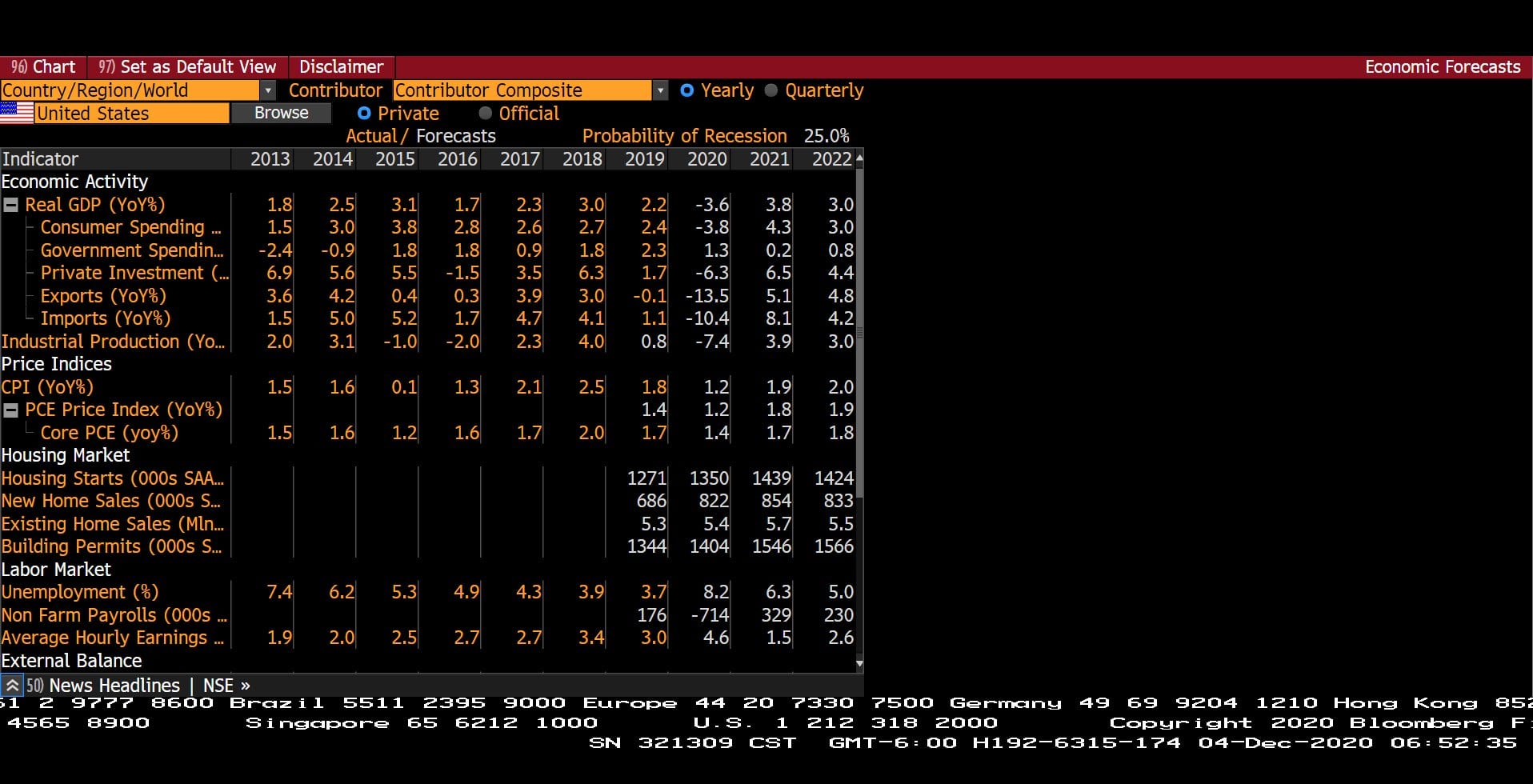

Yearly U.S. Economic Forecasts with Probability of Recession (2013 – 2022)

– Courtesy of Bloomberg LP

BlackRock Corporate High Yield Fund, Inc. (Year to Date)

– Courtesy of Bloomberg LP

Global X MLP ETF (Year to Date)

– Courtesy of Bloomberg LP

Health Care Select Sector SPDR Fund (Year to Date)

– Courtesy of Bloomberg LP

Headline Round Up!

*Dow 30,000!

*UK Vaccine Passport Stamps in 2021!

*Money Flows Towards Yield!

What were The 10 Biggest Financial Surprises of 2020 and The Biggest Potential Surprises of 2021?

Profit Report!

Alex’s Big Surprises

2020 Biggest Surprises:

1) Negative Prices for Oil

2) Shutdowns

3) Resurgence of Bitcoin (it didn’t die?!)

4) Housing Rates Plummet! Alex gets a 2.8% mortgage

5) Housing Goes Boom Boom!

6) 17% growth in M2 – First Time in 75 Years (hint, the Fed prints but doesn’t print)

7) Election Dereliction

8) What do Halloween and Thanksgiving have in common? (Everyone is wearing a mask!)

9) Tech Rally!

10) Massive jump in Gross Domestic Product (GDP) Q3 and Q4

2021 Biggest Potential Surprises?

1) Inflation

2) Higher Taxes

3) College Debt Programs

4) Modern Monetary Theory (MMT), baby and Universal Basic Income (UBI)?

5) Zero Rates/Negative Rates

6) Cashflow Panic

7) No Growth?

8) Flat S&P 500?

9) Bitcoin to $300,000?

10) Alex builds a pool!

Spencer’s Big Surprises

2020 Biggest Surprises:

1.COVID-19

2.ShutDowns

3.Riots

4.Zero Rate Fed Funds

5.Record Stimulus

6.MMT Prevails

7.Valuations Diverge

8.Tech Stocks Surge

9.Elon Musk Defies Gravity

10.Gone to Texas! NASDAQ, Joe Rogan, Elon Musk, etc.…

2021 Biggest Potential Surprises?

1.COVID-19 Containment

2.Inflation Returns

3.Energy Shortages

4.Negative U.S. Rates

5.Traditional Fixed Income Begins to Underperform

6.The Shift to Value and Cash Flow

7.Valuations Matter Again

8.Elon Musk and Richard Branson Go to Space

9.FAANG Tech Correction

10.Housing Market Boom Fizzles