McGowanGroup Wealth Management

Q4 2025 Updates

For You, New Client Portal, State of the Art Applied Technology

Our performance tracking for clients started in the 1990’s along with customer relations management software. Each designed for relentless pursuit of reliable, superior client profits and excellence in service. We have great feedback on the new Black Diamond Client Portal including the mobile app. Just call or email if you would like a refreshed link. The past year we devoted the extra resources to upgrade to the state-of-the-art financial software including the document vault. Special recognition: All Hail Scary Smart Joyce Cheng for her devotion!

Equity Market Melt Up & Overvaluations?

Bull Market Case:

Paul Tudor Jones: “ingredients are in place for massive rally before a “blow off” top to Bull market.

Morgan Stanley: Free cash flow yield for the median large cap stock is almost triple what it was in 2000.

Bear Market Case:

Goldman Sach’s boss David Solomon: “Next 12 to 24 months. . .we see a drawdown with respect to equity markets. . .I think that there will be a lot of capital that’s deployed that will turn out not to deliver returns”

GMO.com: 2025 7-Year Forecast U.S. Large (Cap Equity) Real Return Forecast, negative, similar to 1998. U.S. Deep Value, positive.

Potential Solutions For Investors?

• Is The Portfolio Set Up For Cash Flow?

• Harvest In the Money Positions While Looking for Deep Value Stocks and Dividend Paying Equity?

• Should Investors Look to Discounted High Yield Bonds?

• Are Floating Rate Loan Funds a Viable Option Now?

The First 3 Quarters of 2025

Administration Tariff Chaos, Inflations Concerns & Current High Economic Growth

Reasonable investor concerns regarding current chaotic administration tariff policies include higher prices, inflation, disruption of positive economic activity & Recession. However, inflation is near four year lows with PCE as of August 2025, 2.7%, Personal Consumption Expenditures. In addition, The Atlanta Federal Reserve’s Real GDPNow number estimates Q3 2025 Gross Domestic Product (GDP) at 3.8% as October 7th, 2025.

Brief Bear Market and Tactical Allocations

This past April delivered the official definition of a Bear Market as the S&P 500 Index reached a 20% decline from its Q1 2025 peak. Yet, a recovery driven largely by unexpected lower inflation, higher growth, and artificial intelligence optimism drove the S&P 500 back to near all-time highs at the time of this writing. During the declines, McGowanGroup deployed accumulated tactical safety, dry gun powder, to add attractive, high dividend, blue chip holdings that currently have our portfolios tracking above our targets for the year so far.

Expected Profit Growth

The most current S&P 500 consensus analyst estimates for profit growth are 9% between now and the end of 2025 plus another 16% for 2026. (This link leads to a spreadsheet and not a webpage, FYI) This potentially means a full 25% growth between now and the beginning of 2027!

Energy and Artificial Intelligence

The recent rally in U.S. equity indexes was driven, in part, by rapid recovery in Artificial Intelligence (AI) related companies. The AI revolution is already increasing productivity and profitability for many companies similar the roaring 1990’s PC/Internet driven boom.

Data center expansion is likely the first phase of capabilities to improve efficiency. The initial wave of upgrades delivered attractive growth for the AI technology supply chain. The resulting increases in electricity demand have led to rallies in the Utilities Sector, Nuclear, and Natural Gas. Current capital expenditures appear unsustainable.

Energy Infrastructure

Pipelines: Rising dividends and stock buybacks underscore attractive opportunities for investors. Deregulation possibly leads to increased business productivity and profit growth. Liquid natural gas export capacity is on track to double by the end of 2028 according to the U.S. Energy Information Administration. Currently, the pipelines and export facilities still appear underpriced relative to other sectors. In our estimations, Data Center electricity demand is an obvious choice for natural gas power generation.

Global High Yield Bond Fund prices and Floating Rate Loan Funds remained resilient during the long rate spike with a current overall yield near 8%. Premium prices could result in gain harvesting to increase “dry gun powder” for bargains in other areas of the markets. The higher, longer yields likely create more choices in other parts of the bond market like Tax Free Municipals. Meaningful deficit reduction could result eventually in lower long-term rates and potential gains in longer duration bonds.

Our Next Steps

The McGowanGroup Investment Committee (IC) meets each Wednesday morning to review and upgrade the model portfolios using an impressive, evolving, research process. Equity market rallies provide investors the opportunity to raise Tactical Safety for future resilience especially as valuation targets and underperformers are harvested systemically. Pullbacks in market values for equity provides the opportunity to add high cash flow assets at attractive prices.

Our efforts to raise Tactical Safety during rallies allows the IC to allocate to great cash flowing assets in the next correction, gaining potential advantages for the long term. Our wealth managers and the team remain committed to helping you evolve your financial plan!

Tax Planning 2025-2026

October: Realized Gains and Loss Reports through 09/30/2025 for taxable accounts will be uploaded to your Black Diamond Portal. If we do not have your CPA’s email on file, please provide.

January-March: Realized Gains and Loss reports for taxable accounts, 1099’s, and K-1’s if applicable will be uploaded.

We remain committed to the mission of Superior Client Profits Through Excellence in Service. Thank you for allowing us to serve you and your family!

Spencer McGowan and The Team That Cares,

McGowanGroup Wealth Management

Join Us for The Latest Financial Headlines and Valuable Research from The McGowanGroup. Built for Investors by Experienced Portfolio Managers!

Click here to get the monthly newsletter

Headline Round Up!

*Bullish on North TEXAS: Dallas Based Comerica Bought for $11 Billion in All Stock Deal by Fifth Third Bancorp.

*Planned Potential Fannie Mae and Freddie Mac Initial Public Offerings (IPOs) Lead Big Banks to Woo Trump!

*Berkshire Hathaway’s Largest Deal in Three Years! Company Buying OxyChem from Occidental for $9.7 Million in All Cash Deal. Occidental CEO, Vicki Hollub, says debt reduction from deal would enable a restart in buying back stock.

*International Energy Agency (IEA) Cuts U.S. Renewable 2030 Growth Forecast in Half Due to Trump Policies?

*Nobel Prize for Physics Awarded to Trio Including American Physicist John M. Martinis, Previously of Google!

*NYSE Owner Intercontinental Exchange (ICE) Takes $2 Billion Stake in Polymarket.

*Polymarket: Millions in Bets on Government Shutdown Lasting at Least Two Weeks.

*Gold Prices Top $4,000 per Troy Ounce for the First Time!

*AMD Stock Spikes 28% This Week on Open AI Datacenter Deal Using AMD Chips. AMD now set to rival Nvidia dominance.

*Canadian Company Trilogy Metals Soars 250% This Week After U.S. Government Takes a 10% Stake in Firm.

*Elon Musk Gambles Billions in Memphis with xAI Datacenter City. Memphis divided on massive power and water demands of datacenter.

*IBM Stock Spikes on Anthropic Partnership That Would Allow Claude Models For Developers on IBM Software.

*Dell Hikes Next Four Year Growth Forecasts on Strong Artificial Intelligence (AI) Demand.

*Bessent: Deregulation Benefits Supposed to Start Paying Dividends in Q3 2025. U.S. Economists, as a whole, aren’t quite so sure as Deregulation takes longer and is tougher to assess?

Profit Report

Why Delaying Your Social Security Benefits May Not Make Sense?

Trilogy Metals, Inc. – Daily (10/10/2022 – 10/08/2025)

– Courtesy of Bloomberg LP

Dell Technologies, Inc. – Daily (12/31/2024 – 10/08/2025)

– Courtesy of Bloomberg LP

Dow Jones Industrial Average – Monthly (12/31/2024 – 10/8/2025)

– Courtesy of Bloomberg LP

International Business Machines Corp. – Quarterly (01/01/1967 – 10/08/2025)

– Courtesy of Bloomberg LP

International Business Machines Corp. – Daily (12/31/2024 – 10/08/2025)

– Courtesy of Bloomberg LP

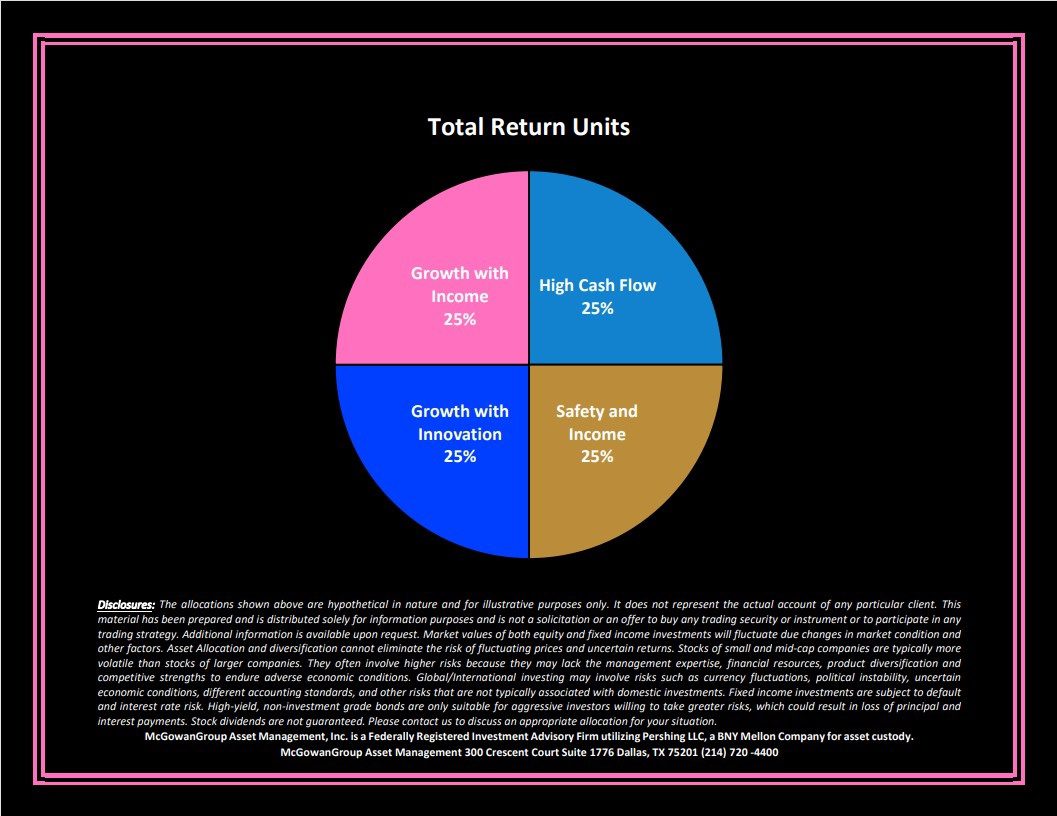

The McGowanGroup’s Total Return Units Allocation Pie Chart (10/08/2025)

– Courtesy of McGowanGroup Asset Management

S&P 500 Index Comparison (01/03/1994 – 12/31/1999) & (01/01/2022 – 12/29/2027 *Projected*)

– Courtesy of Bloomberg LP