Q: What is a potential 2-year investor experience for a portfolio with rational, low cost, Exchange Traded Index funds (ETFs) evenly distributed between Stock and Bond allocations?

A: A loss of about 10% including the net yield of about 2%.

Q: Where could investors “hide” in the equity markets?

A: Investors should look to current asset classes with relatively high cash flows and quantifiable appreciation potential. Further, internal free cash flows are indication of potential forward returns.

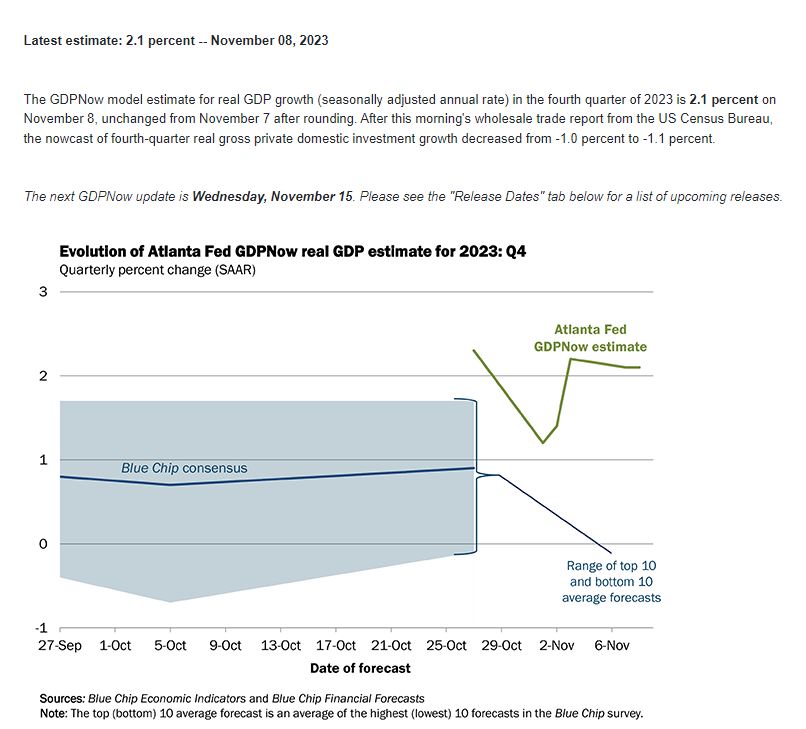

Q: Did the Federal Reserve signal a pause on interest rate hikes?

A: The rhetoric of “wait and see” in the press conference along with “data dependent” decision points raises the possibility that they are finished. Financial markets appeared to anticipate the next part of the cycle which could remove the pressure of higher interest rates on investment asset pricing as rates are potentially lowered.

Headline Round Up

*Ferrari Races Ahead on Better Than Expected Sales & Vehicle Customizations!

*Covid Vaccine Maker Stocks Experiencing Big Write Offs!

*Jeff Bezos Retiring to Miami.

*Artificial Intelligence (AI) + Profits = Microsoft 10th Daily Gain in a Row. Best Streak Since 1987.

*Zweig Breadth Thrust Indicator Flashes Rare Buy Signal that Has Only Occurred 18 Times Since 1945.

*Warner Brothers Discovery Drops 20% in a Week. Stock Down 89% from Peak?

*Bridgewater Brackish? Hedge Fund Founder Ray Dalio Calls New Book on Bridgewater “Sensational & Inaccurate Tabloid Book[s] Written to Sell Books to People Who Like to Gossip”!

*Pickleball Mania! Dallas’ Brookhaven Country Club in Farmer’s Branch Hosts USA Pickleball National Championships.

*The Slow-Motion Crisis in Commercial Real Estate. How long will it last?

*Texas State Energy Fund Texas Prop 7 Establishes $10 Billion State Energy Fund with Natural Gas as a Big Winner!

*The Austin Real Estate Boom Hits a Wall.

*Dust in the Wind: New Jersey’s Wind Venture Loses $4 Billion for Renewable Energy Firm Ørsted, Citing Cost Overruns.

*China’s 3rd Real Estate Developer Hitting the Skids.

*China’s Exports Tumble Again for the 6th Straight Month.

*Foreign Firms Pull Billions Out of China as a Combination of Interest Rates, U.S. Tensions & a Weak Chinese Economy Lessen the Country’s Investment Appeal.

*Credit Card Debt Soars $154 Billion in a Year & Now Over $1 Trillion.

*A Record Number of Supertankers on the Way to Scoop Up U.S. Oil.

*American Airlines Offering $250,000 Pilot Bonuses to Poach Pilots.

*Vistra Corp. Powers Ahead to New Highs After Better Than Expected 3rd Quarter.

*Topgolf Buying $29 Million Dallas Based BigShots Golf.

*Electric Vehicle (EV) Price Wars. Dealers and Car Executives Say Discounts and Price Cuts Necessary.

*AstraZeneca Entering Weight Loss Drug Market.

*SUX – Sioux City, Iowa Capitalizes on Airport Moniker!

McGowanGroup Wealth Management

The 10 Stages of Estate Planning

Who processes the investment assets for your estate? Who guides your spouse and family through the process with experience, diplomacy, and advice?

The answer: Your financial advisory team! These 10 stages are rooted in The McGowanGroup Wealth Management’s decades of logistical experience in aiding client families to plan effectively.

Stage 1: Retirement Plan Beneficiary Selections

For most clients, the initial encounter with estate planning involves deciding the beneficiary of an IRA or 401k acct. A common mistake is designating your estate as the beneficiary, potentially leading to taxation in the case of a pretax account. A subsequent step involves selecting contingent beneficiaries in the event of your primary beneficiary’s demise.

Stage 2: The Will

Inspired by the wisdom of renowned investors like Charlie Munger and Warren Buffett this stage focuses on choosing your Executor, Executrix, or Trustee. It’s crucial that your financial team possess an executed copy of the will, as they are expected to execute it posthumously with an Estate Planning Attorney’s assistance.

Stage 3: The Revocable Family Living Trust

Considering a Living Trust as an alternative to a will is a pertinent question for your estate planning attorney. Based on our extensive experience, a living trust, with a successor trustee, proves to be the most efficient and least disruptive process, particularly for surviving spouses. This trust operates under the social security number of the individual or couple, functioning similarly to an investment account.

Stage 4: Coordination

Productive brainstorming on optimal choices results from coordinating the advice of your CPA, estate planning attorney, and your financial advisor at each stage.

Stage 5: Trustee Bootcamp

Your executrix, executor, or trustee should at least have the contact information of your financial advisor, attorney, and CPA. Additionally, this stage offers an opportunity for parents to enhance their heir’s investment planning skills. Trustee Bootcamp involves adding your most eligible children to the McGowanGroup’s confidential database, where they receive updates on performance tracking and investment planning.

Stage 6: Charitable Planning

In collaboration with your CPA, one simple technique is to make gifts from highly appreciated assets to a church or charity rather than cash, preserving the capital gains tax. More advanced strategies, such as Charitable Lead Trusts and Charitable Remainder Trusts, can save taxes while alive, particularly if a church or charity is a prospective beneficiary. These options, along with Donor Advised Funds, are worth discussing with your CPA and Estate Planning Attorney.

Stage 7: Updates for Tax Changes

The current lifetime estate and gift tax exemption of $12.92 million for 2023 is set to halve, adjusted for inflation, in 2026 due to the sunset of the current law. The recent mandate requiring IRA beneficiaries to withdraw the balance before a 10-year deadline introduces a level of tax planning with the CPA to minimize tax consequences and maximize benefits.

Stage 8: Gifting and Irrevocable Trusts

For families with substantial investment portfolios, land holdings, and family businesses exceeding the 2026 exemption amount (projected to be $7 million or less), preparation often includes gifting to an irrevocable trust using Form 709 and the lifetime gifting exemption. For larger land holdings and mineral rights, planning frequently involves Family Limited Partnerships, allowing for annual gifting of a partnership portion to children while maintaining control and facilitating future legacy planning.

Stage 9: Updates for Life Changes

McGowanGroup Wealth Management has long provided the necessary care, attention & understanding to families undergoing significant life changes. The logistical experience and guidance from The McGowanGroup makes a significant difference during challenging times. Coordination with the estate planning attorney & CPA gives way to prompt solutions that pave the way for legacy success.

Stage 10: Estate Processing, Distributions, and Logistics

Prompt execution of journals, account changes, trust funding, and distributions demands an experienced team committed to a fiduciary duty to the owners

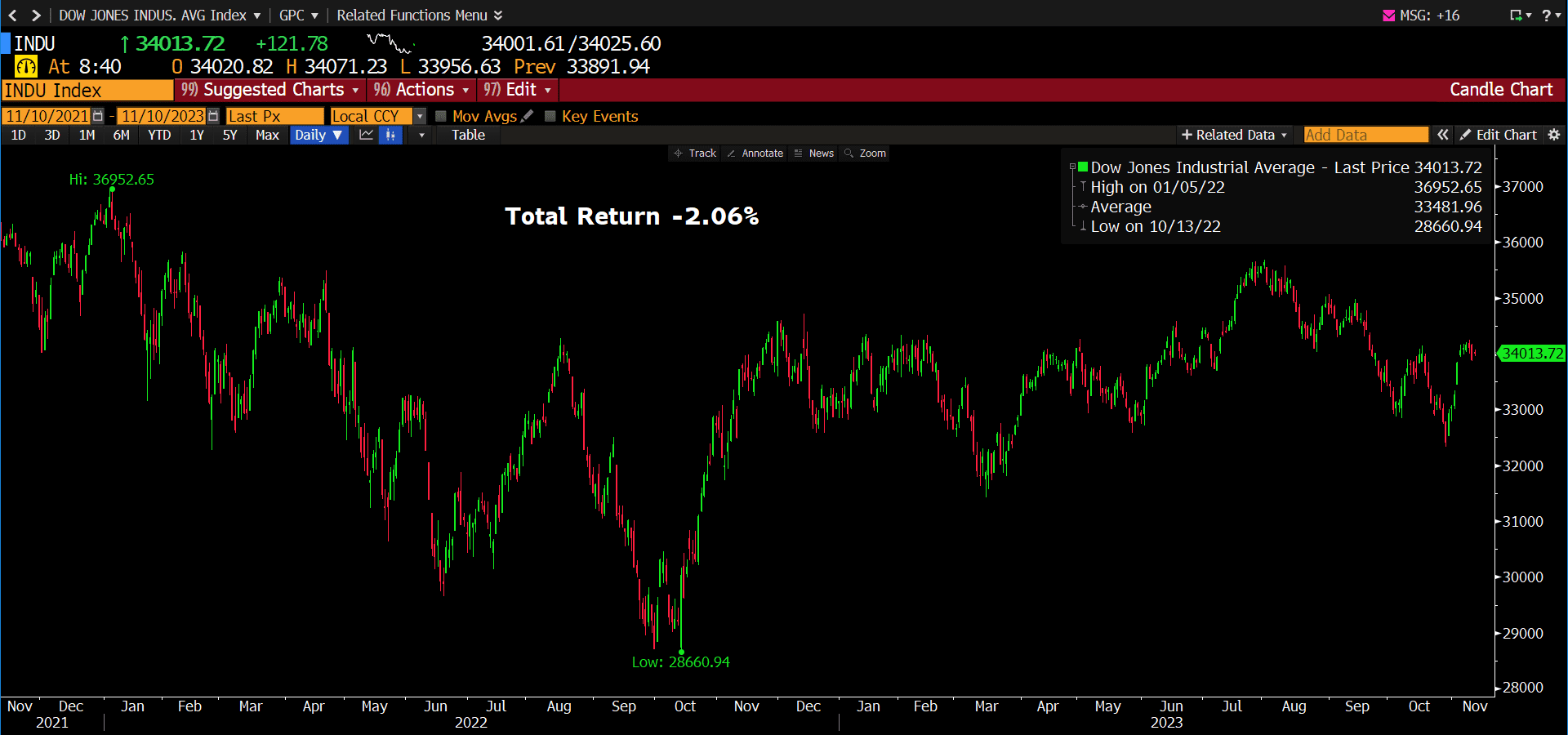

Dow Jones Industrial Average Index (11/10/2021 – 11/10/2023)

– Courtesy of Bloomberg LP

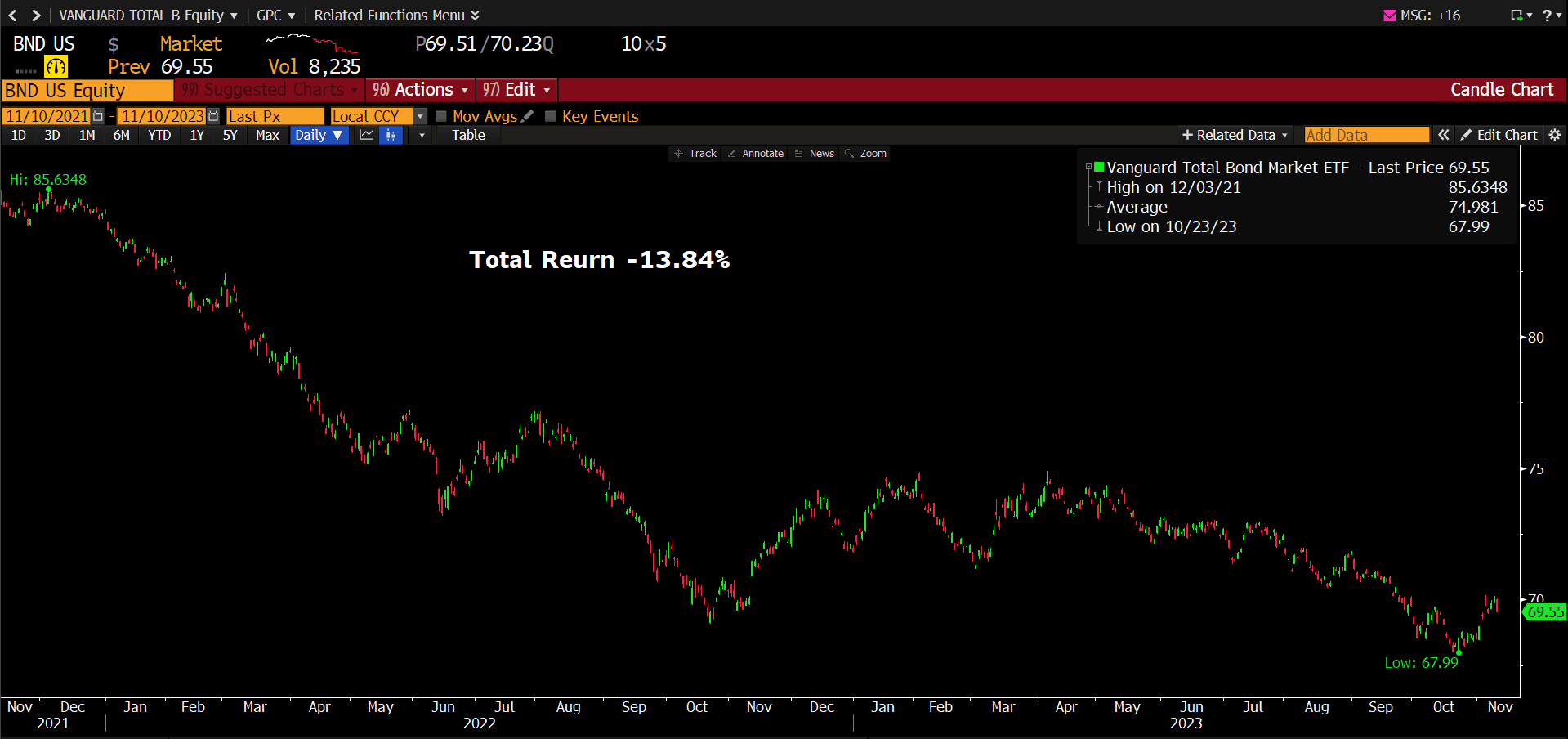

Vanguard Total Bond Market Exchange Traded Fund (11/10/2021 – 11/10/2023)

– Courtesy of Bloomberg LP

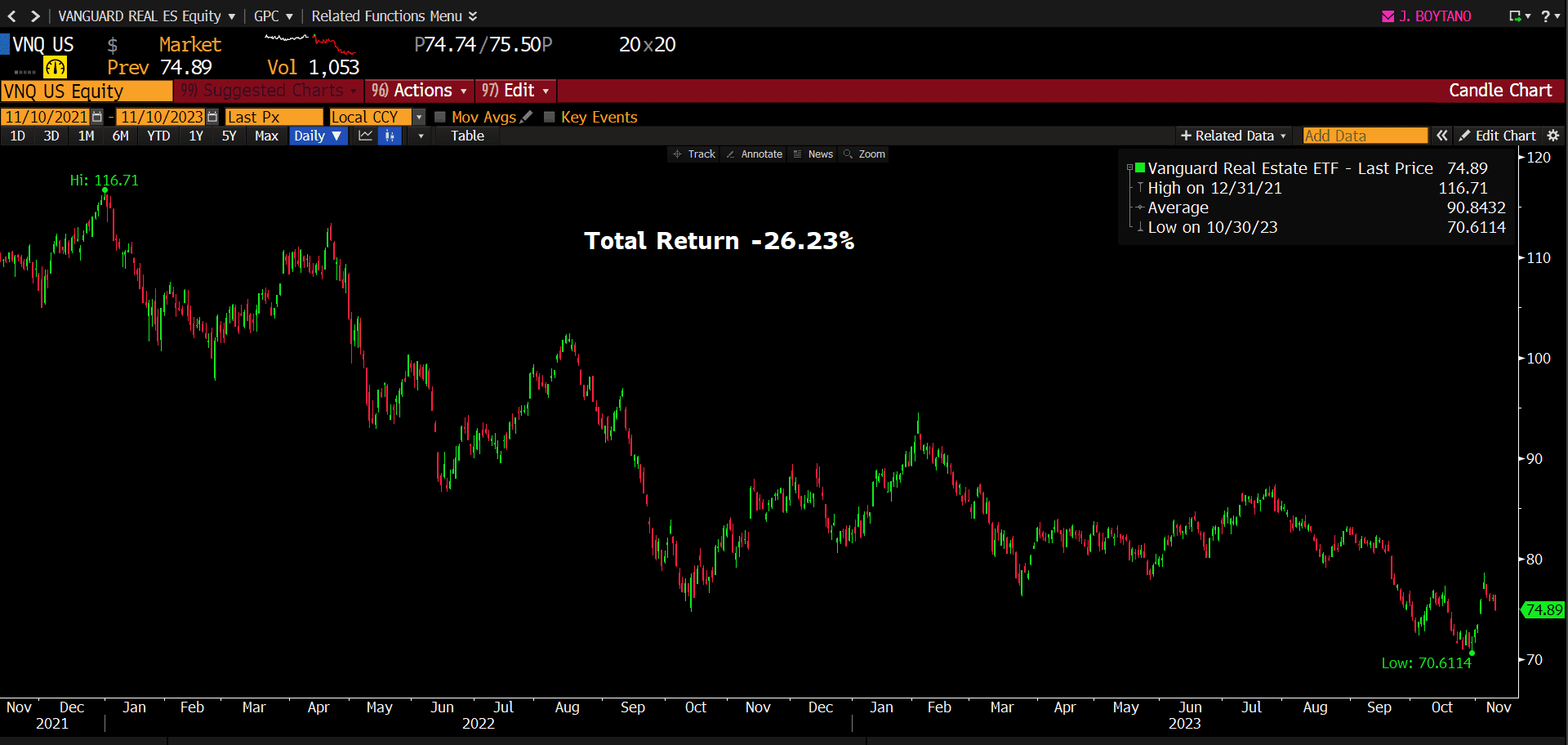

Vanguard Real Estate Exchange Traded Fund (11/10/2021 – 11/10/2023)

– Courtesy of Bloomberg LP

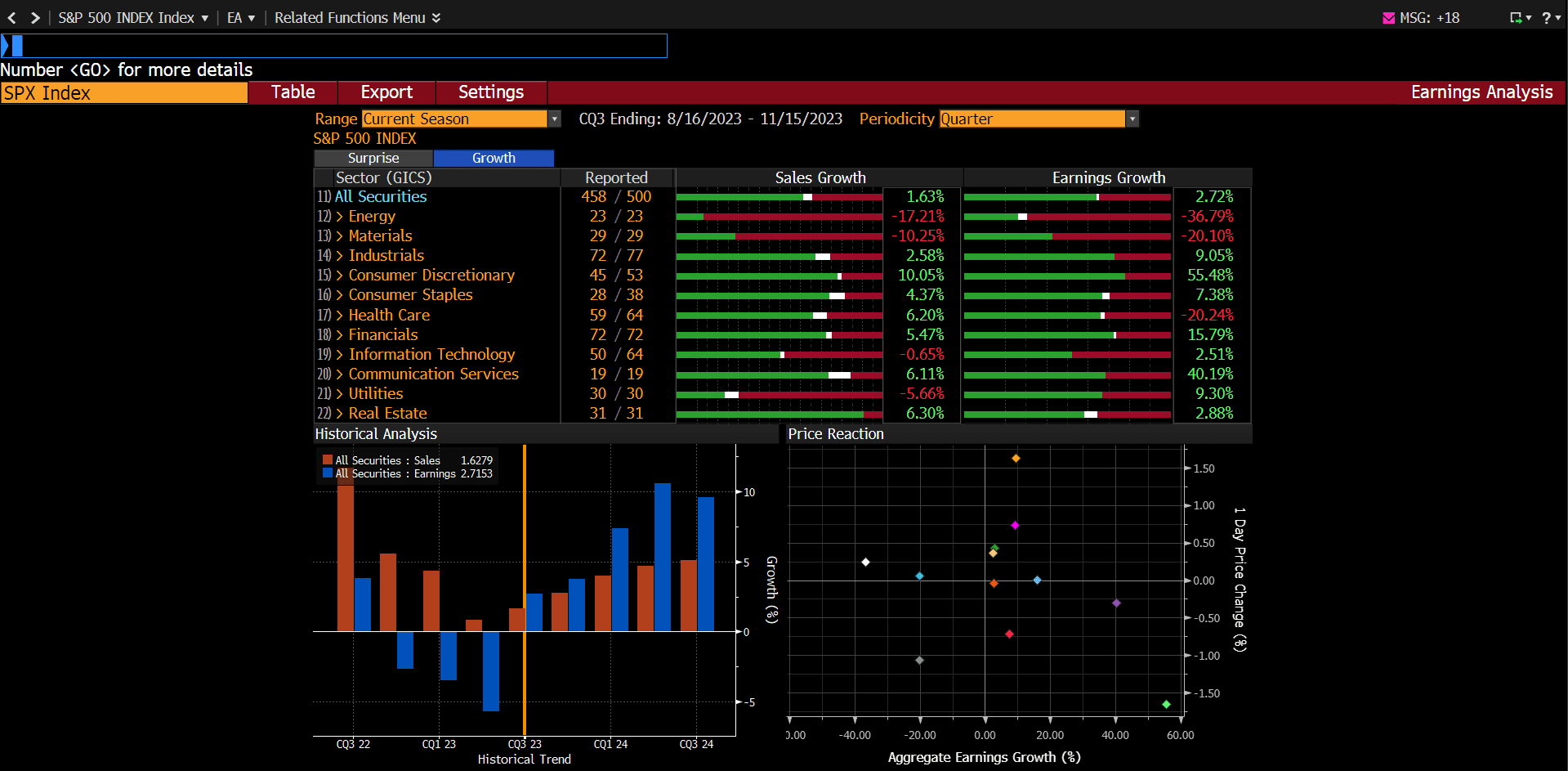

Standard & Poor’s 500 Index – Earnings Analysis by Sector (08/16/2023 – 11/15/2023)

– Courtesy of Bloomberg LP

Evolution of Atlanta Fed GDPNow Real GDP Estimate for Q4 2023 (11/08/2023)

– Courtesy of The Atlanta Federal Reserve

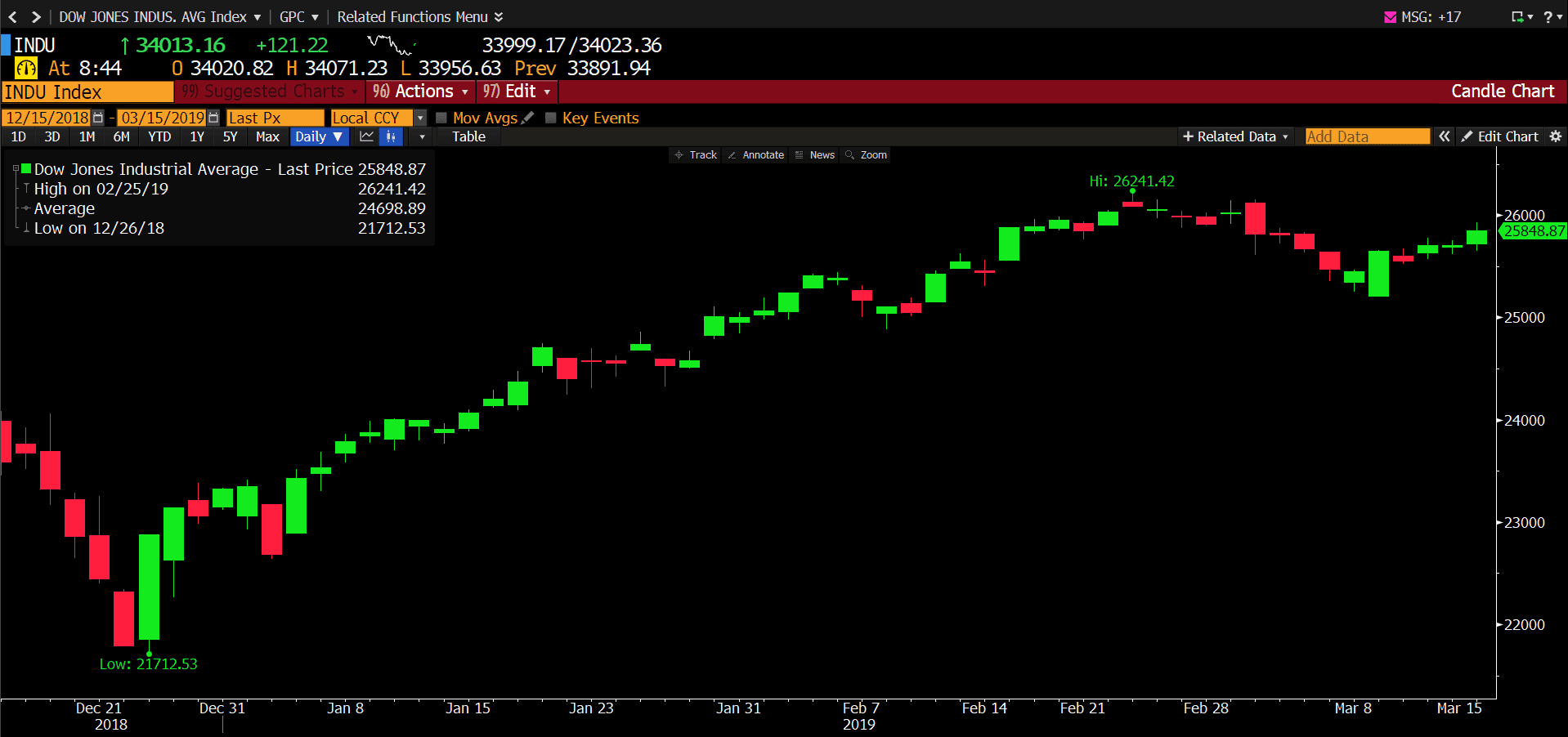

Dow Jones Industrial Average Index (12/15/2018 – 03/15/2019)

– Courtesy of Bloomberg LP