What Sectors indicate inflection points over the past few weeks?

What did the Federal Reserve’s announcements this week tell us about 2022 Money Flows and Interest Rates?

What did we learn from the last recovery cycle that can help us in the current recovery?

Has Economic Growth stalled?

What did Zillow teach us about the current Residential Real Estate cycle?

What is the potential impact of this week’s election outcomes on 2022 tax hikes?

Headline Round Up

*Record Dow Over 36,000!

*Zillow Implodes!

*Fed Said Taper Slowly Through 2022.

*Washington Still Confused? Hot Mess?

*Oh Virginia! Does this stall legislation?

*Natural Gas Spikes Again! Back to $5.70, why?

*Oil $120 By June 2022 Says Bank of America!

*Higher for Longer: Energy Costs Impacted by Chronic Underinvestment.

*Rockdale Texas: America’s Biggest Bitcoin Mine! 6.25 New Bitcoins Every 10 Minutes = Approx. $2 Million Per Hour.

*Elon Musk Says Hertz Waits Like Everyone Else!

*Earnings Rally: Google, Microsoft, AMD, Adobe, Tesla, and Salesforce! Overpriced?

*This Week in Earnings Reports.

*Congressional Insider Trading? Republicans Outperform?

*Battery Bottlenecks!

*Energy Demand Outpacing Renewable Growth. Texas Energy Goldrush Updates.

*North Texas Home Values Up Nearly 25% Beating National Home Values Up a Record 19.66%.

*Economic Growth Slows to 2%!

Dow Jones Industrial Average (Year to Date)

– Courtesy of Bloomberg LP

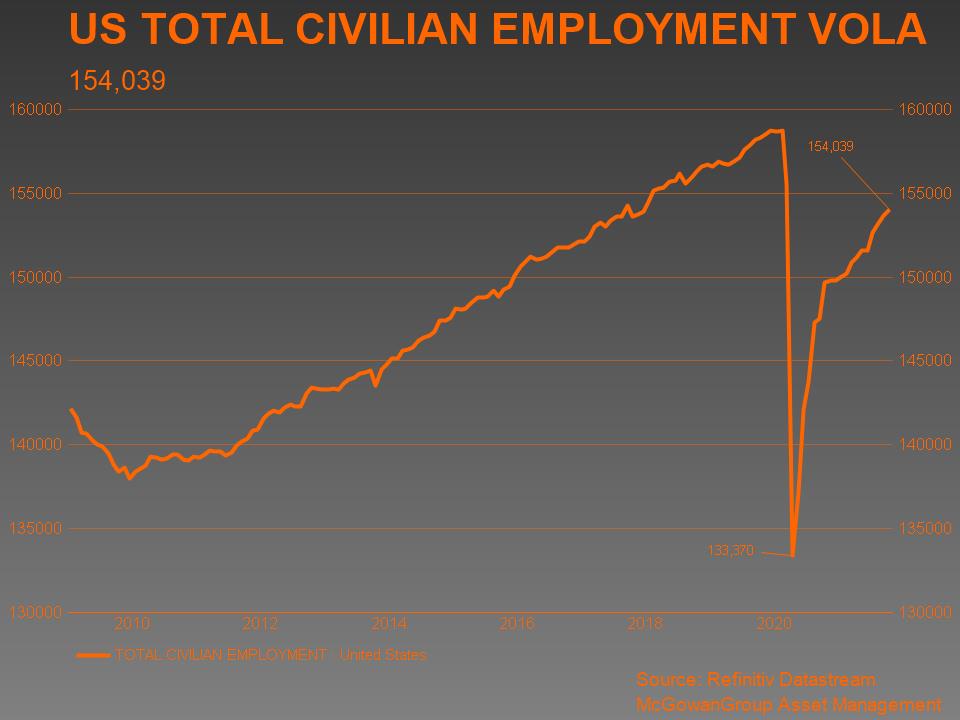

U.S. Total Civilian Employment VOLA (11/05/2021)

– Courtesy of Refinitiv Datastream

Zillow Group, Inc. (Year to Date)

– Courtesy of Bloomberg LP

Exxon Mobil Corp. (Year to Date)

– Courtesy of Bloomberg LP

Tesla, Inc. (Year to Date)

– Courtesy of Bloomberg LP

Advanced Micro Devices, Inc. (Year to Date)

– Courtesy of Bloomberg LP

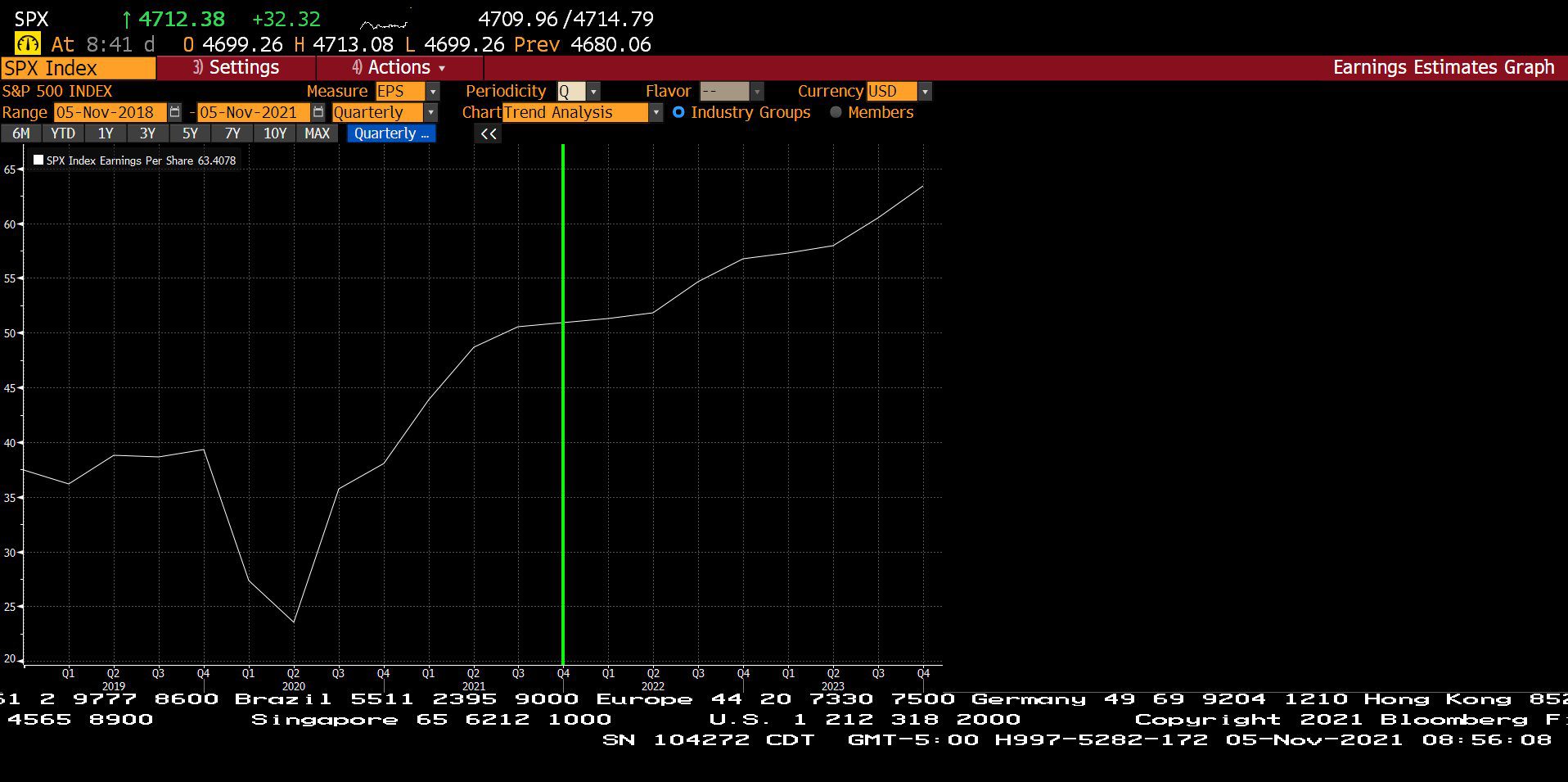

Standard & Poor’s 500 Index – Quarterly Earnings Estimates (Q1 2019 – Q4 2023)

– Courtesy of Bloomberg LP

Profit Report

5 Portfolio Constructions Themes for 2022!

Great Questions Can Be The Basis for Great Answers!

7 Key Steps for 2022 Investment Plan Upgrades & How do I Adjust My Investment Plan for future Inflation?

1. Why is Investment Portfolio cash flow so important longer term? – For retirees, the ideal ratio is reinvestment of 20% of portfolio cash flow. This standard provides a framework for Allocation and Expense planning.

2. What is a “Tactical Safety” allocation and how can it be used effectively? – With slowing growth through 2022, tactical safety allows a plan to react to future corrections with a target list for great assets. Cash reserves help to avoid selling assets at unfortunate times.

3. Why should High Yield Global Lending be a permanent allocation for my Investment Portfolio? – Well managed portfolios of loans and bonds can provide opportunities for increased income and gain potential. In times of crisis, attractive discounts tend to emerge from fearful selling. Allocation planning can build in rebalancing additions. “Be the Bank!”

4. How do I prepare for future market corrections? – The study of prior market selloffs provides lessons for planning that can be likened to a fire drill where pre-planned actions increase the likelihood of success.

5. Why is excellent service so important for improving my Investment Performance? – A long-term plan executed by a well-managed and devoted team helps avoid service distractions. Excellent service is the basis for staying focused on opportunity because of the peace of mind created.

6. How can automated performance tracking improve my decision making? – The database record of actual overall performance provides guidance for future decisions in a more scientific process. Headlines and politics can often result in poor decisions driven by anxiety.

7. How can my goals and allocations be adjusted for current inflation forecasts including likely beneficiaries? – The world economies have moved from oversupply crisis to demand exceeding supply in many areas. Capital that provides solutions to these issues likely benefits with excess returns.