Q: What is The McGowanGroup’s year end trading package and what areas of the equity markets are current candidates?

A: Tax loss selling pressure at the end of the year can push out-of-favor companies to attractive bargain valuations. Tax loss selling pressure typically ends at the end of December creating potential appreciation in January and beyond. Technology companies were a good example after the NASDAQ fell over 30% in 2022. Stay tuned to find out what Spencer McGowan & Alex Tollen are currently excited about!

Q: How much is a battery replacement for an 11 year old Chevy Volt?

A: A recent Florida Chevy dealer gave a quote for a battery replacement near $30,000! The car was no longer under warranty & General Motors no longer makes the car’s battery. A third party supplier was the only way to get the battery and therein lies the rub.

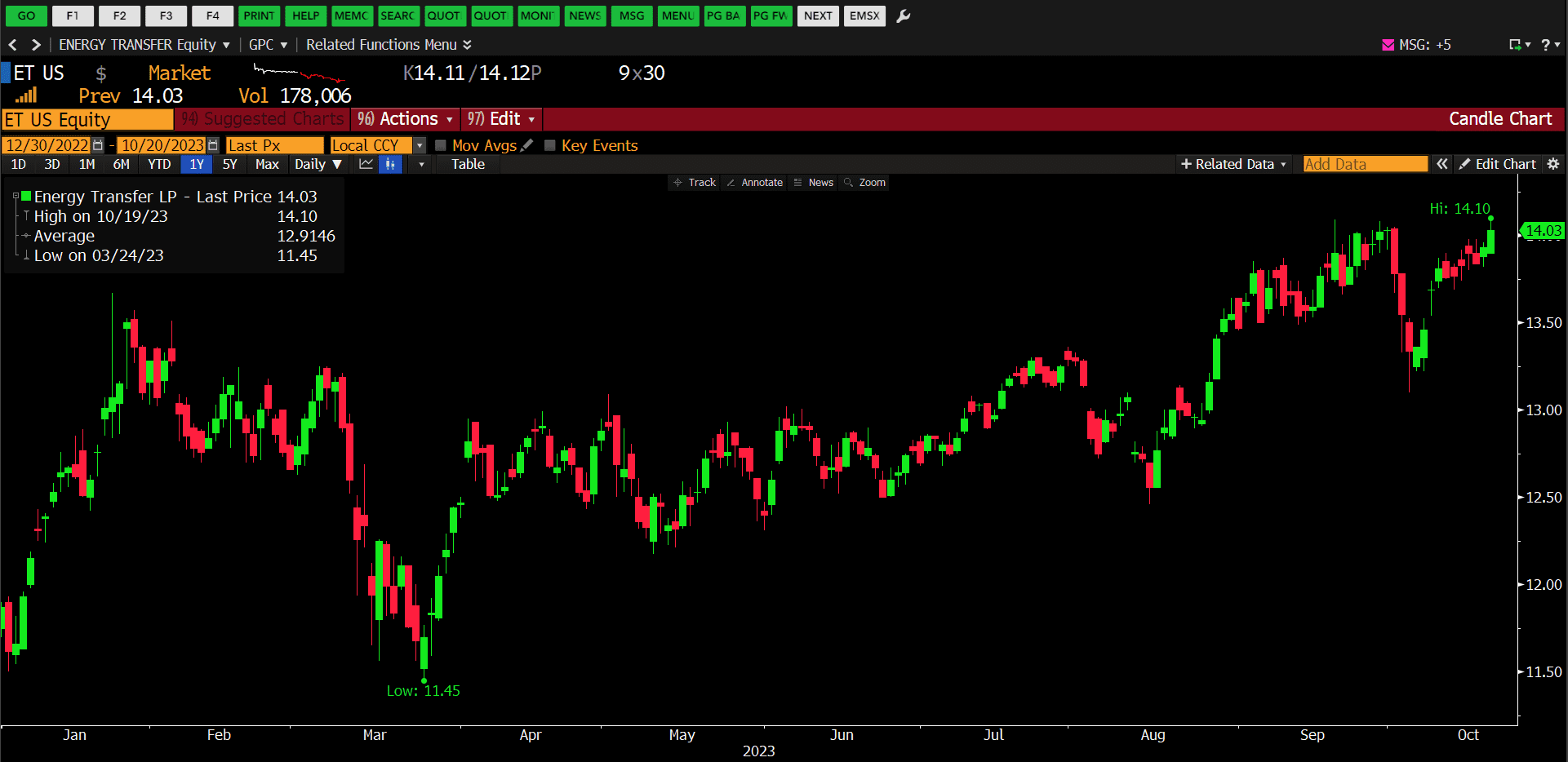

Q: What currently attractive categories are included in a McGowanGroup model portfolio?

A: Global High Yield bonds, Medical Dividend companies, Energy Infrastructure, along with Growth and Innovation companies.

Headline Round Up

*Recent U.S. Economic Data Stronger Defying Forecasts!

*Taylor Swift Concert Movie Hauls in between $95-$97 Million on Opening Weekend.

*Iran Calls for Immediate & Complete Oil Embargo on Israel.

*Chesapeake Energy Approaches Southwestern Energy About Possible Acquisition.

*Frozen: Existing Home Sales Hit 13 Year Low.

*Mortgage Applications 28 Year Low as Interest Rates Continue to Rise?

*Discover Profits Hit: Discover Financial Services Write Offs of Delinquencies Doubled From a Year Ago.

*Miss America Promotes Nuclear Energy?

*Tesla Profits Falls 37% in Q3 & Shares Fall 12% This Week.

*The Next Phase of the Shale Revolution. Potential Acquisition Candidates?

*Electric Vehicle (EV) Batteries Costs Could Surge 22%.

*U.S. Median Household Net Worth Surged 37% from 2019 to 2022.

*China’s Evergrande Made Broken Promises to Chinese Citizens.

*China’s Office Building Vacancies Rise This Year.

*Ozempic For Everybody? Protective Effect on Heart, Liver & Kidneys?

*Goldman Sach’s Analysts See Obesity Drugs $100 Billion Potential.

*While EV Sales Continue to Grow, Unsold EV Inventories Rising?

*Huge Inflation Hike Increases Healthcare Cost.

*Commercial Property Distress Rises to 10 Year High in Third Quarter.

Profit Report

*Some of the Best Client Questions of the Week.

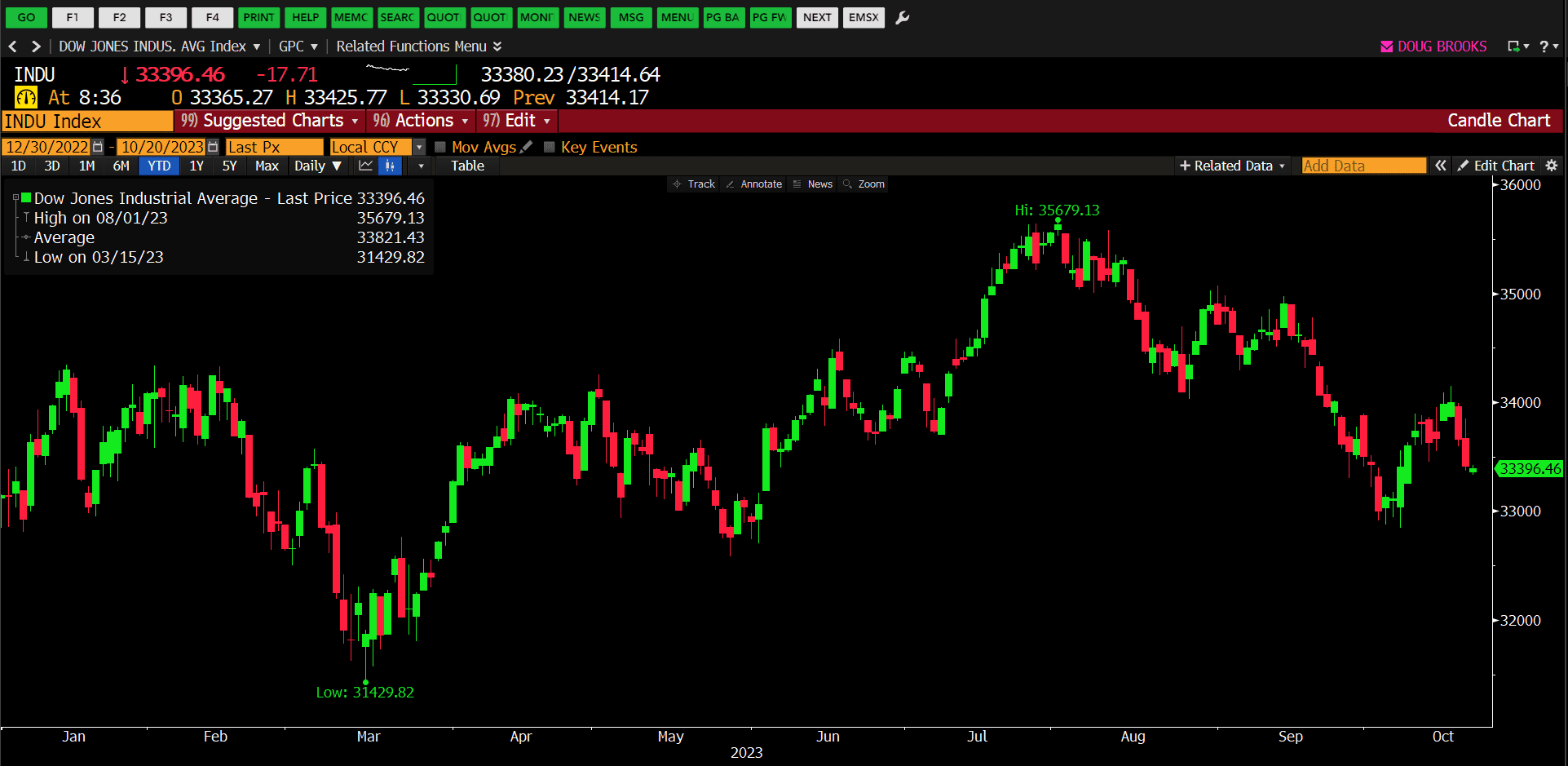

Dow Jones Industrial Average Index (12/30/2022 – 10/20/2023)

– Courtesy of Bloomberg LP

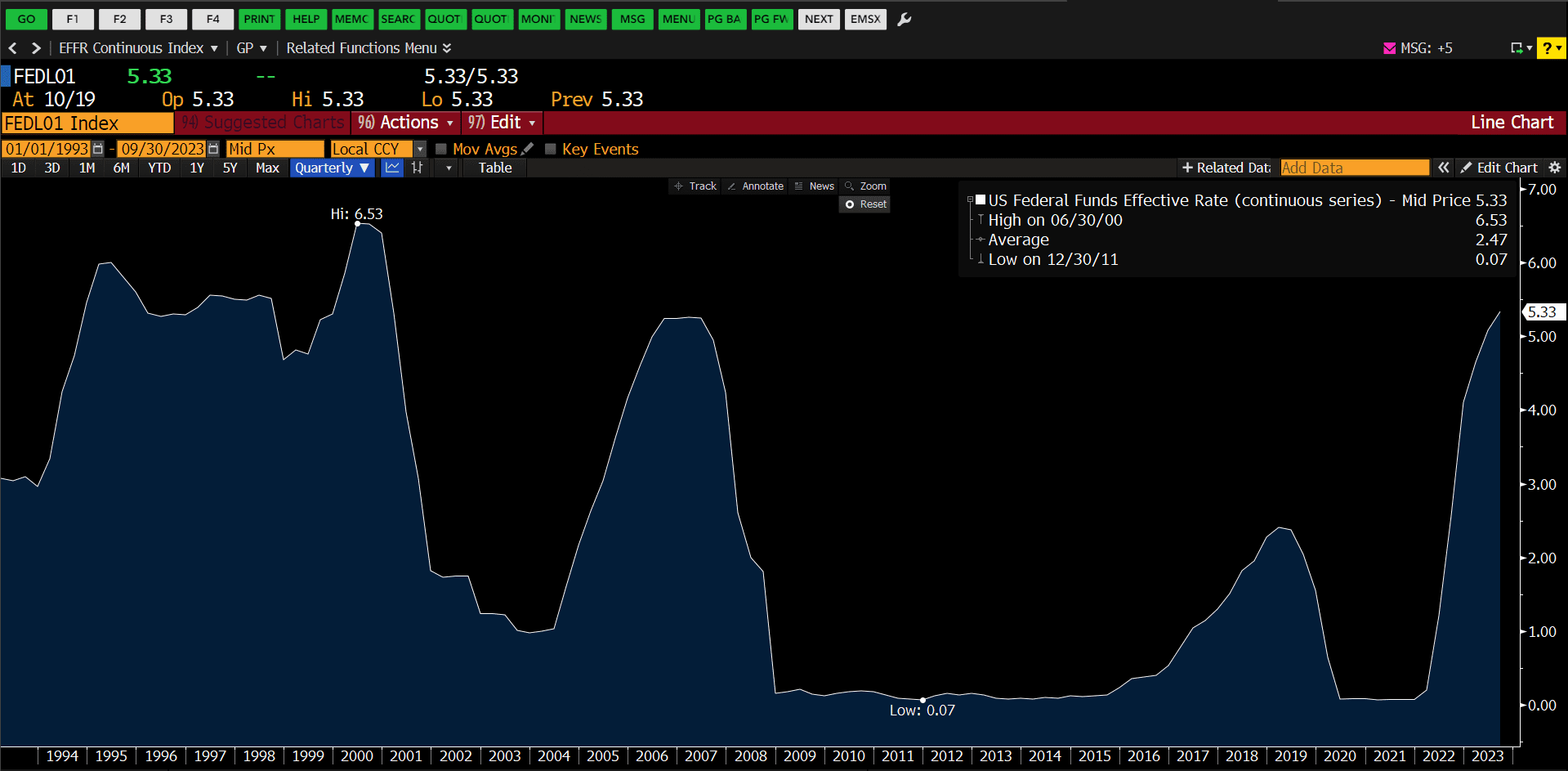

U.S. Federal Funds Effective Rate (01/01/1993 – 09/30/2023)

– Courtesy of Bloomberg LP

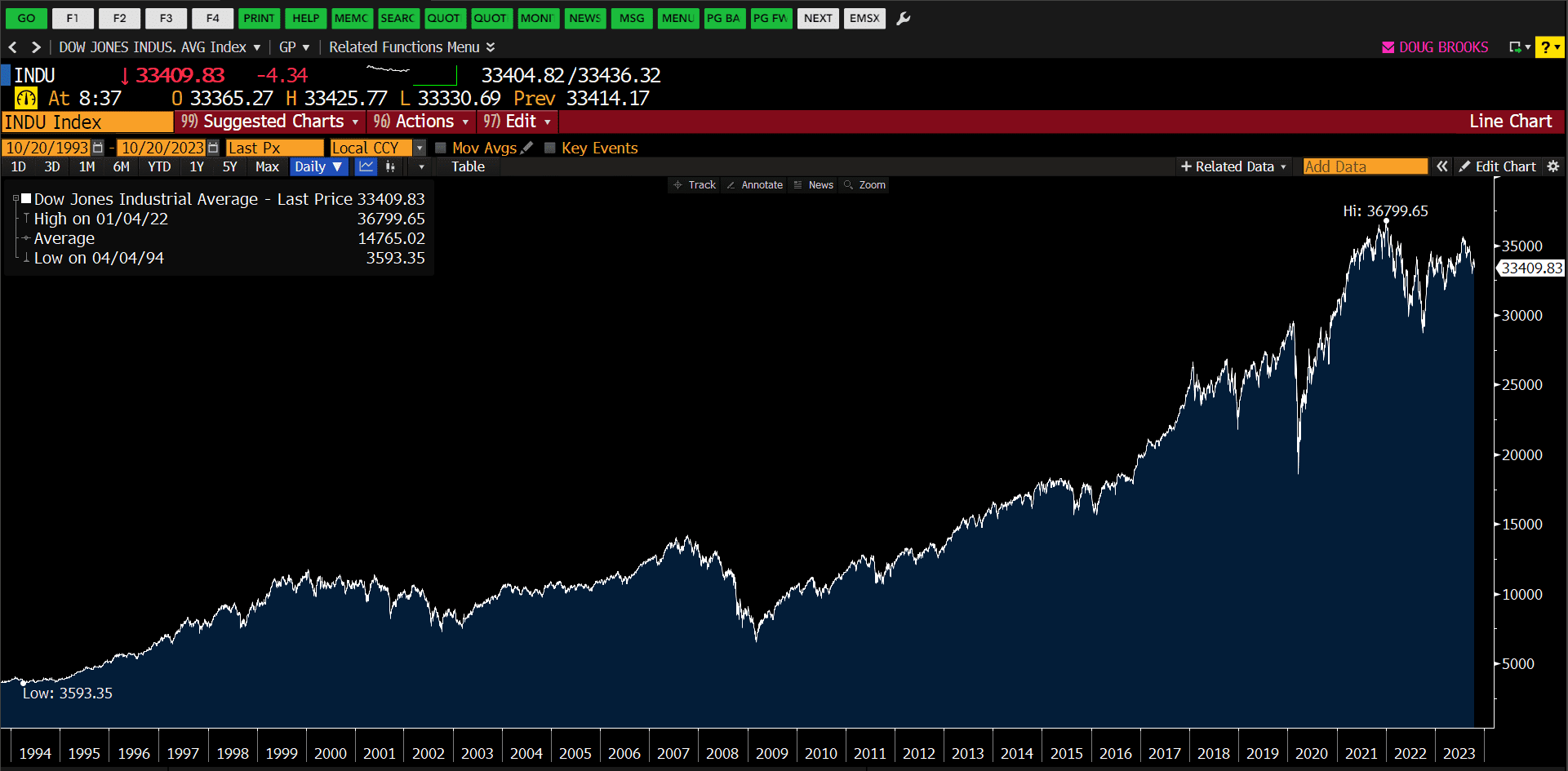

Dow Jones Industrial Average Index (10/20/1999 – 10/20/2023)

– Courtesy of Bloomberg LP

Standard & Poor’s 500 Index – Earnings Analysis by Sector (08/16/2023 – 11/15/2023)

– Courtesy of Bloomberg LP

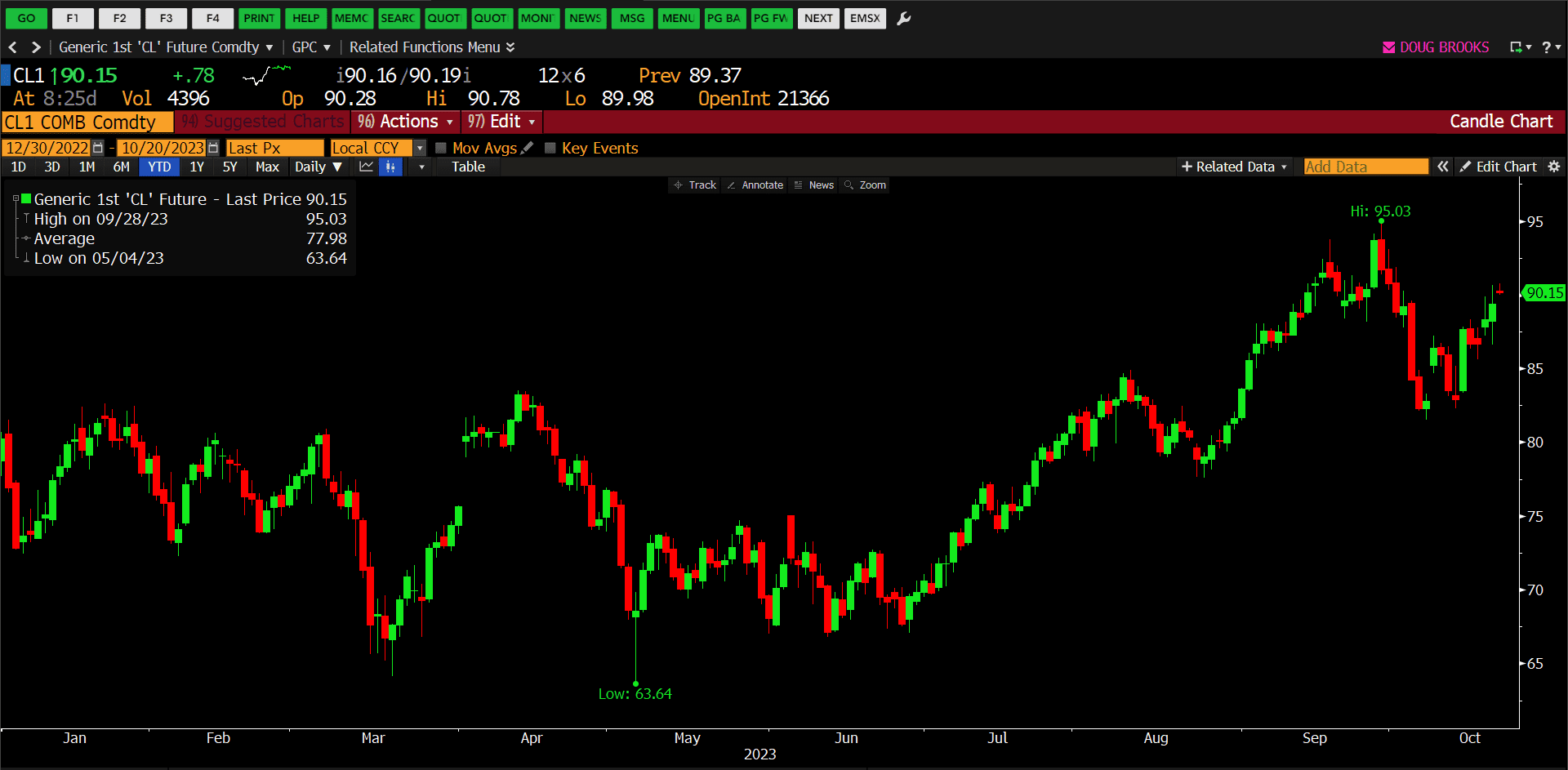

Generic Oil Futures Contract Spot Price (12/30/2022 – 10/20/2023)

– Courtesy of Bloomberg LP

Energy Transfer LP (12/30/2022 – 10/20/2023)

– Courtesy of Bloomberg LP

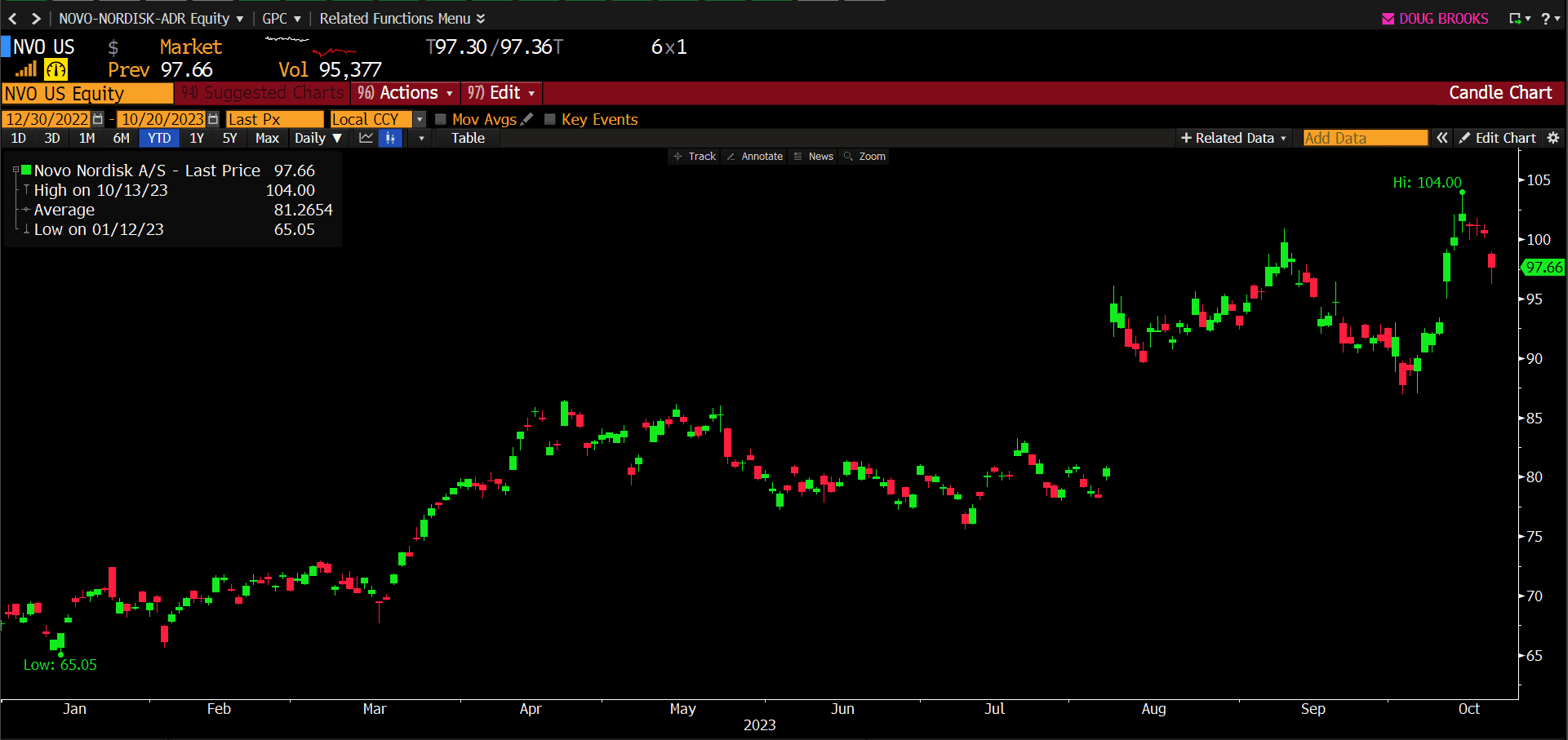

Novo Nordisk (12/30/2022 – 10/20/2023)

– Courtesy of Bloomberg LP