What can Japan teach us about large debt, growth rates, monetization, and the way forward for U.S. markets?

How long can Interest Rates stay low?

How much would taxes have to rise to balance the Federal budget?

What does the US Debt Clock teach us?

What is the actual status of the $1.2 Trillion Infrastructure package and what is in the additional $3.5 Trillion spending package?

What are the top 3 tax increases in the Congressional discussions?

Why should I have The Team That Cares on my side for the future?

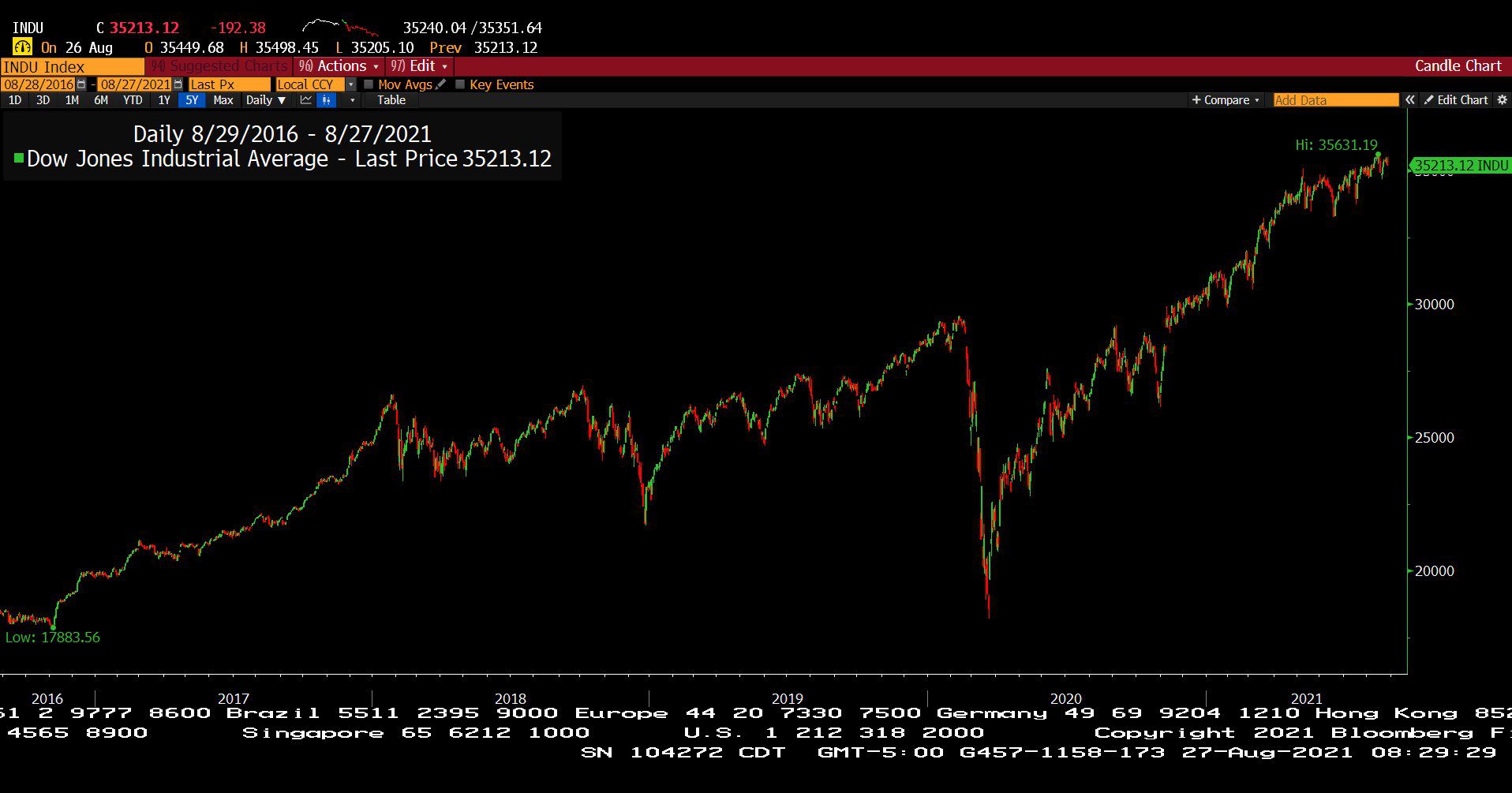

Dow Jones Industrial Average (Approx. 5 Years)

– Courtesy of Bloomberg LP

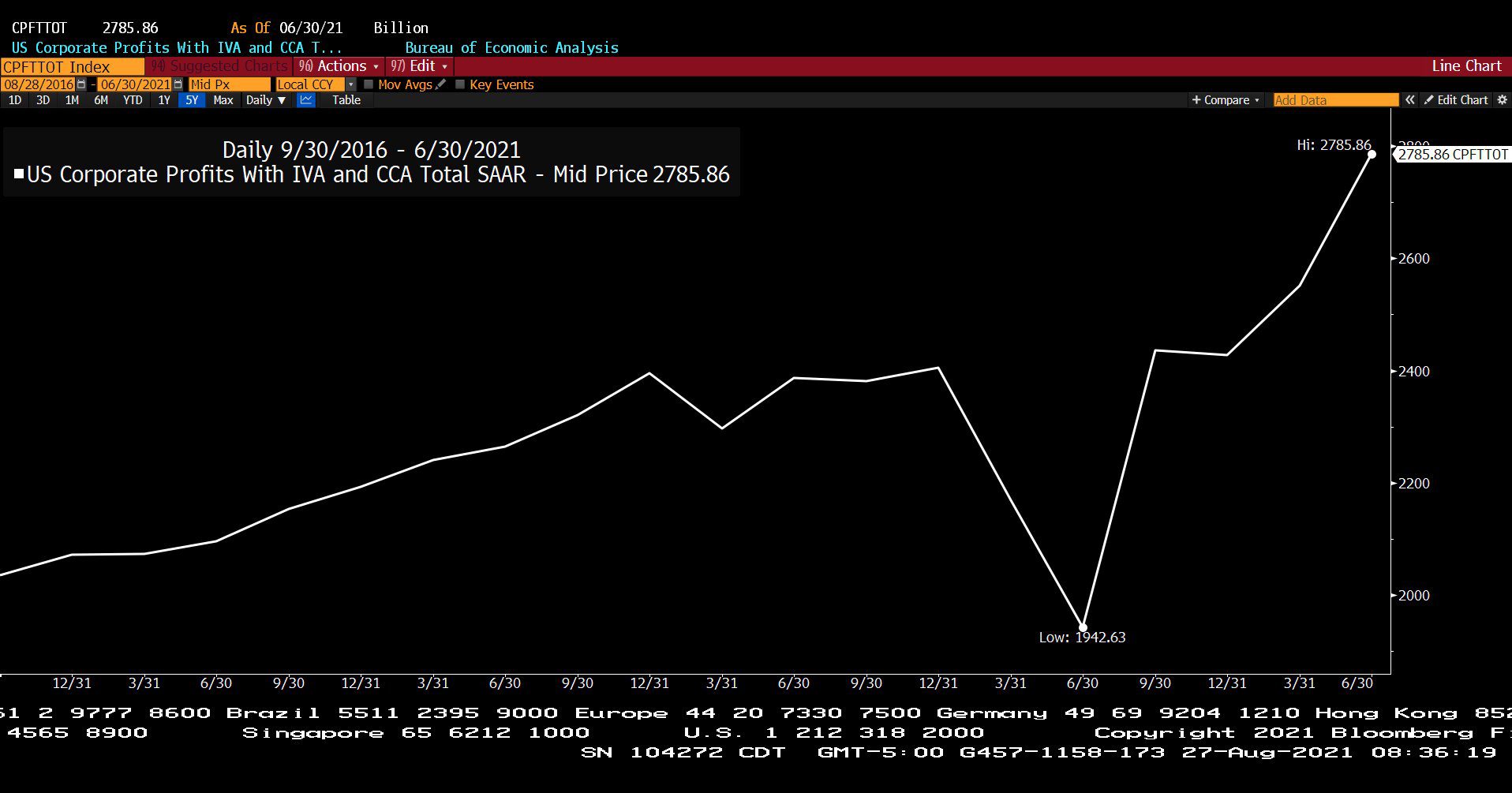

U.S. Corporate Profits with Inventory Evaluation Adjustment & Capital Consumption Adjustment with Total Seasonally Adjustment Annual Rate (Approx. 5 Years)

– Courtesy of Bloomberg LP

Quarterly Standard & Poor’s 500 Index Earnings Estimates (5 Years)

– Courtesy of Bloomberg LP

Nikkei 225 Index (Approx. 35 Years)

– Courtesy of Bloomberg LP

International Monetary Fund – Japan General Government Gross Debt in U.S. Dollars Spot Price (40 Years)

– Courtesy of Bloomberg LP

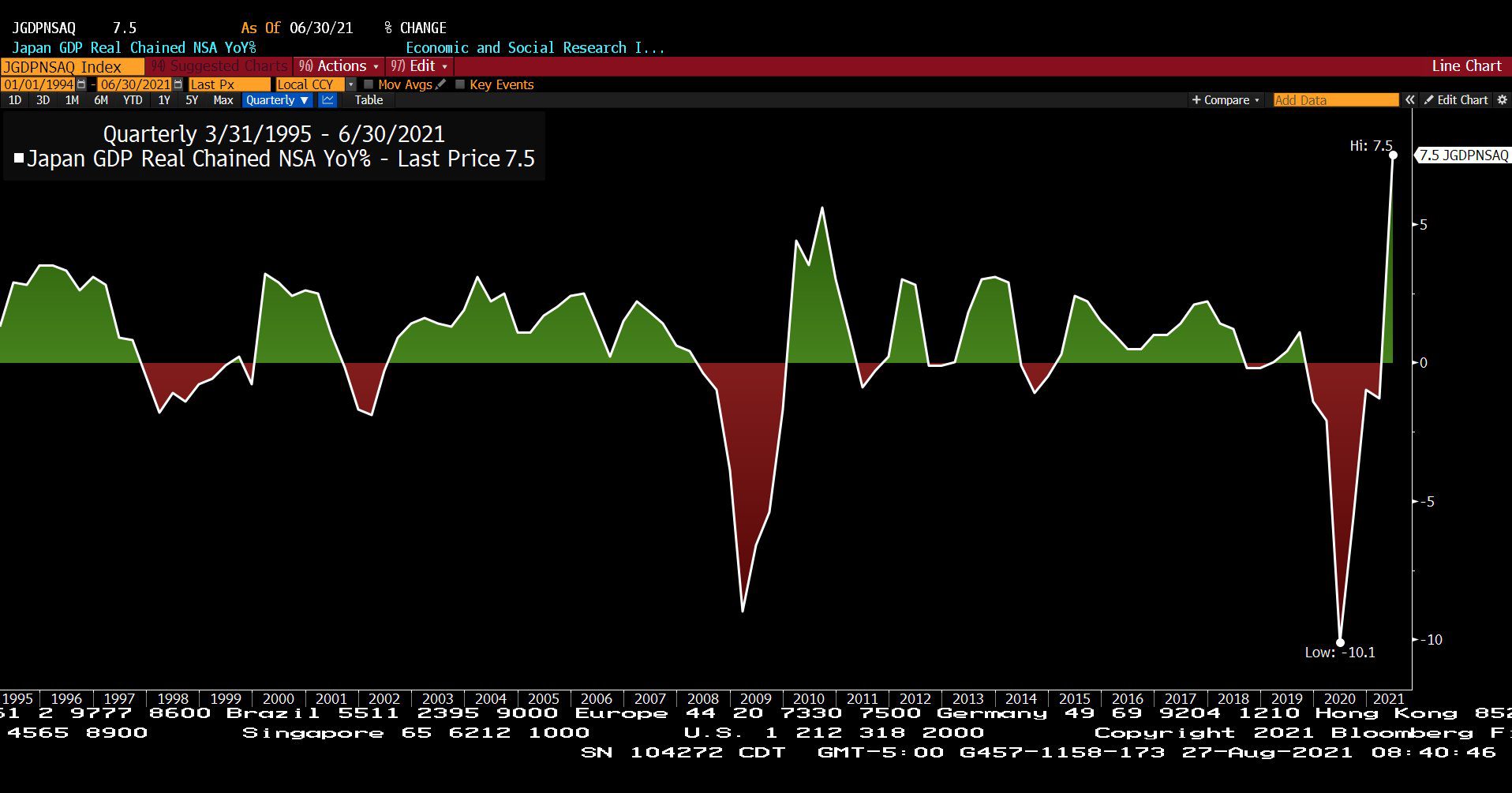

Japan Gross Domestic Product Real Chained, Non Seasonally Adjusted – Year over Year (Approx. 26 Years)

– Courtesy of Bloomberg LP

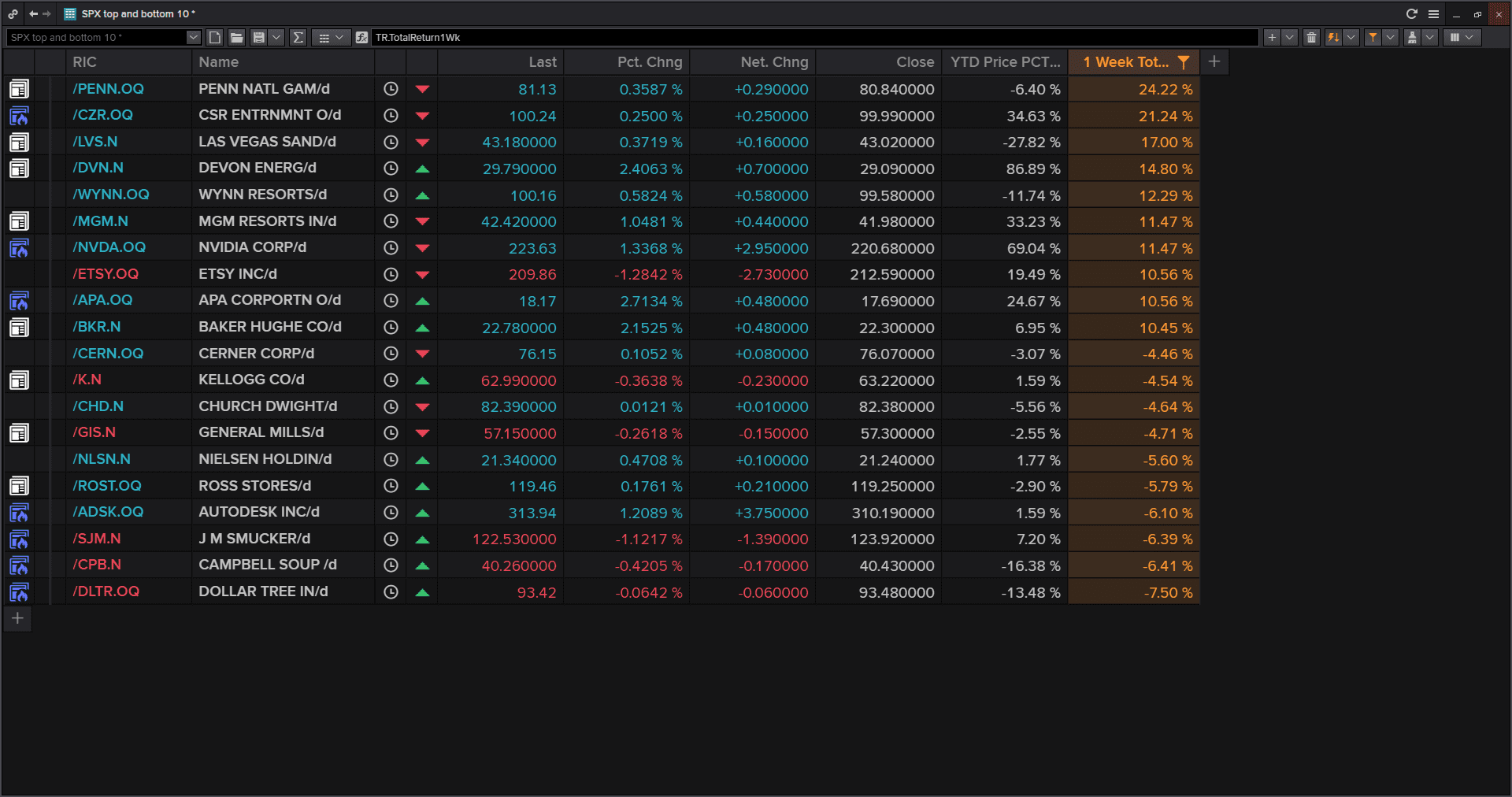

Standard & Poor’s 500 Index Top 10 and Bottom 10 (08/27/2021)

– Courtesy of Refinitiv

Headline Round Up

*Zero-Carbon Capitulation! California Opens 5 Natural Gas Plans to Avoid Blackouts!

*Liquified Natural Gas (LNG) Shortages!

*Biden Restarts Oil Leases? Energy Shortages?

*Evergrande’s EV Stock Loses $80 Billion!

*Hedge Funds Hot Again? Good luck?

*Non Fungible Tokens (NFTs) Surge!

*Net Worth of The Rolling Stones?

*House Adopts $3.5 Trillion Budget? Is the total spending closer to $6.8T???

*How Much Money Has Been Printed? What happens after that?

*Negative Real Interest Rates?

*Texas! Dominates List of Best Places to Buy a Home! Is the housing boom still on?

*Fixed Income Returns? Do we need tactical cash?

*Best Buy, Ulta Beauty, Williams Sonoma, and Other Retailers Nail the Recovery!

*The Biggest Tax Hikes in History?

*SEC to Delist Chinese Stocks?

*CryptoMania Updates!

*Branson Virgin Orbit Gets SPAC’d.

*Shipping Crisis! Shortages and Inflation?

Profit Report

Best Client Questions?

MGAM Disciplines and Evolution.

The 4 Asset Categories.