What is fast and loose trading?

Which commodities have the widest trading ranges right now?

What does PappaDean have to say about Ukraine?

What is wrong with the latest tax hike proposal?

What is happening on May 4th 2022 and why is this important?

Why is tactical safety (“Dry Gun Powder”) important for allocation timing?

What are other affluent families doing right now with their investment portfolios?

What are the best financial market anecdotes from real clients this week?

Headline Round Up

*Your House Went Up 27%!

*Mortgage Rates Now Approaching 5%?

*Biden Administration Considering Strategic Petroleum Reserve release of 180 million barrels?

*The Wild Ride for Nickel, Oil, and Other Commodities. What can the charts tell us about these commodities and others potentially for the rest of 2022?

*Ukraine Impact on Global Food Supplies.

*Tesla Worth Nearly 10x GM and Ford Combined?

*A Kinder Gentler Bill Ackman?

*Liquified Natural Gas (LNG) Boom!

*Battery Materials Production Sparked by Presidential Cold War Powers?

*Investors Flock Back to Oil and Gas.

*Capital Spending Boom!

*Breakthrough to Solve Water Shortages?

*Jamie Dimon Gets Another $56 Million!

Dow Jones Industrial Average (04/01/2021 – 04/01/2022)

– Courtesy of Bloomberg LP

Generic Iron Ore Futures Contract Spot Price (04/01/2021 – 04/04/2022)

– Courtesy of Bloomberg LP

Generic Cooper Ore Futures Contract Spot Price (04/01/2021 – 04/01/2022)

– Courtesy of Bloomberg LP

Generic Nickel Futures Contract Spot Price (04/01/2021 – 03/31/2022)

– Courtesy of Bloomberg LP

Generic Corn Futures Contract Spot Price (04/01/2021 – 04/01/2022)

– Courtesy of Bloomberg LP

Generic Wheat Futures Contract Spot Price (04/01/2021 – 04/01/2022)

– Courtesy of Bloomberg LP

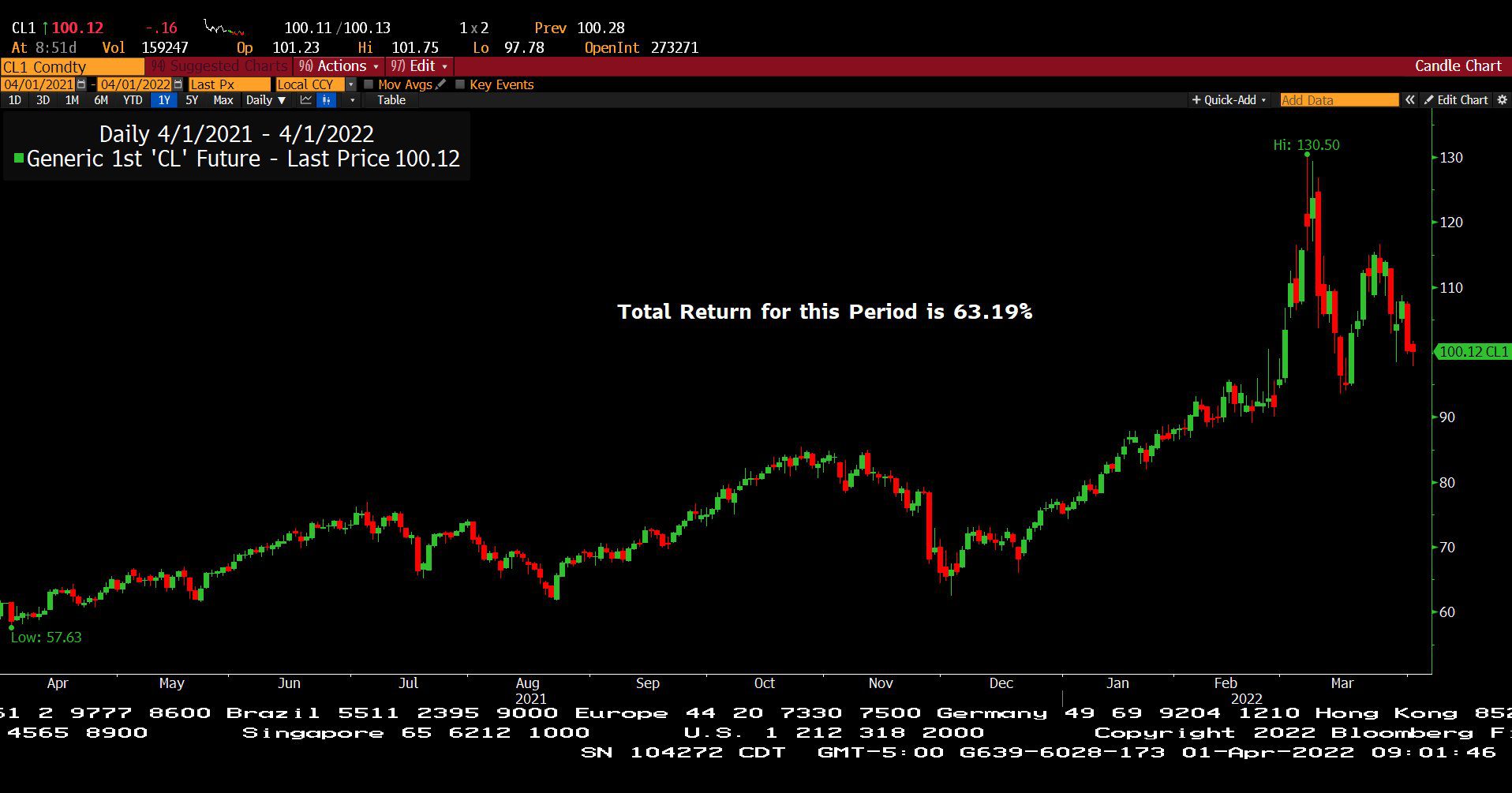

Generic Crude Oil Futures Contract Spot Price (04/01/2021 – 04/01/2022)

– Courtesy of Bloomberg LP

Profit Report

The Most Bizarre Tax Proposal So Far?

Why is Mark to Market a Recipe For Disaster?

The Future of Oil and Gas Exploration Companies?