What did Warren Buffett say this week in his annual letter?

What strategies did he reveal for 2021 and forward?

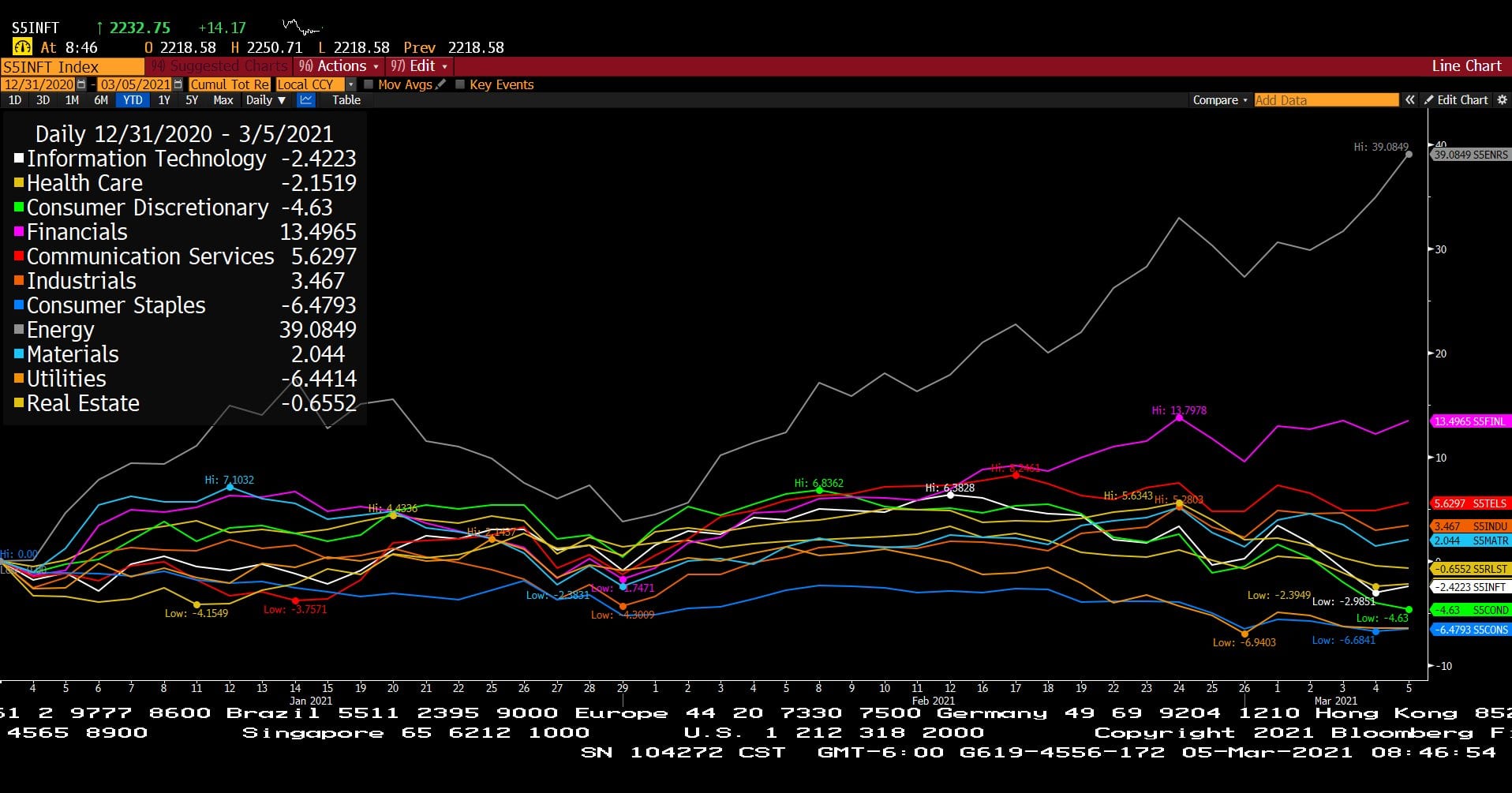

What categories are leading in performance for the year so far?

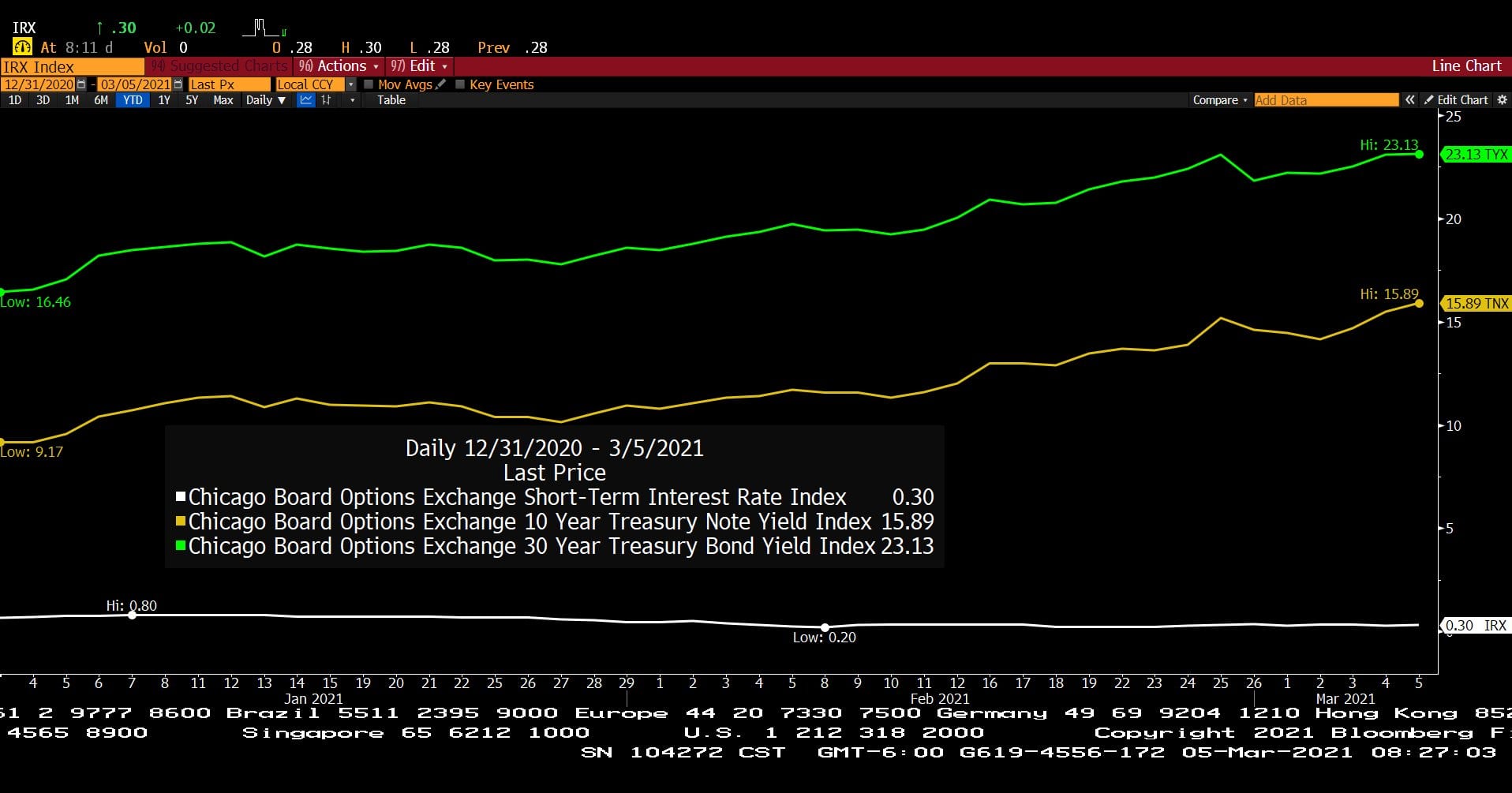

Could US Treasury yields go negative?

What does the rise in long-term Treasury rates tell us?

7% economic growth?

Why do markets often do what is necessary to make the greatest number of investors wrong?

Headline Round Up

*Oil Spikes Over $64 Per Barrel!

*Energy Sector Leading the Market.

*Tech Slammed to a Loss for 2021!

*Post Covid Tech Growth?

*Institutional Research Source: Global Economy Will Experience Strongest Performance Since Early 1990’s Then a Shock!

*Yield Spike Settles Down. What is ahead?

*The SPAC Goldrush! What does it have to do with index funds?

Standard & Poor’s 500 Index by Sector (Year to Date)

– Courtesy of Bloomberg LP

WTI Generic Crude Oil Future Spot Price (Year to Date)

– Courtesy of Bloomberg LP

WTI Generic Crude Oil Future Spot Price (1 Year)

– Courtesy of Bloomberg LP

U.S. Treasury 13 Week Bill, U.S. Treasury 10 Year Note, and U.S. Treasury 30 Year Bond Yields (Year to Date)

– Courtesy of Bloomberg LP

Global X MLPA ETF and Invesco QQQ (Year to Date)

– Courtesy of Bloomberg LP