Q: What is the current inflation rate in the U.S. right now?

Q: How is the U.S. economy actually doing so far in 2025?

Q: What are current profit reports and short term profit forecasts telling investors in the U.S. equity markets right now?

Q: Will the Federal Reserve (the Fed) cut interest rates at their July 30th meeting?

Q: Is the Fed predicting a slowdown or a recession for the U.S. economy?

Join Us for The Latest Financial Headlines and Valuable Research from The McGowanGroup. Built for Investors by Experienced Portfolio Managers!

Click here to get the monthly newsletter

Headline Round Up!

*Record $7.4 Trillion in U.S. Money-Market Funds and Growing! Where could it go when interest rates drop?

*Oil Drops from $77 recent high to $66 per barrel as U.S. and Iran Strikes Spare Iranian Export Hub.

*U.S. Manufacturing Expands at Steady 52 for Purchasing Managers Index. Anything above 50 signals growth?

*Copper Faces Historic Squeeze as London Metal Exchange Inventories are Rapidly Depleted!

*BlackRock, and others, Deepen Push Into Private Investments for Investors. Buyer Beware?

*Withdrawal Requests at Illiquid Starwood Private Investment Fund Hit $850 Million as Fund Sells 1.6Billion in Assets to Meet Redemptions Needs!

*BlackRock Bullish?

*Three Mile Island Restarting & Set to Deliver Nuclear Power a Year Early Potentially in 2027!

*Bad Behavior! China Still Choking Exports of Rare Earths Despite U.S. – China Agreement?

*Pipeline Expansion By Energy Transfer and Enbridge.

*$2.9 Billion Texas Liquified Natural Gas (LNG) Expansion By Cheniere!

*Texas Law Signed By Gov. Abbott Will Require Warnings on M&Ms?

*Delisting! Chinese Stocks in Danger of Losing U.S. Stock Market Access?

*Trump Policy Guts Residential Solar Industry.

*Tesla’s Robotaxi Austin Rollout Shows Great Value for Waymo!

2025 Q3 McGowanGroup Wealth Management Client Updates

The First Half of 2025

Administration Tariff Chaos, Inflations Concerns & Current High Economic Growth

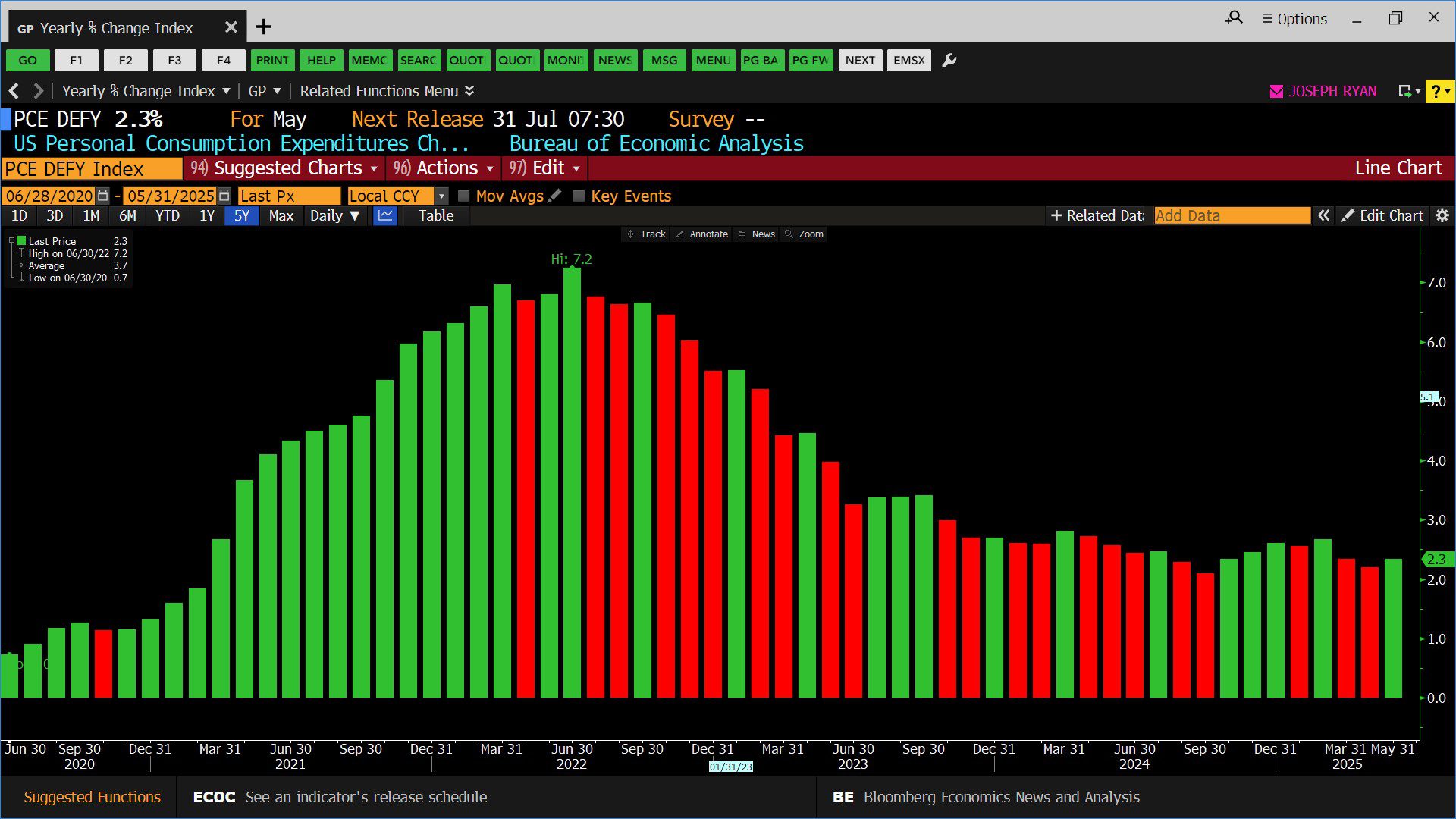

Reasonable investor concerns regarding current chaotic administration tariff policies include higher prices, inflation, disruption of positive economic activity & Recession. However, inflation is near four year lows with May’s Personal Consumption Expenditures, The Federal Reserve’s preferred inflation gauge, coming in at 2.3%. In addition, The Atlanta Federal Reserve’s Real GDPNow number estimates Q2 2025 Gross Domestic Product (GDP) at 2.9% as of June 27th, 2025.

Brief Bear Markets and Tactical Allocations

This past April delivered the official definition of a Bear Market as the S&P 500 Index reached a 20% decline from its Q1 2025 peak. Yet, a recovery driven largely by unexpected lower inflation, higher growth, and artificial intelligence optimism drove the S&P 500 back to near all-time highs at the time of this writing. During the declines, McGowanGroup deployed accumulated tactical safety, dry gun powder, to add attractive, high dividend, blue chip holdings that currently have our portfolios tracking above our targets for the year so far.

The Second Half of 2025 and 2026

Expected Profit Growth

The most current S&P 500 consensus analyst estimates for profit growth are 9% between now and the end of 2025 plus another 16% for 2026. This potentially means a full 27% growth between now and the beginning of 2027!

Energy and Artificial Intelligence

The recent rally in U.S. equity indexes was driven, in part, by rapid recovery in Artificial Intelligence (AI) related companies. The AI revolution is already increasing productivity and profitability for many companies similar the roaring 1990’s PC/Internet driven boom.

Data center expansion is likely the first phase of capabilities to improve efficiency. The initial wave of upgrades delivered attractive growth for the AI technology supply chain. The resulting increases in electricity demand have led to rallies in the Utilities Sector, Nuclear, and Natural Gas.

Energy Infrastructure

The recent Middle East escalation naturally leads investors to a logical premise based upon the past: Oil prices spike and stocks decline due to the flare of instability in the region. The “12-day conflict” left Iran weakened, but their oil exportation facilities intact. Oil briefly spiked and then just as quickly retreated as the equity markets recovered during late June.

Pipelines: Rising dividends and stock buybacks underscore attractive opportunities for investors. Deregulation possibly leads to increased business productivity and profit growth. Liquid natural gas export capacity is on track to double by the end of 2028 according to the U.S. Energy Information Administration. Currently, the pipelines and export facilities still appear underpriced relative to other sectors. In our estimations, Data Center electricity demand is an obvious choice for natural gas power generation.

The Federal Reserve, High Yield Bonds, and Bond Market Impacts

The Federal Reserve (The Fed) echoed the premise above with concerns on tariff inflation and so far has declined to cut interest rates during the first half of 2025. However, with inflation currently near four year lows, and the Federal Funds rate high, the Federal Reserve’s recent projections indicate rate cuts probable during the 2025 and 2026. The Fed’s interest rate cuts tend to provide a potential limit to downside movements in asset prices because of increased future values of discounted cash flows.

Global High Yield Bond fund prices and Floating Rate Loan funds remained resilient during the long rate spike with a current overall yield near 8%. Premium prices could result in gain harvesting to increase “dry gun powder” for bargains in other areas of the markets. The higher, longer yields likely create more choices in other parts of the bond market like Tax Free Municipals. Meaningful deficit reduction could result eventually in lower long-term rates and potential gains in longer duration bonds.

Our Next Steps

The McGowanGroup Investment Committee (IC) meets each Wednesday morning to review and upgrade the model portfolios using an impressive, evolving, research process. Equity market rallies provide investors the opportunity to raise Tactical Safety for future resilience especially as valuation targets and underperformers are harvested systemically. Pullbacks in market values for equity provides the opportunity to add high cash flow assets at attractive prices.

Our efforts to raise Tactical Safety during rallies allows the IC to allocate to great cash flowing assets in the next correction, gaining potential advantages for the long term.

Summer Planning Season!

“It’s better to start with a plan than end in a panic.”

During our summer client reviews, our Wealth Managers are happy to share McGowanGroup’s updates to our Tax & Estate Planning process with your CPAs and Attorneys. In fact, McGowanGroup is proud to have evolved our Estate processing checklist, as a guide, to ensure that we provide Excellence in Service as your trusted financial partner. Please do not hesitate to ask how the McGowanGroup can help with your financial planning!

We remain committed to the mission of Superior Client Profits Through Excellence in Service. Thank you for allowing us to serve you and your family!

Spencer McGowan and The Team That Cares,

McGowanGroup Wealth Management

S&P 500 Index – Daily (12/31/2024 – 06/27/2025)

– Courtesy of Bloomberg LP

Tel Aviv Stock Exchange 35 Index – Daily (06/28/2020 – 06/27/2025)

– Courtesy of Bloomberg LP

U.S. Personal Consumption Expenditures Chain Type Price Index – Year over Year, Seasonally Adjusted (06/28/2020 – 05/31/2025)

– Courtesy of Bloomberg LP

The Atlanta Fed GDPNow Real GDP Estimate for 2025, Q2 (06/27/2025)

– Courtesy of The Federal Reserve Bank of Atlanta

Chicago Board Options Exchange 10 Year Treasury Note Yield Index – Daily (12/31/2024 – 06/27/2025)

– Courtesy of Bloomberg LP