What are the most bizarre examples of wild speculation in the current financial markets?

Will Oil hit Goldman’s $80 target in Q3?

Why is Sector Rotation likely for Q4?

What does slowing growth mean for the Equity markets?

What are the possible outcomes regarding current Monetary and Fiscal policy for investors?

What does $5 Natural Gas tell us about the next 5 years?

How strong is the highly effective network of veterans?

How do I use tactical safety in a pullback?

What are the 4 main asset categories?

Dow Jones Industrial Average (12/31/2020 – 09/15/2021)

– Courtesy of Bloomberg LP

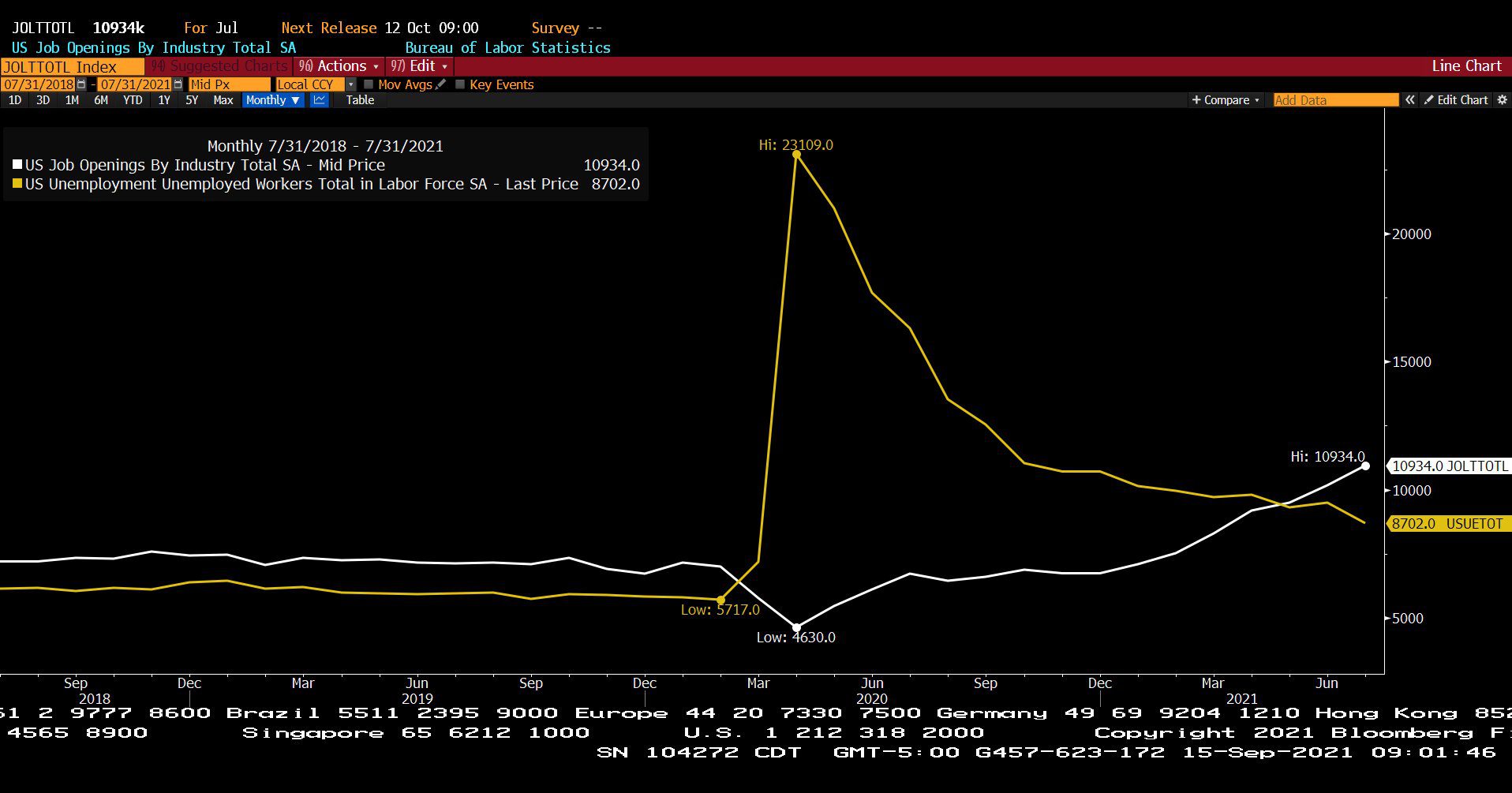

U.S. Job Openings by Industry, Seasonally Adjusted & U.S. Unemployment/Unemployed Workers Total in Labor Force, Seasonally Adjusted (07/31/2018 – 07/31/2021)

– Courtesy of Bloomberg LP

Standard & Poor’s 500 Index (12/31/2020 – 09/15/2021)

– Courtesy of Bloomberg LP

Health Care Select Sector SPDR Fund (12/31/2020 – 09/15/2021)

– Courtesy of Bloomberg LP

Natural Gas Futures Spot Price (12/31/2020 – 09/15/2021)

– Courtesy of Bloomberg LP

Global X MLP ETF (12/31/2020 – 09/15/2021)

– Courtesy of Bloomberg LP

NetWorth Radio’s Global Business Leadership Series: Spencer McGowan Interviews Brad Olsen and Oliver Doolin from Recurrent Advisors in Houston – Are we in an Energy Shortage Super-Cycle?

Prior to co-founding Recurrent, Brad was most recently the lead MLP portfolio manager for BP Capital Fund Advisors (BPCFA). Under Brad’s leadership, MLP AUM more than doubled (excluding the impact of appreciation).

From 2011 to 2015, Brad led Midstream Research for Tudor, Pickering, Holt & Co. (TPH & Co.), where he was recognized as the top all-around stock picker in the US by the Financial Times in 2013, and the top energy stock picker in the US by Starmine in 2014. Under Olsen’s leadership, the TPH & Co. midstream team was recognized in the WSJ’s “Best on the Street” poll as well as by Institutional Investor Magazine.

Brad also has experience as an investment analyst at Eagle Global Advisors in Houston, where he was part of a 3-person team that grew midstream/MLP AUM from $300mm to over $1bn from 2008 through 2011. He has also worked in investment roles at Millennium International, a large global hedge fund, and Strome Investment Management, an energy-focused hedge fund based in Santa Monica, CA. He began his career in the UBS Investment Banking Global Energy Group in Houston.

Brad earned a BA in Philosophy, Political Science, and Slavic Studies from Rice University in Houston.

Brad resides in Houston with his wife and four children. Brad was nearly fluent in Russian, but is very rusty.

Client Portfolio Manager / Energy Specialist

Oliver has spent over a decade specializing in natural resources, oil & gas, and MLP institutional equity research, most recently at Heikkinen Energy Advisors in Houston.Prior to joining Heikkinen, Oliver served in both research and business development roles at energy-focused investment banks, including 6 years as a Vice President at Tudor, Pickering, Holt & Co (TPH) in Houston, where he specialized in exploration and production (E&P), oilfield services (OFS) and midstream MLP companies.

Oliver began his career as a research analyst covering E&P and Oilfield Service companies for both TPH and Howard Weil, respectively.

Oliver holds a BS with dual concentrations in Finance and Legal Studies (Tulane University) as well as an MS in Accounting from the A.B. Freeman School of Business at Tulane University.

Oliver, originally from south Louisiana, is an avid outdoorsmen and runner. He resides with his wife and two children in Houston.

Headline Round Up

*Consumer Inflation 5.3%! What does PappaDean say?

*WSJ’s Andy Kessler: Stock Market Fails a Breathalyzer!

*Why Are Investors Lending Their Money to a Money Losing Company at 1% Annual Interest for 5 Years?

*Cryptocurrency Mania: Crypto Investors Borrowing Lots of Money to Buy Cars, Houses, and MORE CRYPTO!

*This Week’s List of New Tax Proposals! Where is that infrastructure thing?

*11 Million Jobs Waiting and 9 Million Unemployed? What does Stephen Moore say?

*Amazon Hiring 125,000!

*U.S. is Over 5 Million Homes Short!

*PIMCO Jumps Into Commercial Real Estate Frenzy! What do the intelligence reports tell us?

*Microsoft Plans to Buy Back $60 Billion in Stock PLUS Raises the Dividend 11%!

*European Energy Shortage: Natural Gas and Wind Deficiencies Lead to Record High Energy Prices. Does overregulation lead to shortages?

*$10 Natural Gas Here is U.S.?

*Gulf Storms Reduce Storage Again.

*Reddit Bandits Go Nuclear!

*Chevron Putting on the Green Jacket!

*BofA Says $100 Per Barrell for Oil if Cold Winter Arrives.

*Tesla Co-Founder Jumps on Battery Future.

Profit Report

Best Client Questions?

MGAM Disciplines and Evolution.

The 4 Main Asset Categories.