Where are the best bargains now?

What Strategies are working as we enter 2021?

Where are the biggest dangers to Investors?

MGAM Q1 2021 Client Update

The Stockdale Paradox

“You must never confuse faith that you will prevail in the end—which you can never afford to lose—with the discipline to confront the most brutal facts of your current reality, whatever they might be.” – James Stockdale

2020

The Black Swan, an unforeseen global pandemic, arrived shocking investors in March. The Federal Reserve and Federal Government went into monetary battle mode, like in World War II, infusing disturbing amounts of liquidity and borrowed fiscal stimulus spending to prevent catastrophe.

Many investors sold at the low in March in sheer panic as in 2002 and 2008. Many investors abandoned the principles of Fundamental Analysis selling into a temporary panic, the fastest 38% decline in the Dow Jones in modern history.

We were able to use the protected portion of the portfolios to add great assets with superior cash flow and long-term appreciation potential. The wisdom at this time came from my father, PappaDean McGowan, “Panic Then the Fastest Recovery in History.”

The Asset Categories, Asset Classes, and Tactical Allocation strategies are detailed below. Politics has been a noisy distraction that often guides portfolios in the wrong direction.

Vaccine deliveries have begun, on track for over 200 million people in the first half of 2021.

2021 Intelligence

Our sources predicted the initial record recovery in Q3 after the shutdowns followed by quick action by Washington. Current estimates for economic recovery forecast growth at above 3% through 2021.

Now, with the Economy nearing and exceeding 2019 levels in many cases, intelligence for 2021 is vital. The recovery has now been over anticipated by the Indexes based upon the long-term returns projected by true math and the expansion of technology sector multiples.

Economic growth has returned after astute business leaders have navigated the realities of the pandemic and innovated.

The 2020 multiple expansion and euphoria of Technology stock pricing drove Indexes to undeserved highs like 1999, which led to 12 years of a Range Bound market. How did the McGowanGroup do from 2000 to 2012 in a flat, Range Bound, Equity Market? Keep reading.

Asset Classes and Categories

• Tactical Safety – “Confronting the Most Brutal Facts.” Rates are near ZERO ON CASH, again! Money flows from High Net-Worth Investors and pensions seeking cash yield have already begun to flow into higher yielding investments. This Cash Flow Panic is likely to continue and peak during 2021.

• High Cash Flow – The recovery in our global lending portfolios utilizing 9 great managers indicates that the cash flow panic is underway comparable to 2012. Harvest points at premium capital gains appear likely.

• Growth and Income – The return of Inflation during late 2021 and early 2022 appears to be indicated by the current activity in commodities. The long-term value in dividend companies provides a solution.

The MGAM Investment Committee meets weekly to consolidate the intelligence and data gathered in dedication to making effective decisions for the model portfolios.

Current research is providing bargain candidates for the portfolios in 4 key areas:

1. Innovation Companies

2. Medical Dividends and Technology

3. Clean Technology

4. Energy Infrastructure

Our 2021 targets for current holdings appear to be underway for the model portfolios based upon extraordinary performance during November and December which we will cover individually in your upcoming reviews. As always, we appreciate the trust you place in our firm and we stand ready to serve.

Spencer McGowan and The Team That Cares!

McGowanGroup Asset Management

Dow Jones Industrial Average (Year to Date)

– Courtesy of Bloomberg LP

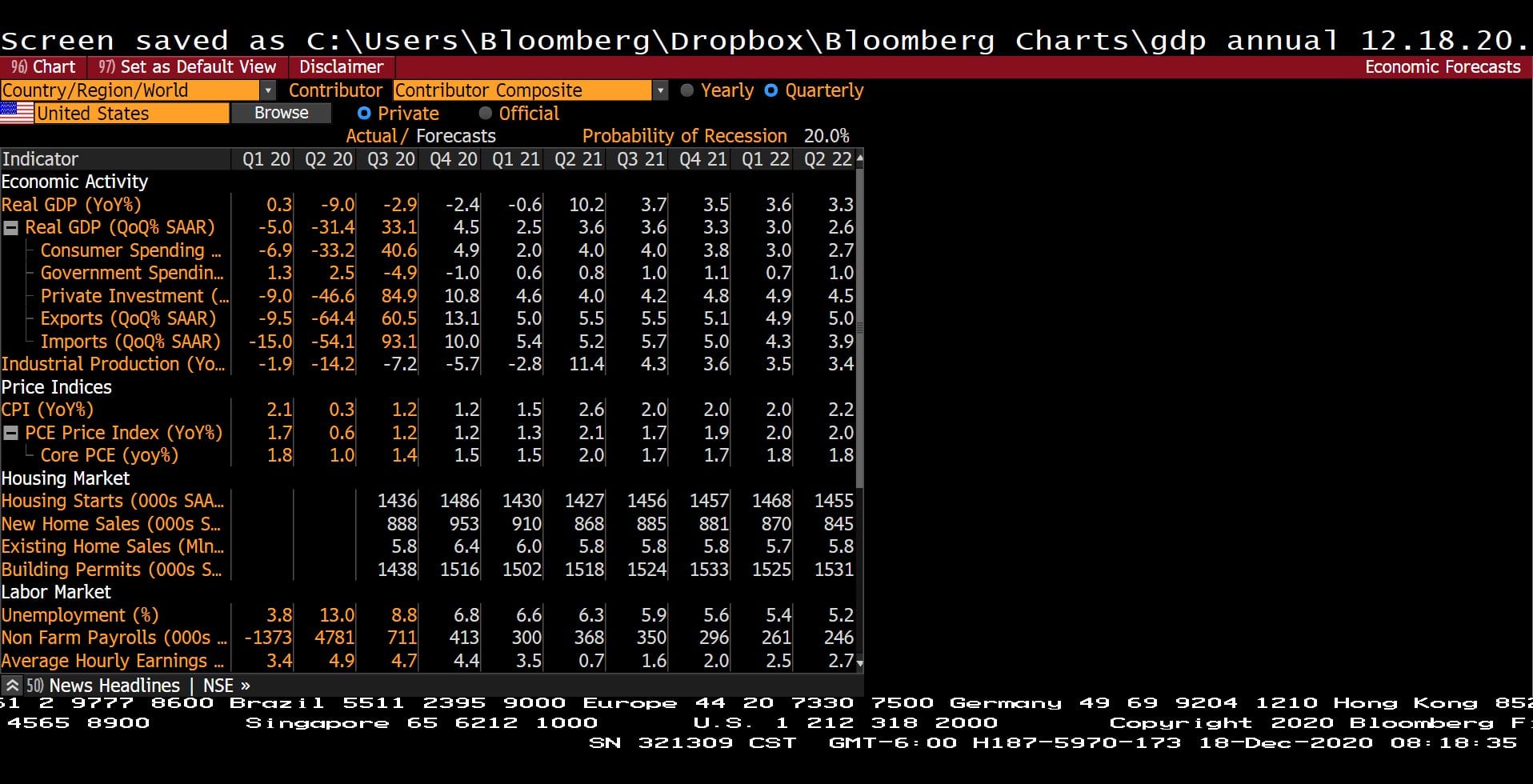

Quarterly U.S. Economic Forecasts with Probability of Recession (Q1 2020 – Q2 2022)

– Courtesy of Bloomberg LP

Yearly U.S. Economic Forecasts with Probability of Recession (2013 – 2022)

– Courtesy of Bloomberg LP

BlackRock Corporate High Yield Fund, Inc. (Year to Date)

– Courtesy of Bloomberg LP

Health Care Select Sector SPDR Fund (Year to Date)

– Courtesy of Bloomberg LP

Bitcoin Spot Price (Year to Date)

– Courtesy of Bloomberg LP

Global X MLP ETF (Year to Date)

– Courtesy of Bloomberg LP

Crude Oil Future Spot Price (Year to Date)

– Courtesy of Bloomberg LP

Headline Round Up!

*Vaccines Roll Out! FedEx and UPS On a Roll Too!

*Stimulus Xanax! Another Dose for the Markets. When will the depression side effect hit?

*Retail Sales 4% ABOVE 2019!

*Housing Starts 14% ABOVE 2019!

*Bitcoin Tops $23,000?

*Household Net Worth Hits $123.5 Trillion on Monetary Adderall and Cheap Mortgages.

*OOPS! Fat Fingered Mistake by Citibank Sends Nearly $1 Billion to Bankrupt Revlon. Still Out a $1/2 Billion?

*God Bless Texas, Again! Oracle Joins Exodus from California Moving to Austin. Hewlett Packard to HOUSTON, Elon Musk to AUSTIN & Joe Rogan at Lake

Austin! New York About to Shut down Again?

*WHAT? Energy Transfer’s Distributable Cash Flow Up 9% OVER 2019 Q3 Annualized at $2.50 per Share. What is 10x cash flow? Energy Infrastructure back in favor?

*Washington Likely to Unite on Long Awaited Infrastructure in 2021? What Companies Benefit?

*OH, CHRISTMAS TREE?! On the Streets of Hong Kong 8 Foot Noble Furs Fetch $2 Grande?

*Demand for Corporate Bonds Drives Real Yields to ZERO!

NetWorth Radio’s Remembrance Interview of Sgt. Robert Ramsey of the University Park Police Department.

The body of Sergeant Robert Ramsey, a 12-year veteran of the University Park Police Department was recovered from Lake Tawakoni about 11:20 a.m. on Thursday December 17,2020.

The body of Sergeant Robert Ramsey, a 12-year veteran of the University Park Police Department was recovered from Lake Tawakoni about 11:20 a.m. on Thursday December 17,2020.

Robert was reported missing 24 hours earlier after he was late arriving home after duck hunting. It appears that Robert had been launching his boat at the lake’s public boat ramp. The circumstances regarding how he ended up in the water is unknown, but his boat was found drifting later in the day. Search and recovery efforts that began yesterday afternoon were conducted by the Texas State Game Wardens with assistance from the West Tawakoni Police Department.

Speaking on behalf of the department, Chief Greg Spradlin said, “Since joining us in 2008, Sergeant Ramsey was a highly valued member of the University Park Police Department. He was a credit to our profession and a true community servant. A former School Resource Officer at Highland Park High School and skilled in firearms, he was the department’s firearms and defensive tactics instructor. Nominated by his colleagues, in 2018 Robert was named City Employee of the Year.” He continued, “I have known and worked with Robert since the 1990’s when we worked together on joint assignments in the twin cities of Texarkana. An avid hunter, Robert loved the outdoors. I would ask you to keep Robert and his family, his friends and fellow officers in your thoughts and prayers. UPPD has already received condolences from partner law enforcement agencies. The support shown is very much appreciated by me and the men and women of UPPD.”

In the days to come, because Robert was such an integral part of the Park Cities community, the City will provide information about services for him. The City is also providing counseling for all those employees inside the department and across the City’s workforce.

Profit Report!

Logistics:

• TOD – Transfer on Death

• Joint vs. Joint Tenants with Rights of Survivorship

• IRA Beneficiaries – Primary, Contingents and Trusts. One client’s solution.

• 10 Year Rule for Inherited IRA’s: How the new rule works.

Avocation Phases

• Our happiest and most prosperous clients design great Avocation Phases of life.

The body of

The body of