Officially a Recession?

What is the difference between Economic Contraction and a “Stealth Recession?”

What is the actual state of the Economy right now?

Which sectors of the economy are having the most difficulty right now?

What do the current earnings reports indicate about the stock market?

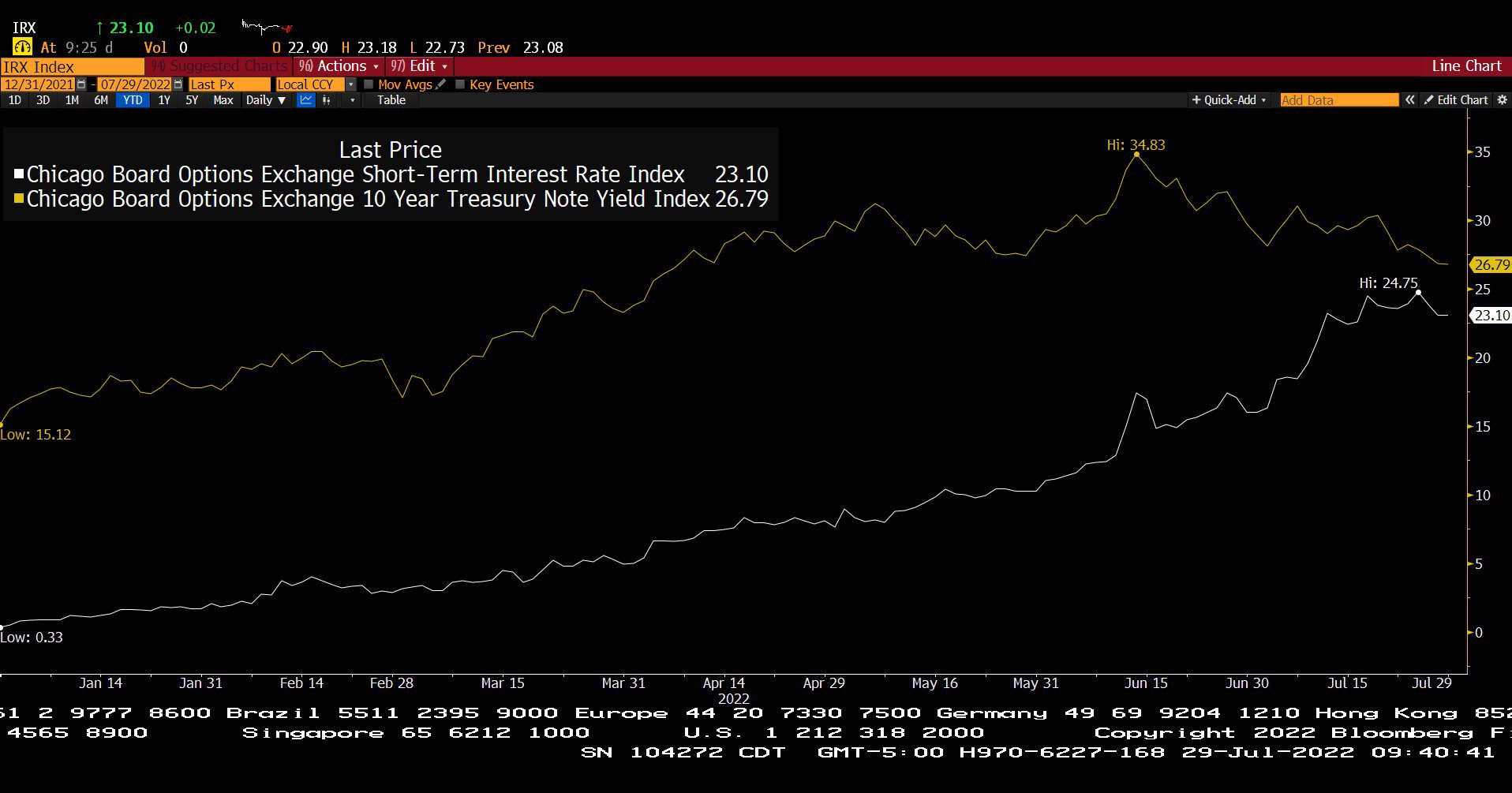

What can the bond market tell us about Federal Reserve (Fed) tightening of interest rates now?

Headline Round Up

*Economy Expands at 7.8%! Inflation Runs Hotter at 8.2%.

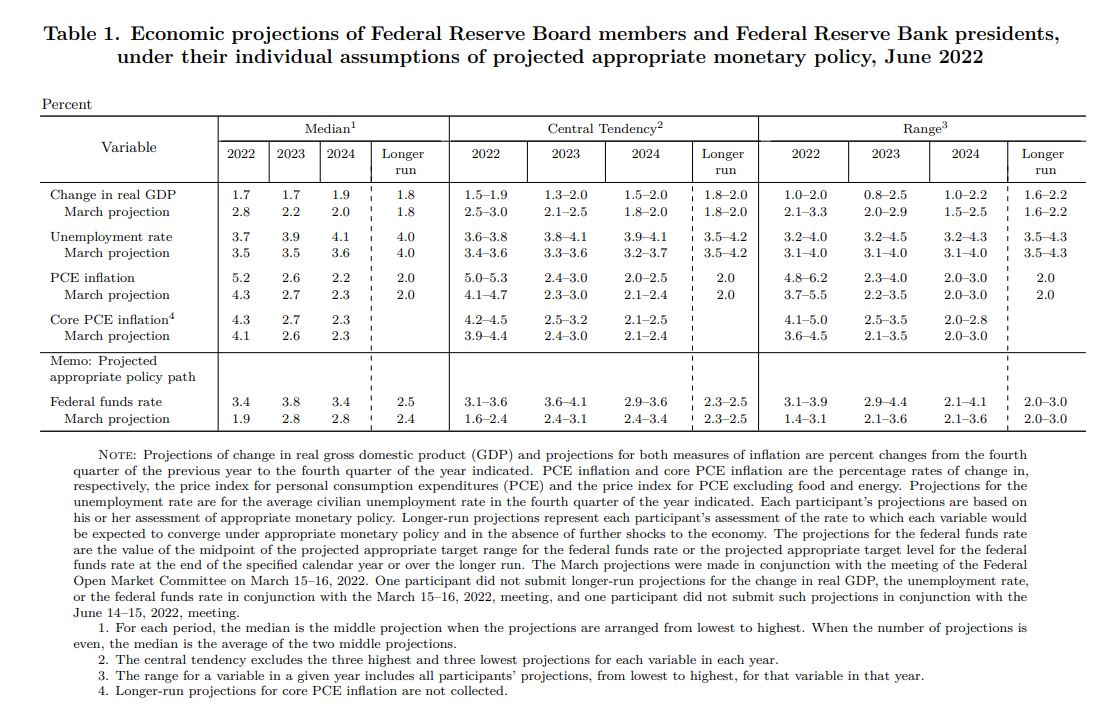

*Fed Projects Anemic Growth, Not Contraction.

*Southwest Airlines Revenue Up 68% with Huge Profits. Another 38% Profit Increase Projected for 2023?

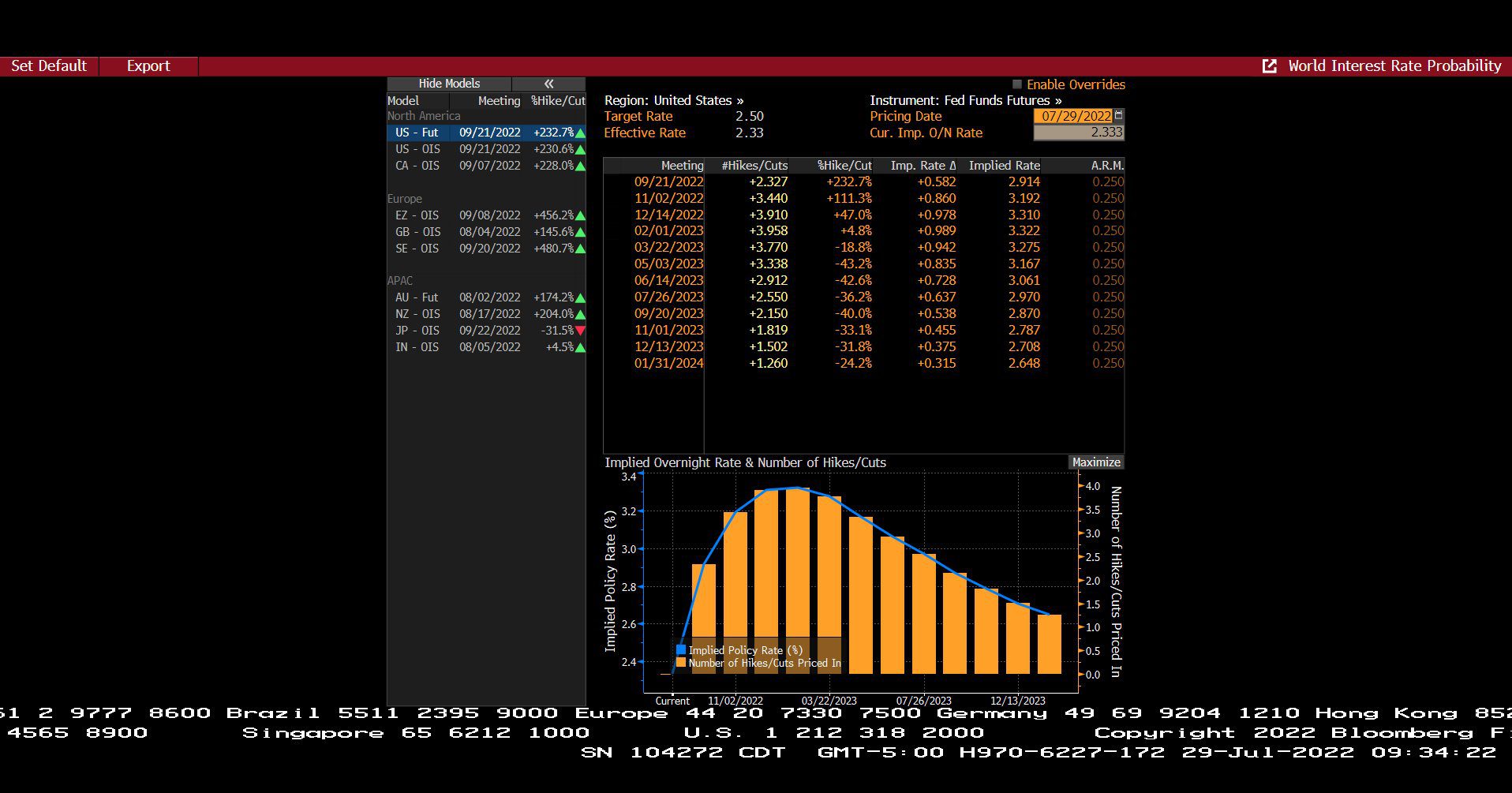

*Bond Market Bets Fed Will CUT Interest Rates Next Year after a ½% Increase in September.

*Inflation Actually on the Way Down?

*Durable Goods Orders Spike 1.9%.

*Pending Home Sales and New Home Sales Drop.

*May Home Prices Show Dallas Up 30.75%!

*International Monetary Fund (IMF): Global Gross Domestic Product (GDP) Growth Forecast 3.2%

*CHIPS Act: $280 Billion Scientific Research, Corporate Welfare, and Government Expansion?

*U.S. Climate Bill: $369 Billion in Scientific Research, Green Subsidies, Corporate Welfare, and Government Expansion?

*Energy Prices In Europe Surge.

*Exxon Mobil Signs 20 Year Deal with Rio Grande Liquified Natural Gas (LNG).

*The Future of Texas Energy According to D Magazine?

*Bullish Case for Nuclear and Uranium Stocks.

*The U.S. Becomes the World’s Largest LNG Exporter.

*OPEC Nearly 3 Million Barrels Per Day BELOW its Target.

*U.S. Refiners Expected to Post 600% Increase in Profits Q2!!

*Enphase Energy, Inc. Profits and Revenue Surge.

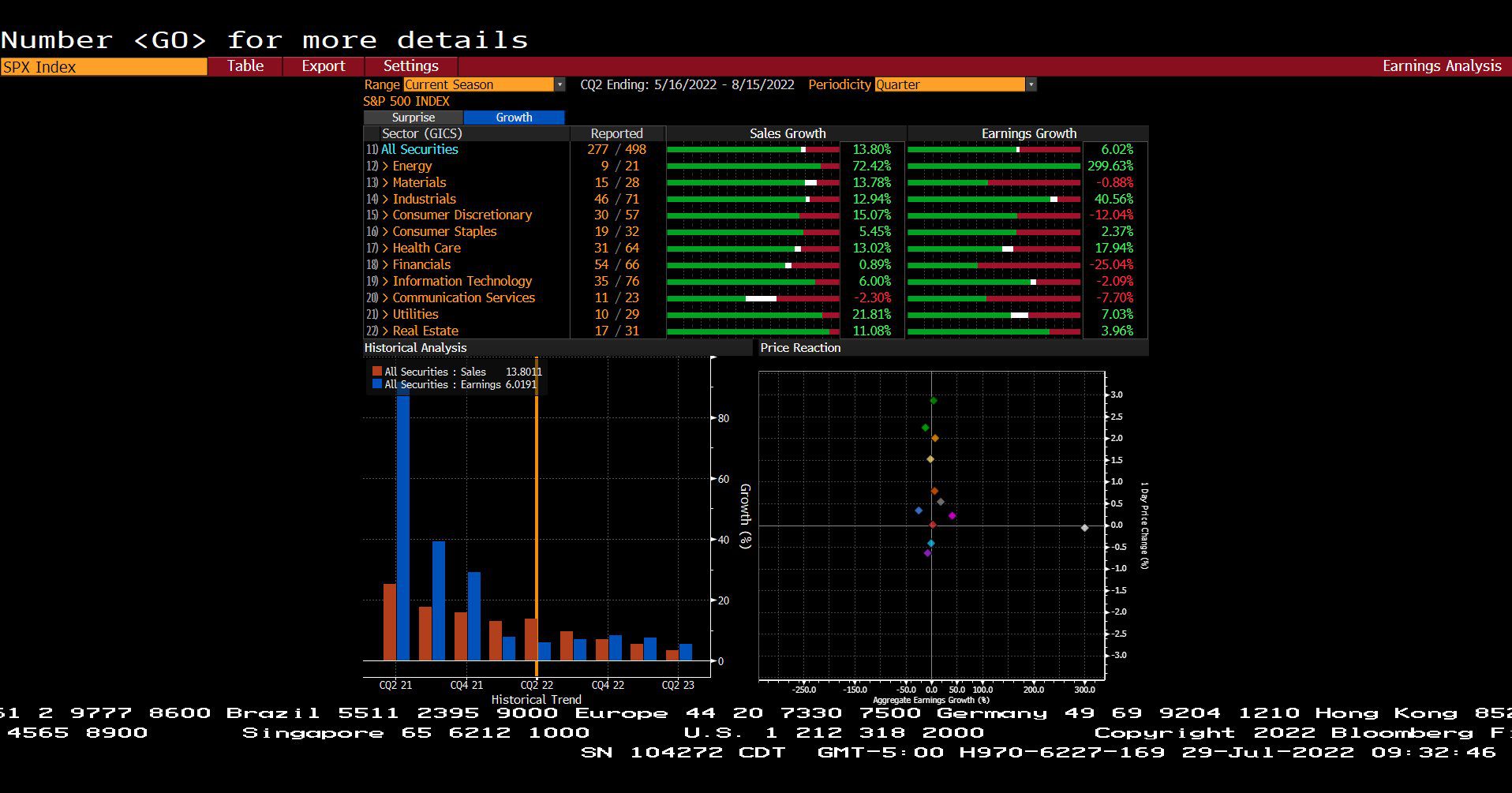

Standard & Poor’s 500 Index – Quarterly Earnings Analysis by Sector, Growth (05/16/2022 – 08/15/2022)

– Courtesy of Bloomberg LP

Standard & Poor’s 500 Index (12/31/2021 – 07/29/2022)

– Courtesy of Bloomberg LP

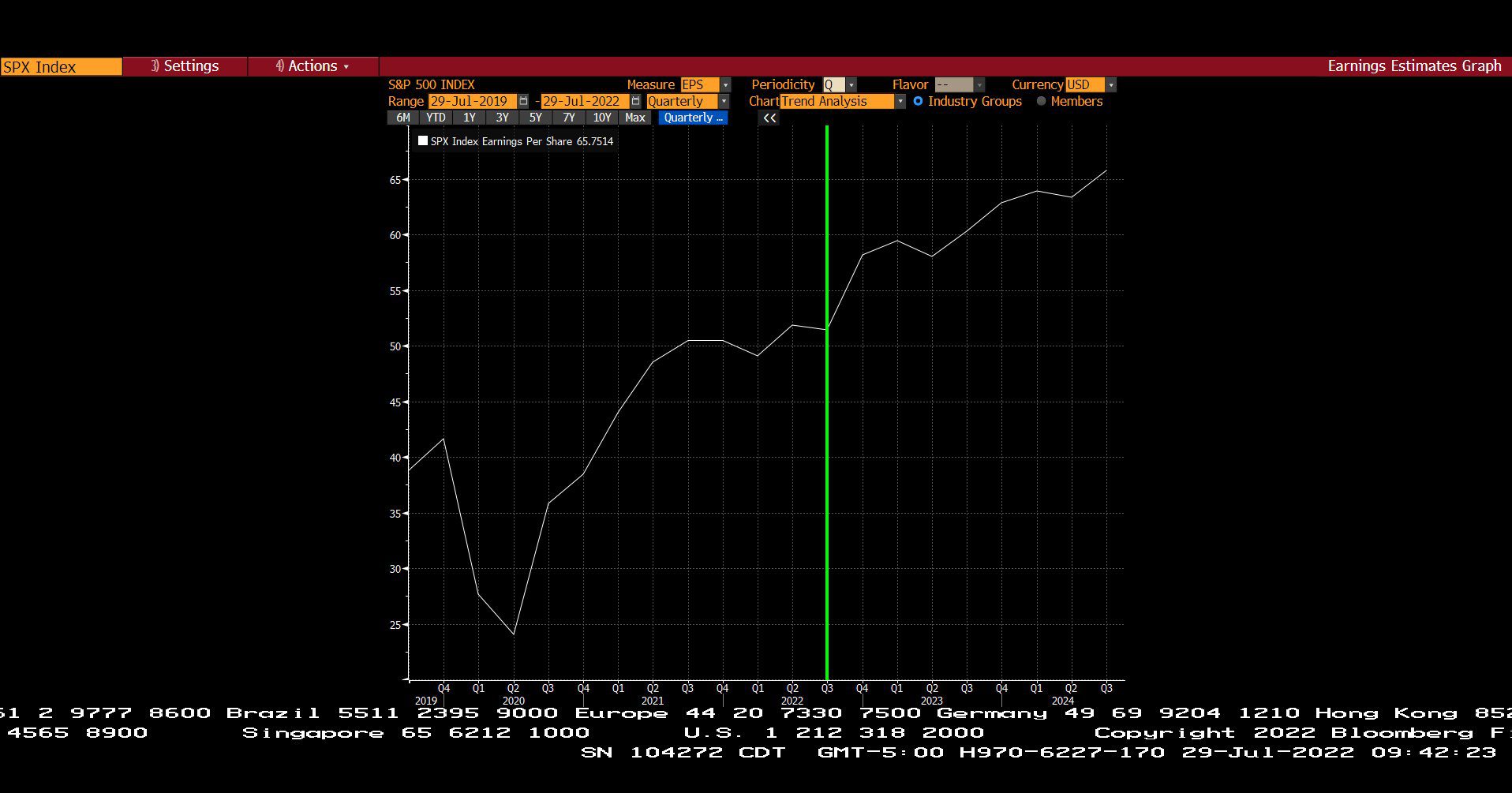

Standard & Poor’s 500 Index – Quarterly Earnings Estimates (07/29/2019 – 07/29/2022)

– Courtesy of Bloomberg LP

World Interest Rate Probability – United States (07/29/2022)

– Courtesy of Bloomberg LP

Summary of Economic Projections, page 2 (06/15/2022)

– Courtesy of the Federal Open Market Committee, Federal Reserve

C.B.O.E. Short Term Interest Rate and 10 Year Treasury Note Yield Indexes (12/31/2021 – 07/29/2022)

– Courtesy of Bloomberg LP

Federal Funds Target Rate Index (07/15/2017 – 07/29/2022)

– Courtesy of Bloomberg LP

Profit Report

What Do the Fed Projections Tell us About High Yield Bond Allocations?

Why should smart, affluent investors and their families choose McGowanGroup Wealth Management (MGWM)?