What happened to cause the prices of GameStop, AMC and others to explode?

What does it tell us for the future of the Trading Markets?

Alternative investments – Is the Long-Short Hedge Fund strategy in danger?

How is the regulatory environment dramatically changing?

What did Jerome Powell and Janet Yellen tell us this week?

Why will the Fixed Income market drastically change during the 2020s?

What are the key events during the 2021 recovery?

Why is The McGowanGroup a great choice for Business Owners and Business Leaders?

Headline Round Up!

*Economic Growth 4% Annualized.

*2021 and 2022 Important Forecasts.

*Home Prices in North Texas Up 7.2% Past Year.

*Retail Recovery Bets: GameStop and AMC: “Coulda, Woulda, Shoulda?” What is a Short Sell? What is a Short Call Option?

*Recovery Preparation! Delta’s Bringing Back 400 Pilots.

*Fed Chair Jerome Powell’s Speech This Week.

*Global Debt Up Nearly $20 Trillion? What happens next?

*Q4 Earnings Beat Expectations, Near Record Levels.

*Looming Supply Deficit for Oil.

*Natural Gas Liquids Demand Fully Restored.

*Hydrogen Fuel Cell Evolution.

Dow Jones Industrial Average Index (Year to Date)

– Courtesy of Bloomberg LP

Health Care Select Sector SPDR Fund (Year to Date)

– Courtesy of Bloomberg LP

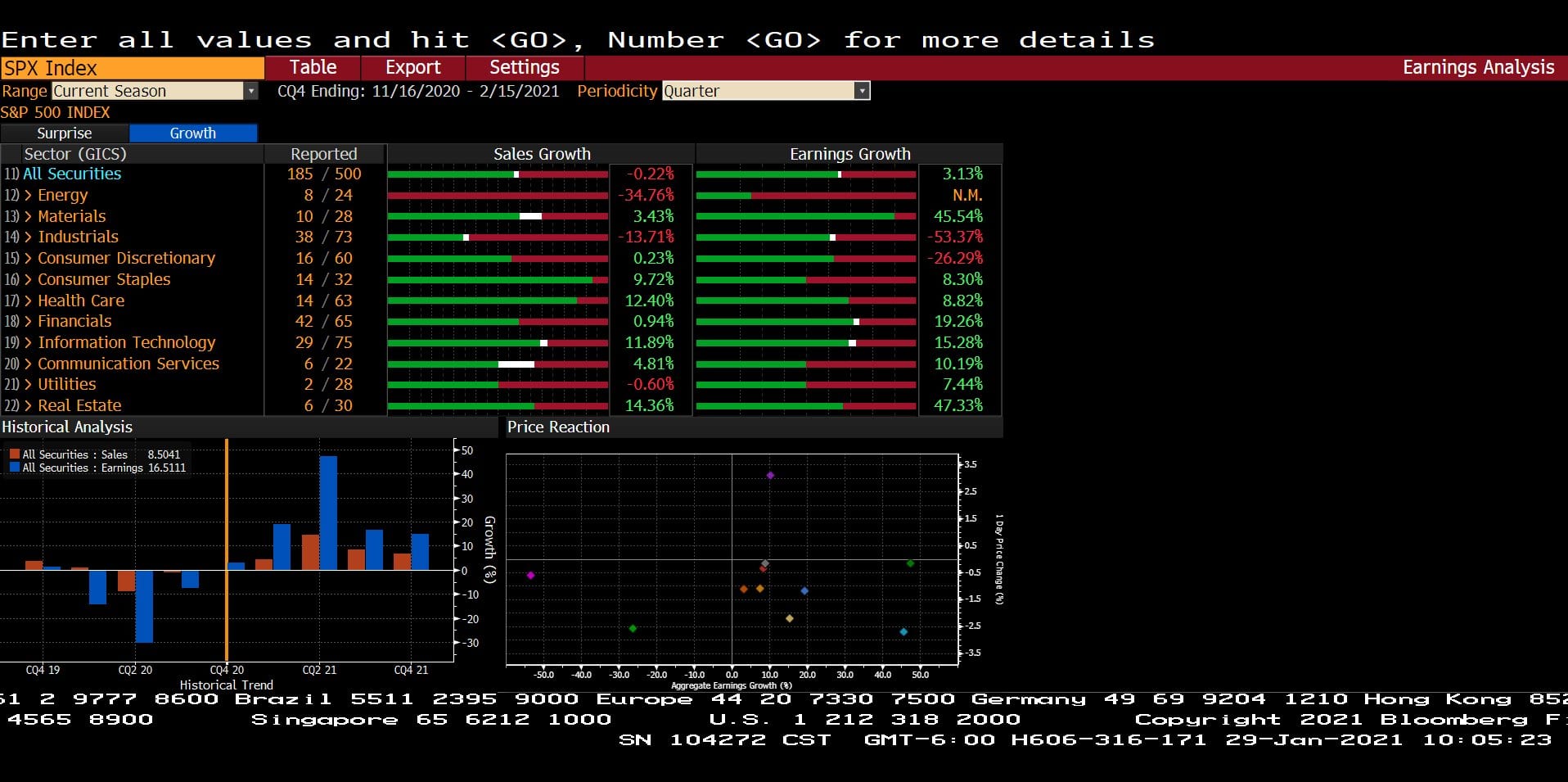

Quarterly Earnings Analysis for Standard & Poor’s 500 Index (11/16/2020 – 02/15/2021)

– Courtesy of Bloomberg LP

GameStop, Corp. – Prices with Cumulative Total Return Gross Dividends (11/02/2020 – 01/29/2021)

– Courtesy of Bloomberg LP

AMC Entertainment Holdings, Inc. (11/02/2020 – 01/29/2021)

– Courtesy of Bloomberg LP

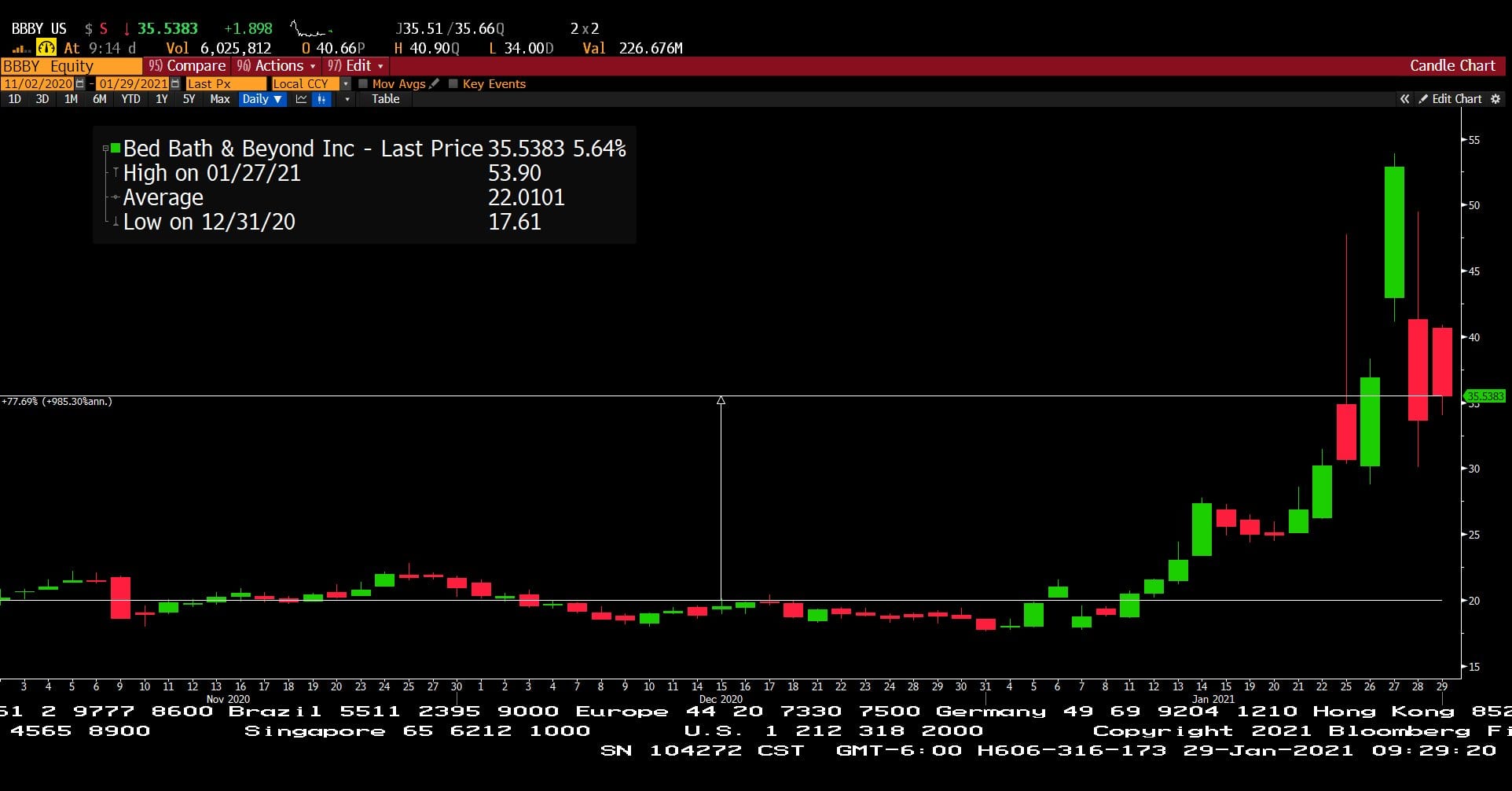

Bed Bath & Beyond, Inc. (11/02/2020 – 01/29/2021)

– Courtesy of Bloomberg LP

Profit Report!

What is a fast, loose and unhinged Traders Market? What happens next?

Dave Ramsey?

Client questions from this week?

Over the next 5 years, what mistakes are built into traditional portfolios? (Hint: 1.1% at a premium with 6.7% duration risk downside.)

Real Estate 2021: When and How?