Q: What was some of the good news for investors this week?

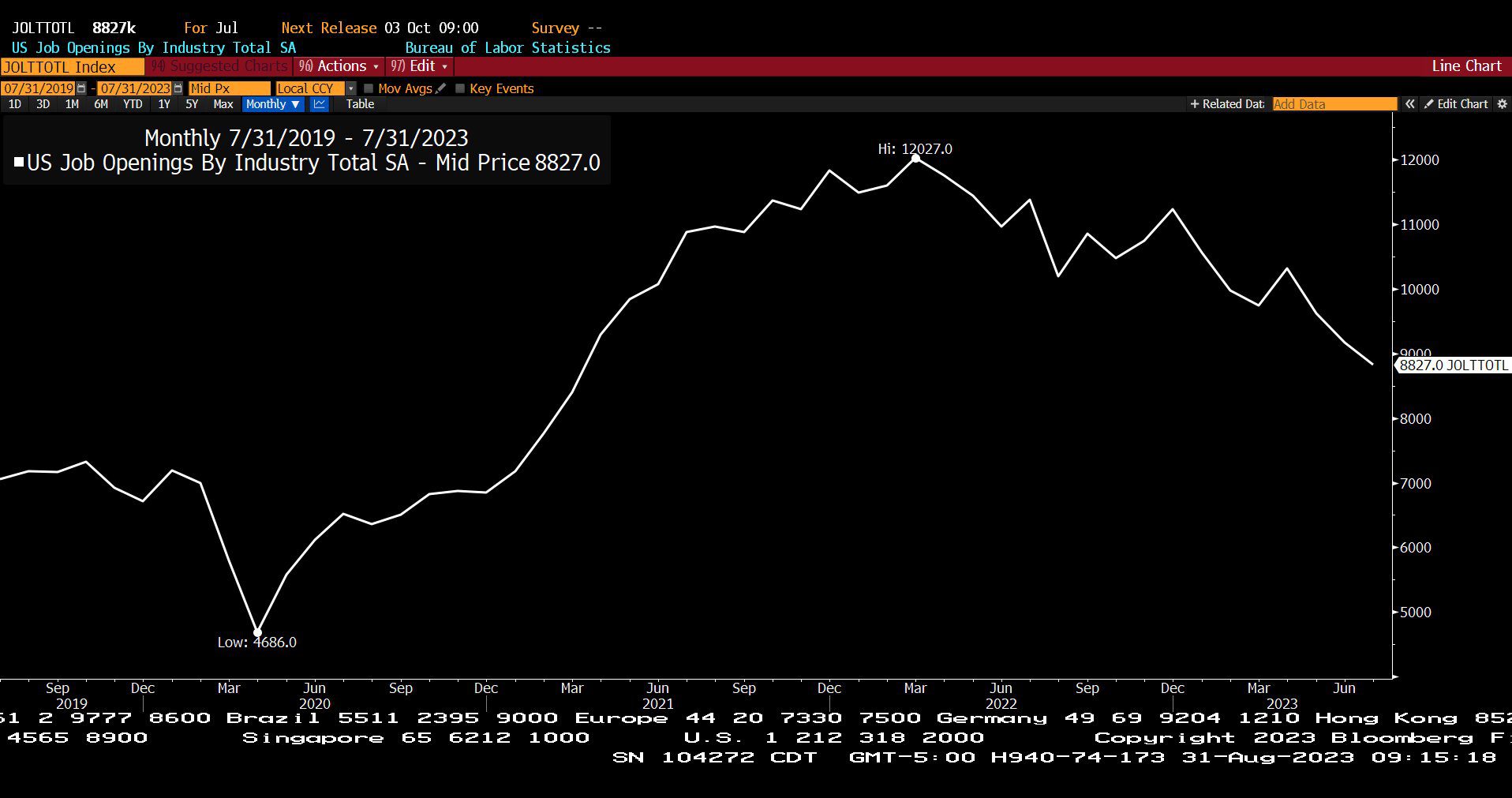

A: Wage push inflation is expected to decline with the Job Openings & Labor Turnover Survey (JOLTS) declining to 8.8 million down from a peak of 11.8 million and the lowest since March 2021. Positive money flows could indicate that the Federal Reserve will not raise interest rates in September and potentially lower rates sooner.

Q: What happens to the Net Present Value of Future Cash Flows when cash interest rates drop?

A: The calculation of Net Present Value of Future Cash Flows is divided by a lower time value of money which results in a higher valuation.

Q: At what point during the year is it possibly best for investors to harvest tax losses from taxable accounts?

A: Generally, Mid-year or after a major rally are ideal times to upgrade losing positions for stronger positions based upon Year to Date performances. The potential advantage for investors comes in Q4 when tax loss selling usually reaches its apex & allows for the addition of bargains instead of selling at a low point for tax planning.

Q: Is Tax Harvesting automatically done in The McGowanGroup’s managed accounts for investors?

A: The McGowanGroup prides itself on working with investor’s specific tax situations to maximize advantageous outcomes. In other words, YES!

Headline Round Up

*Enphase Energy Begins Shipping Breakthrough Solar Microinverters from Arlington, Texas!

*Irony: Oil and Gas Companies Lead Carbon Capture Prowess With Generous Government Support!

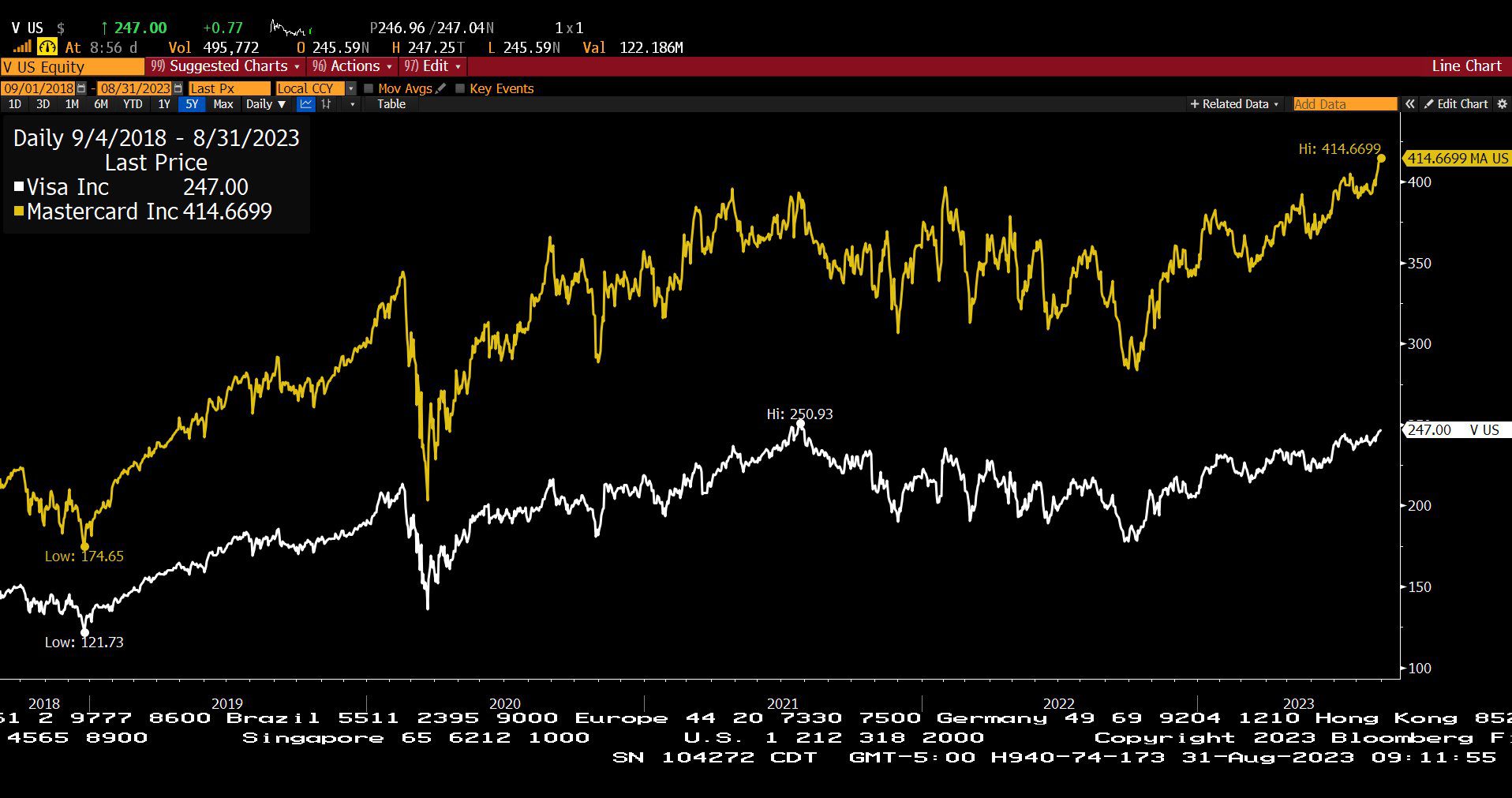

*Visa and Mastercard Hit All Time Highs After Increasing Merchant Fees.

*Shark Tank’s Mr. Wonderful, Kevin O’Leary, Weighs in on Soaring Interests Rates Causing Real Chaos for the U.S. Economy.

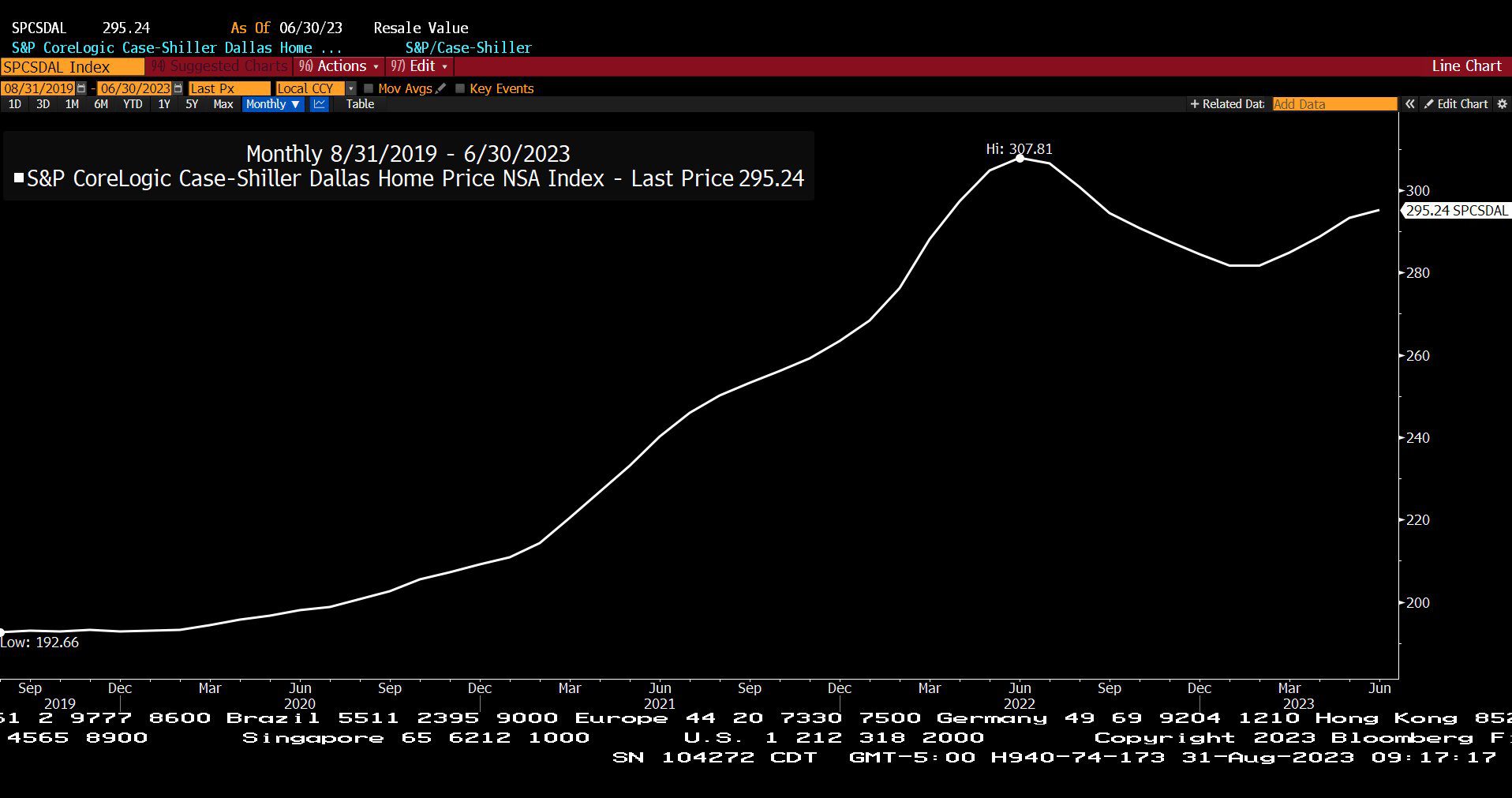

*Home Prices Rise in June, But North Texas Homes Still Down 4.1% Over 12 Months. Will the counties lower appraisals?

*Court Rules in Favor of Grayscale on Bitcoin Exchange Traded Fund (ETF)? Will the SEC actually clear one?

*The Real Story Behind Scion Asset Management’s Dr. Michael J. Burry & his 1.6 Billion Dollar Short Position.

*Nordstrom Closes Premier San Francisco Location After 57% Increase in Property Crime, Including Shoplifting, Since 2019. Nordstrom’s Employee States,

“It is definitely partially due to the crime in the area. COVID had a big impact.”

*Wall Street Journal: How to Play and Select Possible Real Estate Bargains.

*93 Year Old Warren Buffett at the Top of His Game!

*The End of Rate Hikes? Federal Reserve Chairman, Jerome Powell, to “Proceed Carefully” Signaling Lack of Urgency to Interest Rate Increase in September?

*Nvidia’s Artificial Intelligence (AI) Chip Partner SK Hynix Stock Soars.

*Google Announces AI Enhancements for Corporate Gmail Users.

Mergers and Acquisitions:

*U.S. Steel Up 25% in One Month Since Bidding War Began.

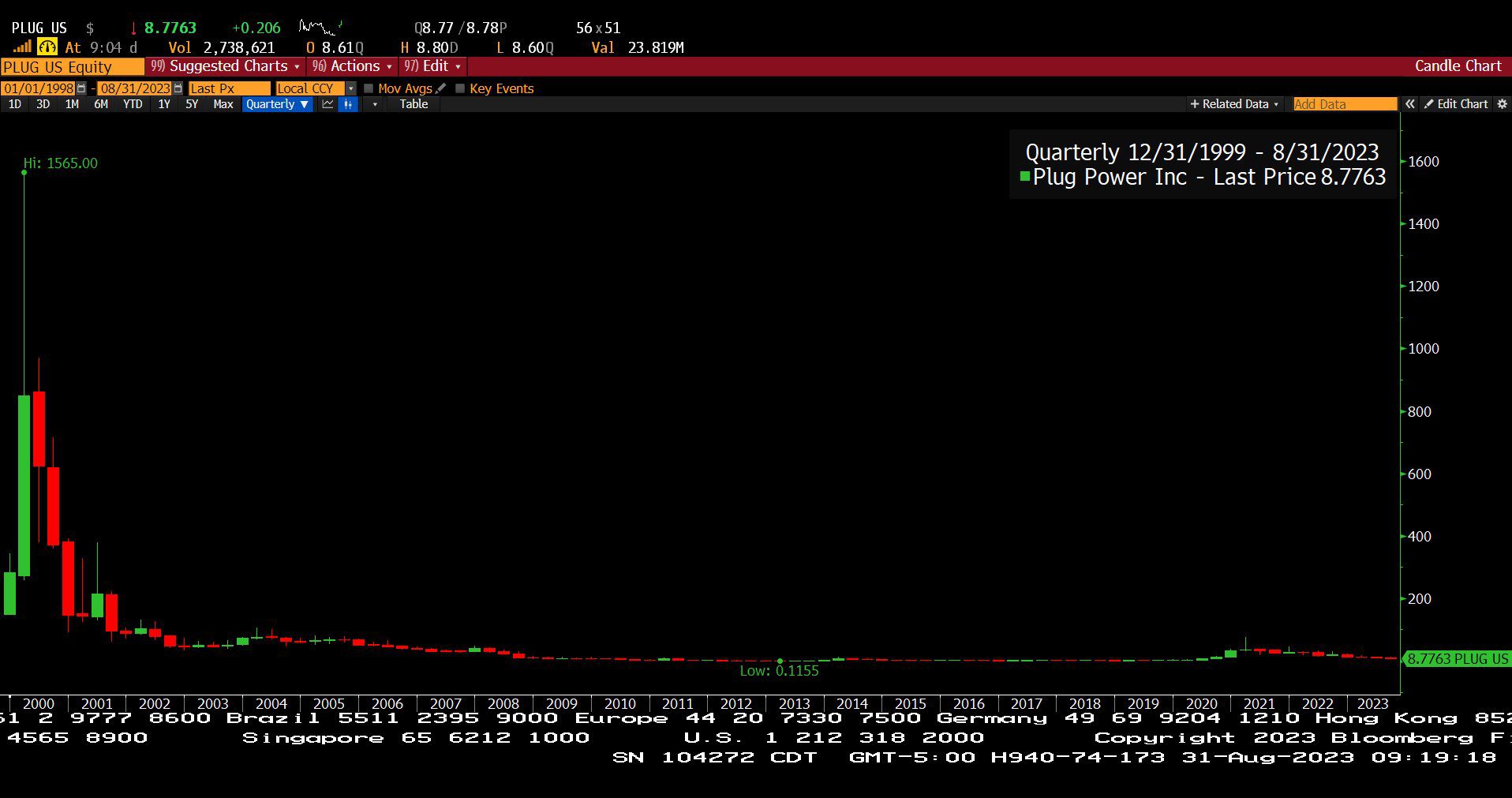

Skid Row:

*Plug Power Down 99.9% During 23 Years of Losing Money.

Standard & Poor’s CoreLogic Case-Shiller Dallas Home Price, Non Seasonally Adjusted, Index (08/31/2019 – 06/30/2023)

– Courtesy of Bloomberg LP

Dow Jones Industrial Average Index Year to Date (12/30/2022 – 08/31/2023)

– Courtesy of Bloomberg LP

Visa, Inc. & Mastercard, Inc. (09/04/2018 – 08/31/2023)

– Courtesy of Bloomberg LP

U.S. Job Openings By Industry Total, Seasonally Adjusted (07/31/2019 – 07/31/2023)

– Courtesy of Bloomberg LP

C.B.O.E. 10 Year Treasury Note Yield Index (12/30/2022 – 08/31/2023)

– Courtesy of Bloomberg LP

Plug Power, Inc. (12/31/1999 – 08/31/2023)

– Courtesy of Bloomberg LP

Profit Report

*How realistic is the Federal Reserve’s target of 2% inflation?

*Why should investors hire McGowanGroup Wealth Management (MGWM) to build Energy and Global High Yield portfolios?