Q: With headlines focused on short term anxiety, what are some important themes for long term investors to remember? Any recent good news or bad news investors should pay attention to?

Q: What is an “over-priced slowing growth spanking” with regards to the equity markets and how could investors avoid one?

Q: Which sectors of the financial markets are considered “boring choices”, but currently attractive for longer term investors based upon estimated forward returns and reliability?

Join Us for The Latest Financial Headlines and Valuable Research from The McGowanGroup. Built for Investors by Experienced Portfolio Managers!

Click here to get the monthly newsletter

Headline Round Up!

*Big Tech Now 30% of S&P 500 Index Reaching Three Times Their Weighting From a Decade Ago!

*Hey Optimus Clean My Kitchen, Please? Musk Deemphasizing Car Business & Says Tesla Will Derive 80% of Value From Optimus Robots That Are Still in Development & A Ways Off From Generating Revenue?

*Trump Family Launches $5 Billion Cryptocurrency Venture That Began Publicly Trading This Week! How much is Trump Media worth now?

*Redfin: U.S. Homeowner Population Stops Growing as Number of Homeowner Households Declines For The First Time Since 2016?

*July Home Purchases Cancelled At Record Rate Up From Last Year? Is the residential market overpriced?

*Kraft Heinz to Split Into Two Unhealthy Processed Food Companies?

*Trader Jane! Jane Street Group Nets $10.1 Billion in Q2 Net Trading Revenue Market Making in Technology and Risk Management.

*Anthropic, Owner of the AI(Artificial Intelligence) Claude Chatbot, Now Worth $183 Billion After Another Funding Round Raises 13 Billion!

*Macy’s Raises 2025 Annual Forecast After Best Comparable Sales Growth in Three Years, But Warns of Consumer Concerns About Inflation & Tariffs.

*Jobs Reports! Job Openings Fall in July?

*90 Day T-Bill Hits 4.1% Forecasting Likely September 30th Cut? Federal Reserve Governor Christopher Waller Says, “We need to start cutting rates at the next meeting, and then we don’t have to go in a locked sequence of steps,” continuing “We can kind of see where things are going, because people are still worried about tariff inflation. I’m not, but everybody else is.”

*The Manhattan Office is Back! Norwegian Sovereign Fund Invests $543 Million in Manhattan Office Building in Partnership with Beacon Capital Partners. Stake gives the fund 95% ownership!

*Google Keeping Chrome as Judge Rules Company Barred From Exclusive Deals in High Stakes Agreement with Apple. Alphabet hits all time high, Is it now the cheapest AI play?

*Texas! Bullish on East Texas as Dillard’s Buys The Longview Mall in Longview for $34 Million?

*Government Shutdown Looms as Congress Returns From August Recess! We have less than a month to run in circles, scream and shout?

Profit Report

Wall Street Journal’s Billionaire Round Up!

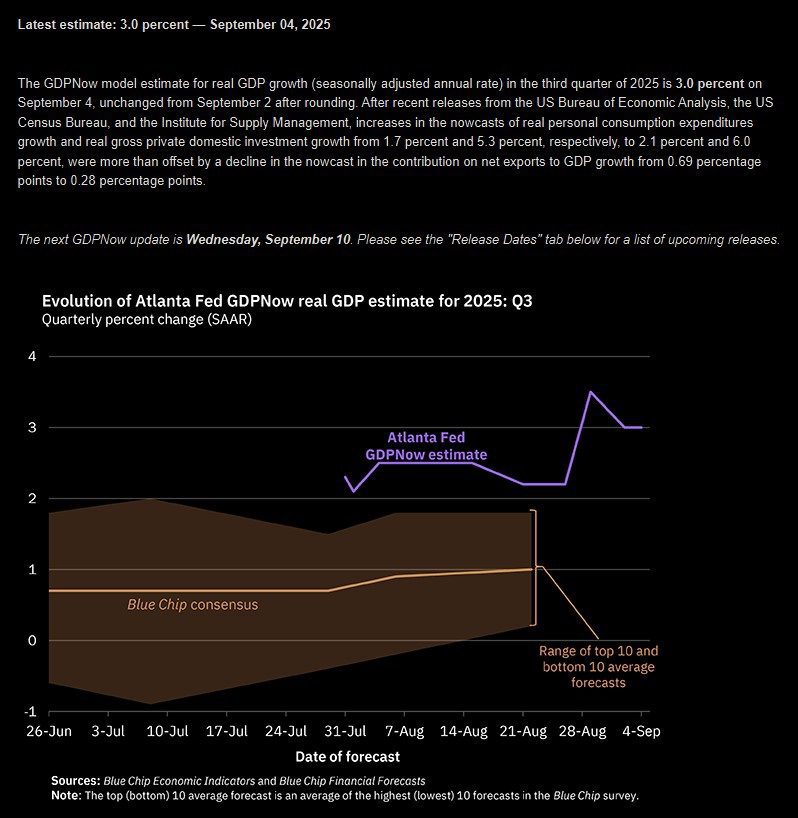

Atlanta Federal Reserve’s GDPNow Real GDP Estimate for 2025 Q3 (09/04/2025)

– Courtesy of The Federal Reserve Bank of Atlanta

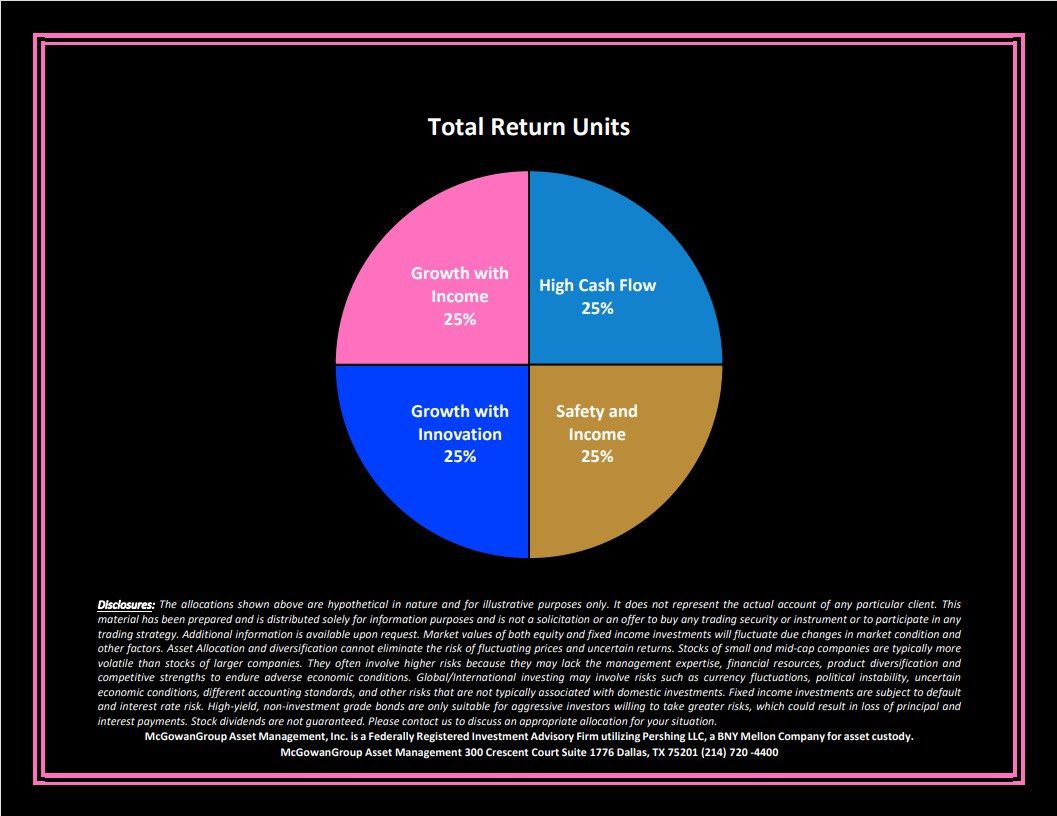

The McGowanGroup’s Total Return Units Allocation Pie Chart (09/05/2025)

– Courtesy of McGowanGroup Asset Management

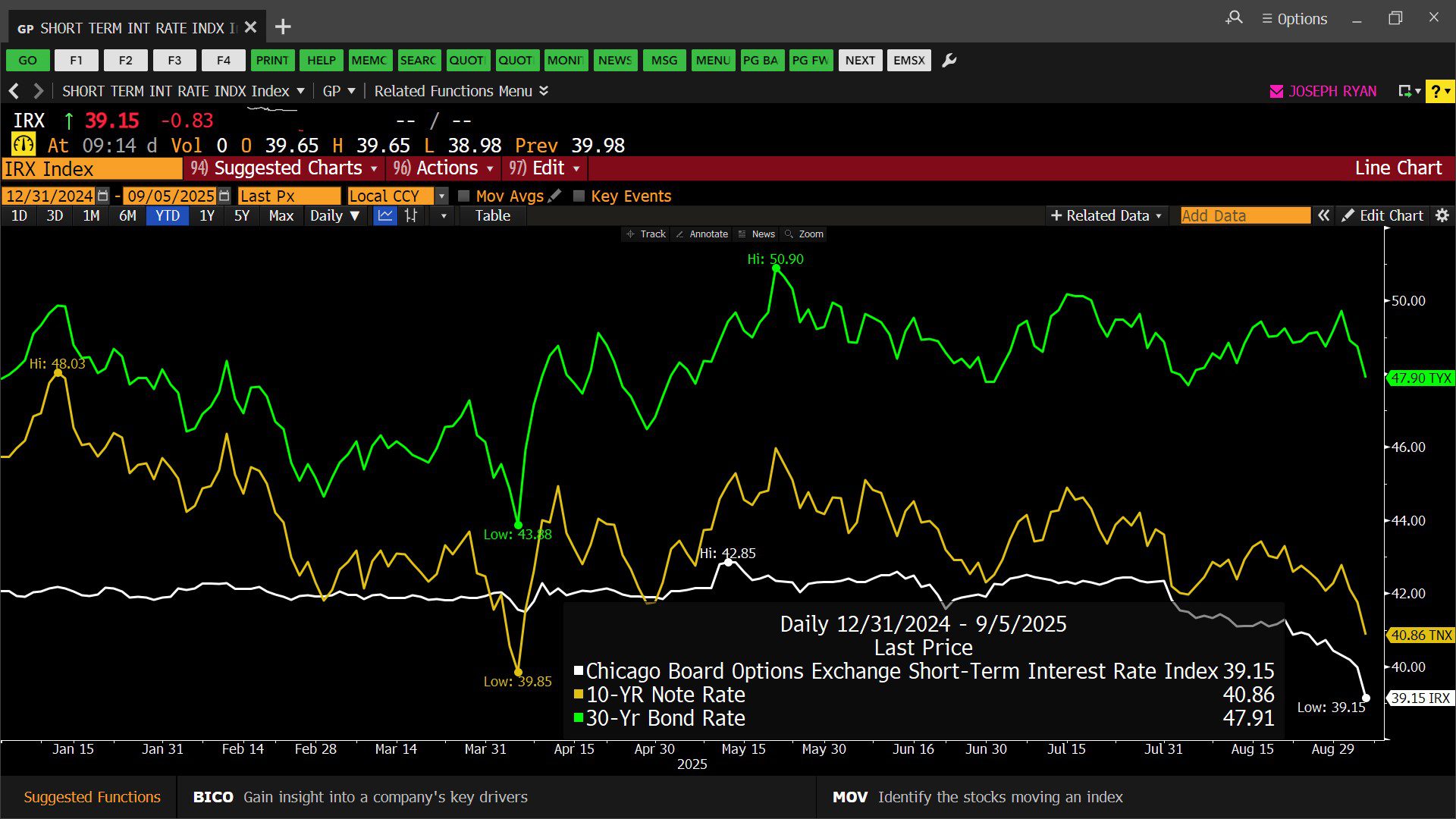

Chicago Board Options Exchange Short Term Rate Index, 10 Year Note Rate Index & 30 Year Bond Rate Index – Daily (12/31/2024 – 09/05/2025)

– Courtesy of Bloomberg LP

SPDR Dow Jones Industrial Average ETF (Exchange Traded Fund) Trust– Daily (12/31/2024 – 09/05/2025)

– Courtesy of Bloomberg LP

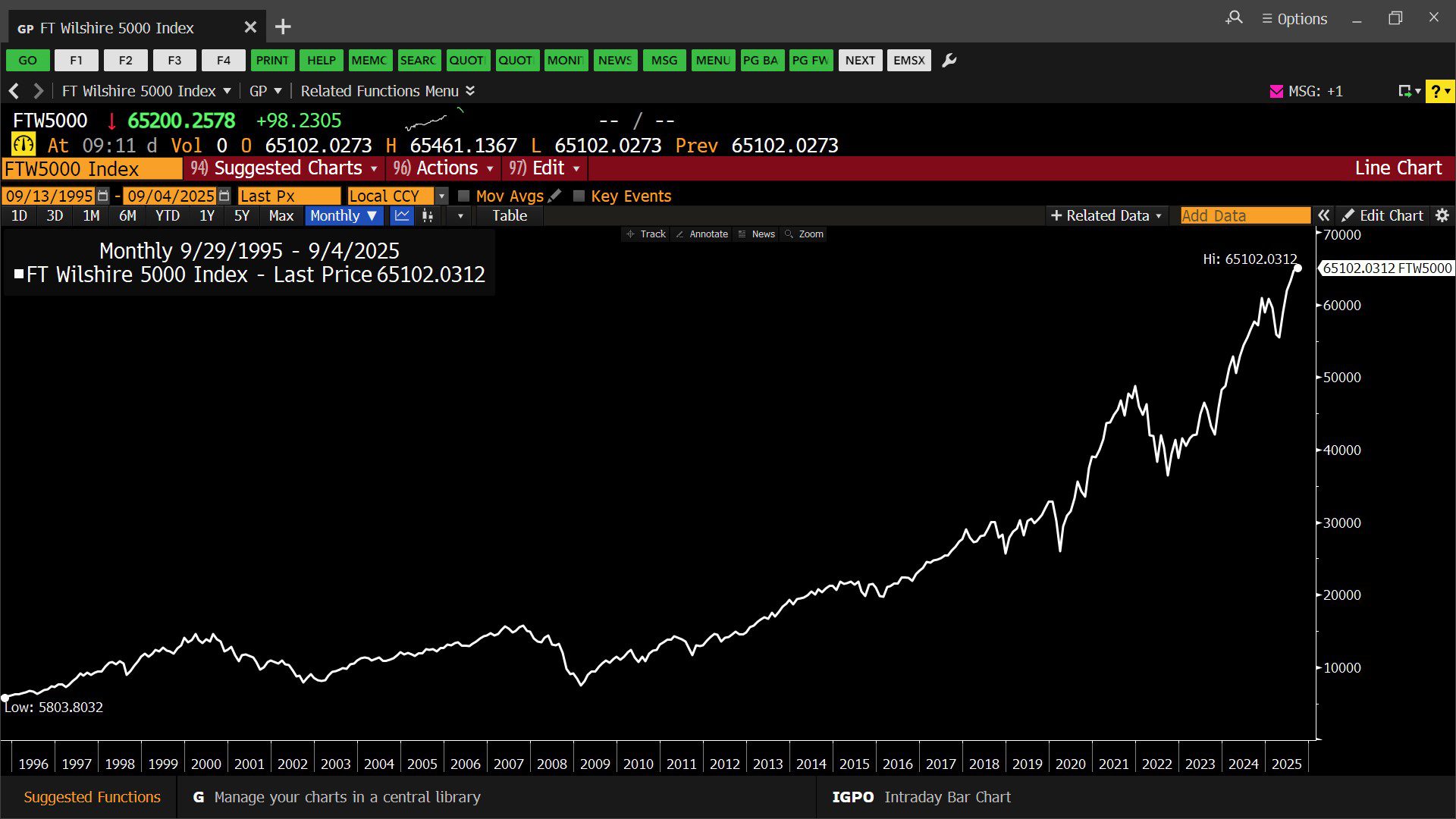

FT Wilshire 5000 Index – Monthly (09/13/1995 – 09/04/2025)

– Courtesy of Bloomberg LP

Zoom Communications, Inc. – Weekly (01/01/2018 – 09/05/2025)

– Courtesy of Bloomberg LP

BlackRock Corporate High Yield Fund, Inc. – Daily Total Return Analysis (05/30/2003 – 09/05/2025)

– Courtesy of Bloomberg LP

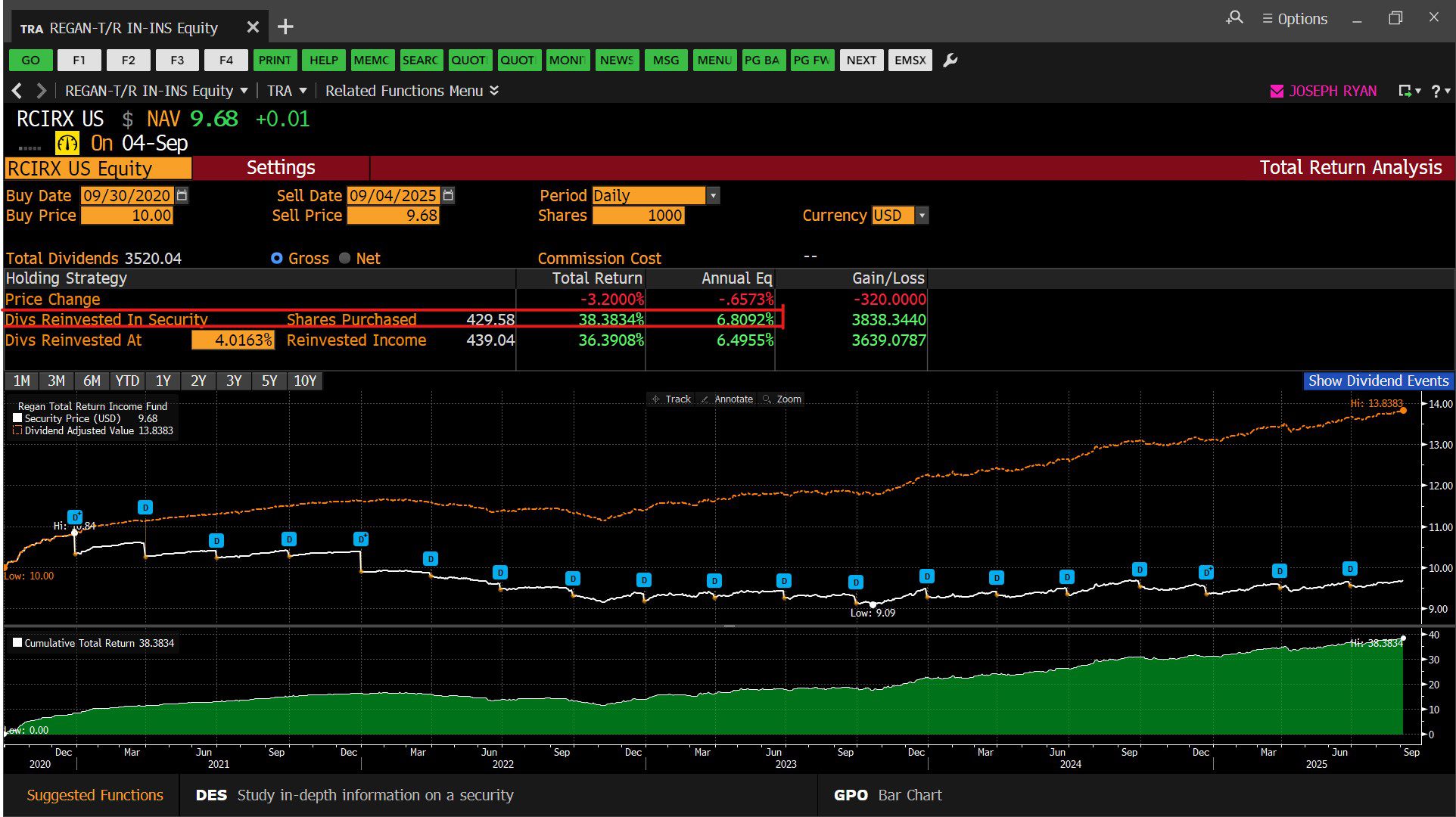

Regan Total Return Income Fund – Daily Total Return Analysis (09/30/2020 – 09/04/2025)

– Courtesy of Bloomberg LP