The Resilience of the U.S. Economy

At this writing, Q3 GDP economic growth, according to the Atlanta Fed, defies projections again with a 4.9% estimate. The impressive growth stands opposite of projections of near breakeven at the beginning of the quarter. Correspondingly optimistic, Yardeni Research projects S&P 500 operating profits to increase 20% by the end of 2025.

Federal Reserve Projections Through 2026

According to the projections by the Federal Reserve published during September show growth slowing to just under 2% with inflation moving down to 2% over the next 3 years while the Fed Funds rate is lowered to a more normal 2.5%.

The short-term obsessions with the next move of the extended Fed tightening cycle appear to miss the point of longer-term projections. One likely impact is increased valuations for high cash flow assets between now and 2026.

Commercial Real Estate Storm Cloud Warnings

The Fed is likely to be forced to begin reducing rates faster than their projections. Raising the base rate of capital costs have resulted in commercial capitalization rates (cap rate) moving up from approximately 6% to 8% according to Bloomberg.

Capitalization Rates: Divide the free cash flow by your target cash return plus appreciation. A building with free cash flow after expenses of $1 million would be worth $16.7 million at a 6% “cap rate.” At the current 8%, the value drops to $12.5 million, a 25% likely decrease in value across the market.

Add an estimated 20% reduction in office occupancy, $800,000 in free cash flow is only $10 million for the same building. Already, foreclosures and “renegotiations” are hitting the market.

At a 40% reduction in value, many properties cannot be refinanced and the banks, while healthy now, will likely take extra loan loss reserves to prepare. The Fed is aware that higher rates are impacting their constituency, the banks. Our view is that real estate investment trusts are likely to be bargains during tax loss selling NEXT year, 2024.

Relentless Pursuit of Superior Client Profits

The Investment Committee meets each Wednesday and often by email in pursuit of the best bargains and to replace or eliminate underperforming assets.

Selling underperformers in tax loss harvesting for McGowanGroup Wealth Management (MGWM) has been completed in Q3 to avoid selling pressure in Q4 for underperforming sectors and raise cash for bargains in December. We are researching future bargains for additions daily, in the meantime.

Global High Yield

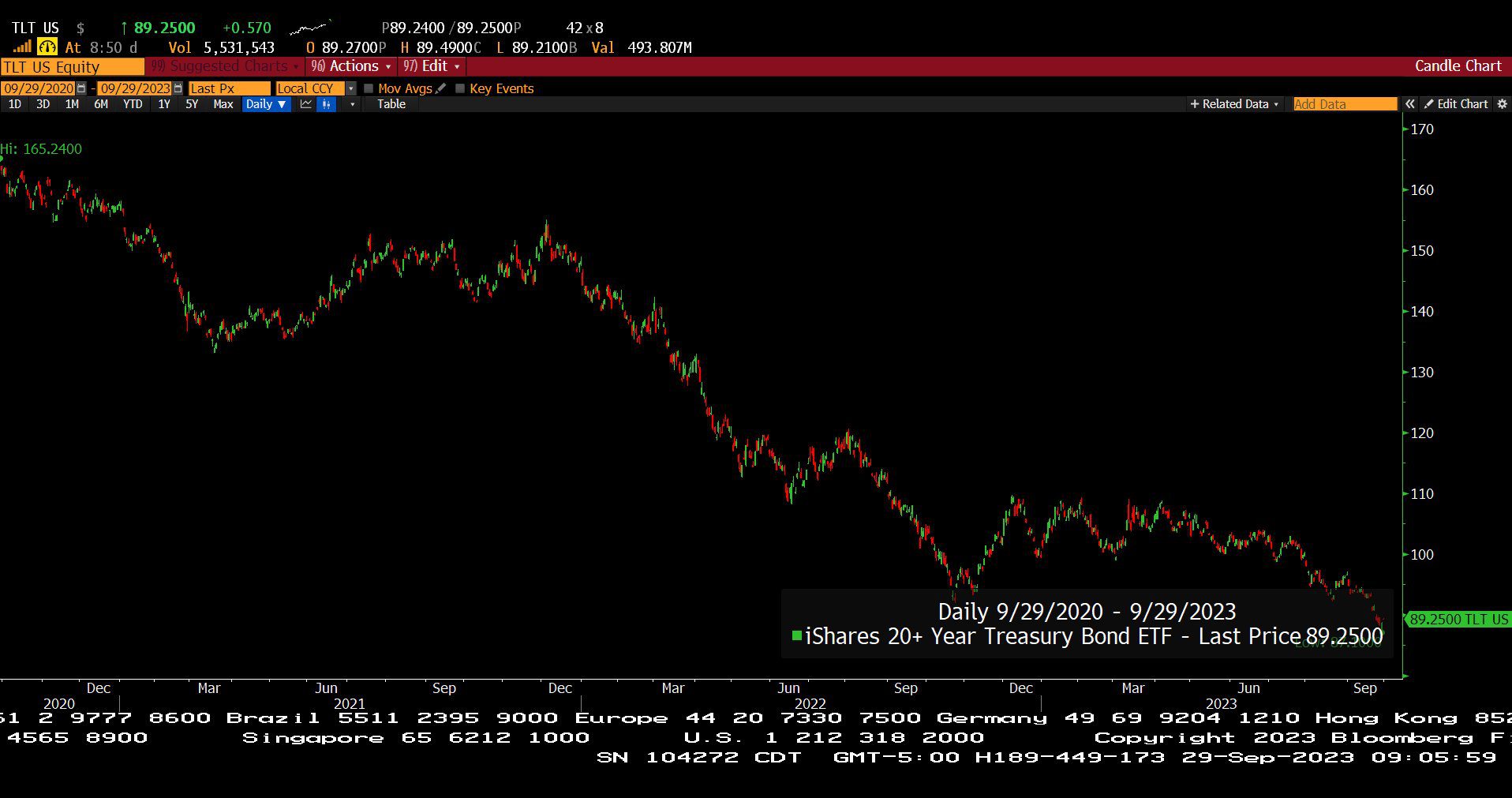

Current yields are available near 9% at a near 25% discount in well managed global high yield bond funds. Assuming the Fed fulfills its own projections, an additional imbedded capital gain can result.

Energy Infrastructure, Historically an Inflation Hedge

According to Recurrent Advisors in Houston, energy infrastructure is producing near 16% free cash flow with current valuations at near 6x cash flow. The industry is buying back about 7% of shares outstanding each year according to Recurrent Advisors.

This potentially increases our assets under control per share with an attractive dividend that has been rising. Current yields are near 7% after recent dividend increases. Oil recently topped $92. JP Morgan at the end of September said a surge to $150 is possible.

Dividend Companies

Medical dividend companies, pharmaceutical technology companies, and insurance, are considered inflation friendly due to pricing power. The category has a history of rising dividends and capital gain potential.

Growth and Innovation

For the Growth Units and Total Return Units, we are adding selective strong performances in innovation. Software, profitable solar, nuclear, and batteries are currently included in the allocations.

Excellence In Service

Our team of 10 is the most extraordinary that we have seen in our careers. Each of us with expertise above and beyond the average in our industry. Please welcome Michelle Brady as the 10th team member of McGowanGroup Wealth Management as our Client Services Specialist!

Wealth Management: Coordination of Tax and Estate Planning

During Q4 we will be uploading tax planning documents to the client portal for CPAs to complete a preliminary 2023 return. In your next review, we are happy to review your current estate plan and provide bullet points for discussion with your estate planning attorney to evolve your plan.

Q: What days of the year are statistically the worst for the equity markets annually?

A: According to The Stock Trader’s Almanac, the final 10 trading days of September contain the largest declines for equity values. Whew, aren’t we glad September is over!

Q: What is the “Dynamic Dashboard” that the McGowanGroup Wealth Management (MGWM) Investment Committee uses to enhance portfolio decisions?

A: The “dashboard” is a combination of institutional investment research including Daily Graphs, Bloomberg research, The Wall Street Journal, and outside research selected by committee members.

Headline Round Up

*The Dreaded U.S. Government Shutdown! How afraid should investors be?

*Microsoft Stock Upgraded on Artificial Intelligence (AI) Dominance!

*Big Pharma Stock Trades of 2023: Weight Loss!

*Robo-Taxis Cause Traffic Mayhem in Austin!

*N.Y. Cannabis Regulator Looks to Grant 1,500 New Licenses as Surplus Builds Up!

*Overregulation? Securities & Exchange Commission (SEC) Consolidated Audit Trail Regulation Causing Investor Concern Over Privacy.

*Federal Trade Commission (FTC) Sues Amazon! Alleges Amazon is a monopolist that stifles competition!

*Federal Communications Commission (FCC) Pledges to Reinstate Reimpose Net Neutrality?

*CarMax, Inc. Falls 13% on Premarket Trading 9/28 on Lower Sales & Citing Higher Interest Costs for Buyers in Q3.

*China Evergrande Shares Suspended After Founder Accused of Crimes.

*Private Equity Firm, Cerberus Capital Management, Makes a Fortune on Bushmaster and it’s AR-15 Success.

*World’s Biggest Crypto, Binance, Firm Melting Down.

*The Inside Story of FTX Last Moments.

*Mick Jagger’s Net Worth Estimated at $500,000,000. Still Going Strong After 60 Years.

*JPMorgan Analyst Sees Energy Supercycle With Oil as High as $150 a Barrel.

*Decade-Low Stocks at Cushing May Send Oil Prices Even Higher.

*Energy Storage Batteries Bailed Out Texas Grid as Inflation Reduction Act Provided First Ever Credit for Battery Storage Only! Energy storage additions hit record high in Q2.

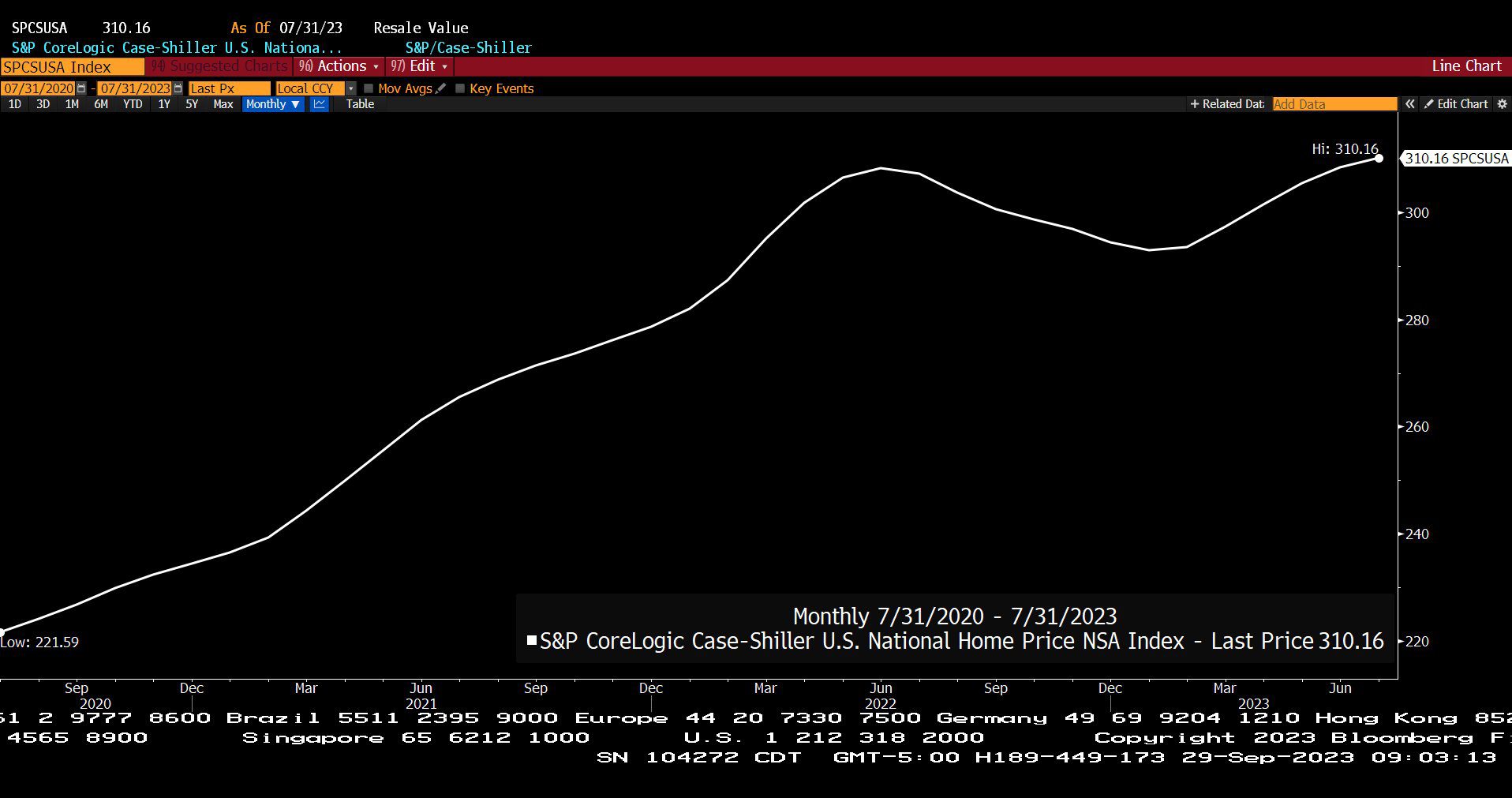

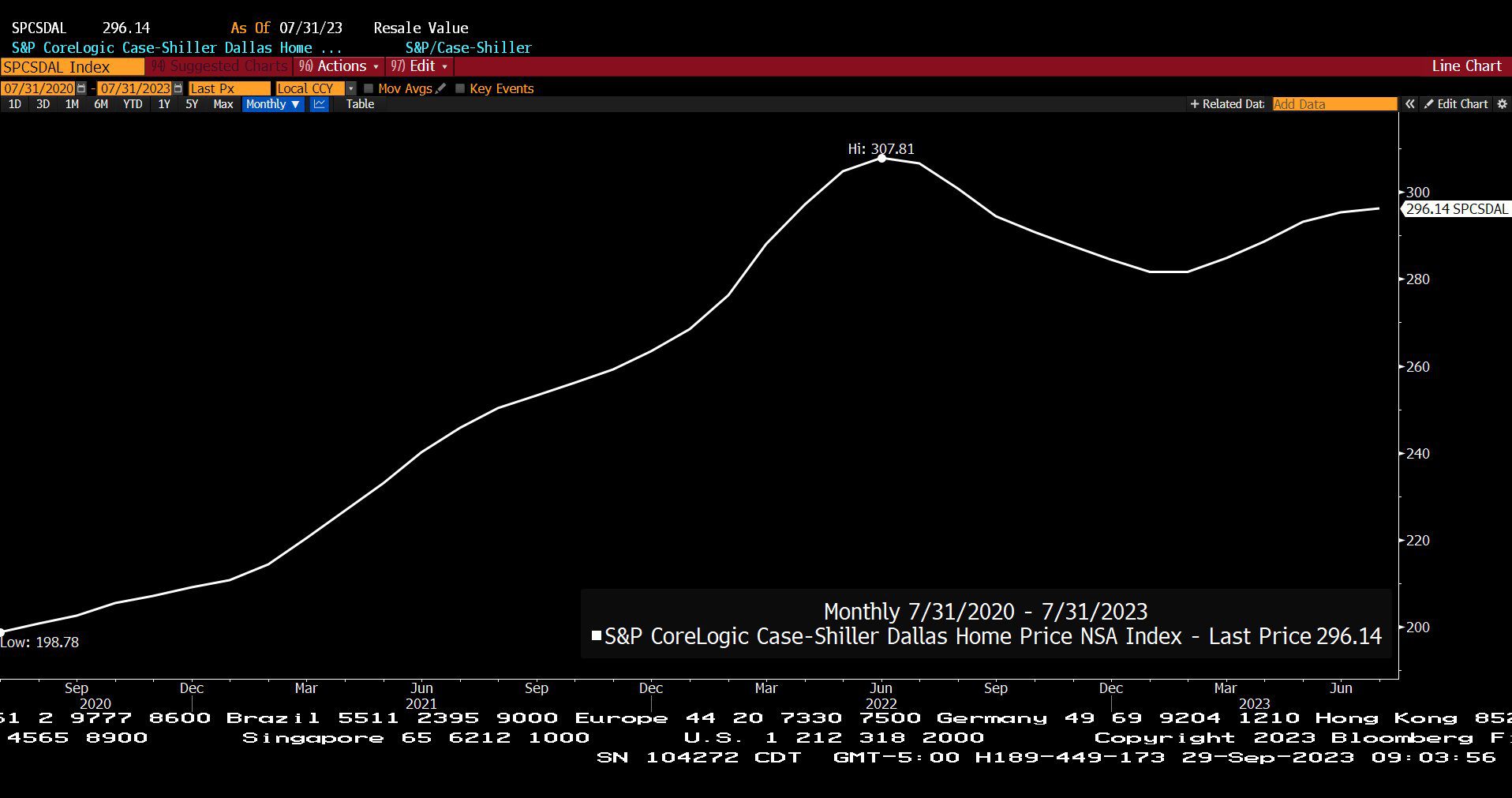

*National Home Prices Hit Record as Mortgage Rates Rise. North Texas recovers to -3% below last year’s bidding war.

Mergers and Acquisitions and Joint Ventures

*Peloton Gets a Bailout from Lululemon?

Skid Row

*Snapchat Collapsing Again?

*Rumble Failing to Rumble?

Dow Jones Industrial Average Index (09/29/2020 – 09/29/2023)

– Courtesy of Bloomberg LP

Dow Jones Industrial Average Index (12/17/2018 – 03/15/2019)

– Courtesy of Bloomberg LP

Generic Oil Futures Contract Spot Price (09/29/2020 – 09/29/2023)

– Courtesy of Bloomberg LP

Chevron Corp. (Quarterly, 09/30/1980 – 09/29/2023)

– Courtesy of Bloomberg LP

S&P CoreLogic Case-Shiller U.S. National Home Price Index, Non-Seasonally Adjusted (07/31/2020 – 07/31/2023)

– Courtesy of Bloomberg LP

S&P CoreLogic Case-Shiller Dallas Home Price Index, Non-Seasonally Adjusted (07/31/2020 – 07/31/2023)

– Courtesy of Bloomberg LP

iShares 20+ Year Treasury Bond Exchange Traded Fund (09/29/2020 – 09/29/2023)

– Courtesy of Bloomberg LP

Rumble, Inc. (Weekly, 04/16/2021 – 09/29/2023)

– Courtesy of Bloomberg LP

Snap, Inc. (Weekly, 03/03/2017 – 09/29/2023)

– Courtesy of Bloomberg LP

Profit Report

*Oldest bond issuance turns 375 and is still alive!

*How is conservative media misrepresenting current U.S. economic data? Why is this important for investors and their investment decisions? Lessons from 2012-2016.