Q: What potential deflationary crisis is unfolding that is likely to change the Federal Reserve’s focus?

A: According to Bloomberg, [Capitalization Rates] or “Cap Rates” on commercial real estate have moved from 6% to 8% decreasing values potentially by 25%. If Cap Rates moved to 10%, the decrease in value would be 40%. Bank solvency is endangered by loans that cannot be refinanced, potentially forcing discounted sales to private investors.

Q: Currently, what sectors of the equity markets have strong estimated returns based upon cash flows, earnings and growth potential?

A: At this time, those areas include discounted Global High Yield, Energy Infrastructure, and Dividend Companies to name a few.

Q: What is the process for consolidating with McGowanGroup Wealth Management (MGWM) and our review process?

A: Tune in to today’s broadcast and follow along as Alex Tollen, Chief Operating Officer, outlines the MGWM process!

Headline Round Up

*Notable IPOs of the Week!

*Remote Work Could Wipe Out $800 Billion in Office Building Values.

*Dolly Lenz, CEO of Dolly Lenz Real Estate, Says San Francisco is a Real Estate Disaster.

*Thought The U.S. Office Market Was Bad? Try China.

*Impact of Higher Interest Rates on U.S. Households.

*Natural Gas Pipeline Shortage According to Richard Meyer, American Gas Association’s Vice President of Energy Markets, Analysis and Standards!

*Unstoppable Oil Rally Led By Tightening Supply & Chinese Demand?

*Oil Tops $92 Mid-Week. Next Challenge $100 a Barrel?

*Crude Inventories Declining Rapidly Per the American Petroleum Institute.

*Oil Industry Not Investing Enough to Meet Demand Says Wood Mackenzie Analysts.

*The Yield Curve “Inversion” Pioneer Campbell Harvey Warns Fed Not to Raise Rates Again.

*King Dollar Shocks Bears.

*Cisco Buys Splunk Cyber Security at a 31% Premium.

*Big Rally in Risky Corporate Loans?

*Microsoft Poised to Overtake Apple in Market Capitalization.

*Intel Announces Artificial Intelligence (AI) Tools That Could Be Central to AI Boom.

*Airbnb Using AI to Stop Wild Parties.

*Texas Renovation Power Couple Chip and Joanna Gains Estimated Net Worth Over $50 Million?

*Eli Lilly Sues Businesses Selling Knock Off Mounjaro.

*FedEx Tops Earnings Estimates By Over 20%.

*Ron Baron, Top Fund Manager at Baron Capital, Riding High on Concentrated Bets.

*Manhattan Based Federal Prosecutors Scrutinize Personal Benefits Tesla may have provided Elon Musk Since 2017?

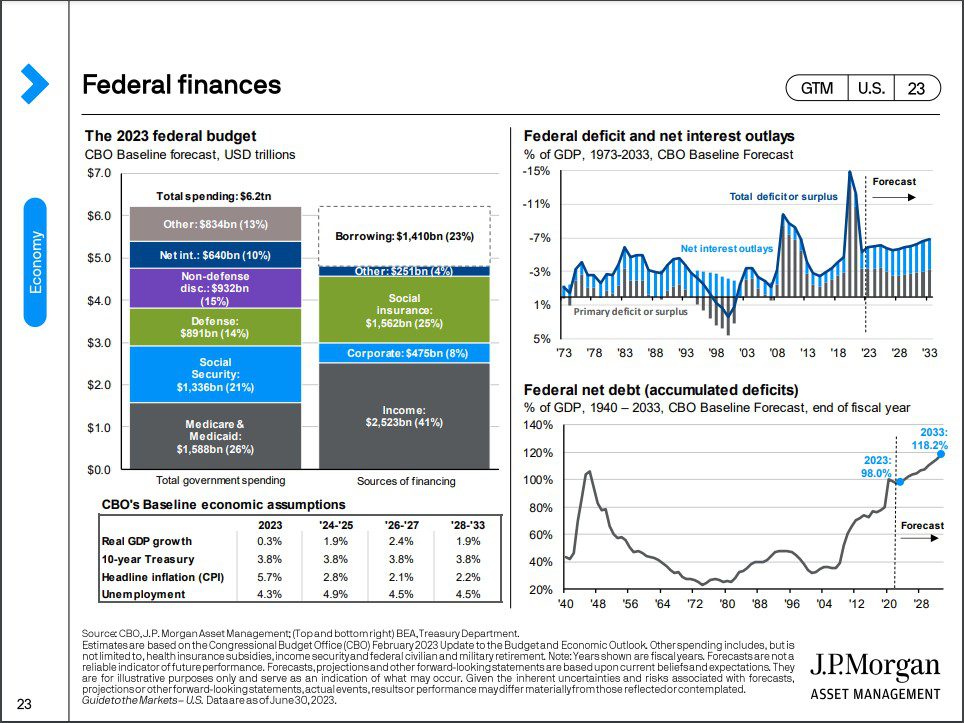

J.P.Morgan Asset Management – U.S. Guide to The Markets Q3 2023, pg 23 (08/31/2023)

– Courtesy of J.P.Morgan Asset Management

iShares 20+ Year Treasury Bond Exchange Traded Fund (09/22/2021 – 09/22/2023)

– Courtesy of Bloomberg LP

Dow Jones Industrial Average Index Year to Date (09/22/2021 – 09/22/2023)

– Courtesy of Bloomberg LP

Generic Oil Futures Contract Spot Price (09/22/2021 – 09/22/2023)

– Courtesy of Bloomberg LP

ARM Holdings, PLC (09/14/2023 – 09/22/2023 Intraday)

– Courtesy of Bloomberg LP

Maplebear, Inc. DBA Instacart (09/19/2023 – 09/22/2023 Intraday)

– Courtesy of Bloomberg LP

Klaviyo, Inc. (09/20/2023 – 09/22/2023 Intraday)

– Courtesy of Bloomberg LP

Profit Report

*Infrastructure Investing?