Q: What was the equity market reaction to this week’s Federal Funds Rate increase?

A: The Dow Jones Industrial Average spiked 170 points as Federal Reserve Chairman, Jerome Powell, indicated the tightening cycle is likely over. “It’s possible that we would choose to hold steady . . .”

Q: What is a “Soft Landing?”

A: Investopedia.com: “A soft landing, in economics, is a cyclical slowdown in economic growth that avoids recession. A soft landing is the goal of a central bank when it seeks to raise interest rates just enough to stop an economy from overheating and experiencing high inflation, without causing a severe downturn. Soft landing may also refer to a gradual, relatively painless slowdown in a particular industry or economic sector.”

Q: What is an In-Service IRA Rollover?

A: Also defined as a pre-termination rollover, allowing participants, usually after 55, to roll a large portion of their 401k to an IRA in preparation for retirement. McGowanGroup has in depth logistics and planning experience to help investors explore this option.

Headline Round Up

*Healthy Economic Growth: Q2 GDP Comes in at 2.4% Matching The Atlanta Fed’s Estimate!

*Big Humble Pie: Bearish Mike Wilson, Chief U.S. Equity Strategist at Morgan Stanley, states, “We were wrong.” Just what was his forecast to investors?

*The Power Phoenix: Vistra, Corp., A Power Generation Giant, Hits All Time Highs.

*EPA New Electric Vehicle (EV) Rules Likely to May Short-Circuit the Power Grid, Says ZeroHedge at Oil.com.

*God Bless Texas! Success Meeting Record Breaking Electricity Demand This Summer.

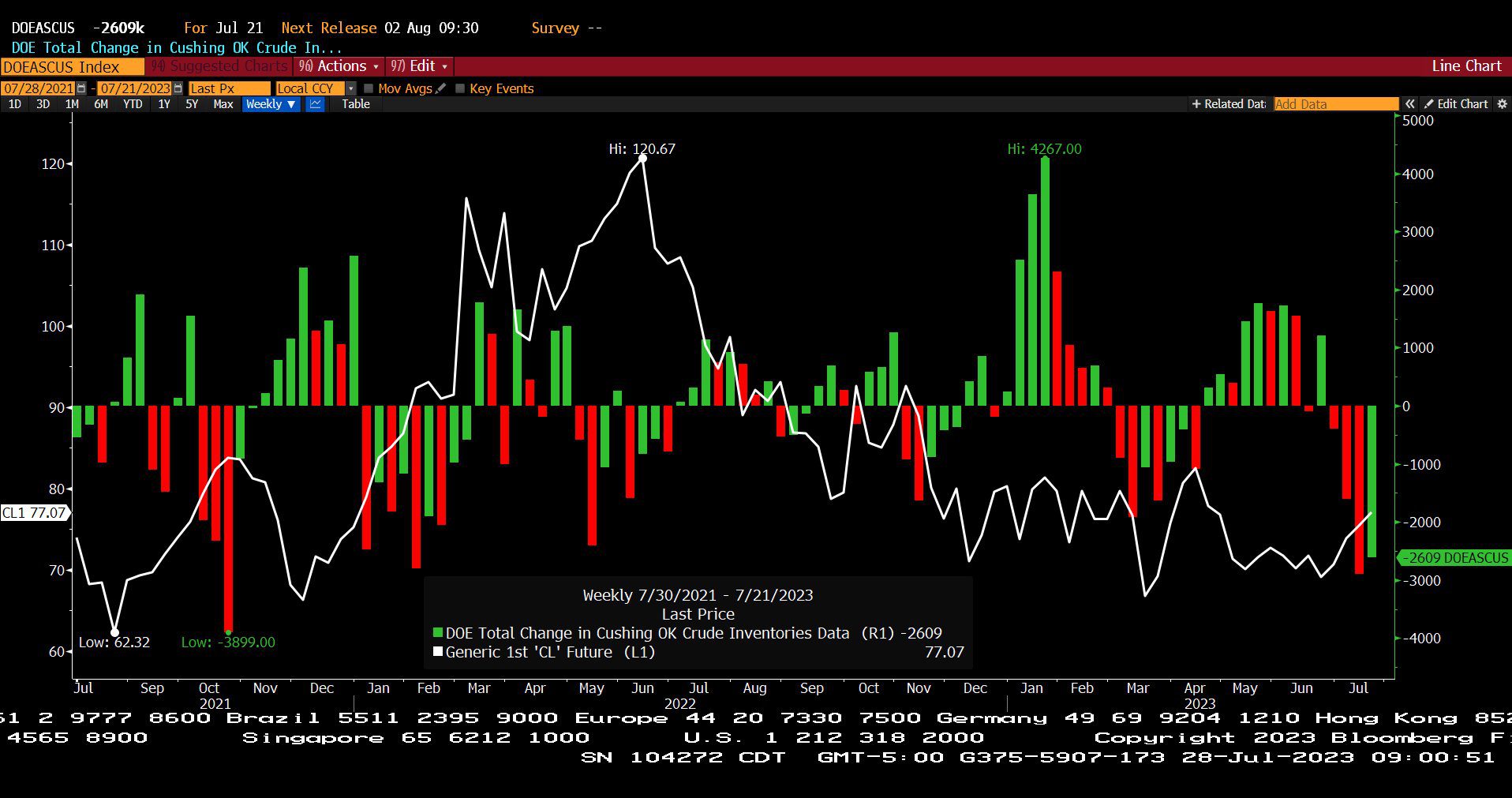

*Oil Dances to $80!

*Crude Axis: China Stockpiles Cheap Russian Oil.

*Exxon Mobil Corp., Standard Lithium Ltd., and Tetra Tech, Inc. Set to Make Arkansas the Lithium Capital of the U.S.

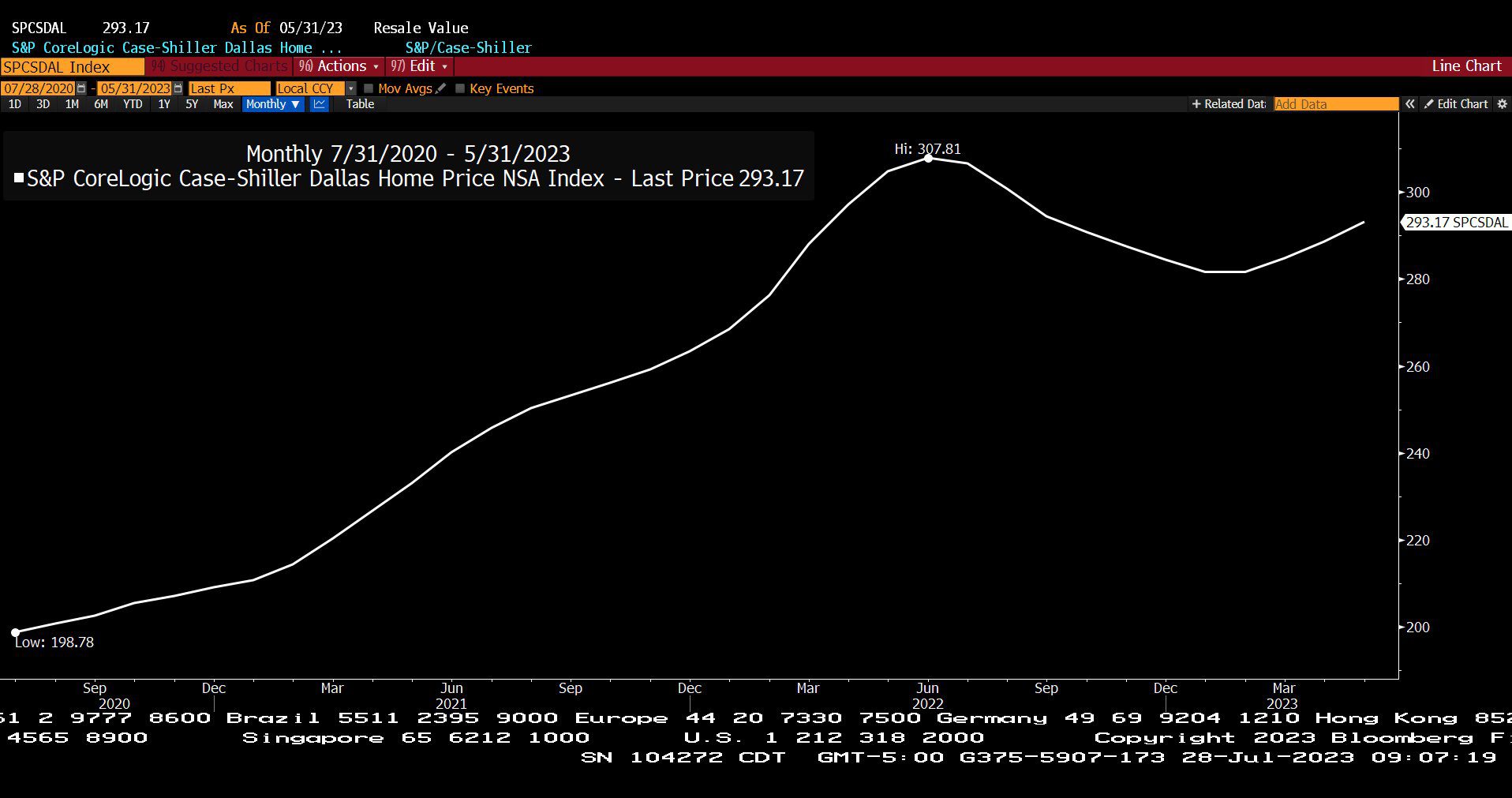

*Nearly $3 Billion in Dallas Commercial Real Estate Recently Listed as Distressed by Dallas Business Journal.

*Breakthrough Battery Technology! Enovix Corp. Announces Army Contract, 25% Production Over Target, With Funding Secured.

*Artificial Intelligence (AI) Insights: Alphabet and Microsoft Earnings Calls.

*AI Speech Platform Taking Over Fast-Food Drive Throughs.

*General Electric Roars Back After 6 Years of Shareholder Degradation and Humiliation.

*Wild Ride: QQQ’s, Nasdaq 100, Even After Surge, But Still Down About 5% Over 18 Months.

*Recurrent Advisors Reports Record Surplus Cash Flow in Excess of Large Dividend Increases for the Pipelines.

Dow Jones Industrial Average (07/28/2021 – 07/28/2023)

– Courtesy of Bloomberg LP

Department of Energy – Total Change in Cushing, OK Crude Oil Inventories Data & Generic Crude Oil Contract Spot Price (07/28/2021 – 07/21/2023)

– Courtesy of Bloomberg LP

Standard & Poor’s Case-Shiller Dallas Home Price Index, Non Seasonally Adjusted (07/28/2020 – 05/31/2023)

– Courtesy of Bloomberg LP

Profit Report

Has your current advisor actually read your Trust and Will?