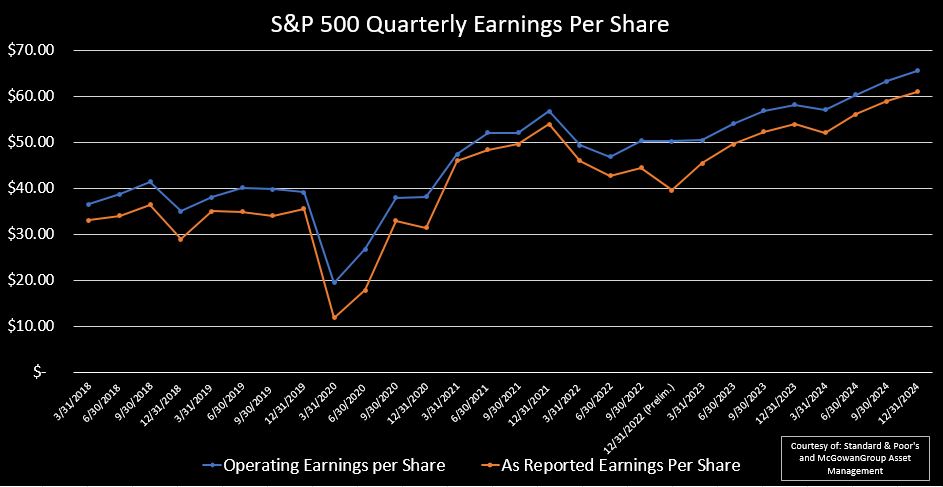

Q: What is the significance of current corporate profit projections between now and 2024?

A: Corporate earnings are predicted to rise significantly over the next 18 months.

Q: Is there now more trouble ahead for the U.S. banking system?

A: By stepping in to backstop all deposits, instead of $250k FDIC limit, at the 2 failed banks the likelihood of contagion Bank Runs appears averted.

Q: Will the Federal Reserve (Fed) reverse course regarding interest rate hikes?

A: By guaranteeing all deposits to Silicon Valley Bank and Signature Bank The Fed is providing liquidity instead of tightening.

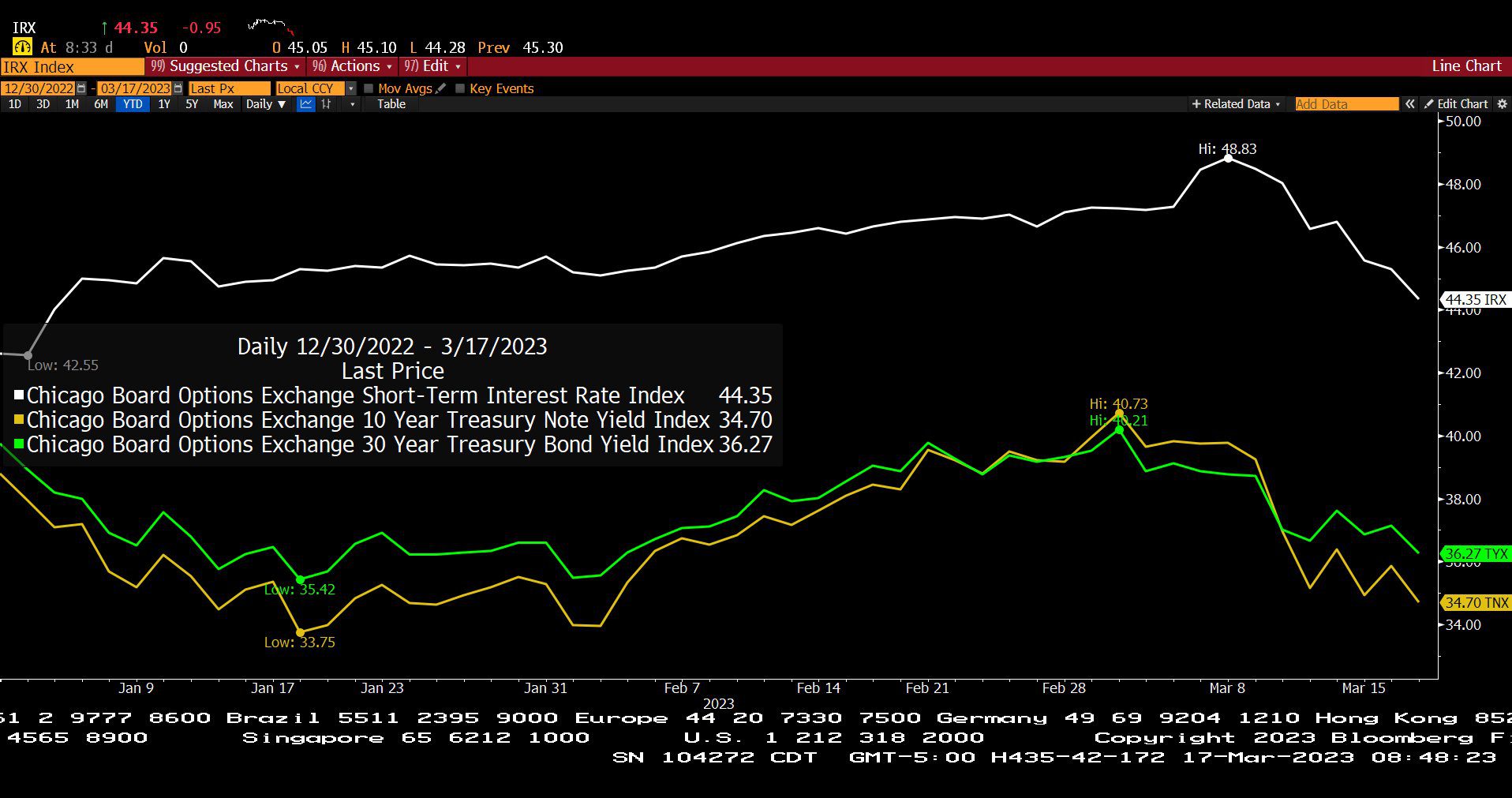

Q: What can the recent movement in U.S. Treasury yields tell us about 2024?

A: The Yield Curve Inversion, combined with the drop in yields this week appear to indicate a return to more normal interest rates next year.

SPDR S&P Regional Banking ETF (03/17/2022 – 03/17/2023)

– Courtesy of Bloomberg LP

First Republic Bank/CA (03/17/2022 – 03/17/2023)

– Courtesy of Bloomberg LP

Comerica Inc., Cullen/ Frost Bankers Inc., Texas Capital Bancshares Inc. (03/17/2022 – 03/17/2023)

– Courtesy of Bloomberg LP

CBOE Short-Term Interest Rate Index, CBOE 10 Year Treasury Note Yield Index, CBOE 30 Year Treasury Bond Yield Index (12/30/2022 – 03/17/2023)

– Courtesy of Bloomberg LP

Dow Jones Industrial Average (03/17/2022 – 03/17/2023)

– Courtesy of Bloomberg LP

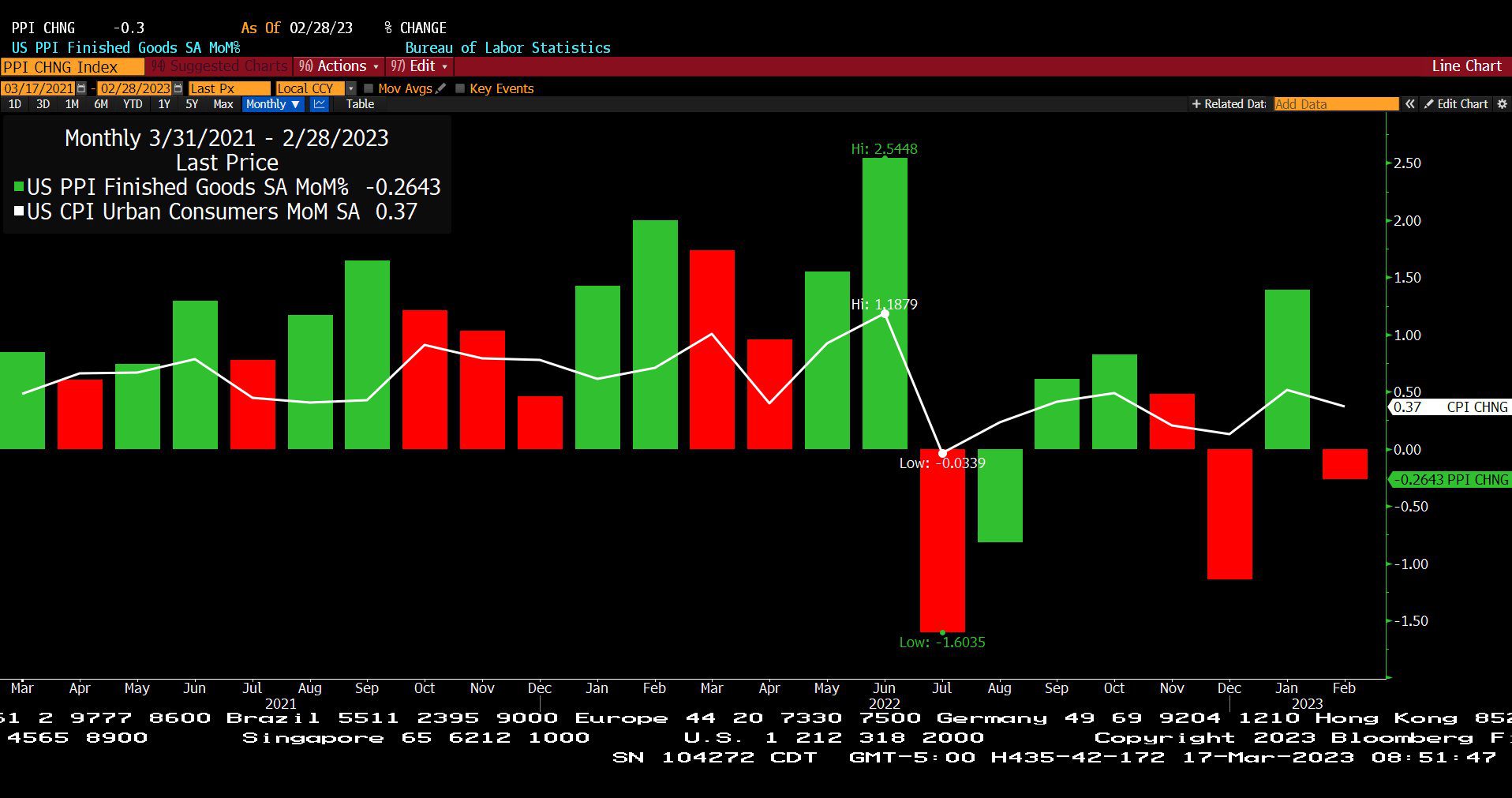

US Producer Price Index Finished Goods SA MOM% and US Consumer Price Index Urban Consumers MOM SA (03/31/2021 – 02/28/2023)

– Courtesy of Bloomberg LP

Standard & Poor’s 500 Quarterly Earnings Per Share (03/31/2018 – 12/31/2024)

– Courtesy of Standard & Poor’s and McGowanGroup Asset Management

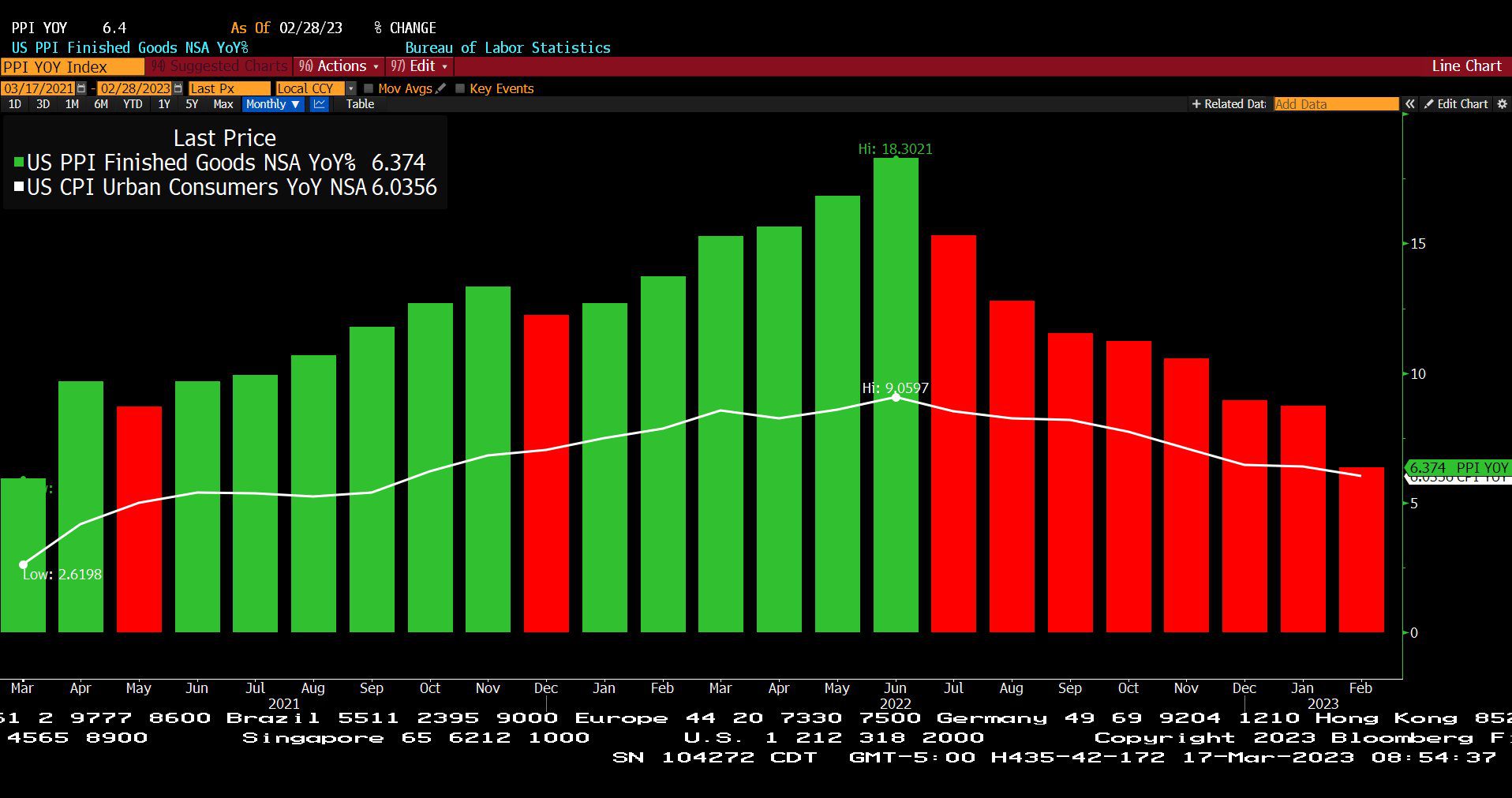

US Producer Price Index Finished Goods NSA YOY% and US Consumer Price Index Urban Consumers YOY NSA (03/17/2021 – 02/28/2023)

– Courtesy of Bloomberg LP

West Texas Intermediate Crude Oil Spot Price (03/17/2020 – 03/17/2023)

– Courtesy of Bloomberg LP

Headline Round Up

*FDIC Averts Contagion Crisis Fully Protecting Deposits at Silicon Valley Bank and Signature Bank.

*Fed Loosens with $25 Billion Bank Term Funding Program.

*Lurking Systemic Risk of Tech Money Machine?

*Traders Bet No More Fed Interest Rate Hikes!

*Jim Cramer, CNBC Host, Awarded Double Bozo Award by NetWorth Radio!

*Swiss National Bank to Save Credit Suisse with $54 Billion Line of Credit!

*Deflation in January for the Producer Price Index.

*Egg Prices Decline Most Since 2020.

*Retail Sales Cool Off Declining in February.

*Healthy Jobs Report from February Plus Declining Wage Inflation.

*A Wealth Management Chatbot? Morgan Stanley Announces OpenAI for Advisors.

*$100 Oil This Year?

*U.S. Set to Become Largest Liquified Natural Gas (LNG) Exporter.

*ConocoPhillips Starts Alaska Work Hours after Willow Approval from Current Administration.

*Warren Buffett Adds 8 Million More Shares of Occidental Petroleum Corp. (OXY) During Downdraft This Week.

Profit Report

The End of Abundant Energy?