Are there too many bearish bets on the equity markets and what does that typically mean?

Why is economic good news possibly bad news for the financial markets?

How much investor money has been lost in Cryptocurrency since November of 2021?

How bad is the current U.S. housing market deep freeze?

What potentially happens to investor sentiment during and following Bear Markets?

What could investors, with a 3-5 year timeline, do right now?

Standard & Poor’s 500 Index (01/06/2022 – 01/06/2023)

– Courtesy of Bloomberg LP

Global X MLP ETF (01/06/2022 – 01/06/2023)

– Courtesy of Bloomberg LP

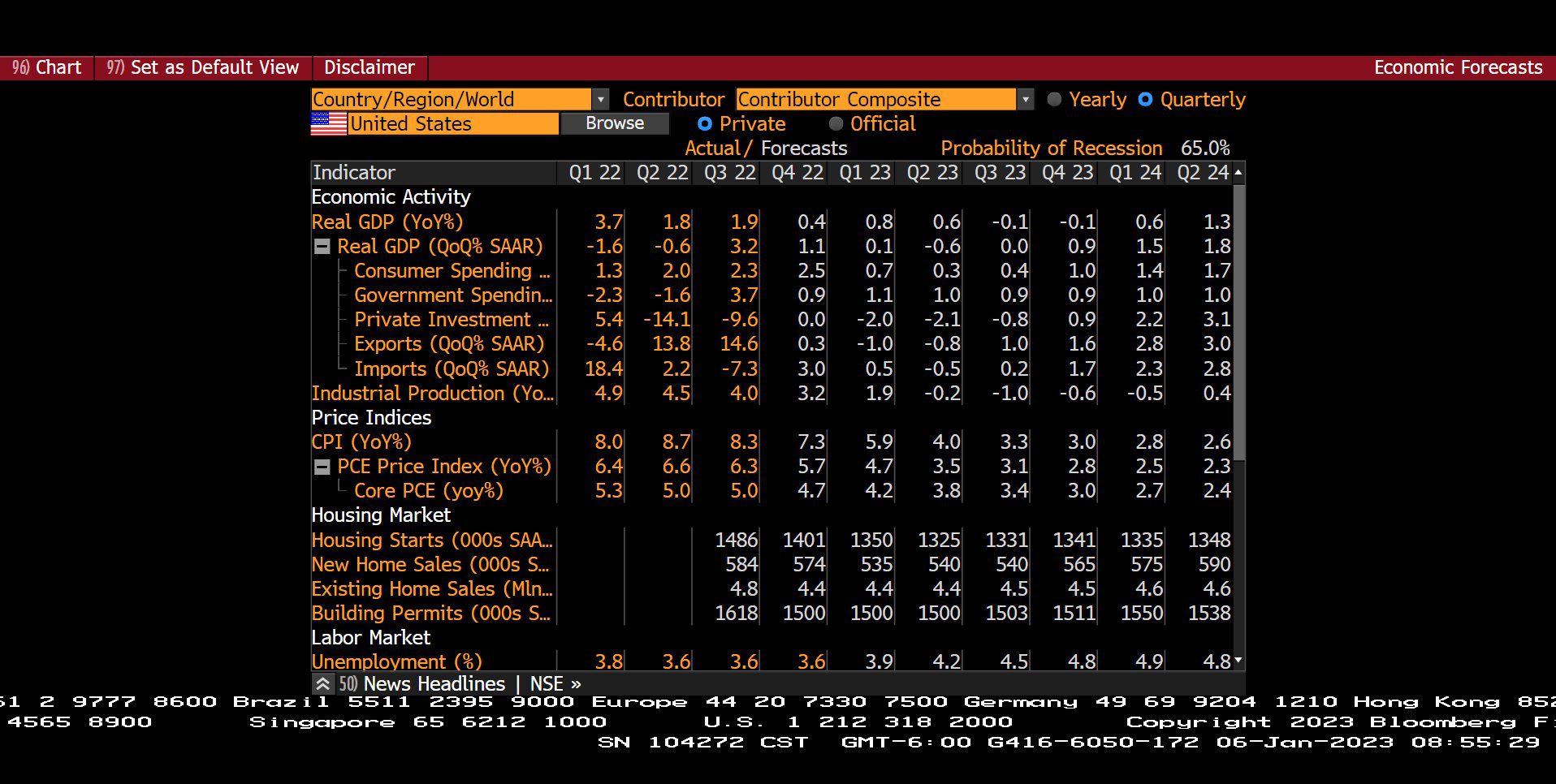

Quarterly U.S. Economic Forecasts with Probability of Recession (Q1 2022 – Q2 2024)

– Courtesy of Bloomberg LP

Standard & Poor’s 500 Index – Quarterly Earnings Estimates (01/06/2020 – 01/06/2023)

– Courtesy of Bloomberg LP

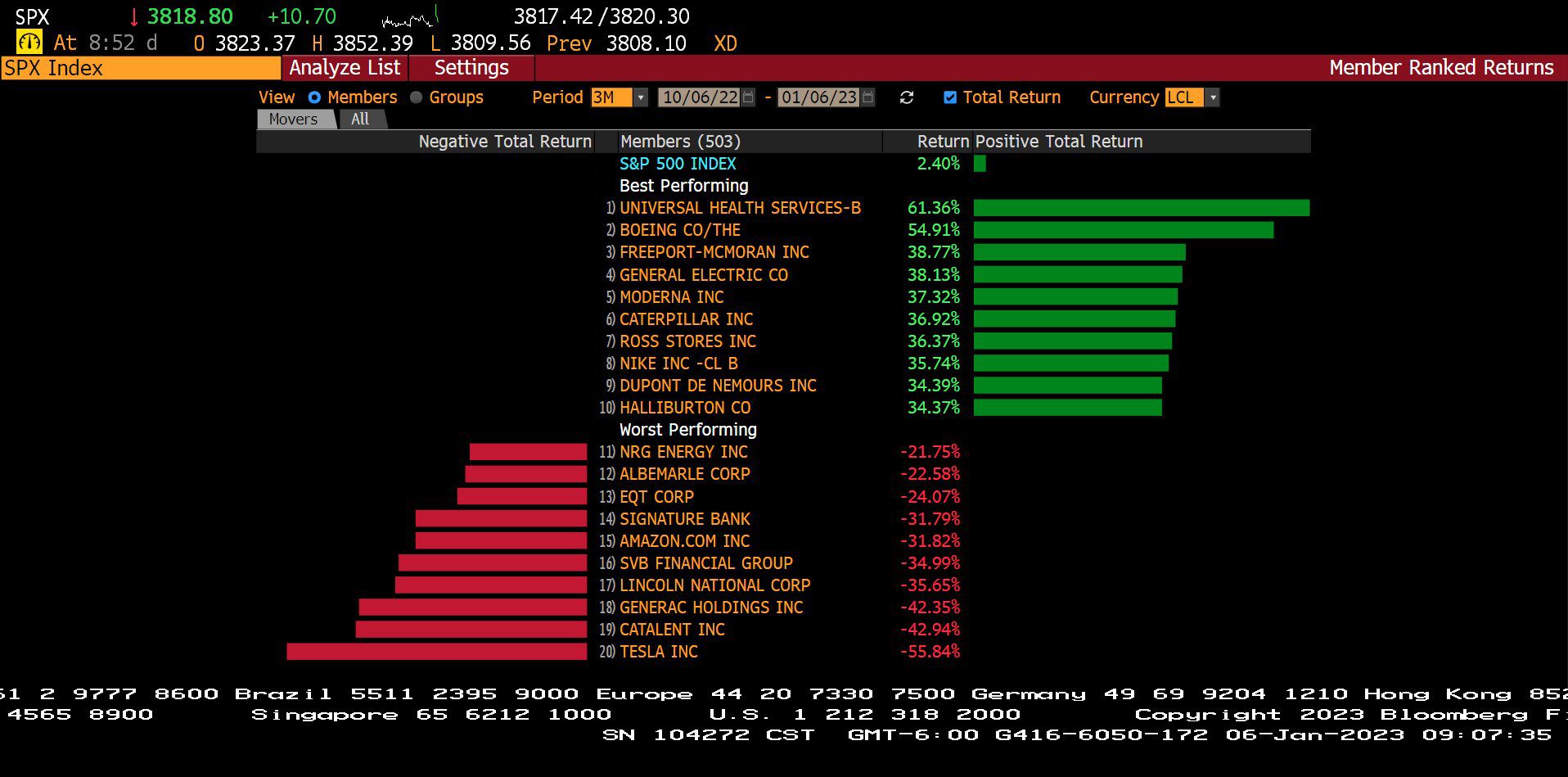

Standard & Poor’s 500 Index – Member Ranked Returns by Company (10/06/2022 – 01/06/2023)

– Courtesy of Bloomberg LP

Headline Round Up

*U.S. Jobs Market Is Healthy!

*Tech Layoff Announcements?

*Gone to Texas! : Top Spot Again in U-Haul Index!

*U.S. Pending Home Sales Plummet! 45.7% in the West.

*Domestic Auto Sales Down 8%! Lowest Since 2011.

*Tech Wreck: Cathie Wood’s ARKK Performance Update and Buy/Sell Roster.

*Warren Buffet’s Top Holdings! OXY and CVX Biggest Additions for 2022.

*ExxonMobil and Chevron Corp. Set for Record $100 Billion in Profits in 2022.

*The New “Big Short” King, Neal Berger Founder of Eagle’s View Capital, Stands Tall!

*JPMorgan’s Top Picks for 2023.

*100MM Fraud? Trader Avraham Eisenberg accused of trying to steal from crypto exchange Mango Markets!

*China? “To Not Too.” Apple Starts Making MacBooks in Vietnam in 2023!

*The Fall of Tesla, Inc. and The Rise of ExxonMobil Amid the Energy Crisis?

McGowanGroup Wealth Management

Q1 2023 Client Update

This year welcomed our 10th and newest team member Preston Lane, Director of Client Relations. Our dedication to Excellence in Service and pursuit of Superior Client Profits remains steadfast!

Key Trends

Expectations for 2023 appear overly pessimistic: As of 12/20/2022, The Atlanta Federal Reserve Real GDPNow projection shows 2.8% economic growth for the fourth quarter. Projections in Bloomberg were for just .2%.

Slowing Growth

The key to happiness in 2023 appears to be low expectations. The current Federal Reserve projections are .5%for 2023 growth. With reduced earnings forecasts the bar is set low, but positive surprises could be the result in January earnings announcements.

Cooling Inflation

Inflation appears to have peaked in June 2022 at an annual Consumer Price Index (CPI) rate of 9.1%. Since June, CPI would annualize at about 2.5% inflation. If inflation does spike again, oil and gas prices are the likely the cause of and beneficiaries of the surge.

Energy Crisis and Strategy

ExxonMobil recently issued a forecast that profits and cash flow could double by 2027. The bold forecast indicates that energy infrastructure could continue to lead the S&P 500 again for an extended period. Energy holdings and inflation friendly medical dividend companies account for McGowanGroup’s resiliency this year versus large declines in the equity markets.

Interest Rates, Bonds, and Federal Reserve Policy

Is the Interest Rate tightening cycle coming to an end? Federal Reserve projections for the base overnight bank lending rate are poised to reach 5.1%. This could signal ½% rate increase on February 1st, 2023, or two 2 more ¼% increases later in the year. Bonds are currently trading at a discount with yields above 7% likely to benefit from the end of the aggressive tightening cycle.

Capital Gains Strategies

In 2019, as the Federal Reserve reached the end of 2018 tightening cycle, the Bear Market ended with a return to higher valuations.

Possible attractive portfolio additions include:

• Rising Dividend Companies

• Energy Companies

• Clean Technology Companies

• Deeply Discounted Bond Funds with Attractive Yields.

Profit Report

The McGowanGroup Wealth Management (MGWM) Planning Process: Alex, what does that process look like and why has it worked so far?

What are some of the most important lessons for investors over the last 30 years?

Logistics of consolidation with The McGowanGroup!