What is the Mastermind Principle and how does it apply to Investing?

What is the Research and Allocation process at The McGowanGroup?

How has the average investor really performed according to Dalbar?

What would “multiple contraction” cause as the Federal Reserve changes it’s posture on Interest Rates?

What did investors do during the meltdown of 2020?

How does advanced Estate Planning enhance a family legacy for generations?

What does the meltdown of a Texas dynasty teach us about Estate Planning?

What should I do for my legacy in 2022?

Headline Round Up

*China’s Omicron Freak Out! Locked Down Ports and Mother of all Supply Chain Shocks?

*Profits Ebb for Large American Banks? Is the Financial Sector rally over?

*Steep Slope for a Ski Empire! Worker Shortages and Robust Customer Demand.

*Stealth Correction? The Number of Stocks at 52 Week Lows Highest Since Pandemic Sell Off.

*World’s Largest Oil Trader: Prices Set to Rise Further!

*Guggenheim Likes 2 Solar Stocks, But Are They Bargains?

Dow Jones Industrial Average Index (01/31/1997 – 01/18/2022)

– Courtesy of Bloomberg LP

U.S. Generic Government 10 Year Index & U.S. Consumer Price Index – Urban Consumers Year over Year, Non-Seasonally Adjusted (01/31/1972 – 01/18/2022)

– Courtesy of Bloomberg LP

West Texas Intermediate Crude Contract Spot Price (01/19/2017 – 01/18/2022)

– Courtesy of Bloomberg LP

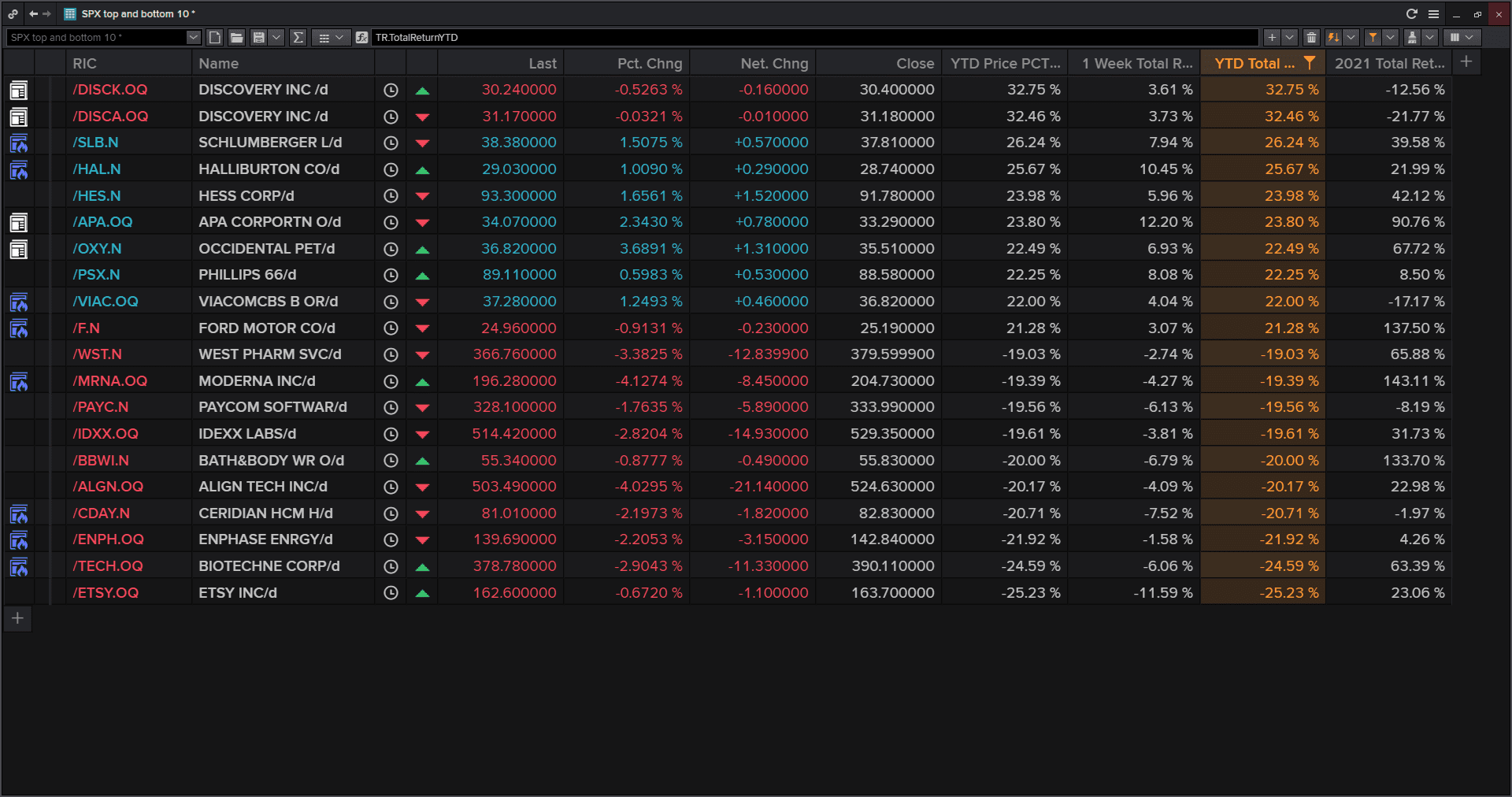

Standard & Poor’s 500 Index Top 10 and Bottom 10 Year to Date (01/18/2022)

– Courtesy of Refinitiv Datastream

Profit Report

The McGowanGroup Wealth Management Process!

Lessons from Dalbar!

A Texas Dynasty Turmoil as Heirs Squabble Publicly!

The Dangerous Precedent of Government Price Controls and the Irony of Created Shortages.