Key Strategies for Investment Plan Updates

1. Unprecedented Fiscal and Monetary Expansion

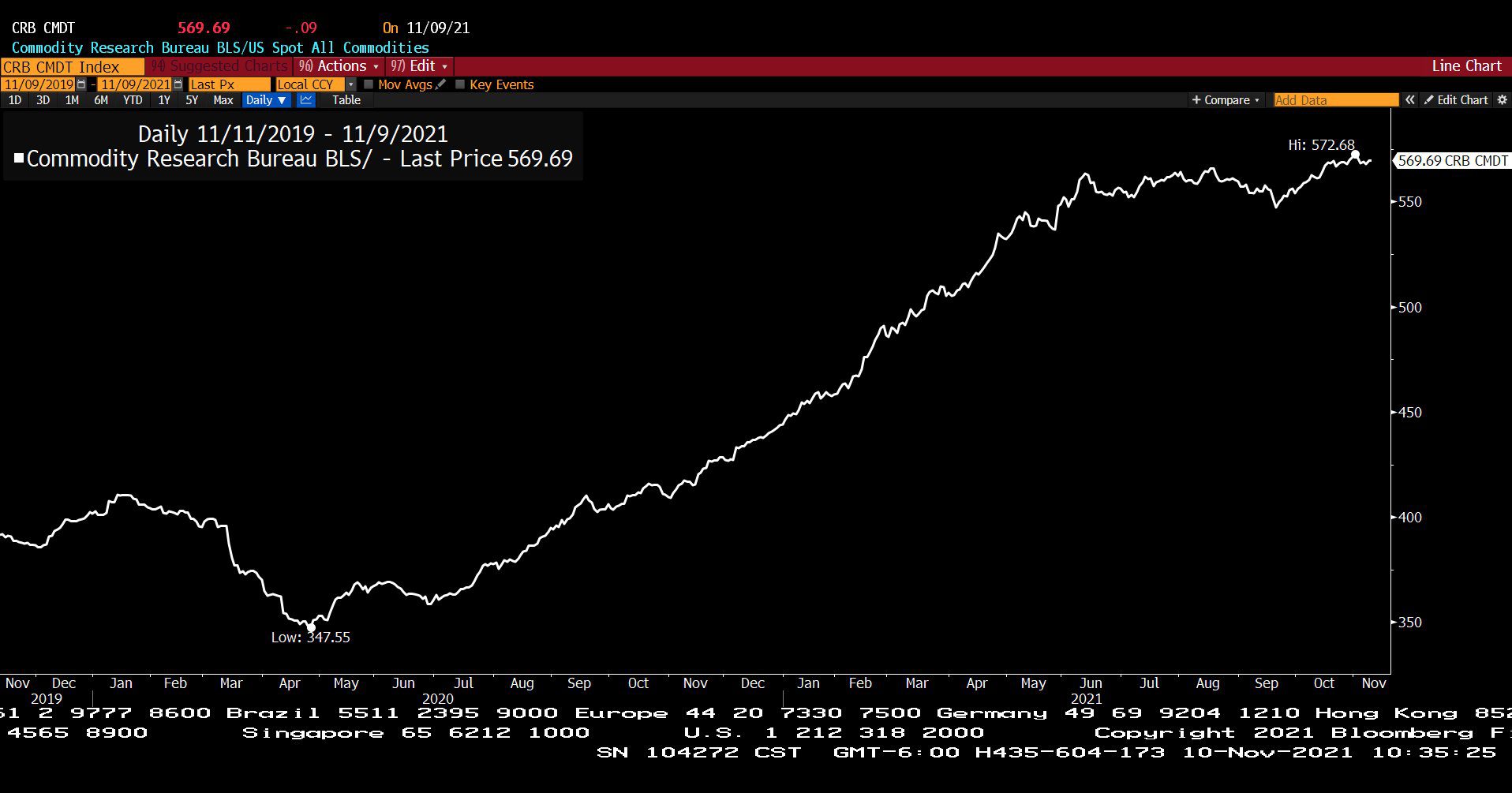

2. Demand Overwhelming Supply – Shortages and Commodity Spikes

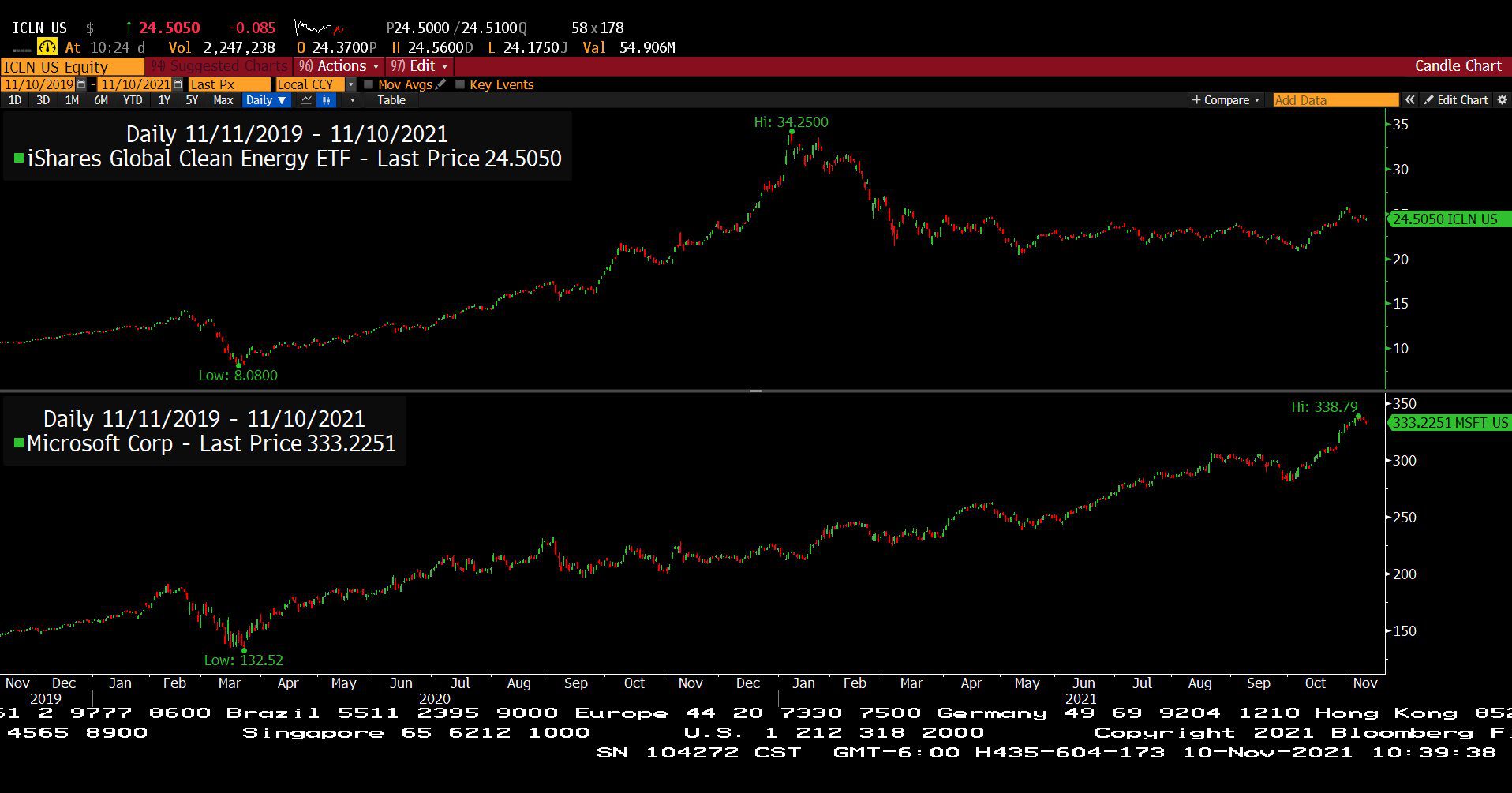

3. Global Energy Crisis: The Texas Energy Gold Rush – The Clean Technology Revolution

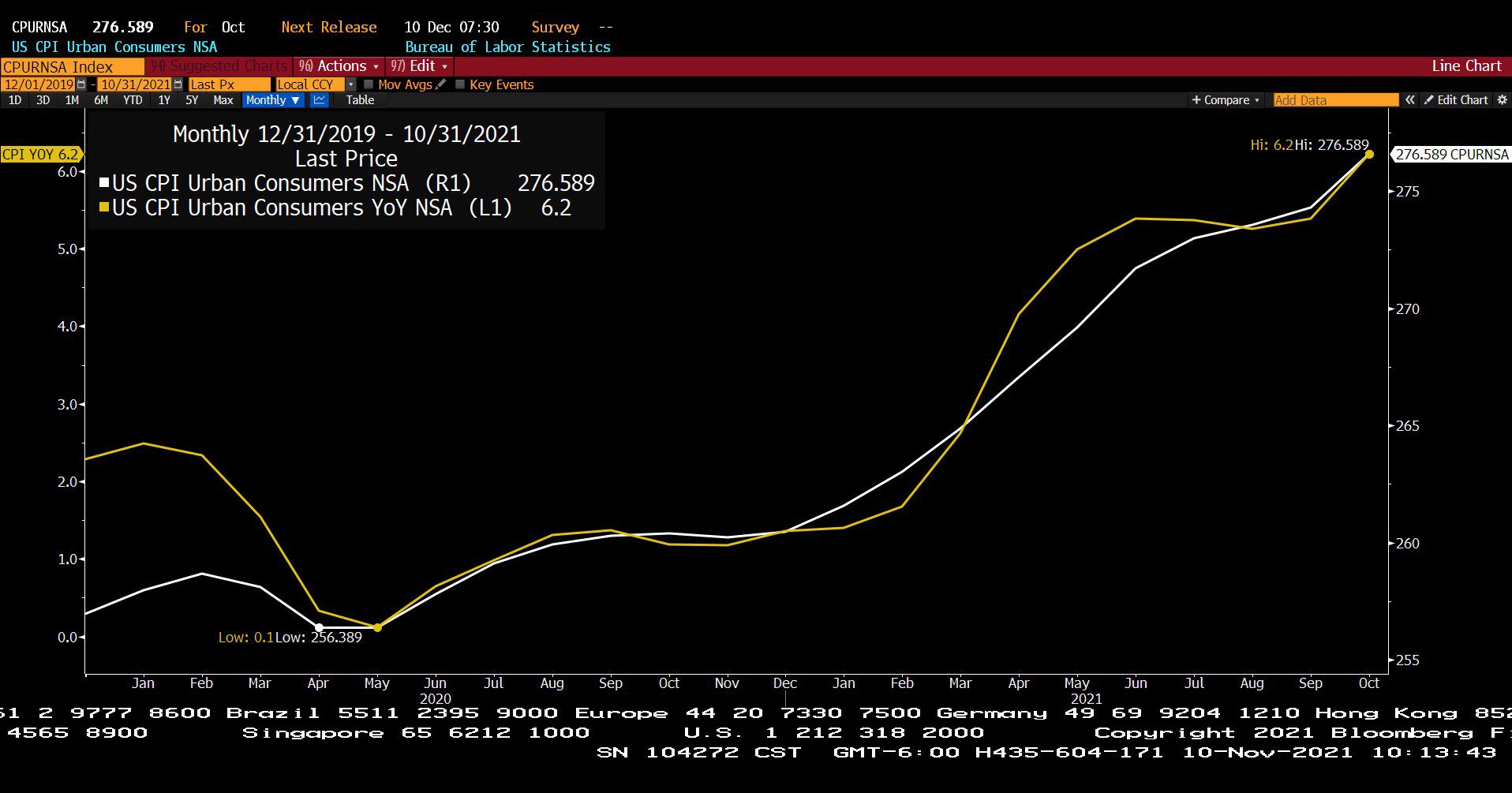

4. Inflation

5. Accelerating Digital Technology Revolutions

6. Capital Markets Innovations

7. Crypto Mania

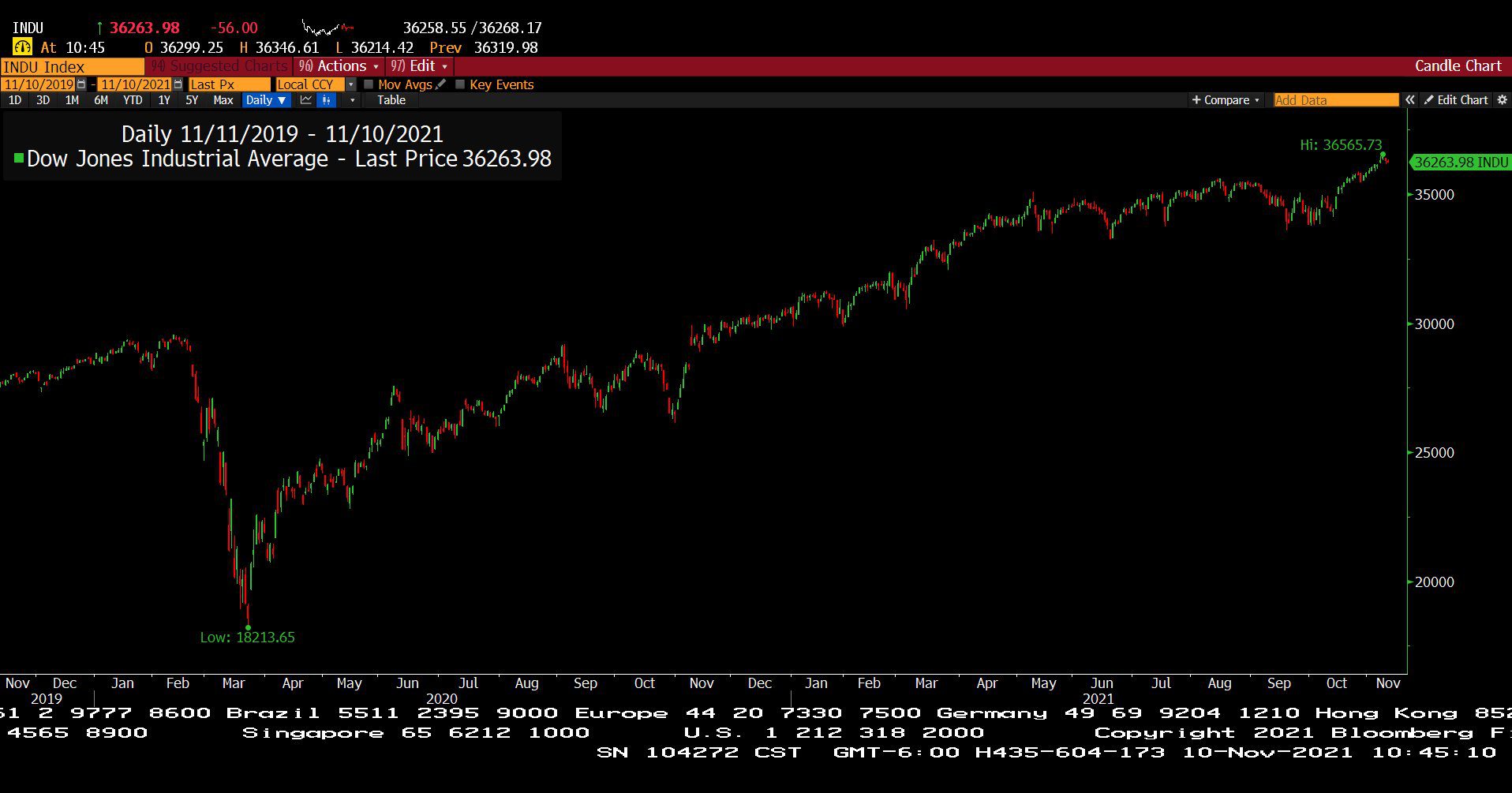

8. Raging Bull Market in Equities and Real Estate

9. Tax Planning Uncertainty

Headline Round Up

*Consumer Price Inflation Over 6% During the Past Year. October .9% Annualizing Double Digits?

*Red Hot Housing Leads to $63 Billion Cash Out Refi!

*Art is Hot! Pieces Could Go for 15x Asking Price?

*Oh Canada! Retail Cannabis Shops Filling Up Pandemic Real Estate Vacancies.

*Nvidia Up 50% in Under 2 Months!

*The Rise, Fall and Breakup of Blue Chip GE.

*Elon Musk Has a $15 Billion Tax Bill? Implications for the wealth tax discussion.

*China’s Property Values Dive. A warning sign?

*Building and Renting Single Family Homes Delivers Returns and Pulls in More Capital.

*China’s Nuclear Build Out Designed to Meet Climate Goals.

*Lithium Skyrockets!

*Rivian Automotive, Inc. Valued at Over $100 Billion? Ford and GM Valued at About $80 Billion.

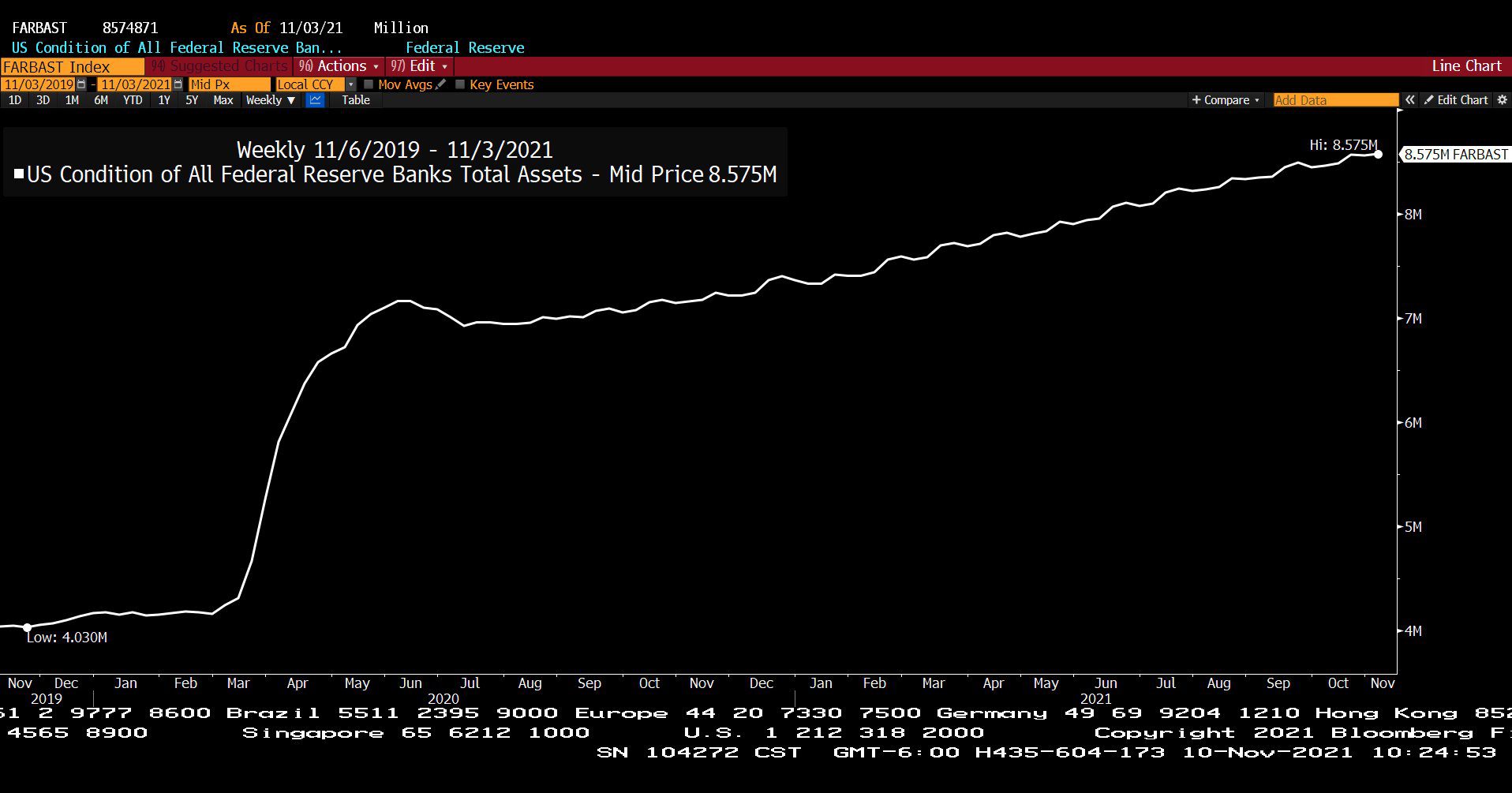

U.S. Condition of All Federal Reserver Banks Total Assets (11/06/2019 – 11/03/2021)

– Courtesy of Bloomberg LP

Commodity Researech Bureau Index (11/11/2019 – 11/09/2021)

– Courtesy of Bloomberg LP

Natural Gas Futures Contract Spot Price (11/11/2019 – 11/10/2021)

– Courtesy of Bloomberg LP

U.S. Consumer Price Index for Urban Consumers, Non Seasonally Adjusted & Year over Year, Non Seasonally Adjusted (12/31/2019 – 10/31/2021)

– Courtesy of Bloomberg LP

iShares Global Clean Energy ETF & Microsoft Corp. (11/11/2019 – 11/10/2021)

– Courtesy of Bloomberg LP

IPOX SPAC Index (07/30/2020 – 11/10/2021)

– Courtesy of Bloomberg LP

Bitcoin Currency Spot Price (11/10/2019 – 11/10/2021)

– Courtesy of Bloomberg LP

Dow Jones Industrial Average Index (11/11/2019 – 11/10/2021)

– Courtesy of Bloomberg LP

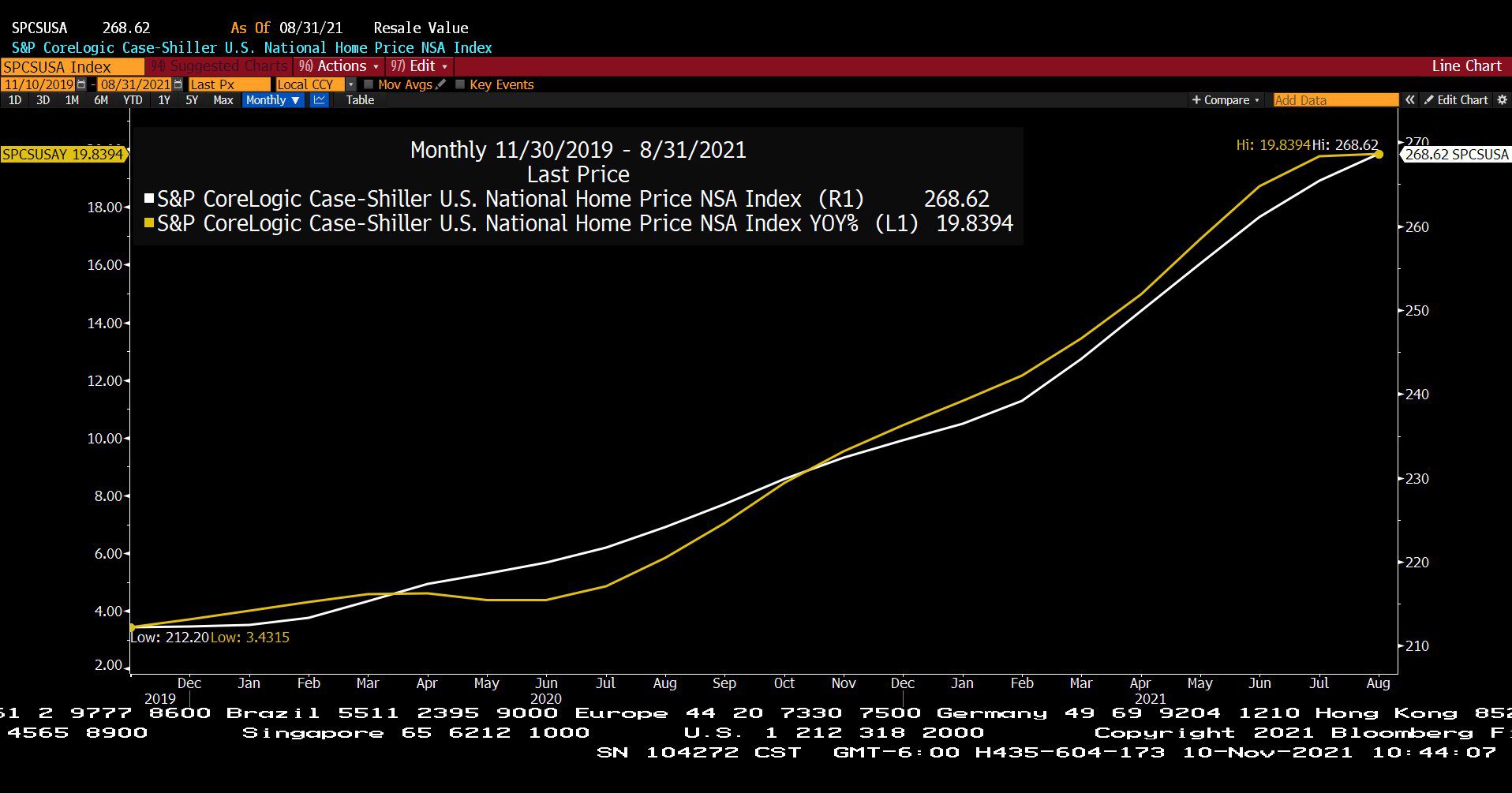

S&P Corelogic Case-Shiller U.S. National Home Price Index, Non Seasonally Adjusted & Year over Year (11/30/2019 – 08/31/2021)

– Courtesy of Bloomberg LP

Profit Report

5 Portfolio Constructions Themes for 2022!

Great Questions Can Be The Basis for Great Answers!