A: Another sell off in the financial markets ahead of the Federal Reserve raising Interest Rates combined with business preparing for slowing growth.

Q: If I cannot rely on a rally in the equity markets, what should I be doing?

A: Increase forward cash flow in assets that are undervalued.

Q: How are successful investors different from those that make big mistakes?

A: One major difference, The McGowanGroup sees, is an investor’s steadfast commitment to own great assets when attractively priced.

Q: Where could investors find some of the most attractive cash flowing investments right now?

A: Potentially Treasury Bills or Better.

Dow Jones Industrial Average (12/30/2022 – 02/24/2023)

– Courtesy of Bloomberg LP

Standard & Poor’s 500 Index (12/30/2022 – 02/24/2023)

– Courtesy of Bloomberg LP

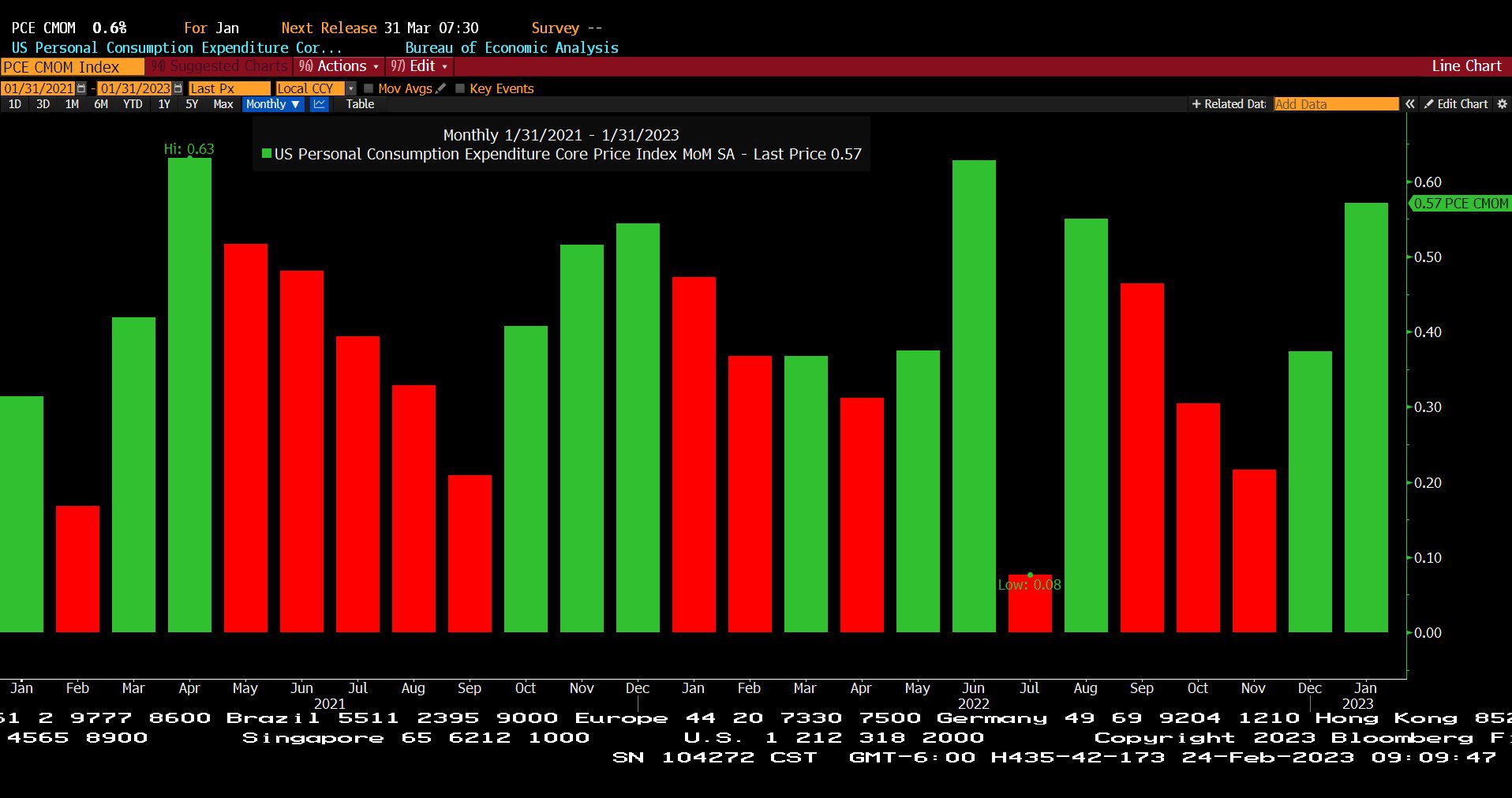

U.S. Personal Consumption Expenditure Core Price Index – Month Over Month, Seasonally Adjusted (01/31/2021 – 01/31/2023)

– Courtesy of Bloomberg LP

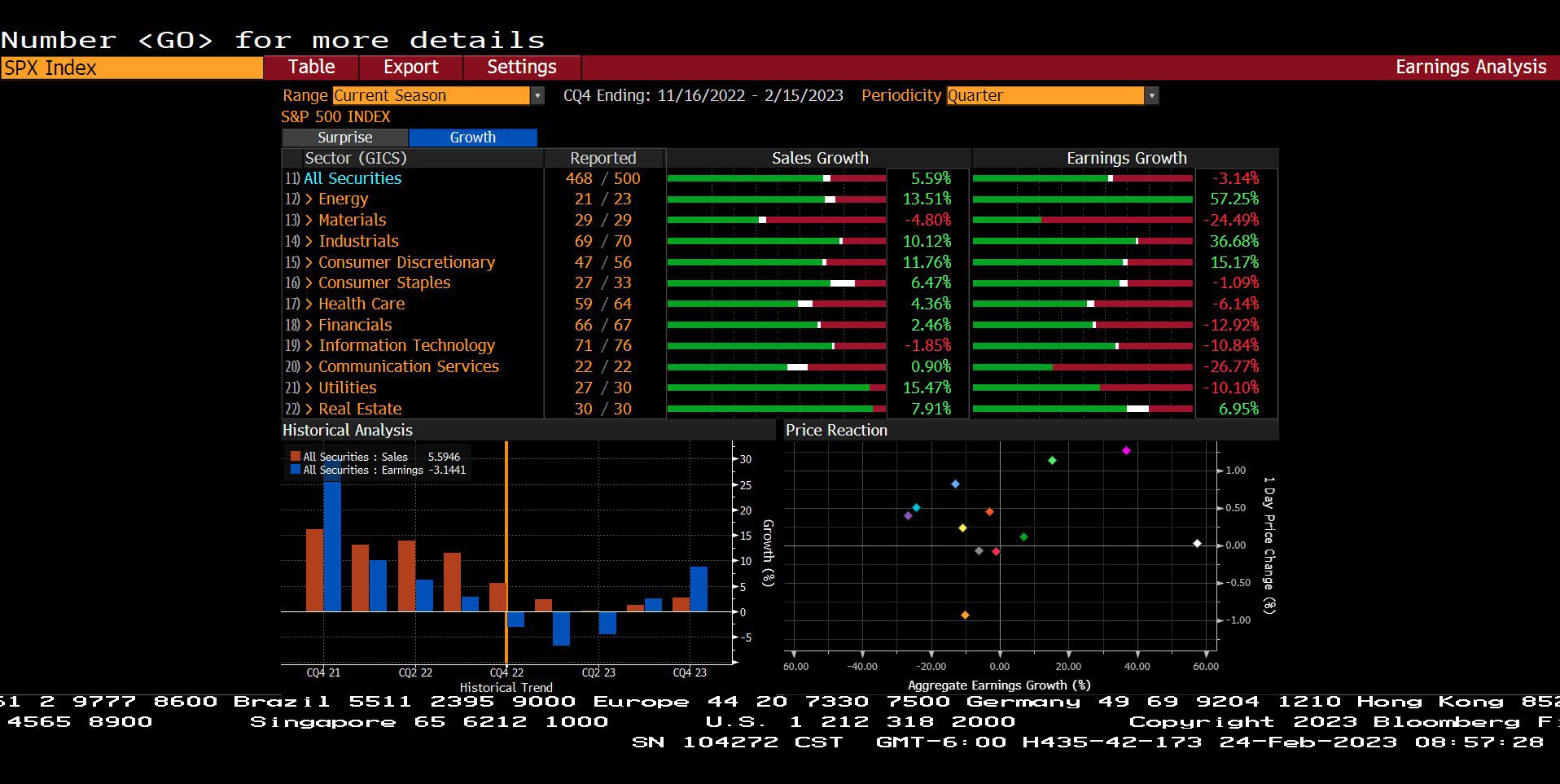

Standard & Poor’s 500 Index – Quarterly Earnings Analysis By Sector (11/16/2022 – 02/15/2023)

– Courtesy of Bloomberg LP

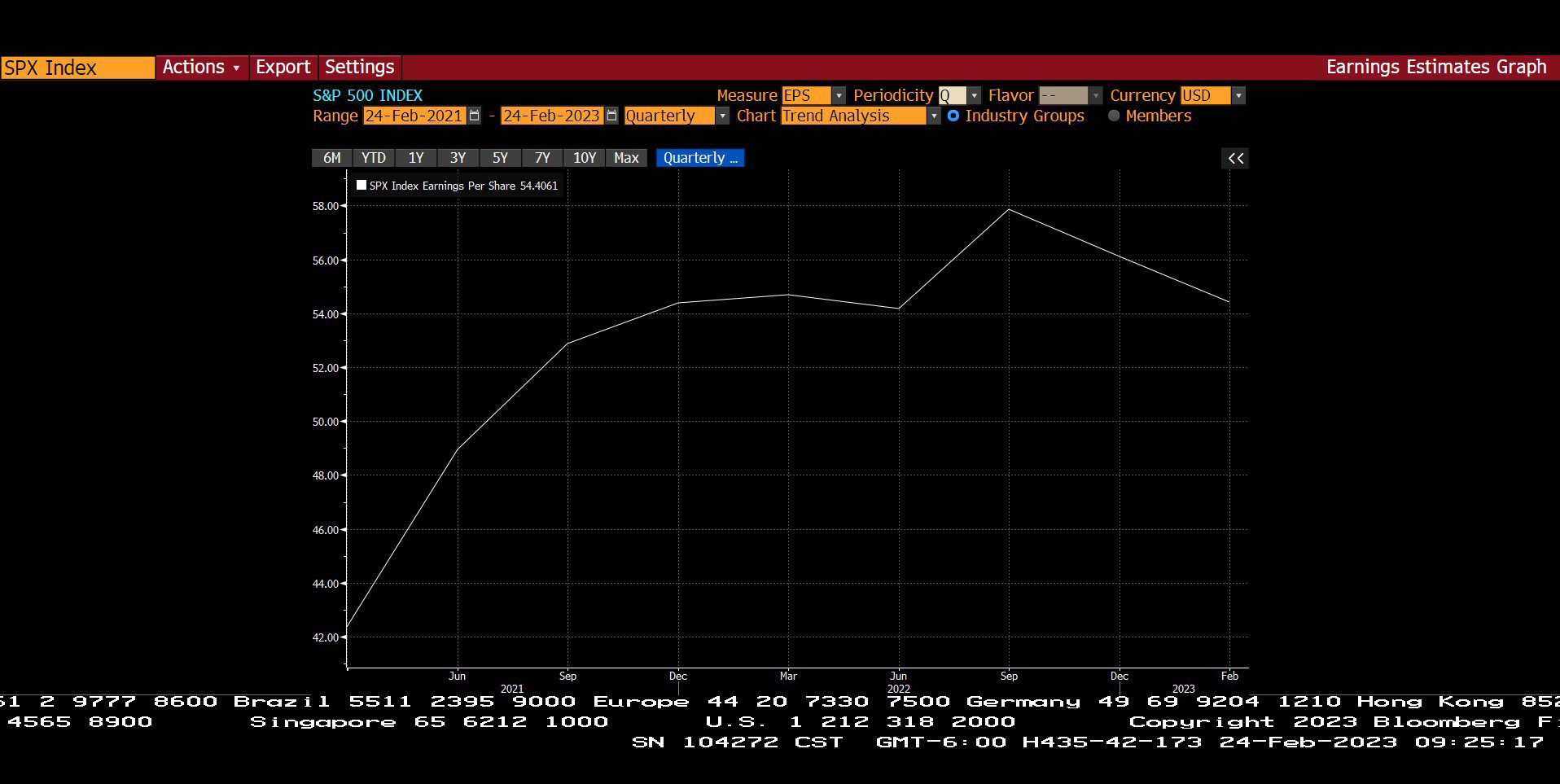

Standard & Poor’s 500 Index – Quarterly Earnings Estimates (02/24/2021 – 02/24/2023)

– Courtesy of Bloomberg LP

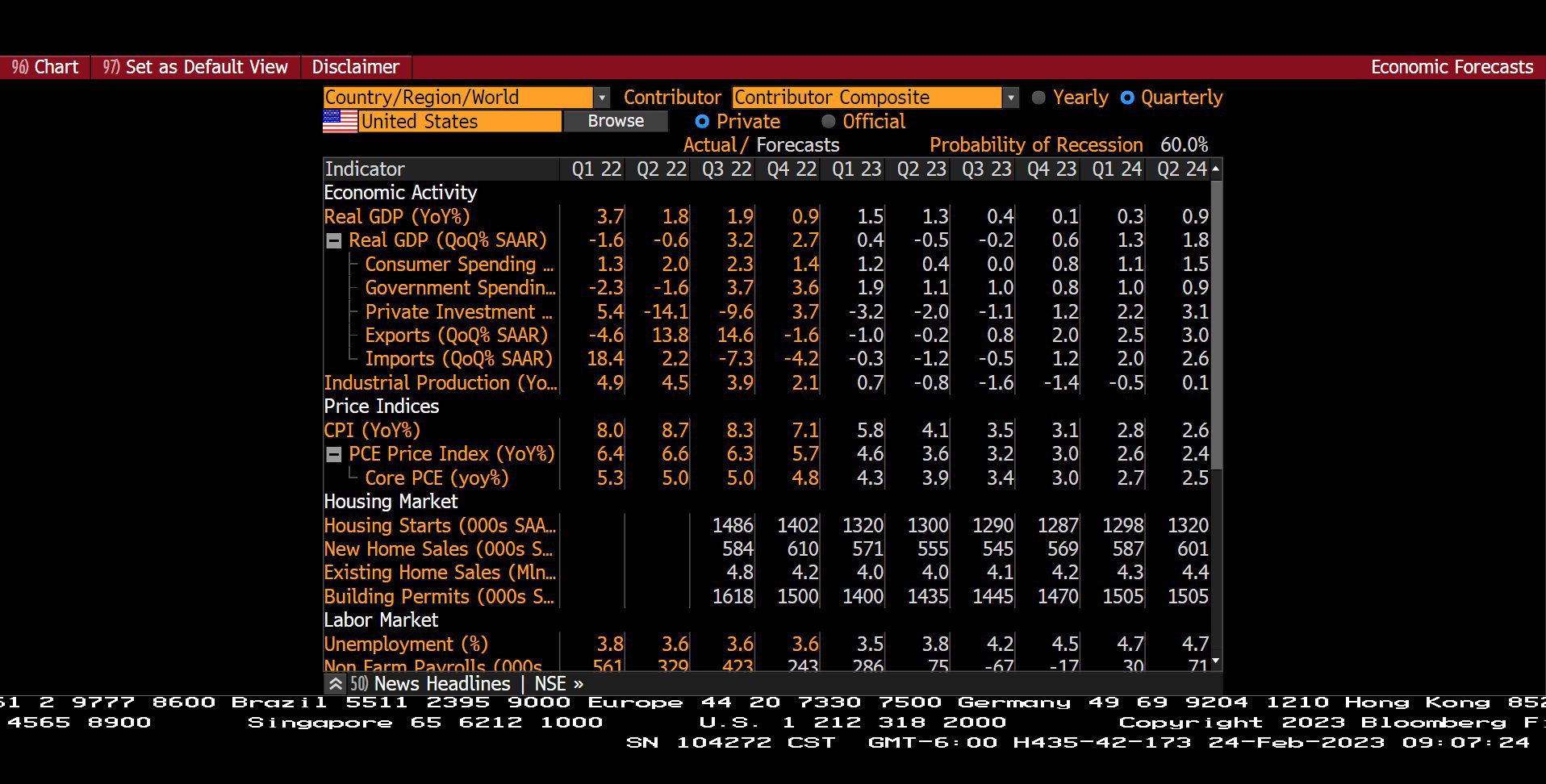

Quarterly U.S. Economic Forecasts With Probability of Recession (Q1 2022 – Q2 2024)

– Courtesy of Bloomberg LP

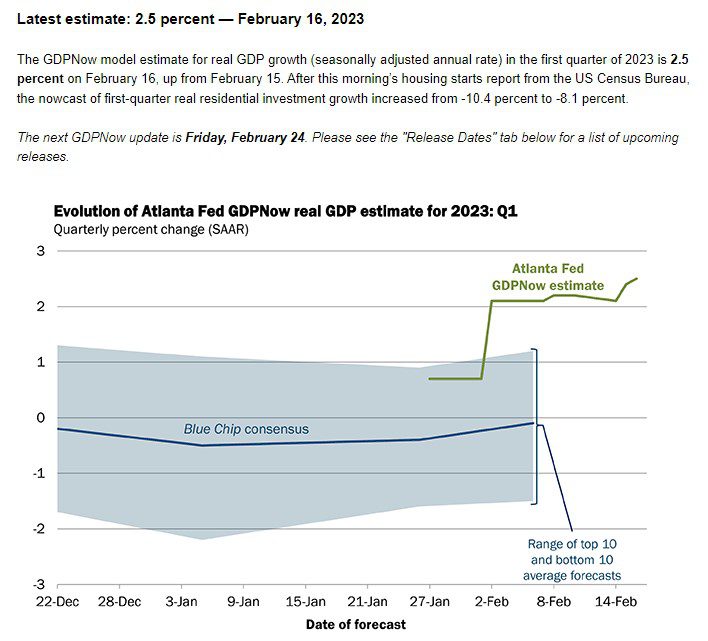

Evolution of Atlanta Fed GDPNow Real GDP Estimate for 2023 (02/16/2023)

– Courtesy of The Atlanta Federal Reserve

Headline Round Up

*Oil and Gas Companies Continue to Book Record Cash Flow and Profit, Again!

*Morgan Stanley Starts of the Week Declaring a “Death Zone?”

*Leuthold’s Chief Investment Strategist, Jim Paulsen, Says S&P 500 Will Hit 5000 in the Coming Year & This is the Start of a New Bull Market! Who will win the Sir John Templeton Award and who will win the Bozo Award?

*Nurse’s Side Hustle Banks $2 Million Net Profit Last Year!

*Vanguard “Not in the Game of Politics” and Refuses to Rule Out New Fossil Fuel Investments.

*Existing Home Sales Lowest Since October 2010.

*AI Writes A Great Article on Business Valuation!

*Global Oil Demand Record Hit in December 2022.

*Morgan Stanley Forecasts for Global Oil Demand Raised By 36% or an Increase to 1.9 Million Barrels Per Day by 2024.

*Natural Gas U.S. Glut Due to Weak Winter Heating Demand & Freak Industrial Outage.

*Kitchin Cycle Predicts Higher Oil and Gas Prices Potentially by Year End.

*Home Depot No Growth in Sales for First Time in 2023.

*Walmart Lowers Guidance After Good Results in Q4 2022. Weaker than expected outlook for 2023.

*Global High Yield Bond Spreads Highest Since 2009?

*Business Activity Stronger Than Expected in the U.S., Eurozone & U.K.!

*Germany Extends Nuclear Plants Poised to Close in 2022 Until April 2023.

Profit Report

Globally, How Far Have We Really Gotten With Alternative Energy?