Q: How are corporate earnings for Q3 2024?

A: With 25 out of 500 S&P companies reporting so far, earnings growth was over 7.3%. In Q2 earnings growth was at 11%.

Q: Is the equity market overpriced right now?

A: The McGowanGroup Investment Committee is finding that many companies have become overpriced relative to current growth and projections. We currently have harvest targets for significant positions in our model portfolios. Presently, Energy Infrastructure remains a relative bargain according to our calculations.

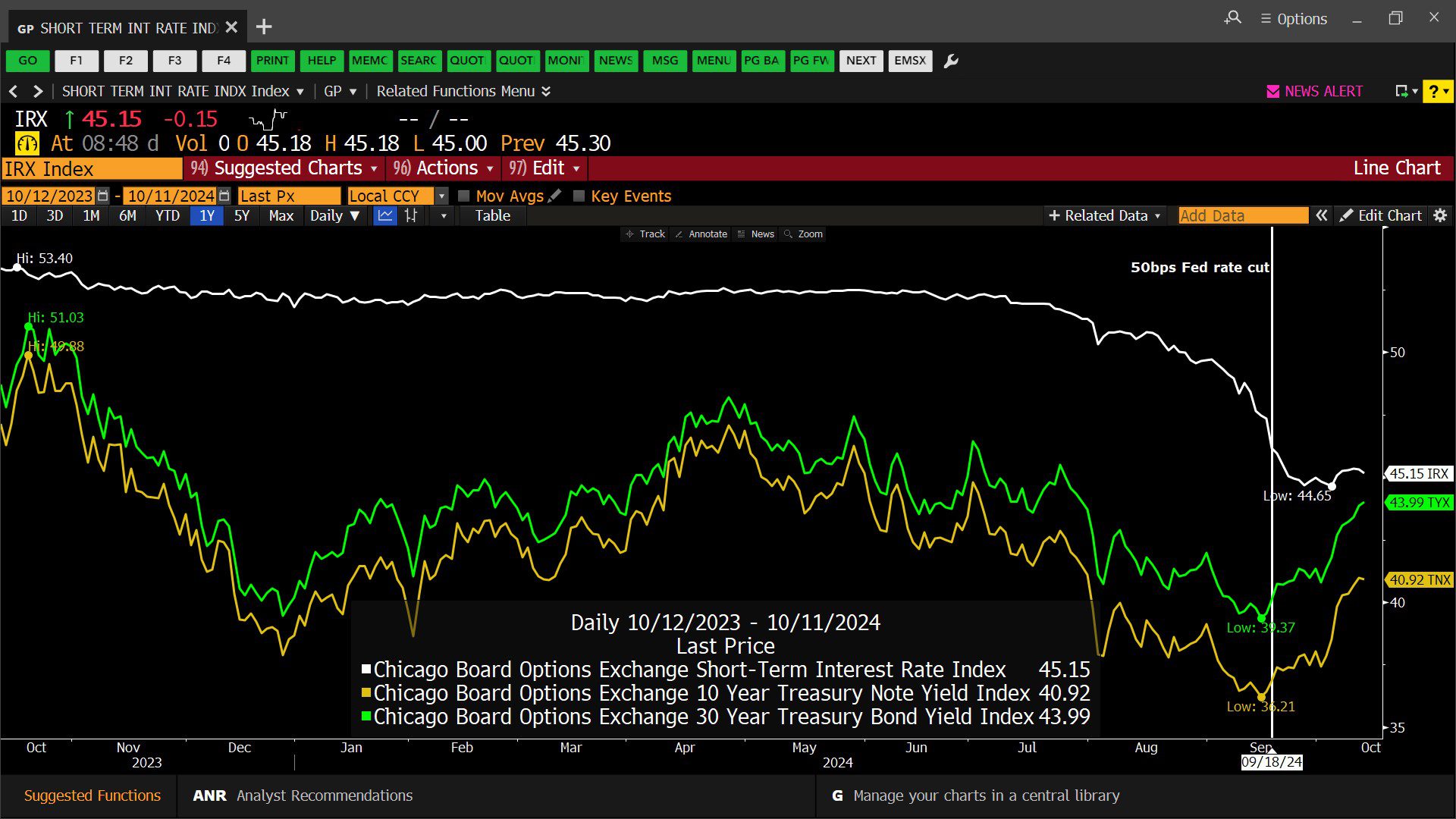

Q: The recent T-Bill rate moves appeared to predict the ½% rate cut before the Federal Reserve lowered the Fed Funds rate by ½%. With this in mind, what can recent moves in the U.S. Treasury bond market tell us about the Federal Reserve’s meetings on November 7th and December 18th?

A: After the interest rate cut, the mid-point of the target range in the overnight bank lending rate is 4.875%, yet the 90 day T-Bill rate is 4.64% indicating a possible rate cut of ¼% at the November 7th meeting and another one potentially after the December 18th session or subsequent meetings in Q1 2025.

Q: What is the McGowanGroup’s current Assets Under Management?

A: Just under $1 Billion as of September 30th, 2024!

Headline Round Up

*Clearview Energy Partners Predicts if Oil Flows in the Strait of Hormuz Are Blocked, Oil Could Spike $28 per Barrel.

*Top Uranium Producer Cameco Corp. CEO, Tim Gitzel, Says Growing Demand for Nuclear Power Presents the “Best Fundamentals I’ve Ever Seen for Nuclear in My 40 Year Career.”

*Healthcare Premiums Soar Even as Inflation Eases in 2024.

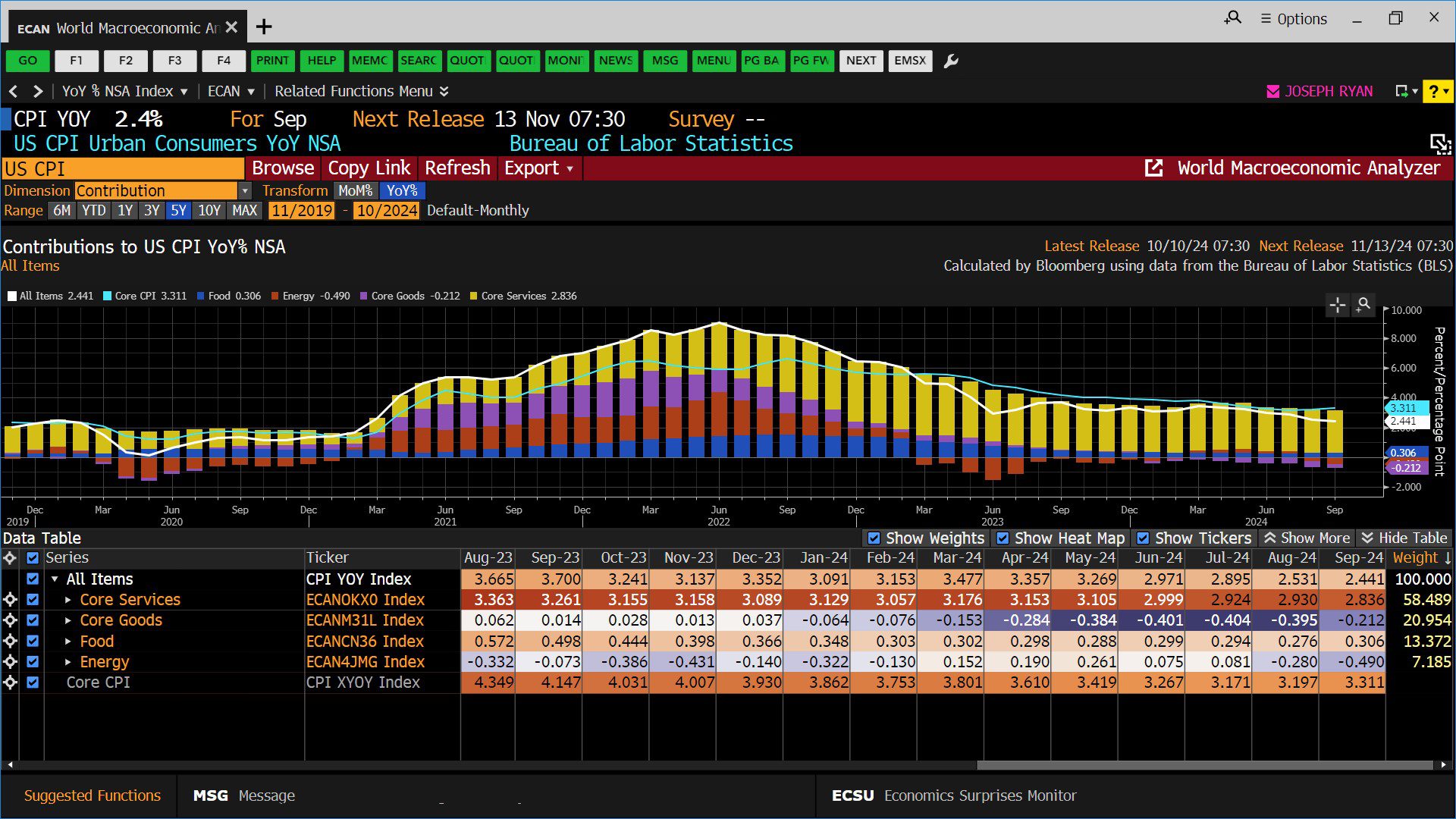

*Inflation at 2.4% for the Past Year in September.

*Lucid 3rd Quarter Quarterly Production Falls Missing Analyst Estimates.

*Rivian Blunders Supply Order & Now Slashes 2024 Output Goal?

*Duckhorn Wines to be Taken Private in 1.95 Billion All Cash Deal?

*New Dockworker Strike on January 15th if Automation Issue Isn’t Addressed?

*Facebook Meta Rolls out Artificial Intelligence (AI) Video Tool for Advertisers to Create New Ads.

*Mexico Turning Away from China in Bid to Curb Chinese Imports.

*Department of Justice (DoJ) Wants Google to Sell Off Parts of Its Business to Mitigate Its Search Dominance?

*AI Power Demand Spikes; Large Utility Stocks Rally.

*Latin American E-Commerce/Fintech Platform MercadoLibre Posts Record Argentinean Sales on Consumer Rebound.

*Reinsurance Stocks Pounded by Milton.

Dow Jones Industrial Average Index (12/29/2023 – 10/11/2024

– Courtesy of Bloomberg LP

U.S. Consumer Price Index – Urban Consumers Year over Year, Non Seasonally Adjusted (11/2019 – 10/2024)

– Courtesy of Bloomberg LP

Standard & Poor’s 500 Index – Quarterly Earnings Analysis by Sector (08/16/2024 – 11/15/2024)

– Courtesy of Bloomberg LP

Department of Energy’s Cushing Oklahoma Crude Oil Total Stocks (10/04/2014 – 10/04/2024)

– Courtesy of Bloomberg LP

Chicago Board Options Exchange – Short Term Interest Rate Index, 10 Year Treasury Note Yield Index, & 30 Year Treasury Bond Yield Index (10/12/2023 – 10/11/2024)

– Courtesy of Bloomberg LP

Department of Energy’s Crude Oil Total Inventory Data, Excluding Strategic Petroleum Reserve (10/04/2014 – 10/04/2024)

– Courtesy of Bloomberg LP

Profit Report

Investment Book Review: Timeless Principles from The Richest Man in Babylon.

The continued evolution of McGowanGroup Wealth Management investment plans.