Real economic growth in the first quarter of 2023 slowed to 1.1%. By 2024, economic growth is expected to reaccelerate according to Bloomberg projections.

Rampant Pessimism

The latest headlines featuring 3 bank failures, “looming recession,” reduced earnings, and bankruptcies of weaker zombie companies have led investors to one of the most remarkably cynical viewpoints that I have seen in my 37-year career. Predictions of a recession, so far, have not occurred. In fact, pessimism usually marks the beginning of the most profitable periods in financial markets: “Bull markets are born on pessimism, grown on skepticism, mature on optimism, and die on euphoria,” – Sir John Templeton.

What Is the “New” Definition of Inflation?

The definition of inflation has changed significantly since its first usage in the 1800s. For many years, it seemed to mean nearly anything besides what it refers to today. Initially, it described the growth of money specifically, not the impact of price growth. Now, when the term inflation is used, it’s generally recognized as a growth in prices that reflects the current economy. The Federal Reserve adjusted interest rates by .5% to control rising prices. While the most recent rate increase was smaller than the previous increases, according to officials, the central bank is still committed to getting prices under control. This increase came late in 2022, and the overall effort is meant to stabilize prices and, thus, the economy.

With so many Americans struggling with price increases, it’s no surprise that the Fed has raised interest rates more than seven times since March 2022. With leftover struggles from the pandemic and wider economic pressures, inflation is still staying fairly high, despite its recent decrease. The Fed’s overall goal of a 2% inflation rate remains in place.

Federal Reserve Tightening Up As Banks Fail

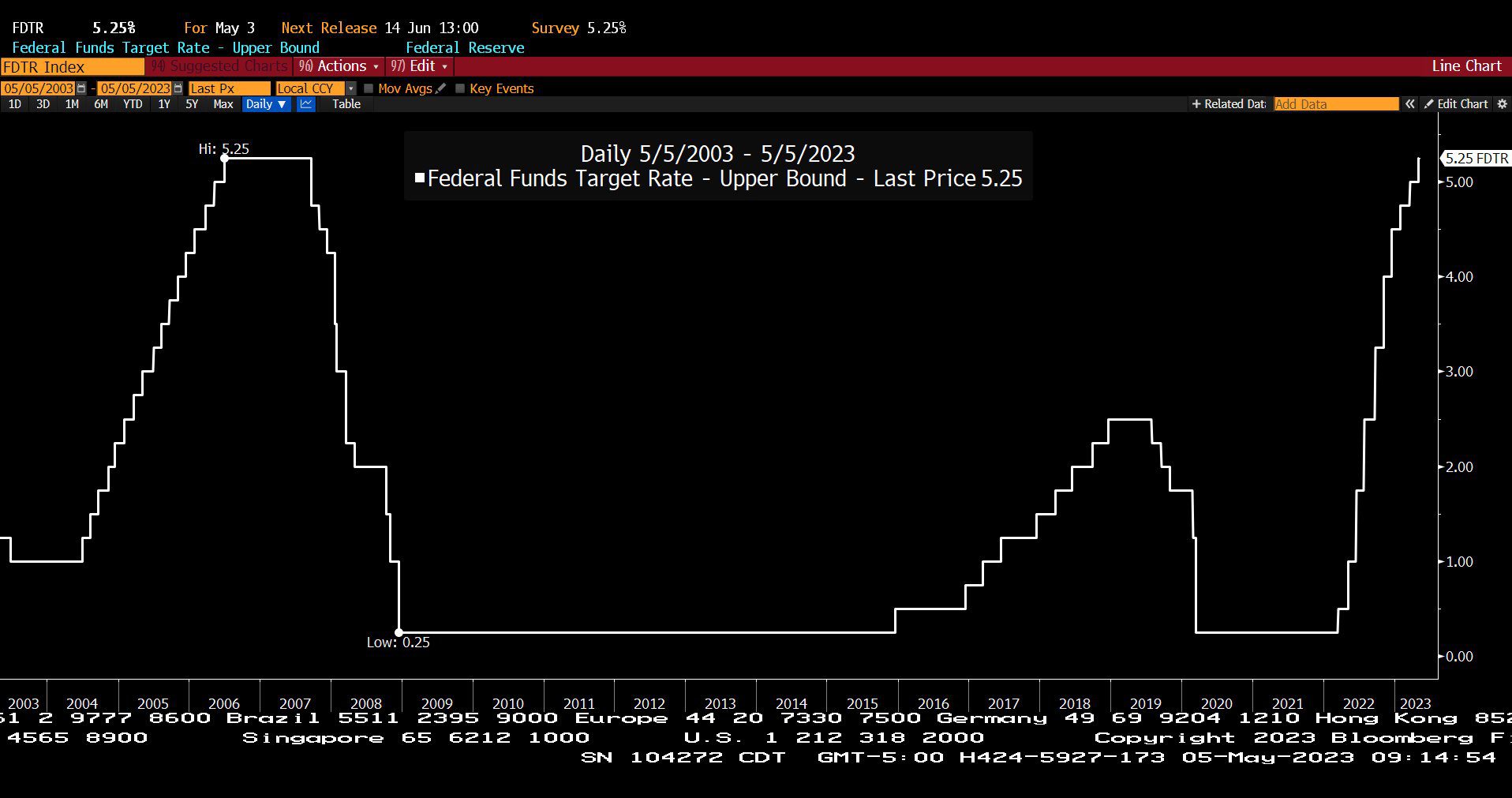

The Federal Reserve’s Interest Rate tightening cycle appears to be coming to an end. The Federal Reserve has essentially reached the “Volker Thesis” requiring the overnight bank lending rate to equal the trailing 12 months inflation rate to reduce forward inflation, essentially 5%. For 16 months, valuations have been compressed by the increase in cash interest rates.

The Federal Reserve is focusing on halting the economy in a continued effort to combat inflation. Beginning in March 2022, the Fed began fighting this issue with small interest rate increases, which have since maxed out at 5.25%. This makes it the highest rate since 2007.

The goal of the Fed is to create price stability, support long-term moderate interest rates, and keep the unemployment rate at a low level. All these things are typically indicators of a strong economy. The interest rate hike is working in an effort to achieve those three goals. Slowing inflation with interest rate increases is one tactic; however, a cut in those interest rates may be seen early this Fall. “The timing of a first-rate cut will depend both on how quickly inflation slows and how quickly the job market becomes less tight,” says Comerica Bank’s chief economist, Bill Adams.

The McGowanGroup Investment Committee

Our Investment Committee meets every Wednesday in person to discuss economic and market conditions, candidates for addition and deletion in our model portfolios, as well as our group brainstorming emails. Changes are made automatically to all portfolios depending on the discipline. The McGowanGroup firmly believes in “No client left behind; no dollar left behind.” The past 16 months, we have focused on increasing the cash flow of our portfolios along with improving forward gain potential.

Taking the above into account, The McGowanGroup believes that we are currently well positioned for outperformance.

Q: What is Mark to Market and how has it contributed to weakening bank capital ratios.

A: Mark to Market can present a figure for the current value of a company’s assets, based on what the company might receive under current market conditions. The Federal Reserve’s interest rate tightening cycle reduced the value of some loans and bonds in bank portfolios not marked as Held to Maturity.

Q: Why Would DR Horton, Inc. and Builders FirstSource, Inc. with earnings down 32% and 24%, Skyrocket 21% and 66% respectively in value so far in 2023?

A: Potentially because the stocks were priced under 5 times earnings.

Federal Funds Target Rate Index (05/05/2003 – 05/05/2023)

– Courtesy of Bloomberg LP

Dow Jones Industrial Average (12/30/2022 – 05/05/2023)

– Courtesy of Bloomberg LP

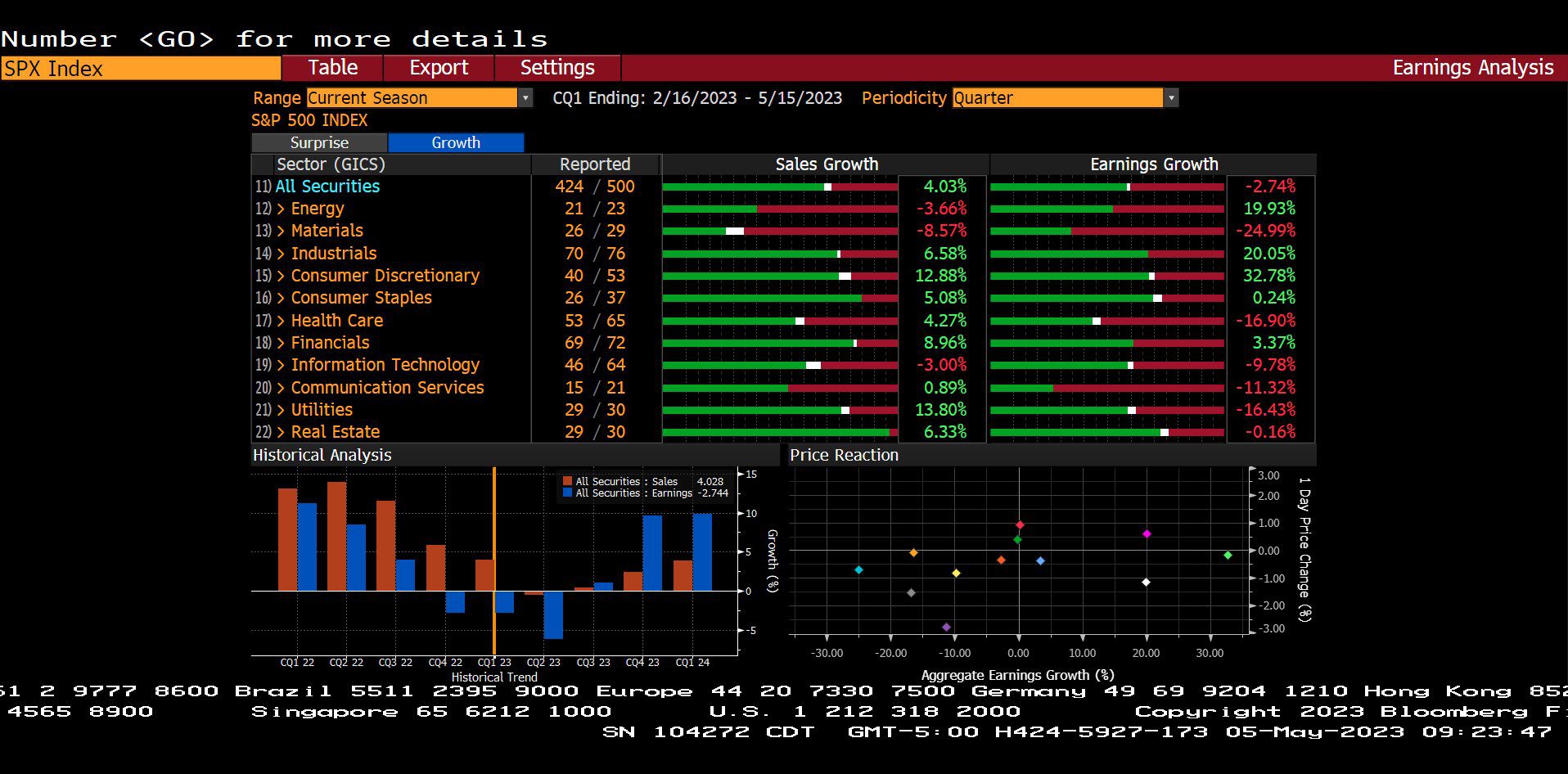

Standard & Poor’s 500 Index – Quarterly Earnings Analysis By Sector (02/16/2023 – 05/15/2023)

– Courtesy of Bloomberg LP

C.B.O.E. 10 Year Treasury Note Yield Index (05/05/2021 – 05/05/2023)

– Courtesy of Bloomberg LP

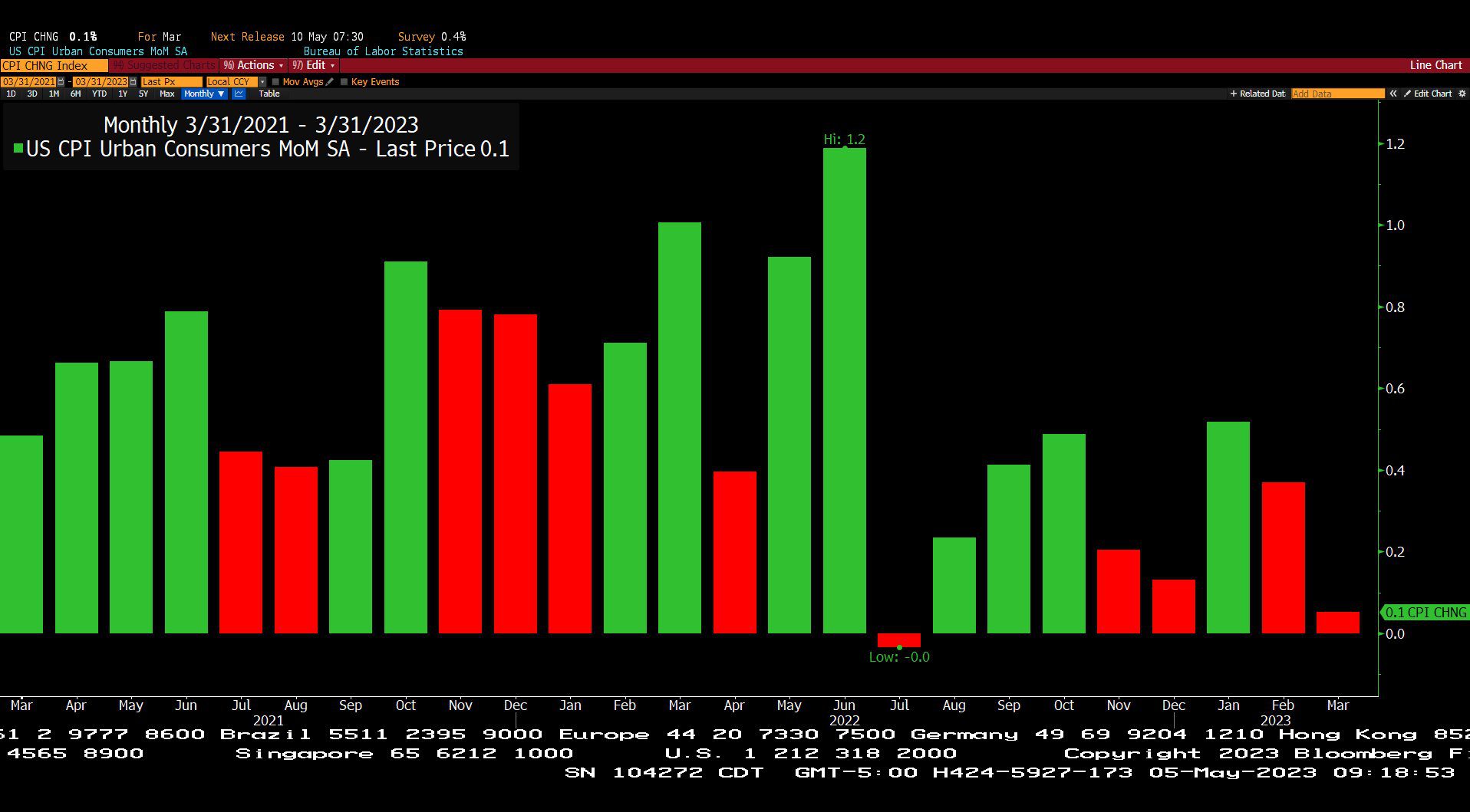

U.S. Consumer Price Index – Urban Consumers Month over Month, Seasonally Adjusted (03/31/2021 – 03/31/2023)

– Courtesy of Bloomberg LP

Headline Round Up

*U.S. Job Market Still Strong!

*Janet Yellen Yellin’ About June 1st Default! Skips right over partial government shutdown.

*Federal Reserve Raises Interest Rates to 16 Year High Over 5% and Pauses?

*Jamie Dimon Gets a Bargain in First Republic Bank!

*Regional Banks Plunge as PacWest Down 70% in a Week.

*Big Tech Earnings Spark Hope That Worst of the Post Pandemic Hangover is Over.

*Eli Lily & Co. and Novo Nordisk Rise Steeply on Demand for Slimming Drug.

*SolarEdge Technologies, Inc. Earnings Per Share More than Doubles!

*Westinghouse Electric Co. Unveils Plans for First Small Modular Nuclear Reactor.

*Carl’s Icahn Enterprises Called “Ponzi-like” by Hindenburg Research.

*Bad Behavior: Iran Seizes a Second Oil Tanker!

*Energy Transfer LP’s Current Annualized Free Cash Flow Over $8 Billion.

*Valero Energy Triples Profit as Refining Margins Strong!

*Enterprise Products and Cheniere Energy, Inc. Beat Estimates.

*Midland Booms, But City Government Fiddles. Inability or refusal to invest in city infrastructure?

*Shell PLC Posts Record Profit in Q1!

Profit Report

-

The Republican House Passes DOA Debt-Ceiling Bill.