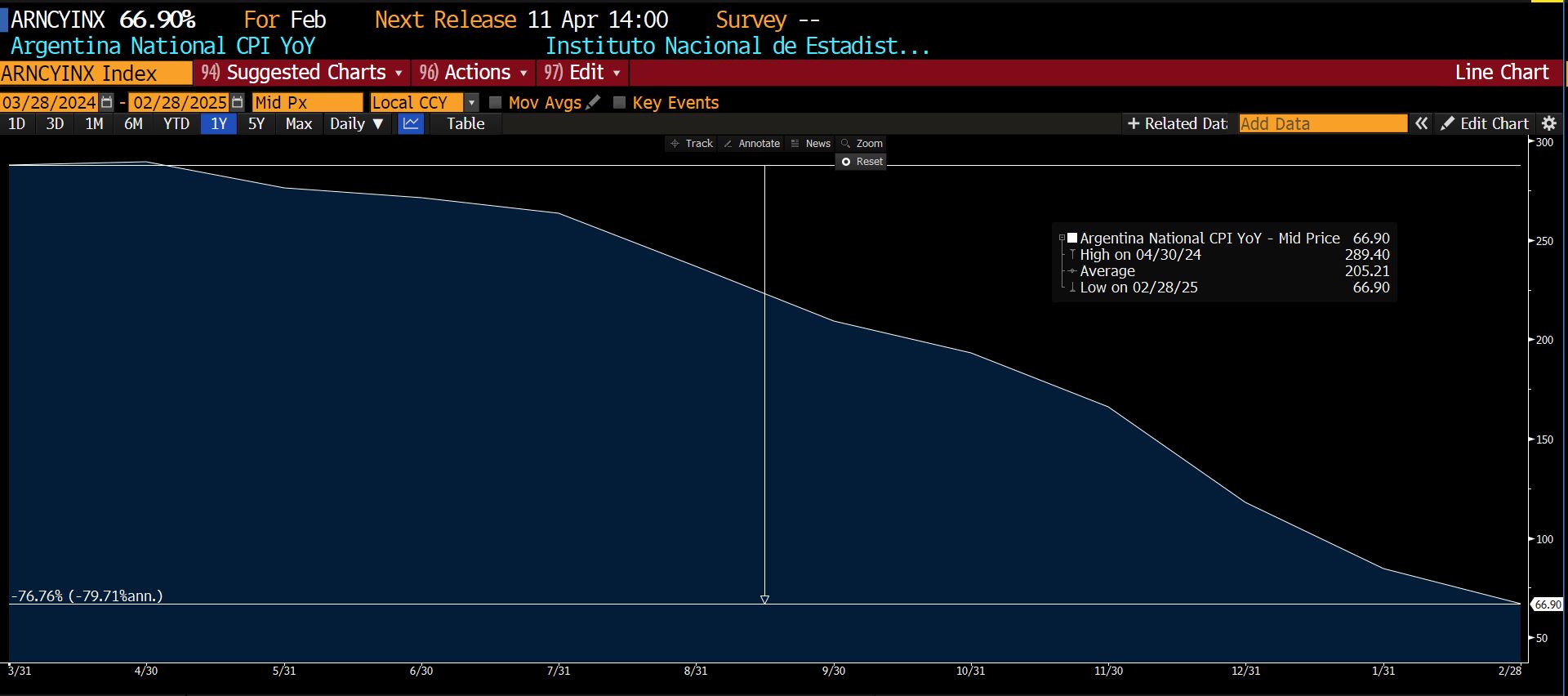

Q: Was the first quarter of 2025 an economic contraction for the U.S. economy?

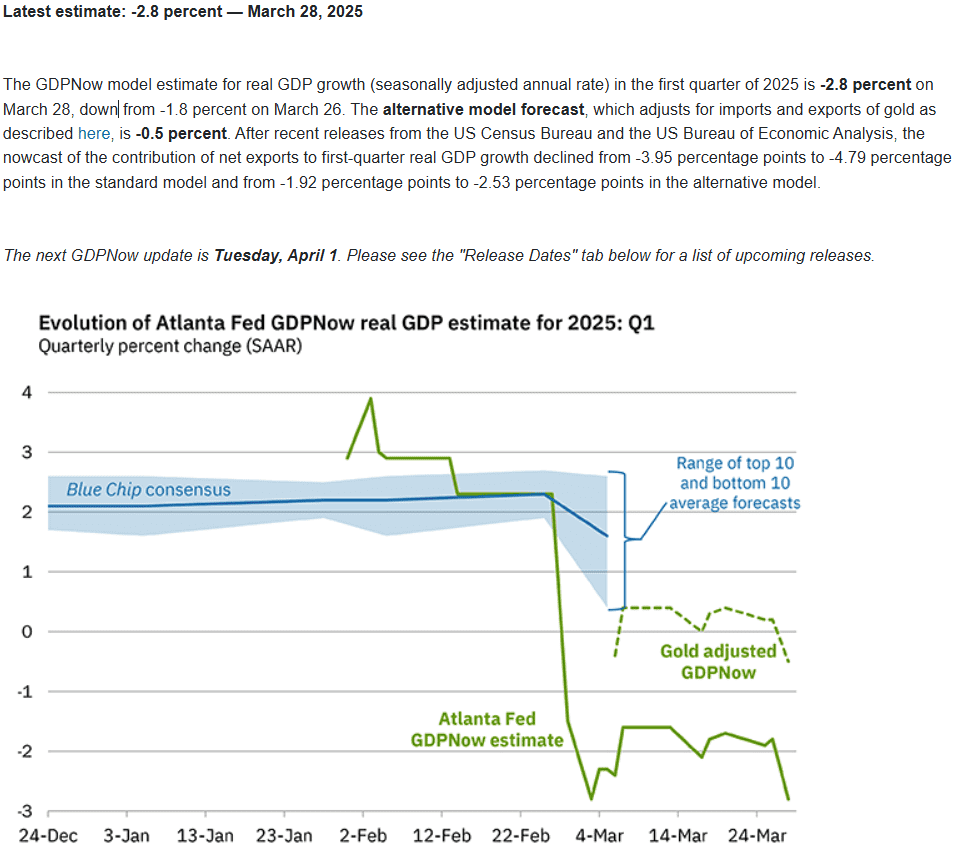

Q: What are some things that happened to Argentina’s stock market after the government spending cuts driven Recession?

Q: What is some of the potential good news for investors regarding the financial markets in 2025 & 2026?

Join Us for The Latest Financial Headlines and Valuable Research from The McGowanGroup. Built for Investors by Experienced Portfolio Managers!

Click here to get the monthly newsletter

2025 Q2 McGowanGroup Wealth Management Client Updates

Spring and Summer Planning Season!

“It’s better to start with a plan than end in a panic.”

During our spring and summer client reviews, our Wealth Managers are happy to share McGowanGroup’s updates to our Tax & Estate Planning process with your CPAs and Attorneys. In fact, McGowanGroup is proud to have evolved our Estate processing checklist, as a guide, to ensure that we provide Excellence in Service as your trusted financial partner. Please do not hesitate to ask how the McGowanGroup can help with your financial planning!

Q1 2025

What was that? – Tariff Chaos, and Overdue Equity Market Corrections.

Recently, an official 10% correction has taken place in the S&P 500 Index and the Dow Jones Industrial Average Index from all-time market highs set at the end of the January. The Magnificent 7 tech leaders fulfilled an official Bear Market definition falling over 20% from December 18th, 2024. Potential selling catalysts appeared to be tariff threats combined with potential deep government spending cuts from the new administration.

Additionally, money flows into Value sectors included Oil and Gas positions along with pipeline infrastructure. The S&P 500 Energy Index was up approximately 8% during the first quarter. Even as major indexes dipped into negative territory, our managed portfolios overall remained resilient and profitable during this time.

2025 and 2026

DOGE Recession? – Current Economic Growth

The Atlanta Federal Reserve’s Real GDPNow number estimates Q1 2024 growth at a recessionary -1.8% (03/26/2025). The website acknowledges, “There are no subjective adjustments made to GDPNow—the estimate is based solely on the mathematical results of the model,” but the final numbers for economic growth and contraction will be important going forward. It is also important to remember that government spending cuts could create a “Stealth Recession” from reduced spending and borrowing.

Expected profit growth – Bloomberg’s recent consensus estimates for 2025 S&P 500 Index profit growth are approximately 10% for 2025 and above 13.5% for 2026.

The First quarter brought the new administration with intended policy changes that include Deregulation, Lower Taxes, Reduced Government waste with spending discipline. Tariff negotiations appear designed to gain national advantages for the United States and U.S. companies with outcomes yet to be seen.

The Second quarter will provide an upgraded review platform and client portal! Your Wealth Manager will incorporate tours of the upgraded systems and formats. Our investment in upgraded systems captures the advantages of advanced applied technology in allocation strategy as well as performance reporting.

I believe the Third quarter can bring clear advances for investors with increased corporate productivity, likely corresponding increased profits, along with potential reduced inflation from intended government spending reduction.

Energy and Artificial Intelligence

Data center expansion is likely the first phase of capabilities to improve efficiency. The initial wave of upgrades delivered attractive growth for the Artificial Intelligence (AI) technology supply chain. The resulting increases in electricity demand have led to rallies in the Utilities Sector, Nuclear, and Natural Gas.

Energy Infrastructure

Rising dividends and stock buybacks underscore attractive opportunities for investors. Deregulation possibly leads to increased business productivity and profit growth. Liquid natural gas export capacity is on track to double by the end of 2028 according to the U.S. Energy Information Administration. The pipelines and export facilities still appear underpriced relative to other sectors. Data center electricity demand is an obvious choice for natural gas power generation. Unfortunately, current geopolitical situations could result in energy supply disruptions including Iranian oil export sanctions enforcement.

Bond Market Impacts

Global High Yield Bond fund prices remained resilient during the long rate spike with a current overall yield near 9%. Premium prices could result in gain harvesting to increase “dry gun powder” for bargains in other areas of the markets. The higher, longer yields likely create more choices in other parts of the bond market like Tax Free Municipals. Meaningful deficit reduction could result eventually in lower long-term rates and potential gains in longer duration bonds.

Our Next Steps

The McGowanGroup Investment Committee (IC) meets each Wednesday morning to review and upgrade the model portfolios using an impressive, evolving, research process. Equity market rallies provide investors the opportunity to raise Tactical Safety for future resilience especially as valuation targets and underperformers are harvested systemically. Pullbacks in market values for equity provides the opportunity to add high cash flow assets at attractive prices. Our efforts to raise Tactical Safety during rallies allows the IC to allocate to great cash flowing assets in the next correction, gaining potential advantages for the long term.

We remain committed to the mission of Superior Client Profits Through Excellence in Service. Thank you for allowing us to serve you and your family!

Spencer McGowan and The Team That Cares,

McGowanGroup Wealth Management

Headline Round Up

*No Indication of a Recession in Sight Says Treasury Secretary Scott Bessent While Federal Reserve Chairman Jerome Powell Says Economy is in Quite a Good Place.

*Investment Commitments in U.S. Near $3 Trillion Since New Administration?

*Dallas Home Prices Lag U.S. Average & Deals on Unsold Spec Homes a Potential Economic Drag?

*New 25% Tariff on Imported Vehicles & GM and Stellantis Share Prices Smacked!

*China’s Industrial Profits Shrink vs 9% Year over Year Increase Forecast. Worrying sign for the U.S. economy?

*U.S. Car Repossessions Surge to Highest Level Since 2009?

*Chief Strategist, Bhanu Baweja, at UBS Says “Visibly Tiring” U.S. Consumer Setting the Stage for Another 8% S&P 500 Index Downside?

*Junk Bonds Now Majority Rated at BB Category as Private Credit Absorbs Risk.

*Your DNA Data Up for Sale? 23andMe Proposes Auction for Assets Including Genetic Data of 15 Million People!

*Park Avenue is Back! $200 Per Square Foot Office Rent, 3X That of Rent in Dallas Uptown. Hello TXSE, NYSE, NASDAQ!

*Ray Dalio Goes to Washington to Warn Congress About Deficits!

*2024: Tale of Two States as Texas’s Jobs Boom vs California’s Jobs Bust.

*Economic Growth Depends on Electricity! “No Single Power Source Will Reliably Serve Our Customers”, Says Dominion Spokesman Aaron Ruby, “We Need Nuclear, We Need Natural Gas, We Need Renewables”.

*Nuclear Reactor Company Terrestrial Energy to go Public Via SPAC.

*Shell Vows to Raise Investor Returns as World’s Top Trader of Liquified Natural Gas (LNG).

*Copper Prices Spikes on Tariff Plans & Long Term Shortages Loom on Declining Output.

*Solar Capacity Surges This Past Decade on Falling Costs, Policy Support & Rising Demand.

*JPMorgan Generates Truly Random Numbers in First with Honeywell’s Quantinuum Quantum Computer!

*D-Wave Claims “Quantum Supremacy” Beating Traditional Computers.

*AI (Artificial Intelligence) Datacenter Bubble? Alibaba’s Chairman, Joe Tsai, Warns & Microsoft Cuts Back on Datacenter Projects Due to Oversupply Concerns of AI computers.

The Atlanta Federal Reserve GDPNow Real GDP Estimate for Q1 2025 (03/28/2025)

– Courtesy of The Atlanta Federal Reserve

Invesco QQQ Trust Series 1 – Daily (12/31/204 – 03/28/2025)

– Courtesy of Bloomberg LP

Standard & Poor’s 500 Index – Daily (12/31/2024 – 03/28/2025)

– Courtesy of Bloomberg LP

Energy Select Sector SPDR Fund – Daily (12/31/2024 – 03/28/2025)

– Courtesy of Bloomberg LP

Global X MSCI Argentina ETF (Exchange Traded Fund) (11/10/2023 – 03/28/2025)

– Courtesy of Bloomberg LP

Argentina National Consumer Price Index, Year over Year (03/28/2024 – 02/28/2025)

– Courtesy of Bloomberg LP