Q: What are the latest updates on the U.S. debt ceiling and default debates?

A: In a shocking moment of common sense, President Joe Biden and House Speaker Kevin McCarthy say the U.S. won’t default. Improv theater debates continue.

Q: What is likely to happen in the financial markets between now and the end of July?

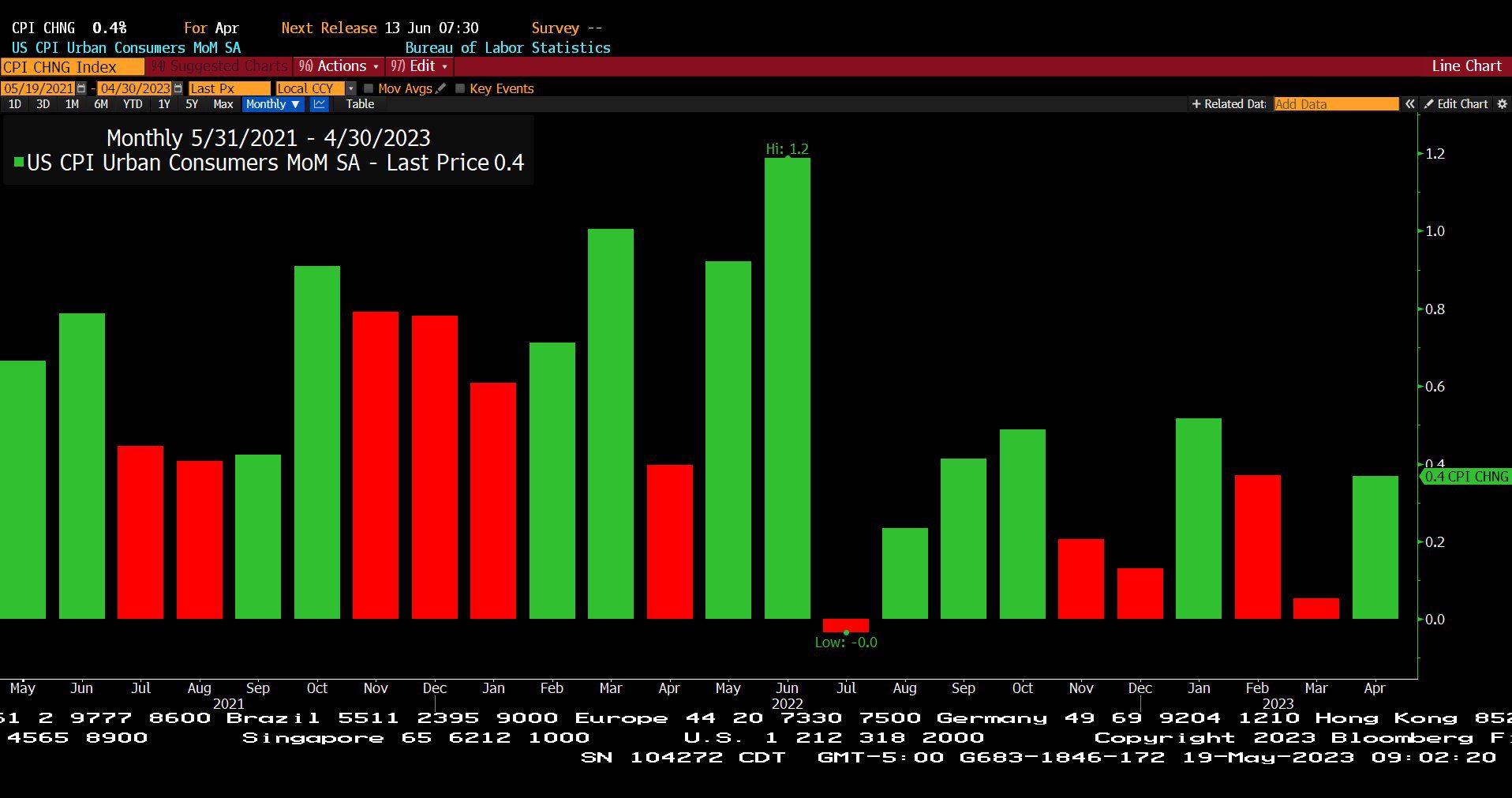

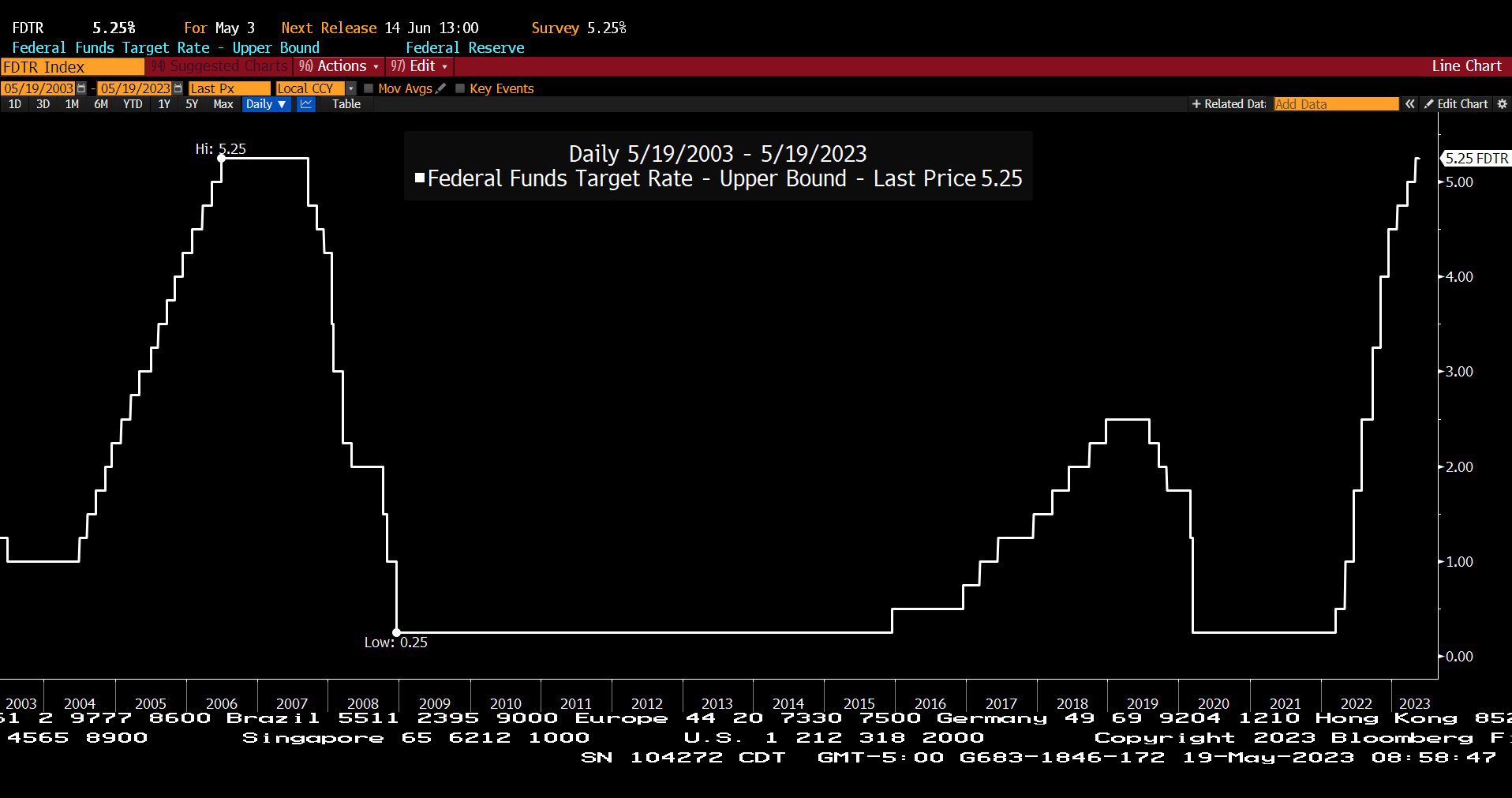

A: The Inflation numbers for May and June of 2022, the largest and 4th largest months of inflation in the current cycle, drop off the trailing 12 month measure. By mid-July, the inflation rate could fall significantly below 4.9% and below the current Federal funds rate of 5.25%.

Q: What were some of the financial market high points discussed this week at the McGowanGroup Wealth Management (MGWM) Investment Committee?

A: Stay tuned for this week’s NetWorth Radio Show!

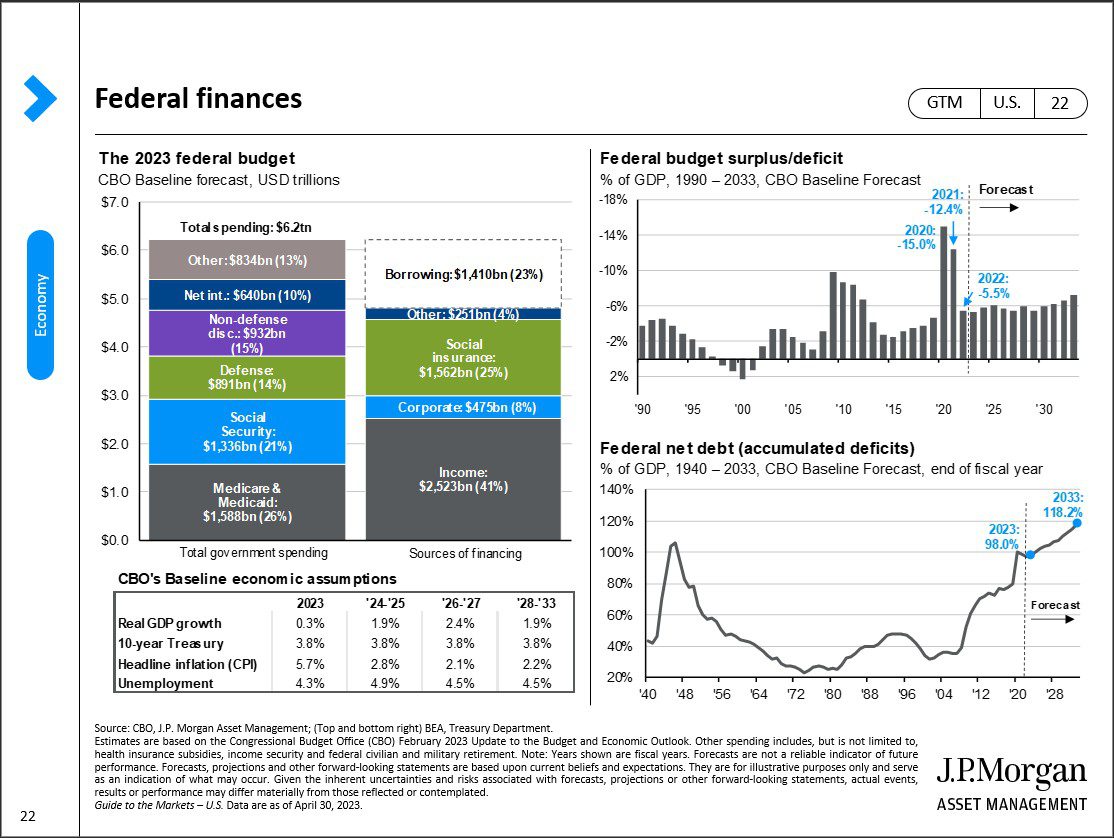

J.P.Morgan Guide to the Markets 2nd Quarter 2023, pg. 22 (04/30/2023)

– Courtesy of J.P.Morgan Asset Management

Dow Jones Industrial Average (12/30/2022 – 05/19/2023)

– Courtesy of Bloomberg LP

Evolution of Atlanta Fed GDPNow Real GDP Estimate for 2023 – Q2 (05/17/2023)

– Courtesy of The Atlanta Federal Reserve

U.S. Consumer Price Index – Urban Consumers Month over Month, Seasonally Adjusted (05/19/2021 – 04/30/2023)

– Courtesy of Bloomberg LP

U.S. Consumer Price Index – Urban Consumers Year over Year, Non Seasonally Adjusted (05/19/2021 – 04/30/2023)

– Courtesy of Bloomberg LP

U.S. New York Federal Reserve Index – Transition Serious Delinquency 90+ For Auto Loans by All Ages (03/31/2008 – 03/31/2023)

– Courtesy of Bloomberg LP

U.S. New York Federal Reserve Index – Transition Serious Delinquency 90+ For Credit Cards by All Ages (03/31/2008 – 03/31/2023)

– Courtesy of Bloomberg LP

Federal Funds Target Rate Index (05/19/2003 – 05/19/2023)

– Courtesy of Bloomberg LP

Headline Round Up

*House Speaker Kevin McCarthy Says Vote on Debt Ceiling Deal Possible Next Week!

*Q2 Gross Domestic Product (GDP) Now at 2.9% According to the Atlanta Federal Reserve. Déjà vu as investors start waiting for the “Looming Recession” again?

*The Federal Reserve is Poised for the Biggest Upward Revision on U.S. Economic Outlook Since 2021!

*Walmart Beats 1st Quarter Earnings/Revenue Expectation & Raises 2023 Full Year Guidance!

*April Retail Sales Spike.

*Home Builders Soar to New Highs on Demand for Housing!

*Airline Bookings Up 35% From May – September 2022 on Strong Summer Bookings with Asia Pacific Region Leading!

*Billionaire Hedge Fund Manager Paul Tudor Jones Says Fed Hikes Done, Stocks to Finish the Year Higher!

*CEO’s Amass Billions in “Top Hat” Nonqualified Deferred Compensation Plans!

*JPMorgan Says Markets are Right to Bet on Interest Rate Cuts, but When?

*Scamsters! Jobless Claims Tumble After Fraud Related Spike Eliminated.

*Canadian Solar Revenue up 36% in the 1st Quarter and Profit Spikes.

*Nuclear Power Helps Bring Down Finland Electricity Prices by 75% From December to April 2023.

*New York Rents Spike to Record so Far in 2023?

*Blistering Rally in Artificial Intelligence (AI) Stocks! New Exchange Traded Fund (ETF) Ticker CHAT.

*Pipelines Too Cheap? Oneok, Inc. to Buy Magellan Midstream Partners, LP in $19 Billion Deal.

*India Leads in “Laundering” Russian Oil Exports to Europe.

*Global Oil Demand Reached Record Level in March Per Saudi based International Energy Forum.

*PIMCO Likes Emerging Market Global High Yield Bonds!

*Oh, That’s Brilliant? Tether Holdings, Ltd., Largest Stablecoin Operator, to Put Reserves in Bitcoin?

Profit Report

Discussion notes on career best and worst investment decisions made by the MGWM Investment Committee members.