What is Herd Immunity?

What does it potentially mean for the Financial Markets?

Did this week’s money flows signal a shift from Growth to Value?

Why are Technology stocks lagging and Energy stocks leading?

What are the “Robinhood Bandit Traders” doing now?

Is Inflation already here? What did the Fed chairman say?

What does the move in long Treasury Rates tell us?

Headline Round Up!

*IRS To the Rescue! Texas Tax Filing Deadline Now June 15th. “We’re from the government and we are here to help.”

*Housing BOOM Update Prices Rise 10%+. Dallas 8.4%

*Housing Boom Dependent on Temporary Fed Support. When does it end?

*Durable Goods Orders Up Big.

*Jobless Claims Fall Dramatically.

*Inflation Addressed by Institutional Strategist John Hook with Analysis of Fed Chair Jerome Powell’s Testimony. What it potentially means for the markets.

*EIA Forecasts Renewables Share of Power Generation Going from 21% to 42% in 2050?

*North Texas Billionaire Shifts from Real Estate to Oil Stocks!

*Total Warns of 10 Million Barrell Per Day Shortage?

*JPMorgan Declares Oil “Supercycle” Through 2023?

*Oil Tops $63 per Barrel.

*Cheniere Reports Results.

*Telsa Dragging on S&P?

*Electric Vehicle Mania Got Punched in Face? What do the charts tell us Alex?

*Crypto-Mania: Elon Musk Appears to Become a Bitcoin Sage?

*GameStop Squeeze Round 2?

*Vaccines, Vaccines, and More Vaccines! What it means for investors.

*NY Times Weighs in with Predictable Praise on Biden’s Early “Fights”.

*Oprah Makes Another Fortune on Oatly?

Dow Jones Industrial Average (Year to Date)

– Courtesy of Bloomberg LP

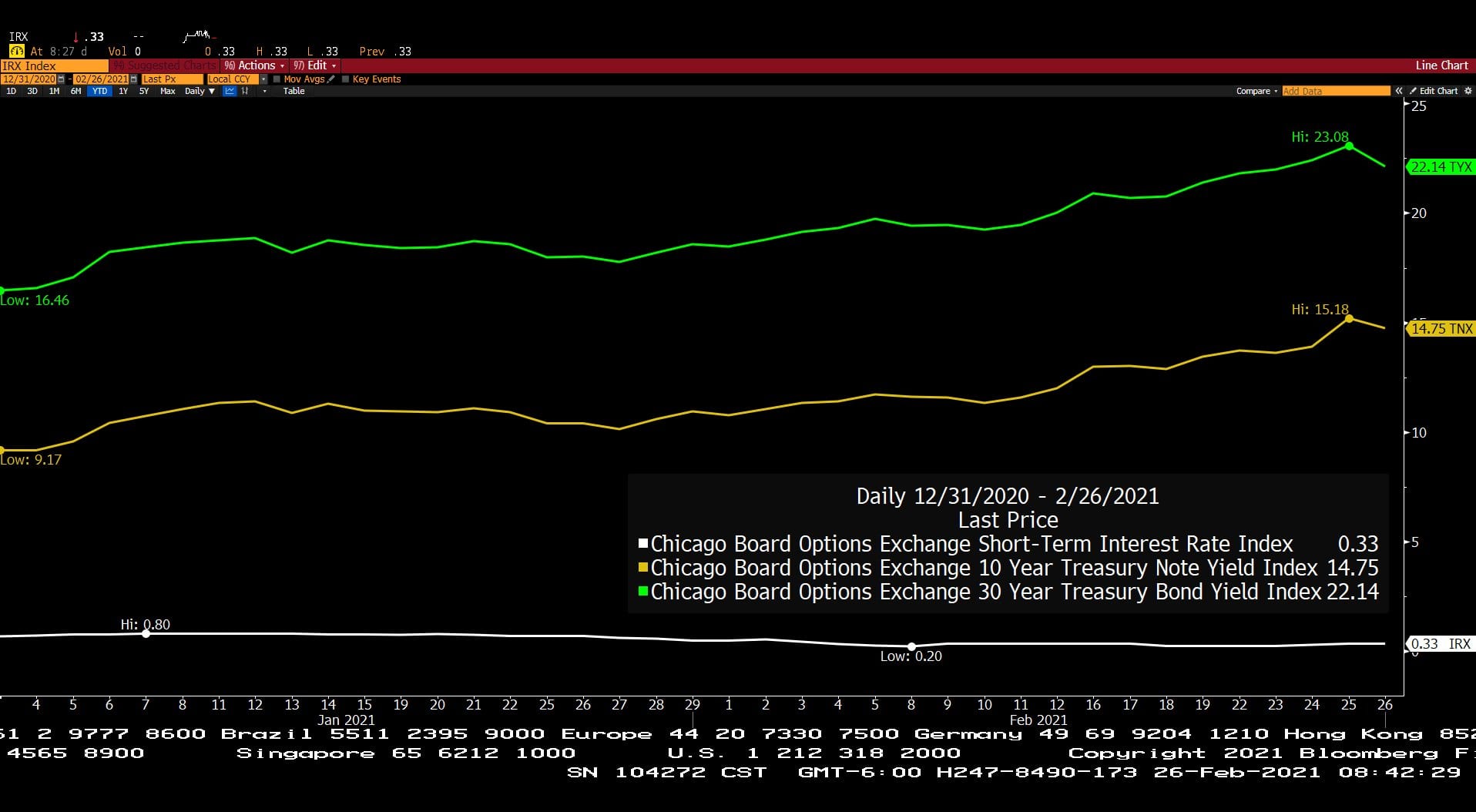

C.B.O.E. 30 Year Treasury Bond Yield, 10 Year Treasury Note Yield and Short-Term Interest Rate Indexes (Year to Date)

– Courtesy of Bloomberg LP

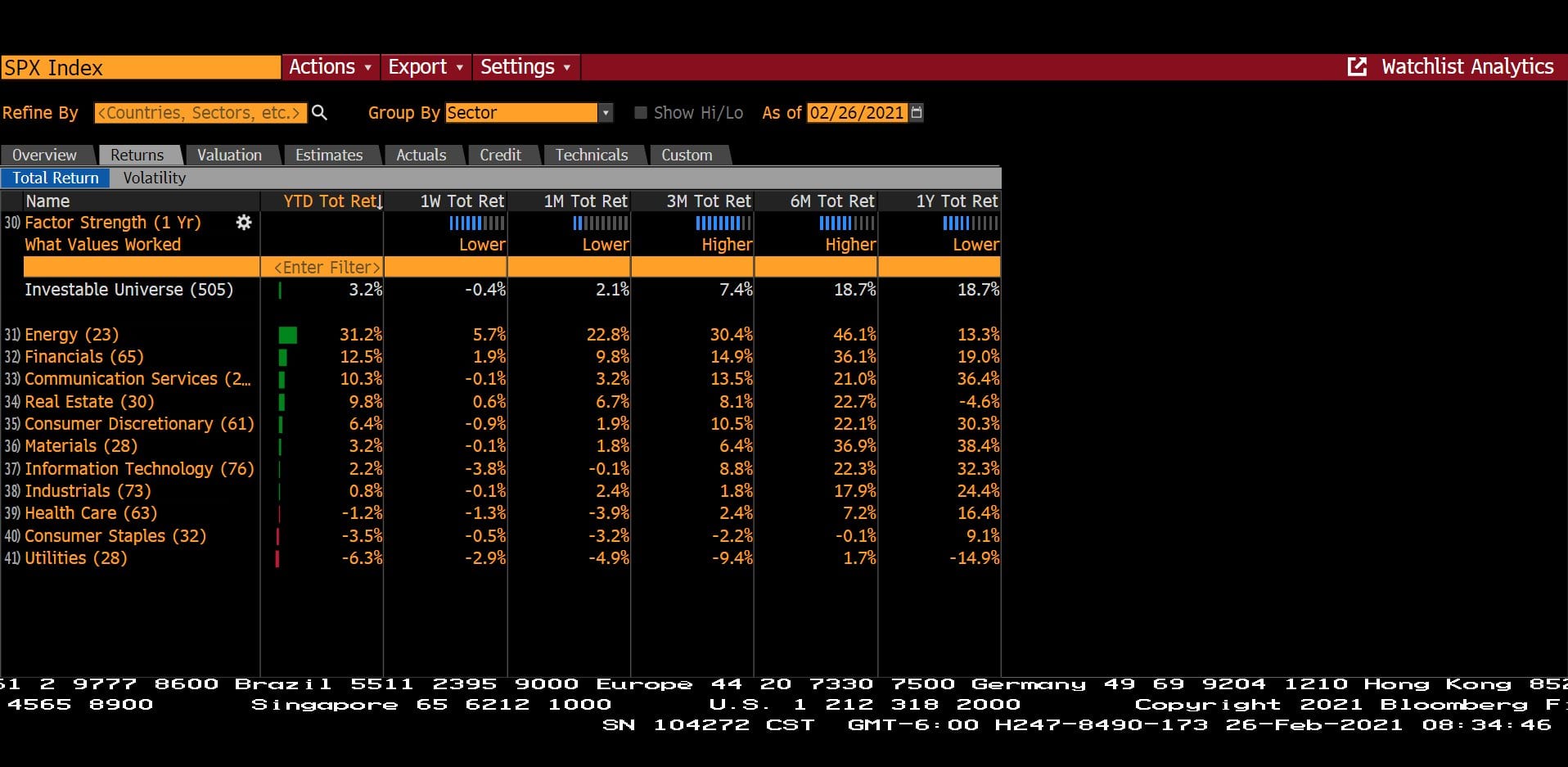

Standard & Poor’s 500 Index by Sector (02/26/2021)

– Courtesy of Bloomberg LP

Generic Crude Oil Future Spot Price (Year to Date)

– Courtesy of Bloomberg LP

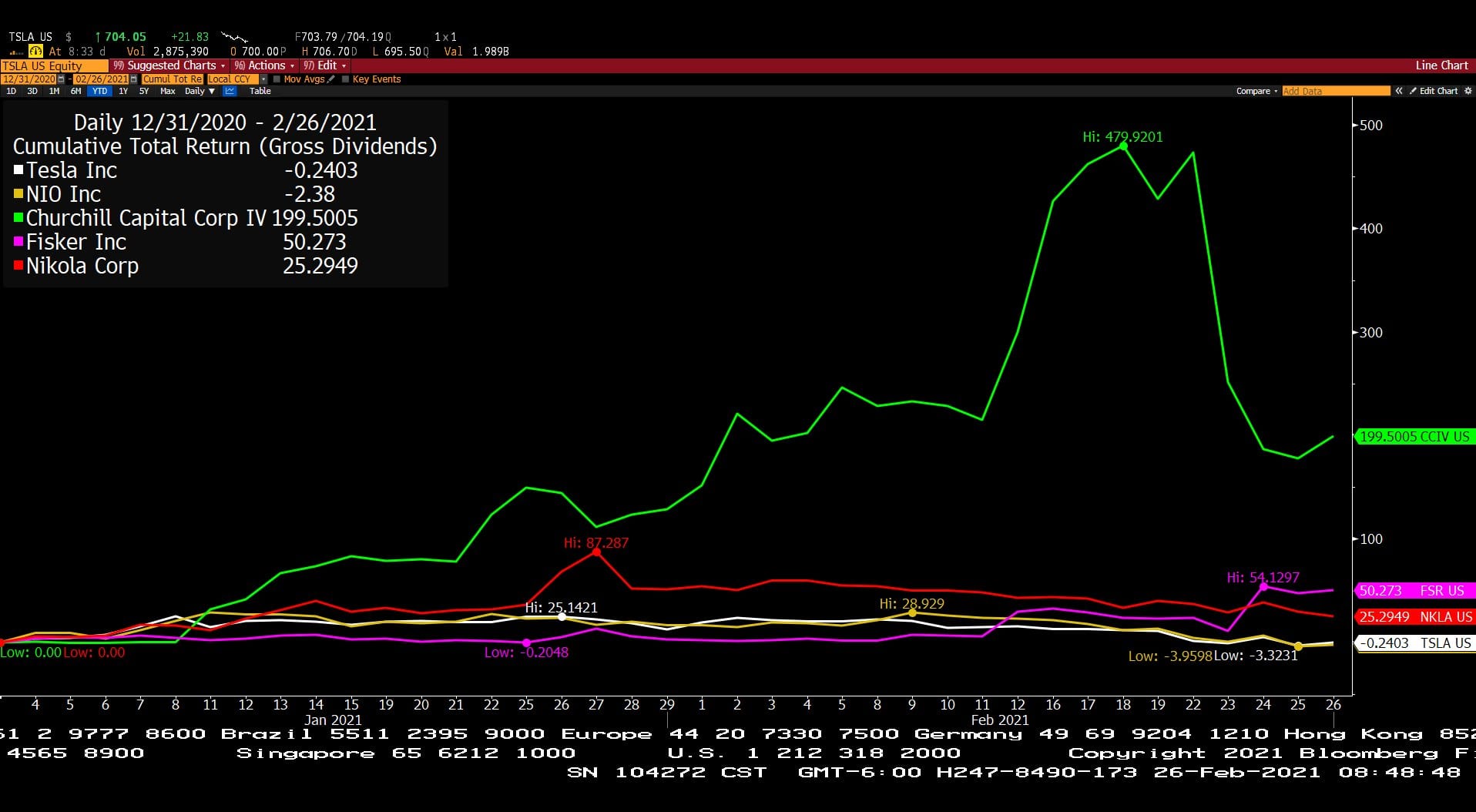

Cumulative Total Return, Gross Dividends, for Tesla Inc., NIO Inc., Churchill Capital Corp IV, Fisker Inc. & Nikola Corp. (Year to Date)

– Courtesy of Bloomberg LP

Profit Report!

*Greatest Investing Track Records: How did they do it? – Gregory Zuckerman

1. Jim Simons – Medallion Fund, 1988-2018: 39.1%

2. George Soros – Quantum Fund, 1969-2000: 32%

3. Steven Cohen – SAC Capital Advisers, 1992-2003: 30%

4. Peter Lynch – Magellan Fund, 1997-1990: 29%

5. Warren Buffett – Berkshire Hathaway, 1965-2018: 20.5%

6. Sir John Templeton – Templeton Growth, 1954-1992: 15%

7. Ray Dalio – Pure Alpha, 1991-2018: 12%

*What Does Dalbar Say About Investor Market Returns for the Last 20 years?