• How did the Financial Markets react to the election?

• Were the markets reacting more to the Pfizer announcement?

• How does Pfizer’s announcement of a 90% effective vaccine change the picture for 2021?

• How many other vaccines and treatments are coming over the next 6 months?

• Why are the markets ignoring the current pandemic resurgence?

• What are the biggest dangers for Investment Portfolios?

• What will a Biden administration do in 2021?

• What would a Trump challenge victory mean for 2021?

• How far can the Bio-Medical stocks run based upon current valuations?

• What will the markets look like when the Coronavirus crisis is over?

• Is there a potential energy shortage after COVID-19 is contained?

• The potential impact of zero cash rates?

• Could negative interest rates occur in the U.S.?

• What is a Cash Flow Panic?

Dow Jones Industrial Average (Year to Date)

– Courtesy of Bloomberg LP

U.S. Employment Total in Labor Force Seasonally Adjusted (Approx. 2 Years)

– Courtesy of Bloomberg LP

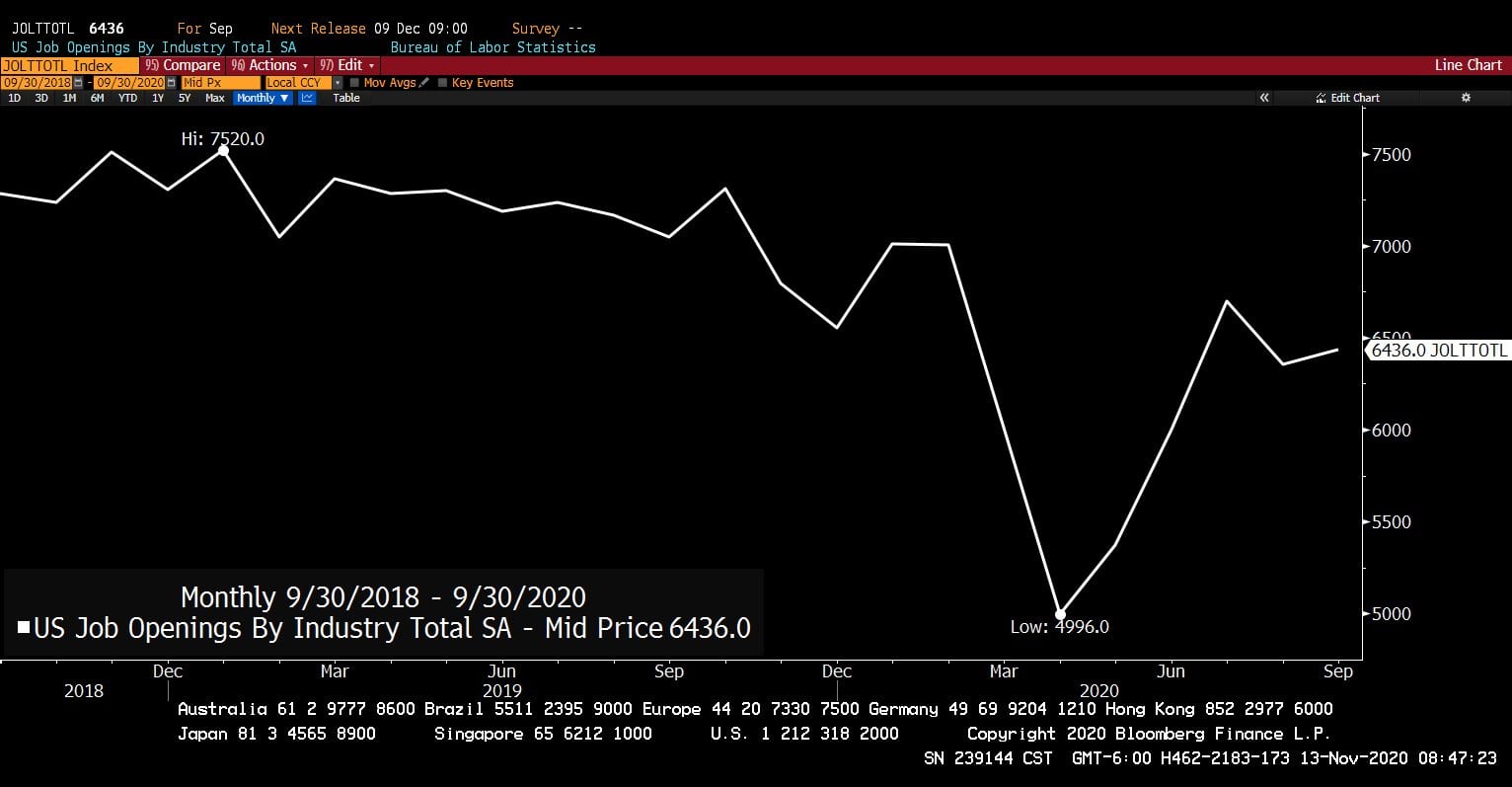

U.S. Jobs Openings by Industry Total Seasonally Adjusted (09/30/2018 – 09/30/2020)

– Courtesy of Bloomberg LP

Invesco Dynamic Credit Opportunities Fund (Year to Date)

– Courtesy of Bloomberg LP

Health Care Select Sector SPDR Fund (Year to Date)

– Courtesy of Bloomberg LP

Natural Gas Future Spot Prices (Year to Date)

– Courtesy of Bloomberg LP

Exchange Traded Fund Flows (11/13/2020)

– Courtesy of Bloomberg LP

Headline Round Up!

*Pfizer Vaccine Announcement Drives Huge Rally!

*2 Trillion in Money Flow on Monday?

*Even Dr. Fauci Says Pandemic Will End.

*Job Rally Continues! Job Openings Back to Healthy Levels Near 2019.

*Wall Street Coming to Texas!

*New Uptown Park and Development?

*How Fast Do Vaccines Make It Nationwide?

*Deposit Rates Taking Nosedive.

*Emerging Markets Hot After Vaccine Breakthrough.

*6 Hottest Energy Tech Stocks for 2021?

*Cummins Hydrogen Truck Engine?

*Global Oil Demand 95% Restored. Restoration Expected During 2021.

*U.S. Liquified Natural Gas (LNG) Exports to China Back on Track.

*JPMorgan Asset Management Lowers 10 Year Forecast for Expected Traditional Allocations!

Profit Report!

*The Infrastructure discussion coupled with the Stimulus discussion.

*The return of Inflation and the opportunity for “Real Assets.”

Research Round Up!

Investors are invited to improve decision making with a comprehensive tour of global economics, indicators, and actual results.

Get on the free subscription list today.

*Guggenheim Opportunities in Fixed Income

Including Scott Minerd’s Comments on Interest Rates

*Cohen and Steers: Inflation and Allocating to Real Assets