Expert Roundup:

The McGowanGroup delivers a comprehensive financial news and intelligence report covering various topics such as inflation, debt, economic data, investments, and estate planning. The report provides insights into the potential outcomes of the U.S. debt ceiling and default debates, the historical data on the Federal Reserve’s interest rate cuts after a tightening cycle, and the boom in solar energy and AI start-ups. The Investment Committee meets every Wednesday and focuses on outperformance.

Q: What is likely to happen in the financial markets between now and the end of July?

A: The Inflation numbers for May and June of 2022, the largest and 4th largest months of inflation in the current cycle, drop off the trailing 12 month measure.

Q: What are the potential outcomes of the current U.S. debt ceiling and default debates?

A: A possible agreement after spending cut compromise, a straight default, or a partial government shutdown?

Q: What did Warren Buffet do and say about the “looming” U.S. default?

A: In the annual meeting for Berkshire Hathaway, he bragged about locking in 5.9% rate on a U.S. Treasury Note in the wake of market disruption and then indicated a compromise solution is the likely outcome.

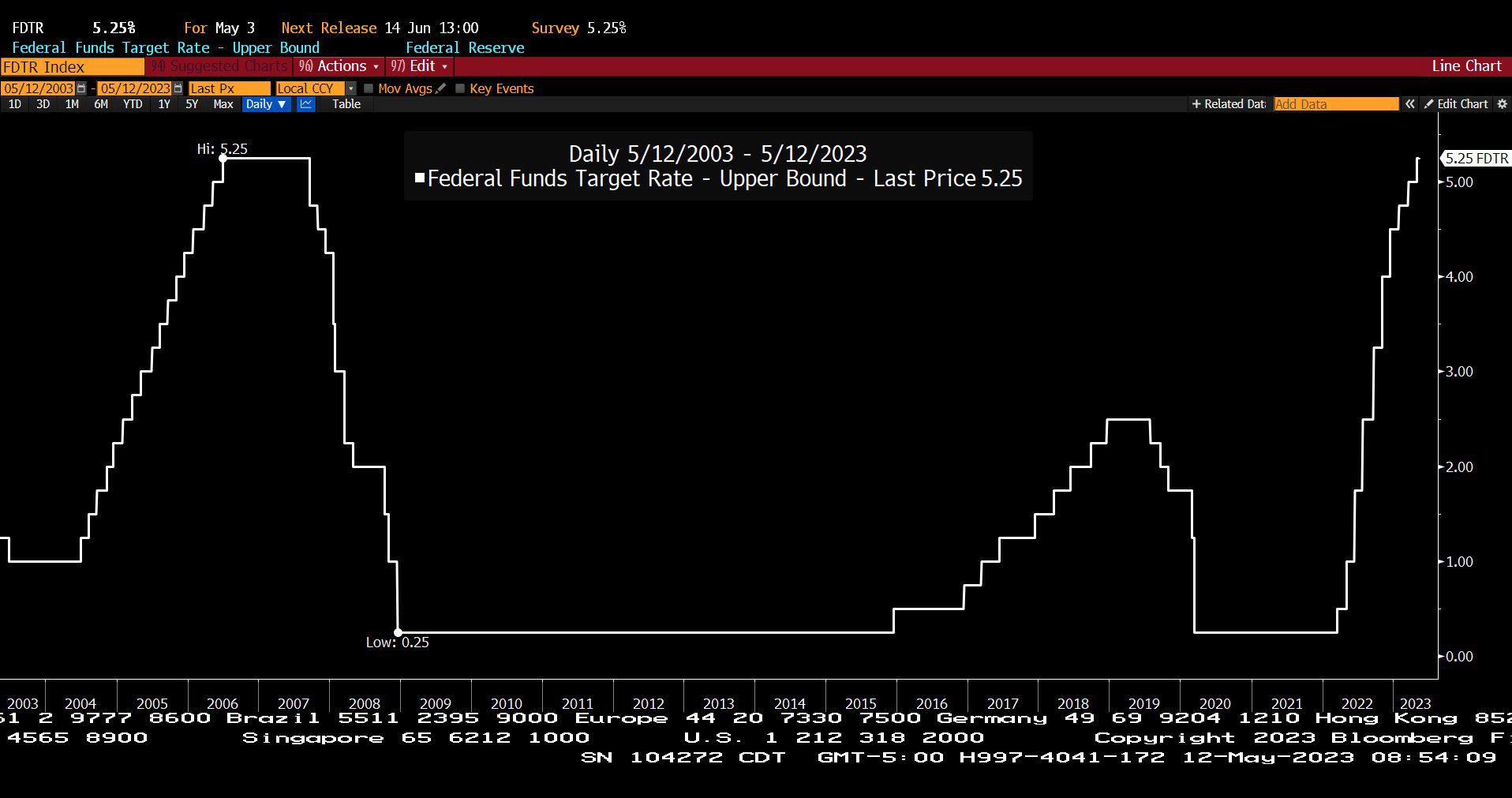

Q: Historically, how long does it usually take for the Federal Reserve to cut interest rates after a tightening cycle?

A: The median time is 4 months; average time is 6 months according to Deutsche Bank Analyst Jim Reid.

U.S. Consumer Price Index – Urban Consumers Year over Year, Non Seasonally Adjusted (05/31/2021 – 04/30/2023)

– Courtesy of Bloomberg LP

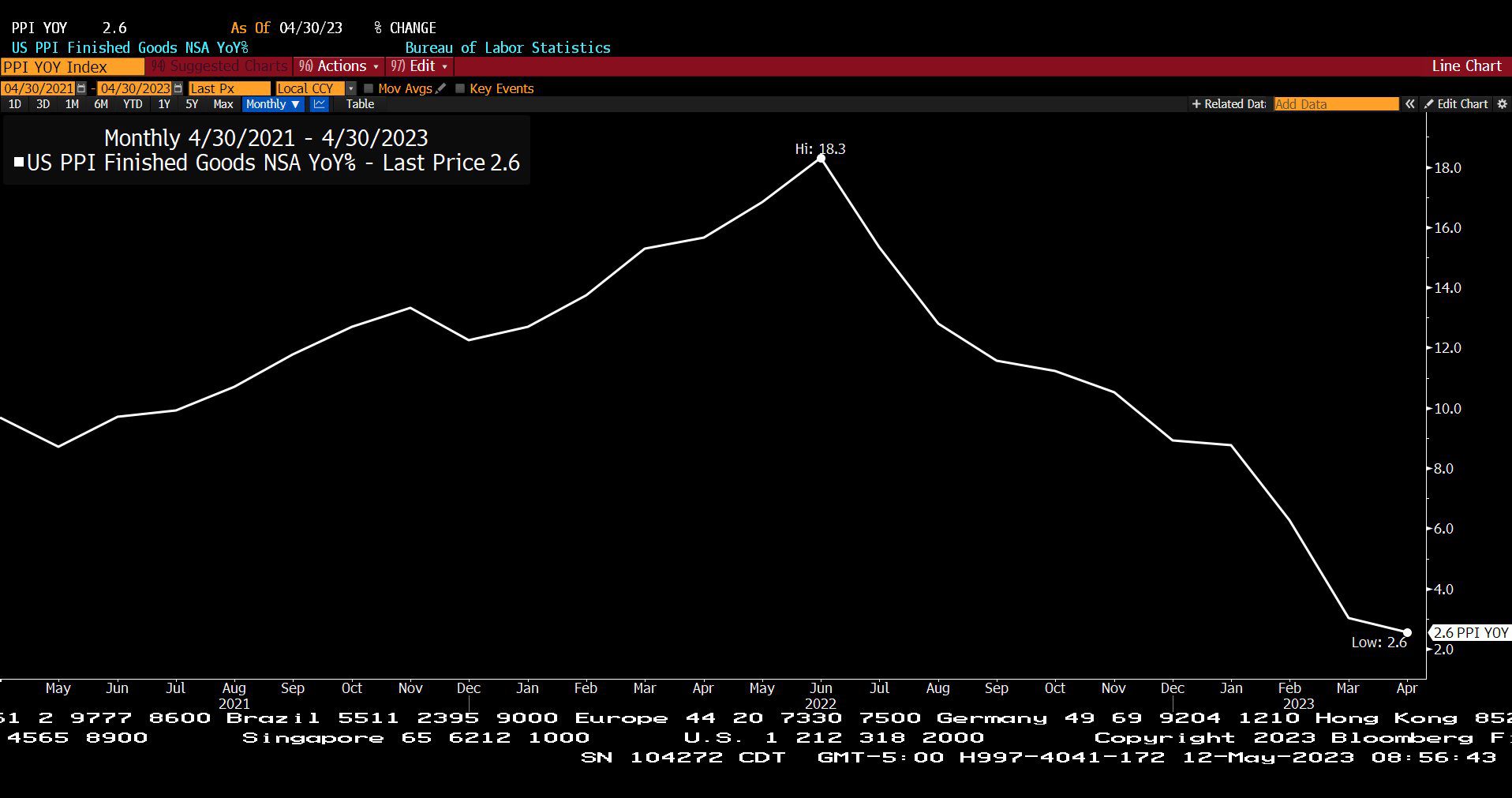

U.S. Producer Price Index – Finished Goods Non Seasonally Adjusted, Year over Year (04/30/2021 – 04/30/2023)

– Courtesy of Bloomberg LP

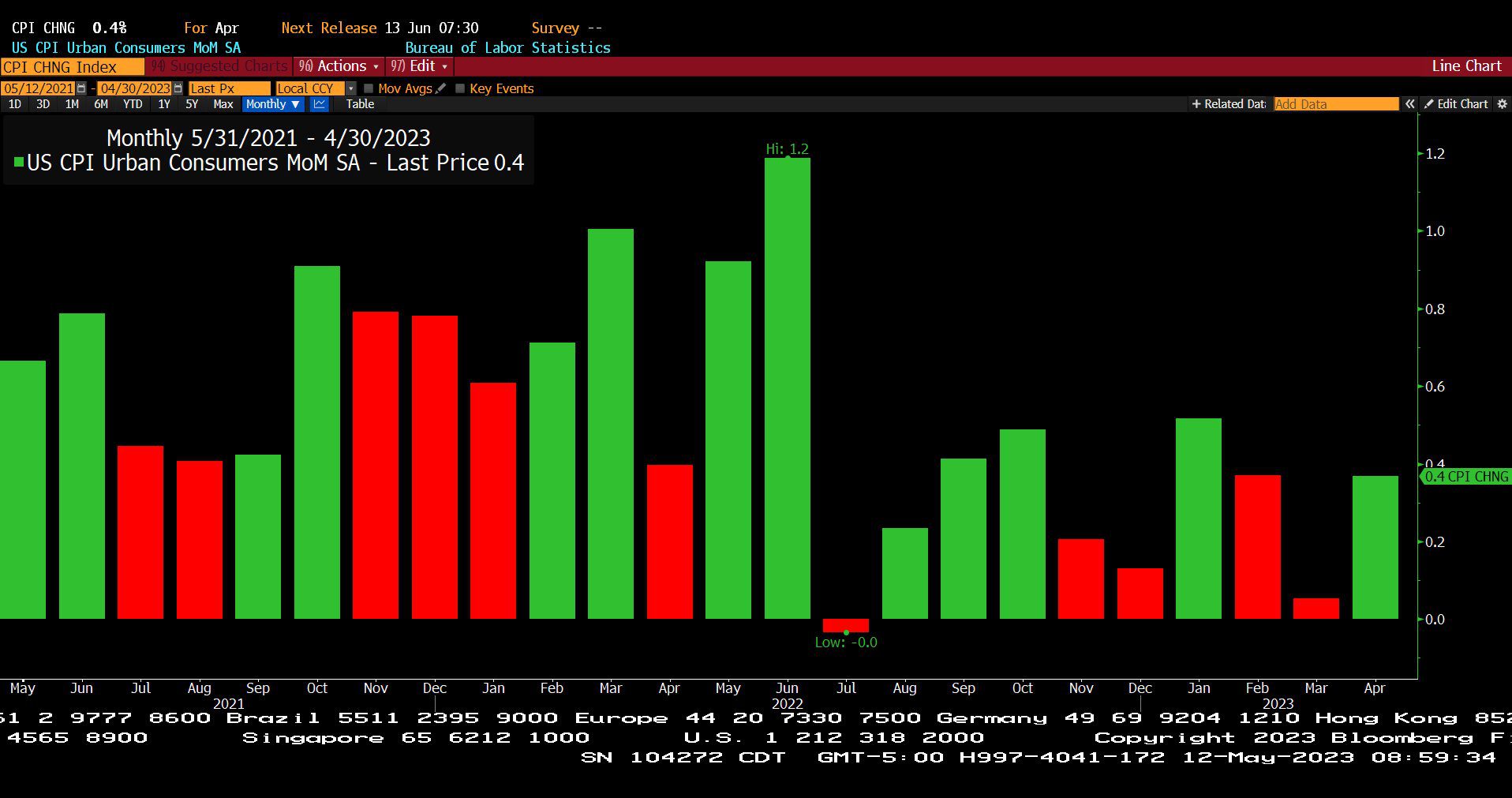

U.S. Consumer Price Index – Urban Consumers Month over Month, Seasonally Adjusted (05/31/2021 – 04/30/2023)

– Courtesy of Bloomberg LP

U.S. Zillow Rent Index – All Homes, Year over Year & U.S. Shelter Consumer Price Index, Year over Year (04/30/2016 – 04/30/2023)

– Courtesy of Bloomberg LP

Dow Jones Industrial Average (12/30/2022 – 05/12/2023)

– Courtesy of Bloomberg LP

Federal Funds Target Rate Index (05/12/2003 – 05/12/2023)

– Courtesy of Bloomberg LP

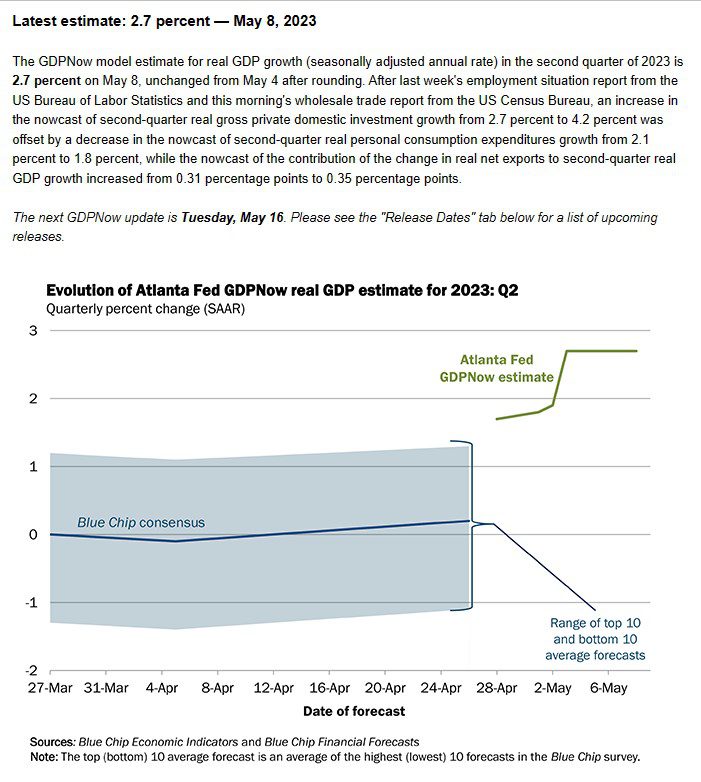

Evolution of Atlanta Fed GDPNow Real GDP Estimate for 2023 – Q2 (05/08/2023)

– Courtesy of The Atlanta Federal Reserve

Standard & Poor’s 500 Index – Quarterly Earnings Per Share With Projections (03/31/2018 – 12/31/2024)

– Courtesy of Standard & Poor’s and The McGowanGroup Asset Management

Headline Round Up

*Consumer Inflation Trailing 12 Months Down to 4.9% and Producer Inflation Just 2.3%. Both Down from Near 9%.

*Novo Nordisk and Eli Lilly Soar on Diabetes Weight Loss Success.

*Travel Boom! Boeing Wins $40 Billion Order from Ryanair.

*Investors Pour Billions Into Artificial Intelligence (AI) Start Ups? No business plan required?

*Wendy’s Drive Through Now Uses AI Chatbots!

*PacWest in Bank Hospice This Weekend. Stock Down 90% From Peak.

*High Points from Berkshire Hathaway’s Annual Meeting.

*What Recession? Lamborghini and Ferrari Punch Record Sales and Sellouts for 2022 going into 2023!

*Solar Boom Record in 2023!

*Big Oil Has $150 Billion in Cash! What will they do with all that cash?

*Tech Earnings Forecast to Fall 7% in Q2.

*2023 Q1 Home Prices Drop Even in Austin?

*American Factory Boom Boosts Caterpillar and Nucor.

*Factory Exodus from China Landing in India.

*Electric Vehicle (EV) Startups Lucid and Fisker Running Out of Cash.

*U.S. Energy Department Declares Need to Double Power Grid to Meet Renewable Energy Production Capacity!

Profit Report

7 key Estate Planning recommendations from experienced wealth managers based on decades of processing Estates and Trusts successfully.

1. Get your wealth manager and estate planning attorney together to review the current plan.

2. Make sure that the latest Wills, Trusts, Power of Attorneys (POA’s) and all associated amendments are in your wealth managers document vault.

3. Introduce your primary Trustee/Executor to your wealth manager and make sure that they exchange contact information.

4. Schedule an Estate Plan review with your CPA to catch potential mistakes.

5. Review the all current documents and strategize asset movement at different life events with your wealth manager.

6. Click the following link if you need a new estate planning attorney. The link takes you to a list of experienced estate planning attorneys that have helped our clients in the past. Remember, The McGowanGroup does not receive compensation for the referrals.

7. Include your future Trustees in the McGowanGroup Wealth Management subscription list to start “Trustee Bootcamp” education.