The second half of 2020 begins in just a few days. After 6 months of shocking headlines, this week’s program provides intelligence reports for the rest of 2020 and beyond. Anxiety often leads to investment mistakes, but great decisions come from abundant research as well as wisdom.

PappaDean joins us for an amazing history of financial market data evolution. Recurrent joins us to provide valuable insights for Texas. The forward economic forecasts provide important guidance for all investors.

Dow Jones Industrial Average (Approx. 3 Years)

– Courtesy of Bloomberg LP

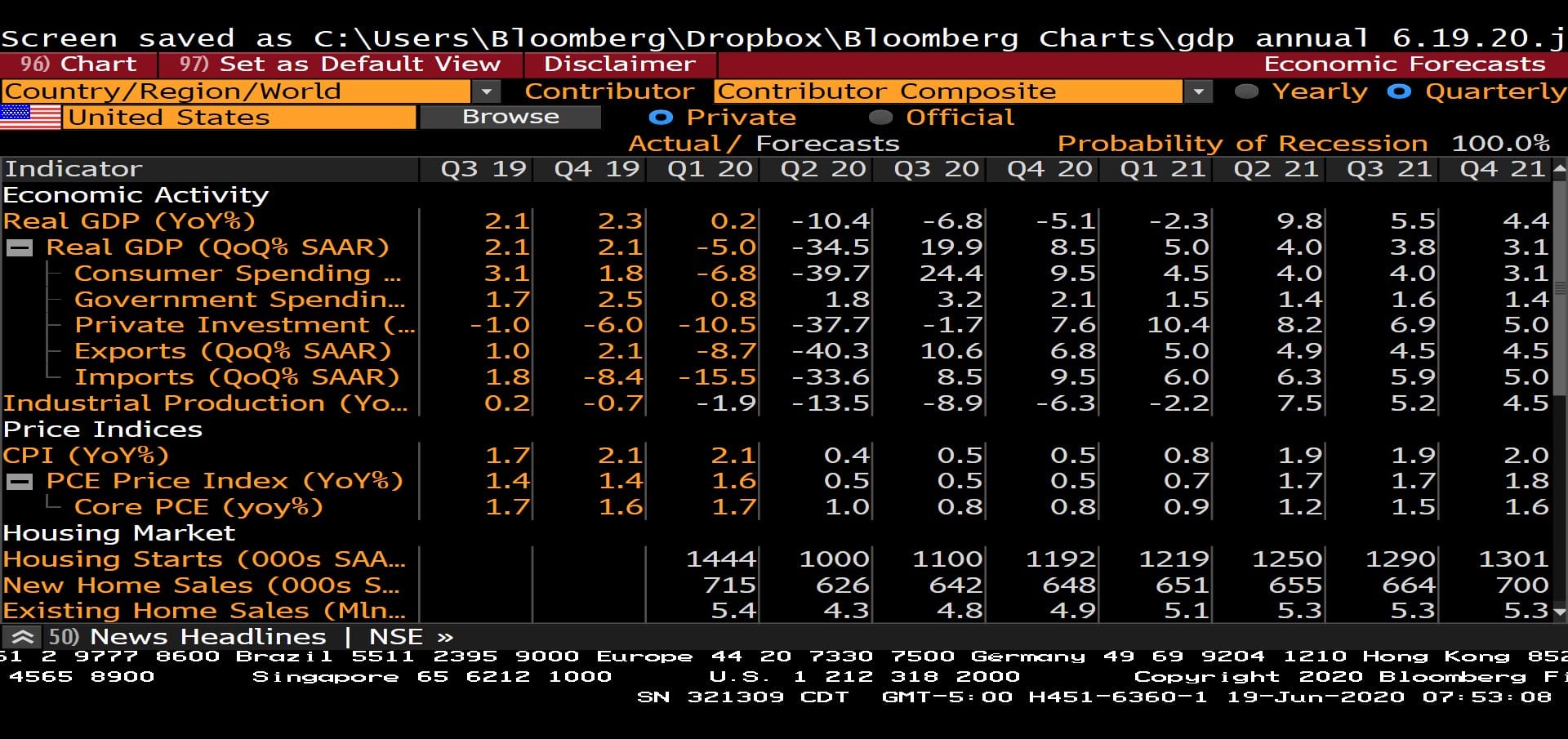

Quarterly U.S. Economic Actual & Estimated Forecasts w/ Probability of Recession (3rd Quarter 2019 – 4th Quarter 2021)

– Courtesy of Bloomberg LP

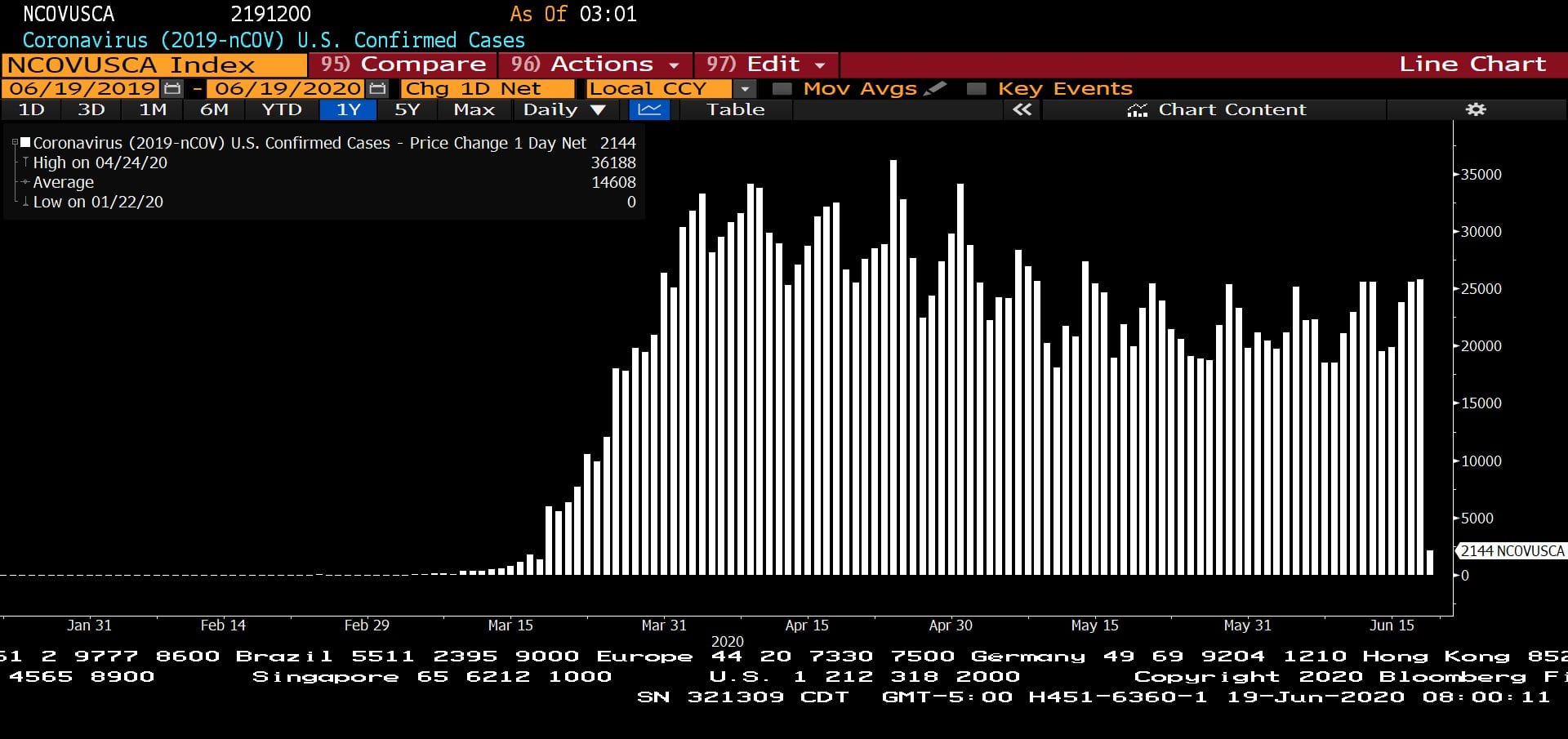

Coronavirus U.S. Confirmed Cases (1 Year)

– Courtesy of Bloomberg LP

Coronavirus U.S. Confirmed Deaths (1 Year)

– Courtesy of Bloomberg LP

Invesco QQQ Trust Series 1 Price (Approx. 15 Years)

– Courtesy of Bloomberg LP

Health Care Select Sector SPDR Fund (Approx. 15 years)

– Courtesy of Bloomberg LP

AllianceBernstein Global High Income Fund, Inc & BlackRock Corporate High Yield Fund, Inc. (12/29/2006 – 12/31/2012)

– Courtesy of Bloomberg LP

U.S. Crude Oil – West Texas Intermediate Spot Price (15 Years)

– Courtesy of Bloomberg LP

Headline Round Up!

*Infrastructure Hype Again?

*Retail Sales Spike Back on Track!

*Beware Nikola Hype?

*Billionaires Benefits of 2020?

*Putin’s Disinfection Tunnel!

*NBA Jumps to Disney World?

*$5 Billion Additional Loan for United?

*Texas Looking HOT!

Texas Energy Gold Rush 2020 to 2030 – NetWorth Radio’s Texas Business Leadership Series: Spencer McGowan Interviews Brad Olsen and Oliver Doolin Who Define The Way Forward!

Prior to co-founding Recurrent, Brad was most recently the lead MLP portfolio manager for BP Capital Fund Advisors (BPCFA). Under Brad’s leadership, MLP AUM more than doubled (excluding the impact of appreciation).

From 2011 to 2015, Brad led Midstream Research for Tudor, Pickering, Holt & Co. (TPH & Co.), where he was recognized as the top all-around stock picker in the US by the Financial Times in 2013, and the top energy stock picker in the US by Starmine in 2014. Under Olsen’s leadership, the TPH & Co. midstream team was recognized in the WSJ’s “Best on the Street” poll as well as by Institutional Investor Magazine.

Brad also has experience as an investment analyst at Eagle Global Advisors in Houston, where he was part of a 3-person team that grew midstream/MLP AUM from $300mm to over $1bn from 2008 through 2011. He has also worked in investment roles at Millennium International, a large global hedge fund, and Strome Investment Management, an energy-focused hedge fund based in Santa Monica, CA. He began his career in the UBS Investment Banking Global Energy Group in Houston.

Brad earned a BA in Philosophy, Political Science, and Slavic Studies from Rice University in Houston.

Brad resides in Houston with his wife and four children. Brad was nearly fluent in Russian, but is very rusty.

Client Portfolio Manager / Energy Specialist

Oliver has spent over a decade specializing in natural resources, oil & gas, and MLP institutional equity research, most recently at Heikkinen Energy Advisors in Houston.Prior to joining Heikkinen, Oliver served in both research and business development roles at energy-focused investment banks, including 6 years as a Vice President at Tudor, Pickering, Holt & Co (TPH) in Houston, where he specialized in exploration and production (E&P), oilfield services (OFS) and midstream MLP companies.

Oliver began his career as a research analyst covering E&P and Oilfield Service companies for both TPH and Howard Weil, respectively.

Oliver holds a BS with dual concentrations in Finance and Legal Studies (Tulane University) as well as an MS in Accounting from the A.B. Freeman School of Business at Tulane University.

Oliver, originally from south Louisiana, is an avid outdoorsmen and runner. He resides with his wife and two children in Houston.

Profit Report!

*This is a GREAT time for a 401k allocation review!

*Now: In-Service Rollovers. Great time to add cash flow for your retirement with a clear & straight forward plan.

*Investors and business leaders are shaken by unrest. Where do we go from here? Updates from Dallas’s Finest!