Post melt-down regret is beginning to set in for investors who sold in March after being taunted by economic as well as market recoveries. Alex refers often to money flows driven by the fear of missing out, FOMO.

The NetWorth Radio dashboard of great research expands this week again building on last week’s fascinating focus on the popular and pricey FAANG group. The obvious group deemed Covid-19 immune beneficiaries of the pandemic.

But, wait! What comes next? Is this a head fake?

Bill Miller’s Bloomberg Radio podcast link will also be included in our next free subscription list email update for clients and listeners. The discussion from a 40 year value veteran unfolds a key scenario that builds on our program from last week.

The vital intelligence here projects one of the most important potential shifts likely for the second half of 2020: money flow moving from growth to value.

Valuable investment intelligence for effective decisions often begins with a clear picture of what has happened leading to future scenarios and possible outcomes. The benefits of clearly defined objectives then provide a logical list of choices to accomplish those goals over longer time horizons.

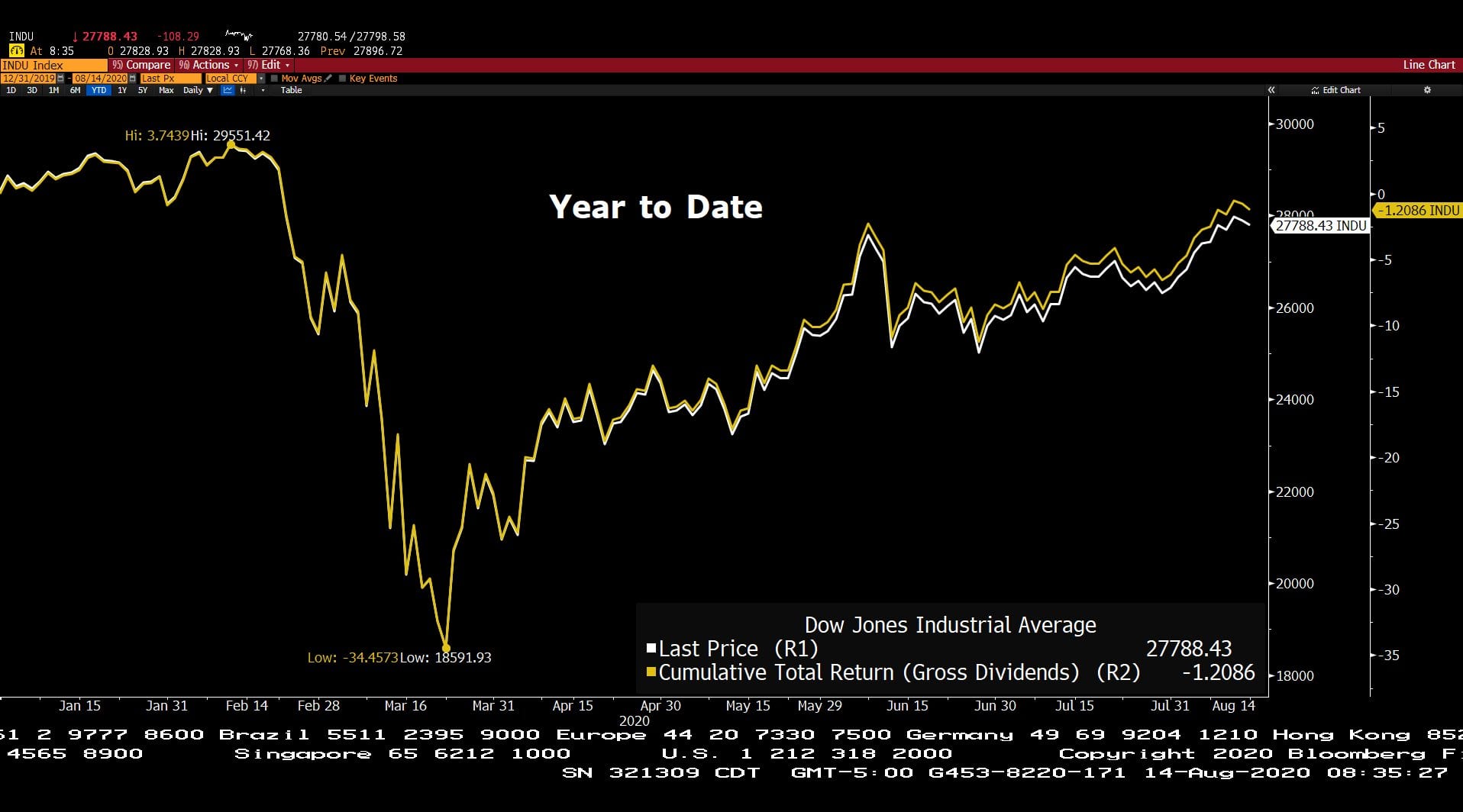

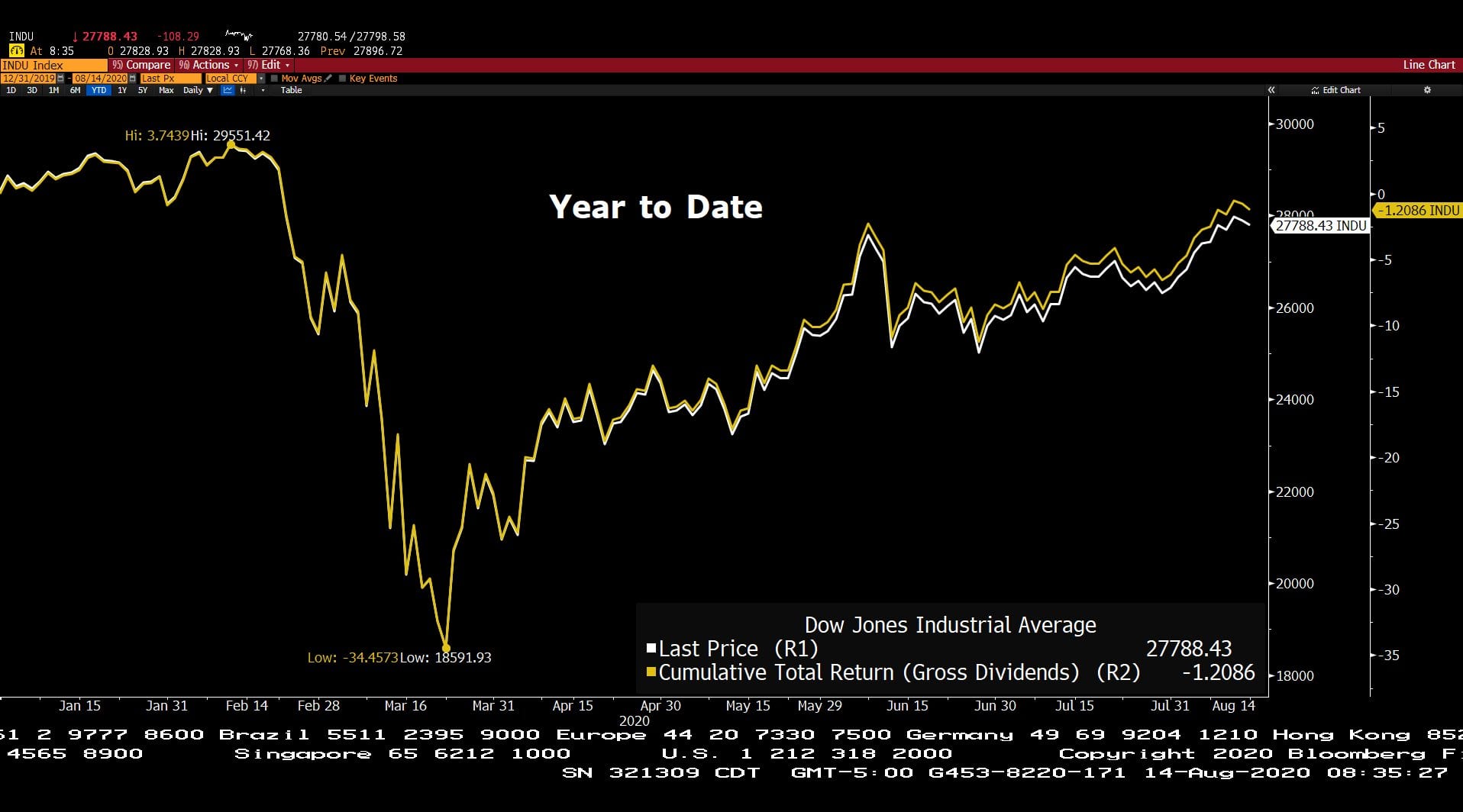

Dow Jones Industrial Average (Year to Date) v.s Dow Jones Industrial Average Total Return (Year to Date)

– Courtesy of Bloomberg LP

U.S. Employment Total in Labor Force (08/07/2000 – 07/31/2020)

– Courtesy of Bloomberg LP

Invesco QQQ Trust Series 1 (Year to Date)

– Courtesy of Bloomberg LP

Gold Spot Price per Ounce (Year to Date)

– Courtesy of Bloomberg LP

Bitcoin (Year to Date)

– Courtesy of Bloomberg LP

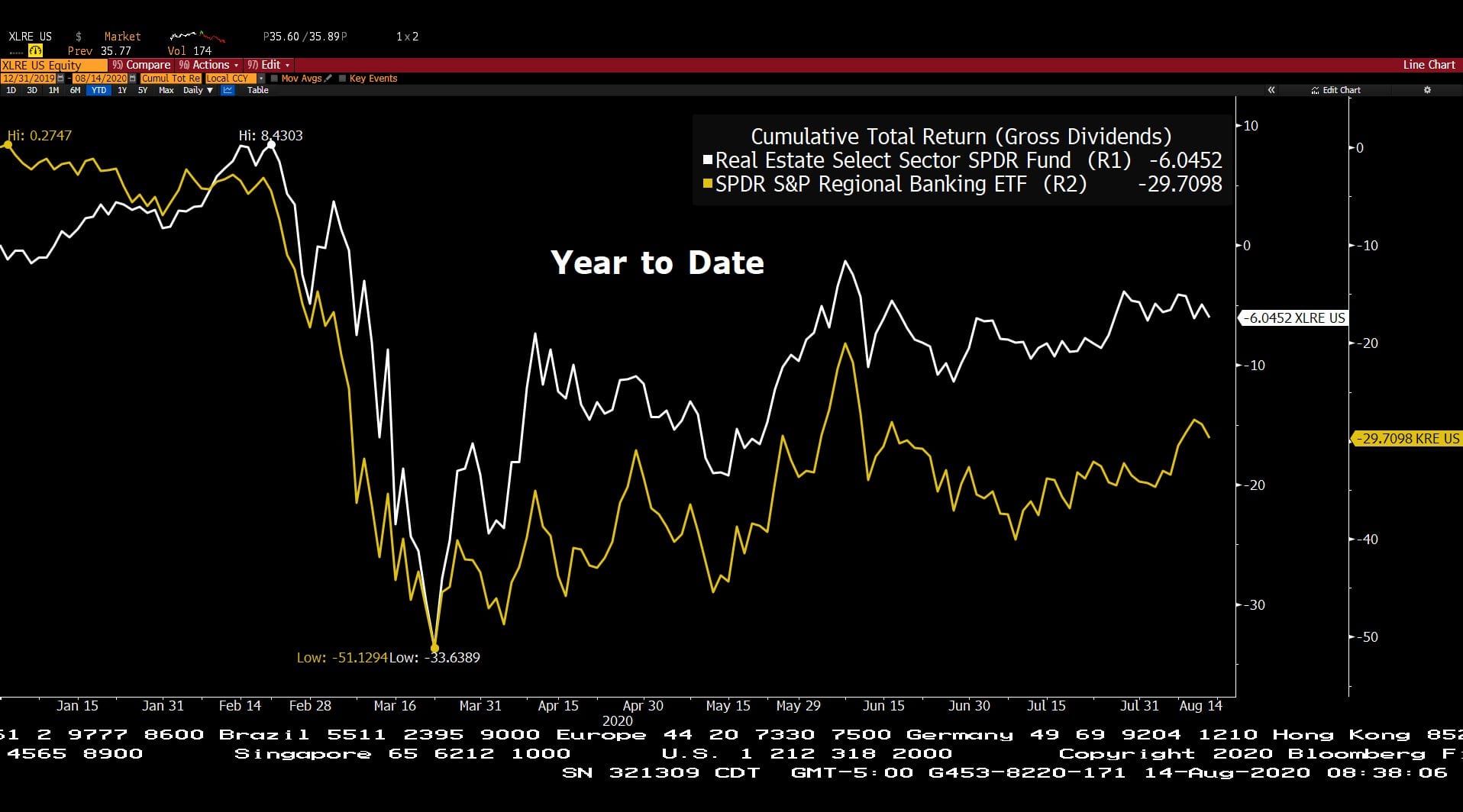

Real Estate Select Sector SPDR Fund & SPDR S&P Regional Banking ETF (Year to Date)

– Courtesy of Bloomberg LP

U.S. Crude Oil West Texas Intermediate Cushing OK Spot Price & Henry Hub Natural Gas Spot Price (Year to Date)

– Courtesy of Bloomberg LP

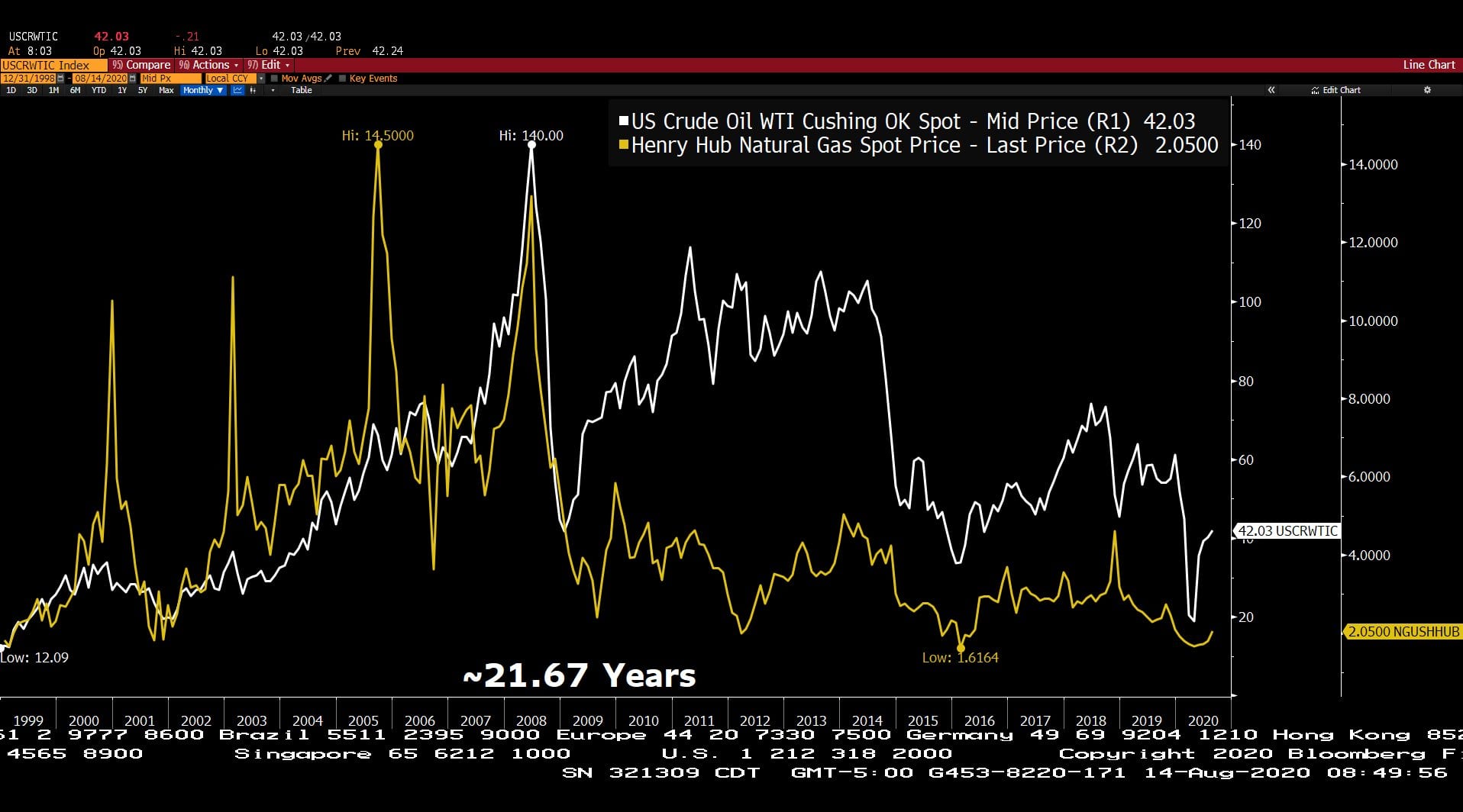

U.S. Crude Oil West Texas Intermediate Cushing OK Spot Price & Henry Hub Natural Gas Spot Price (12/31/1998 to 08/14/2020)

– Courtesy of Bloomberg LP

Headline Round Up!

*Retail Sales Key Data: 2.7% Over 2019!? Powered by Auto Sales!

*500,000 MORE Jobs Waiting to be Filled Total Reaches 5.9 Million Shovel Ready Jobs!

*Inflation Is Back Too!

*Unemployment Claims Lowest Since March, 20% Below Last Week’s Report.

*Everyone’s Got to EAT! Brinker International Spikes Over 25% After Reporting Shutdown Loss.

*Trump Wants a Capital Gains Tax Cut!

*Fed Makes Low Interest Loans to Cities and States.

*Housing Demand Amazing. Low Rates Account for Autos Too.

*DR Horton and Lennox International Lead North Texas Rally!

*Banks Hiring 19,000. Record Mortgage Volume. Alex Goes Spider Monkey On Lender All Week (Expletives Too!)

*The Fall, Rise, and Implosion of Kodak!

*Gundlach Says Trump Wins.

*Kodak

*Putin Wins! First COVID 19 Vaccine. Shirtless Horseback Victory Lap. Grouchi Fouchi Says No.

*How the Tough Really Get Going! Big Spike in New Business Formations.

Texas Energy Gold Rush!

*Saudi Arabia Flooded Market for Cash. Now Holding Back for Higher Prices.

COVID-19 Safety Innovations From a Dallas MD! Dr. David Slater (214) 214-6348 (MD4U)

Dr. David Slater, the founder of Dallas’ Whole Health Kinetics, joins us to provide insights on the future of medical care and progress in medical innovation that is making a difference for patients right here in North Texas.

David A. Slater has been in Family Practice for over 20 years, taking care of patients in and around Irving, Grapevine, Coppell, Euless, Colleyville, Southlake, Westlake, Trophy Club and Dallas. Now, conveniently located in Addison, Dr. Slater introduces a new concept in healthcare with Whole Health Kinetix. He has always wanted to spend more time with his patients, provide customized one-on-one care, help people stay well vs. always treating acute symptoms.

Dr. Slater is a Dallas native, a graduate of Texas A&M University and UT Southwestern Medical School and values his family time with his wife and two beautiful daughters.

Profit Report

*Jim Cramer and Bill Miller View of Q3 and Q4 Shifts!

*Money Flow Reports March and Last 90 Days.

*Tactical Allocation Strategies: Dry Gun Powder, Targets with Internal and External Rates of Return Over 8%. What did MGAM do during March? April? 2002? 2008?

*Who sold in March???? Indexers, moving averaging disciples, and others, driven by fear of the unknown sold into the fastest and largest bear decline in modern history. Strategy implications for long term investors?

*Alex and Spencer’s devotion to effective allocation strategy: 2020 technology upgrades, Zoom! Virtual Meetings, client review disciplines, integrated performance tracking, money flow research, possible outcome discussions, and the McGowanGroup investment committee processes.

Research Round Up!

*Pimco Dynamic Credit and Mortgage Income Fund (PCI) Quarterly Commentary – Pimco

PIMCO_PCI_Quarterly_Commentary_PCEFQU001 (3) – Pimco

Investors are invited to improve decision making with a comprehensive tour of global economics, indicators, and actual results.

Start the Process Today! Be sure to indicate what size portfolio sample you would like to see. A link will arrive when we receive your questionnaire.