What do Q2 Earnings tell us?

Is the Tech rally back?

What is setting up to cause the next Market correction?

With Cash Rates near zero, what other conservative strategies might provide yield?

Will Congress retroactively raise 2021 taxes?

How could I reduce my 2021 tax bill?

What is the updated read on Inflation?

Could Interest Rates fall before they go up?

What are MGAM and NetWorth Radio’s best sources of Investment Research?

Dow Jones Industrial Average (Year to Date)

– Courtesy of Bloomberg LP

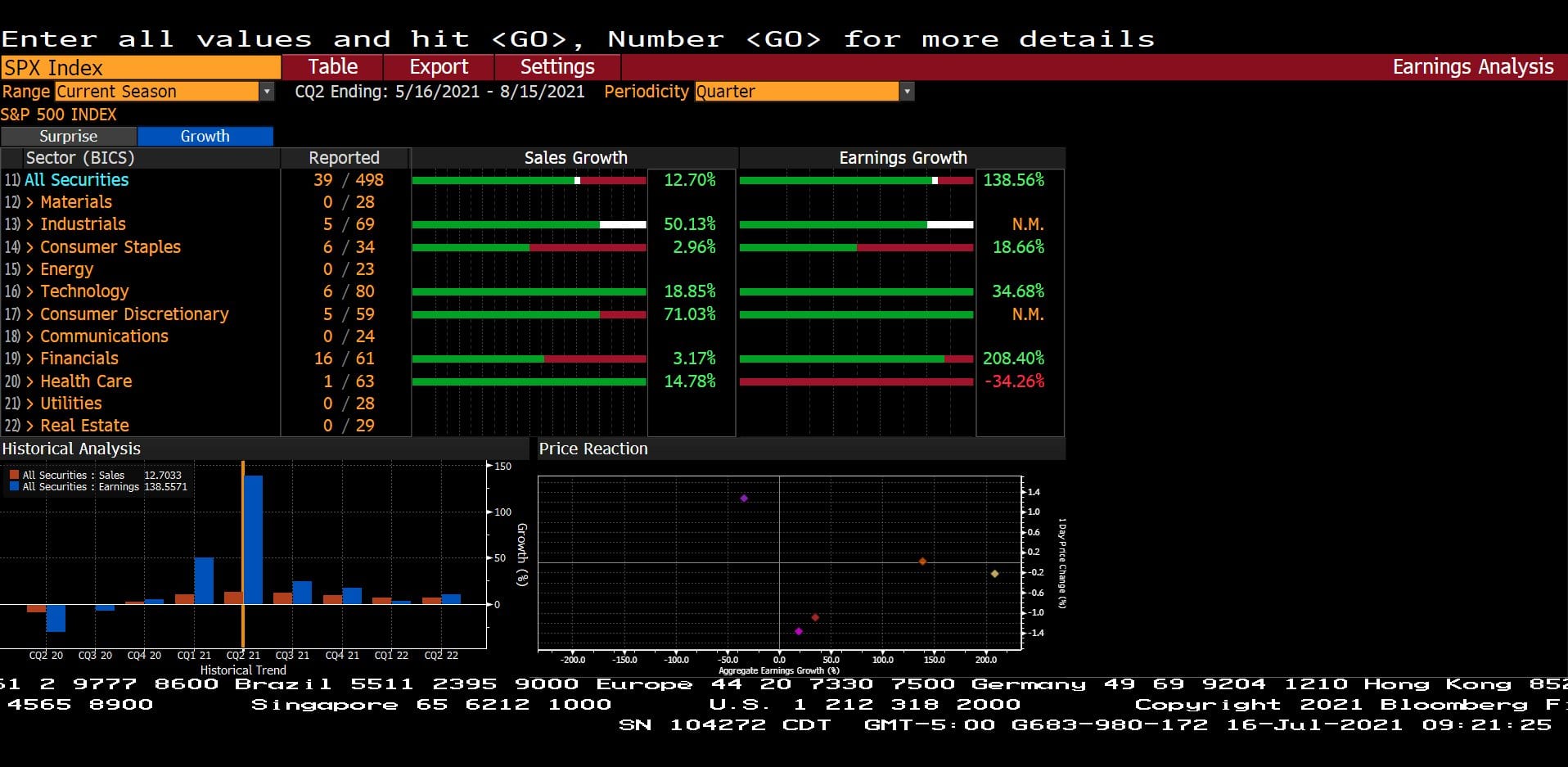

Standard & Poor’s 500 Index Sectors Earnings Analysis for Q2 2021 (05/16/2021 – 08/15/2021)

– Courtesy of Bloomberg LP

Standard & Poor’s 500 Index Quarterly Earnings Estimates (07/16/2018 – 07/16/2021)

– Courtesy of Bloomberg LP

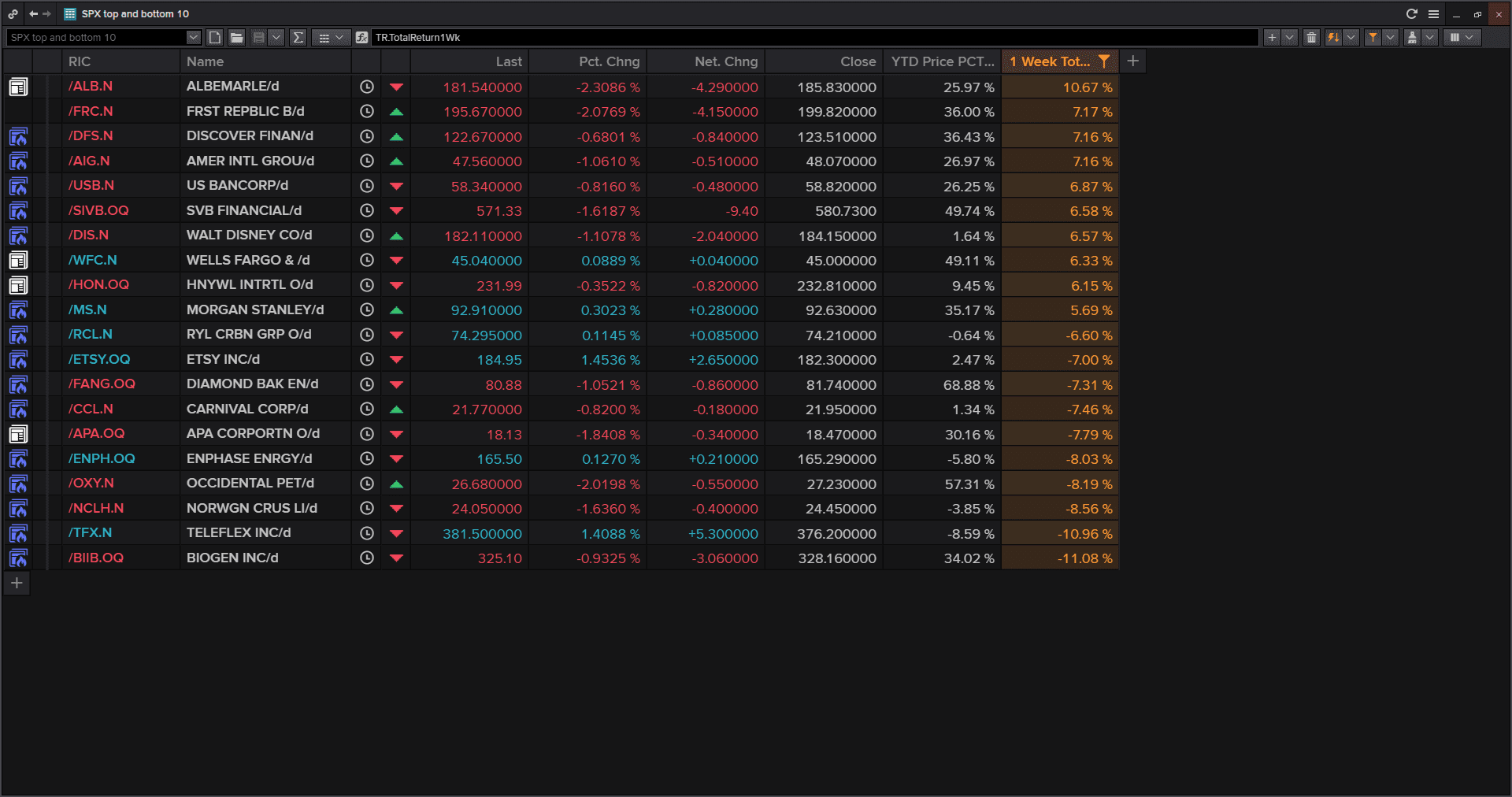

Standard & Poor’s 500 Index, Top 10 and Bottom 10 Companies (07/16/2021)

– Courtesy of Refinitiv

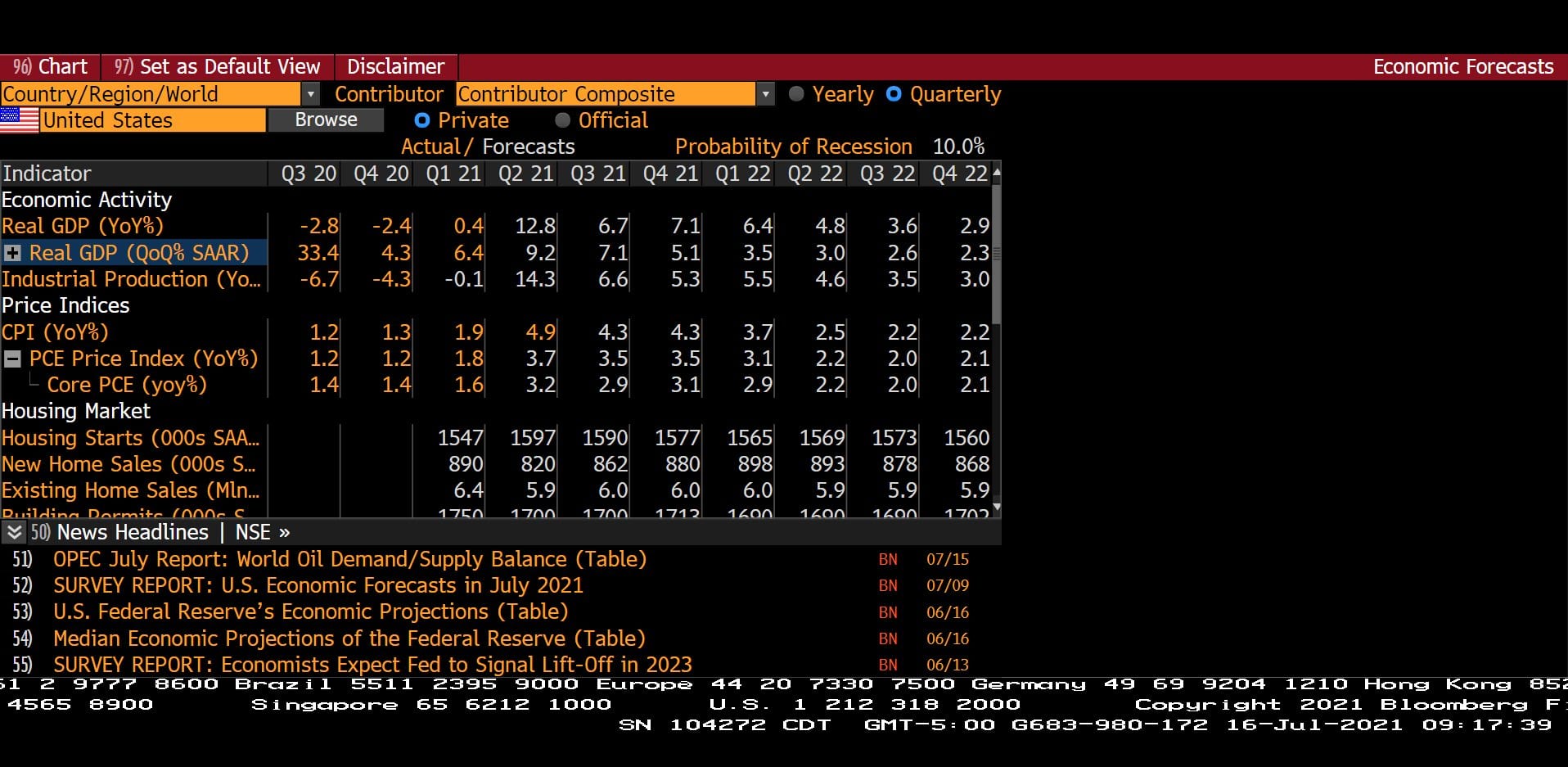

Quarterly U.S. Economic Forecast with Probability of Recession (Q3/2020 – Q4 2022)

– Courtesy of Bloomberg LP

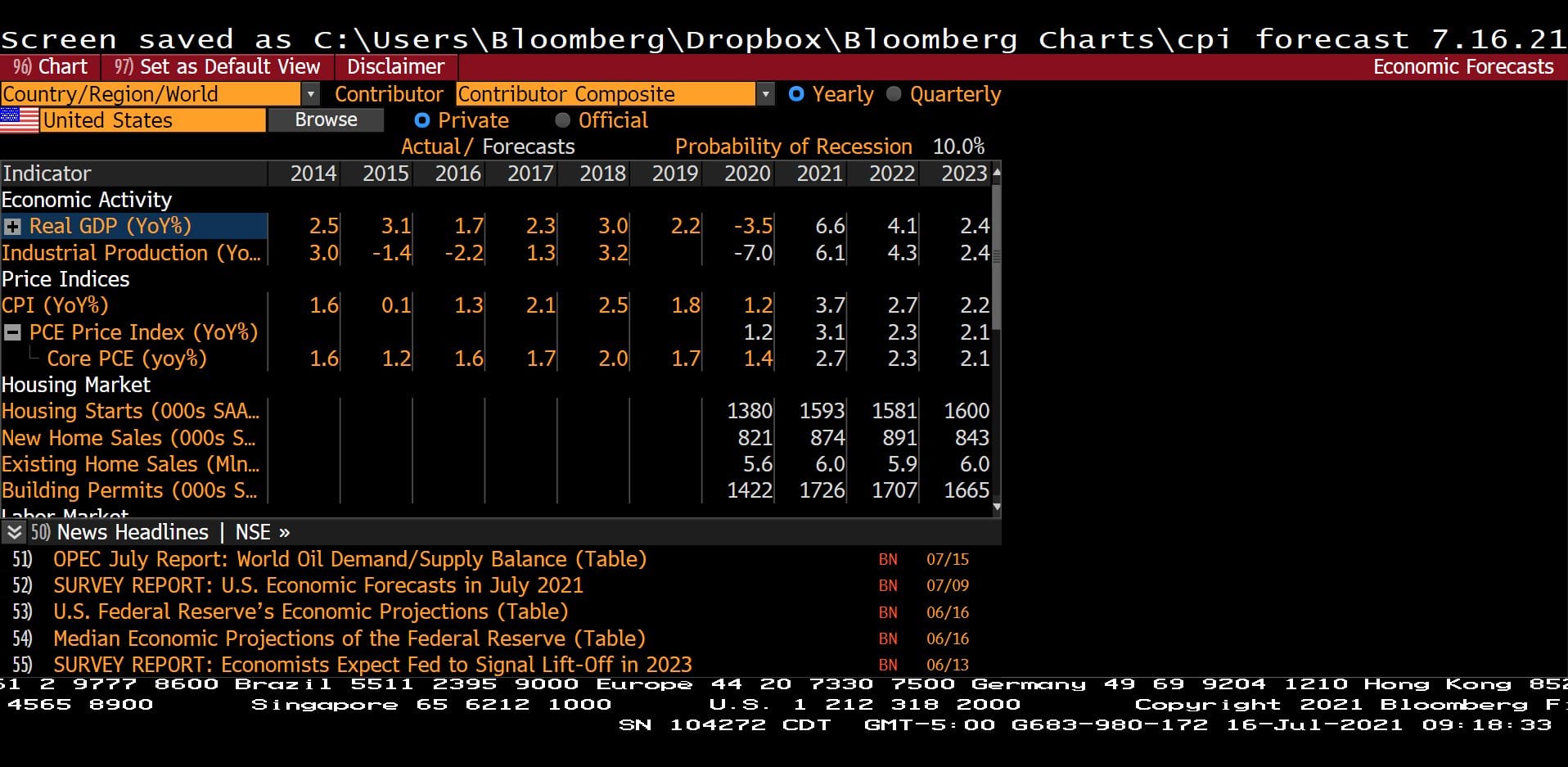

Yearly U.S. Economic Forecasts with Probability of Recession (2014 – 2023)

– Courtesy of Bloomberg LP

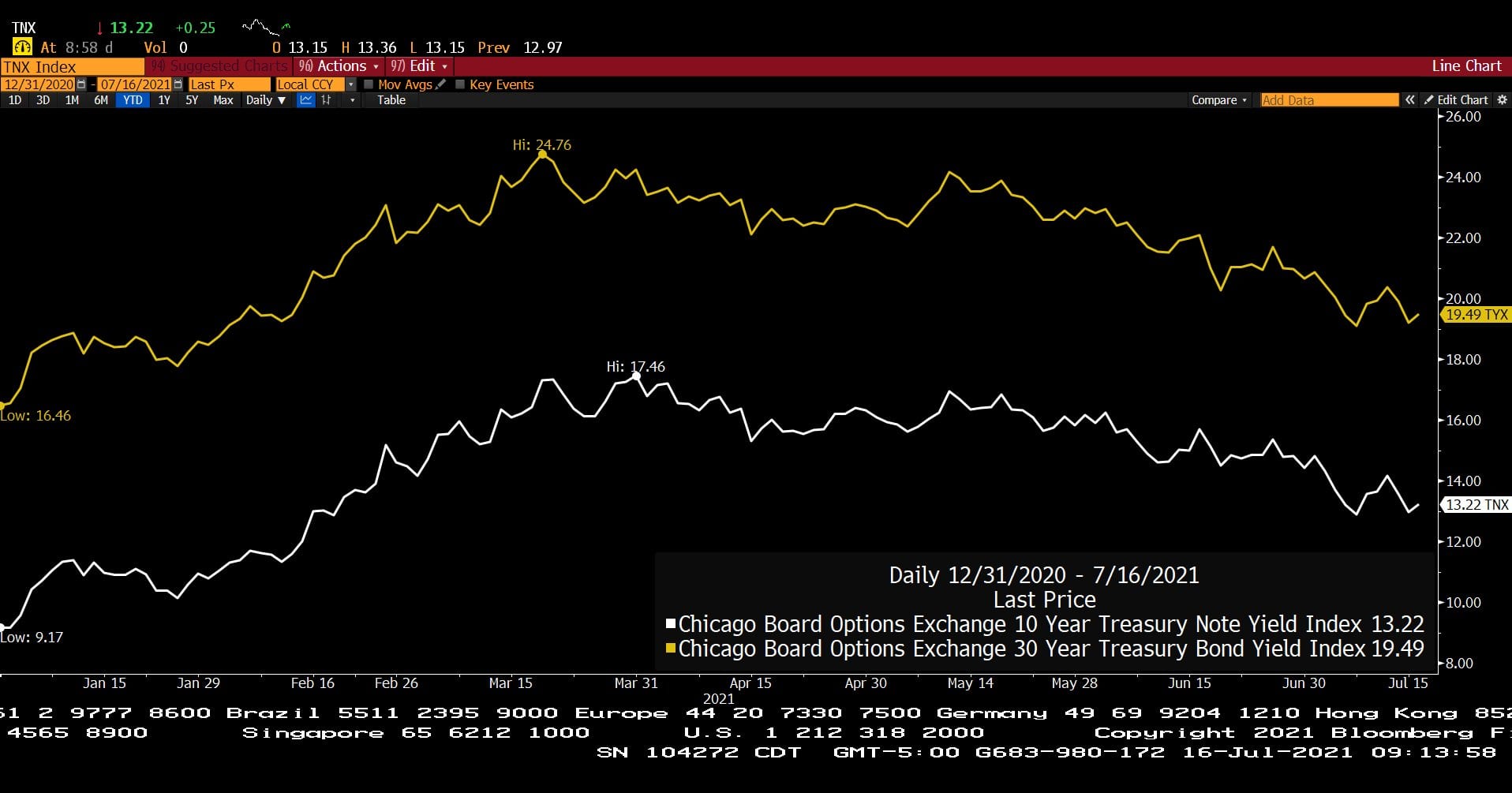

C.B.O.E. 10 Year Treasury Note Yield & 30 Year Treasury Bond Yield Indexes (Year to Date)

– Courtesy of Bloomberg LP

Invesco QQQ Trust Series 1 (Year to Date )

– Courtesy of Bloomberg LP

Healthcare Select Sector SPDR Fund (Year to Date)

– Courtesy of Bloomberg LP

Lumber Futures Spot Price (Year to Date)

– Courtesy of Bloomberg LP

Energy Select Sector SPDR Fund (Year to Date)

– Courtesy of Bloomberg LP

West Texas Intermediate Crude Futures Spot Price (Year to Date)

– Courtesy of Bloomberg LP

Headline Round Up

*Lumber Plummets from $1760 to $600 per 1000 board feet after rising 5X from 2020 lows.

*Premium Gasoline Nearing $5 at Shell Station in Uptown!?

*Consumer Price Index (CPI) Inflation at 5.4% in June!

*10 Year Treasury Yield Dropping Below 1%??

*Fed Chair Powell States “Substantial Further Progress” Needed.

*$9 Trillion in Electronically Printed Money?

*Texas ERCOT Has a Plan? “Better to start with a plan than end in a panic” (like February).

*Texas Development Boom Using Municipal Bonds (Muni’s) for Cheap Capital.

*It’s Not So Much Fun Anymore! Crypto Volumes Plummet.

*Earnings Season High Points!

*The Infrastructure Enigma!

*Record Natural Gas Prices and Liquified Natural Gas (LNG) Exports!

*Hydrogen Car Updates.

*CNBC’s Cramer Loves Exxon Mobil.

Profit Report

Best Client Questions of the Week:

-

Record Income for his company?

-

Strategies to reduce 2021 tax liability?

-

CPA Zoom Calls!

-

Charitable Gifting and Acceleration?

-

Charitable Remainder Trusts?

-

What about a Defined Benefit Plan?

-

What Real Estate holdings should be listed?

-

Should I lever up to buy a big vacation home?

-

Can I make money renting it out?

The Story of the Cash Flow Revolution Starting in 1992!

The Ultimate Combination of Fundamental Cash Flow Analysis With Money Flow Technical Analysis.