What contractions are we already seeing in consumer spending behavior?

What areas, in the equity markets, share prices appear to be predicting substantially lower consumer buying power?

How does the rise in mortgage rates potentially shrink American’s buying power?

What sectors in the financial markets are showing rising cash flows and earnings?

What does Warren Buffett do in response to Inflation?

Can rising interest rates and inflation create opportunities for investors?

What is Disinflation and why is it likely between now and 2025?

How does surplus cash flow help investors overcome reduced buying power?

How can investors and The McGowanGroup succeed together this year and for the next decade?

Headline Round Up

*Inflation Hits 8.5%. March could annualize at 15%?

*Producer Inflation 11.2%! Profit squeeze?

*The Treasury Bill Predicts ½% Increase in Interest Rates by The Federal Reserve May 4th? What can the interest rate charts tell us?

*China’s Lockdown Further Exacerbates Supply Chain Challenges! Alex, is there more to this story?

*Apple Starts iPhone 13 Manufacturing in India.

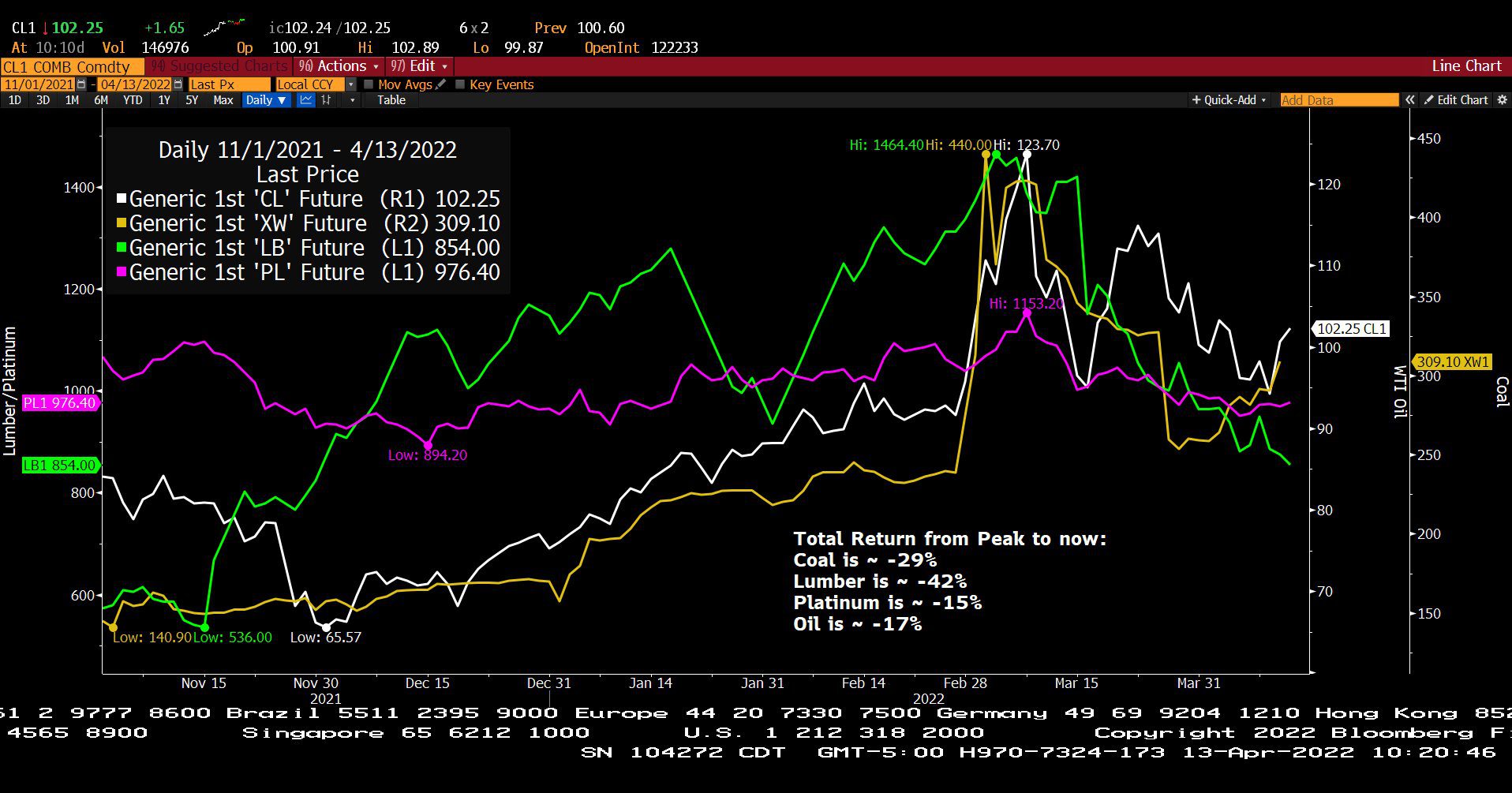

*Fast and Loose Commodity Trading! Real world impact and disinflation?

*Profit Stall Predicted?

*Brazilian Hedgies Give U.S. Bond Traders Brazilian Wedgies!

*Stagflation Hedges?

*Profits Smacked at Bed Bath and Beyond.

*JPMorgan Takes a Hit on Russia and BlackRock Shines.

*Little Rocket Man Kim Jong Un Popping Off Again?

*CarMax Used Car Sales Drop 6.5%. Prices Up 40%?

*Microchip Stocks Down 23% This Year?

*Oil Back Over $100 per Barrel After Reserve Release Smackdown!

Dow Jones Industrial Average (12/31/2021 – 04/13/2022)

– Courtesy of Bloomberg LP

Invesco QQQ Trust Series 1 (12/31/2021 – 04/13/2022)

– Courtesy of Bloomberg LP

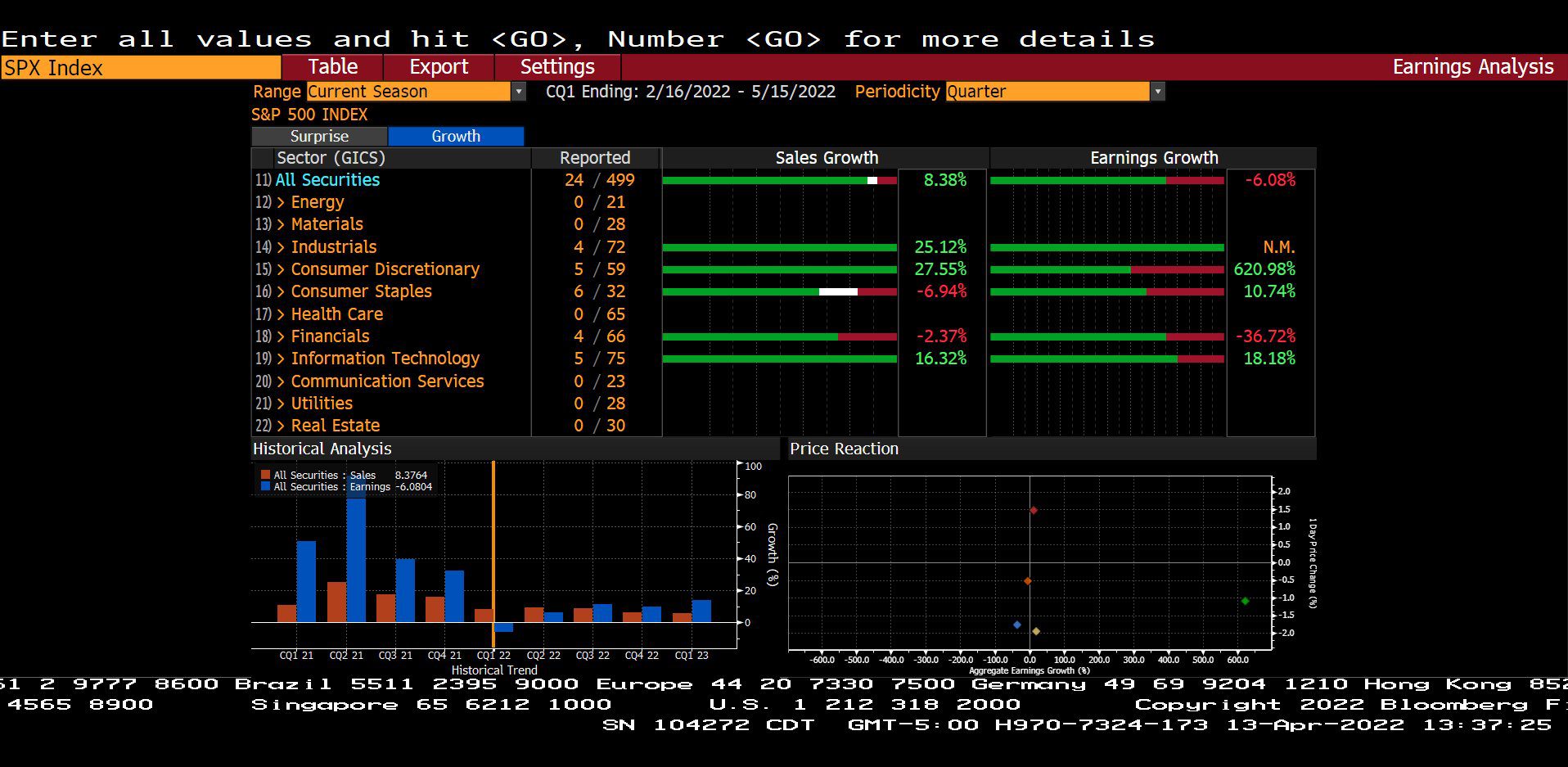

Standard & Poor’s 500 Index – Quarterly Earnings Analysis By Sector (02/16/2022 – 05/15/2022)

– Courtesy of Bloomberg LP

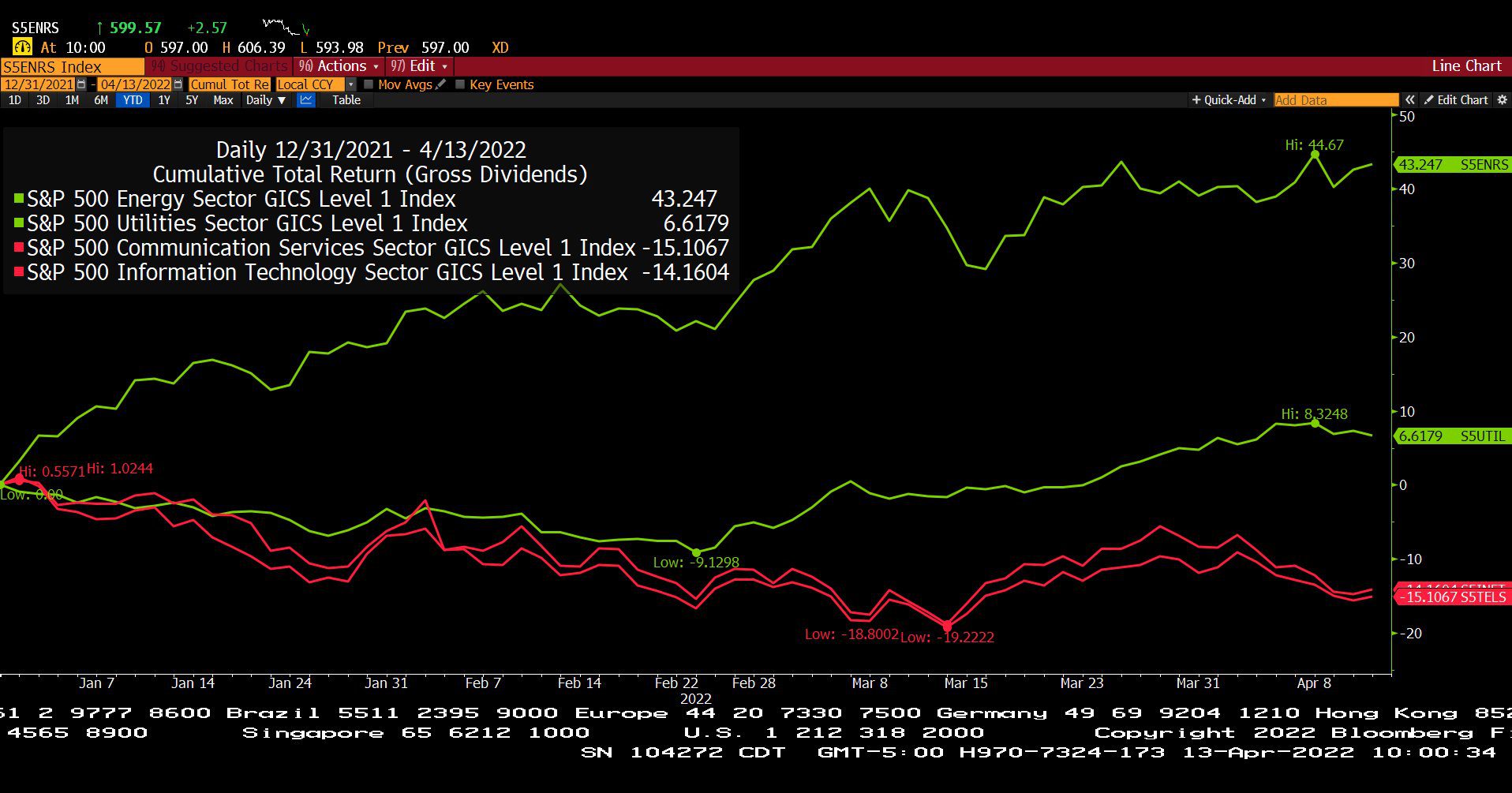

Standard & Poor’s 500 – Energy Sector, Utilities Sector, Services Sector and Technology Sector Indexes Cumulative Total Returns Gross Dividends (12/31/2021 – 04/13/2022)

– Courtesy of Bloomberg LP

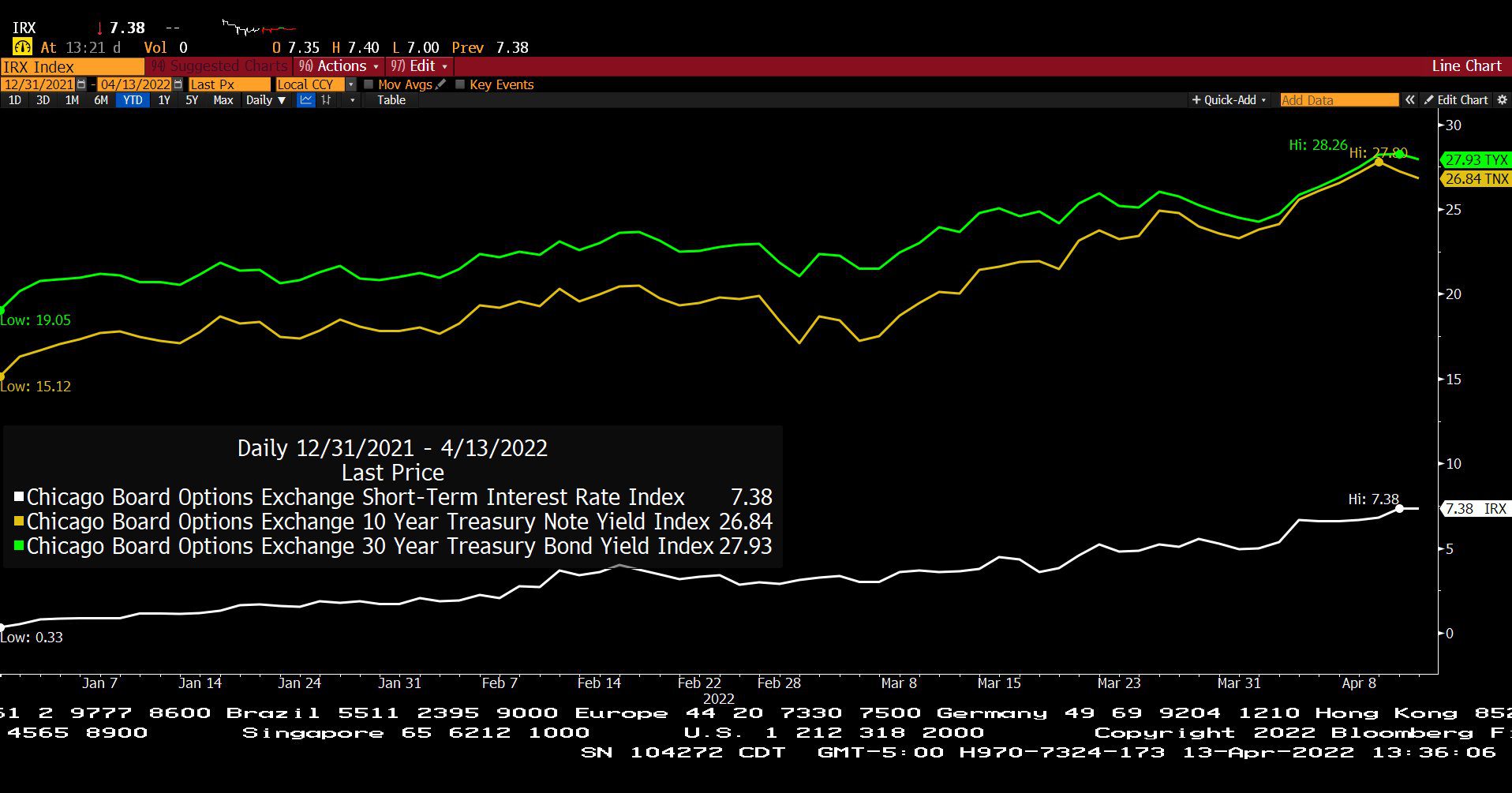

C.B.O.E. 30 Year Treasury Bond Yield Index, 10 Year Treasury Note Yield Index & Short-Term Interest Rate Index (12/31/2021 – 04/13/2022)

– Courtesy of Bloomberg LP

Generic Coal, Lumber, Platinum and Oil Futures Contract Spot Prices (11/01/2021 – 04/13/2022)

– Courtesy of Bloomberg LP

Energy Select Sector SPDR Fund (12/31/2021 – 04/13/2022)

– Courtesy of Bloomberg LP

Standard & Poor’s 500 Index & U.S. Consumer Price Index – Urban Consumers Year over Year, Non-Seasonally Adjusted (01/03/1978 – 12/31/1982)

– Courtesy of Bloomberg LP

Profit Report

*How much is a 1913 dollar worth? Answer: 3.4 cents!

*3.13% 109 year average inflation rate.

*Every 22 years buying power chopped in ½ on average.

*The Most Bizarre Tax Proposal So Far? Why is Mark to Market a recipe for disaster?